Virtual Asset Service Providers: What They Are and Why They Matter

With new technology comes unfamiliar terminology, not to mention changes in regulations, requirements, and laws. All of these developments can quickly become challenging for businesses to navigate, and the failure to keep up can lead to disastrous results. In the world of blockchain technology, one of the most important and frequently used terms is Virtual Asset Service Provider (VASP), and understanding it is vital for businesses that operate in this space.

What qualifies as a VASP, and why does it matter? Anyone, individual or business, who is involved in virtual asset (VA) transactions needs to have in-depth knowledge of the VASP designation and the role that it plays in regulations.

What Is a VA?

One of the easiest ways to understand the concept of a VASP is to break it into pieces and examine them separately. The first component to consider is virtual assets, which are at the heart of every VASP.

VAs Defined

Over the past several years, virtual assets have played an increasingly prominent role in the global economy, with everyone from celebrities to investors to collectors jumping into the market in one way or another. While cryptocurrencies are likely the most recognizable kind, the term refers to a range of digital items.

In essence, virtual assets are digital representations of value that can be traded, transferred, invested, or used as payment. The definition of a virtual asset comes from the Financial Action Task Force (FATF), an inter-governmental body that develops policies to combat money laundering and terrorism financing. The FATF has been a leader in developing regulations, policies, and protections for virtual assets, which, by virtue of their newness, are vulnerable to exploitation and criminal activity.

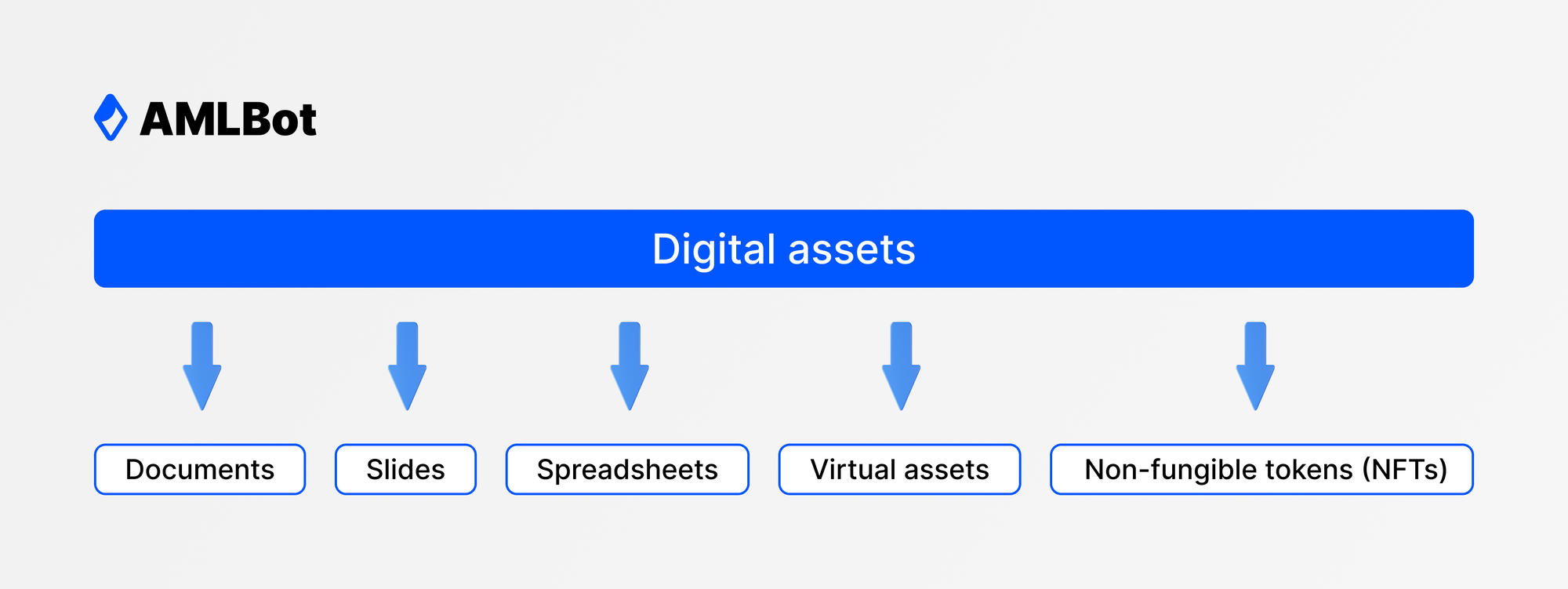

Digital Assets vs. Virtual Assets

It's important to draw the distinction between virtual assets and digital assets. Despite the similarity of the terms, they are not interchangeable. The phrase "digital asset" has much broader applications and encompasses anything that exists exclusively in digital form and has value. Documents, slides, and spreadsheets can all be classified as digital assets, but that does not make them virtual assets. In other words, whereas all virtual assets are digital assets, some digital assets are not virtual assets.

Take the example of non-fungible tokens (NFTs), which are digital assets that represent artwork and collectibles, among other things. While NFTs are always digital assets, they are only virtual assets in certain contexts. According to the FATF's 2021 guidance, NFTs fall under the category of virtual assets when they are considered investments. This might seem like a matter of semantics, but it's actually a significant difference that affects how NFTs are regulated.

What Qualifies as a VA

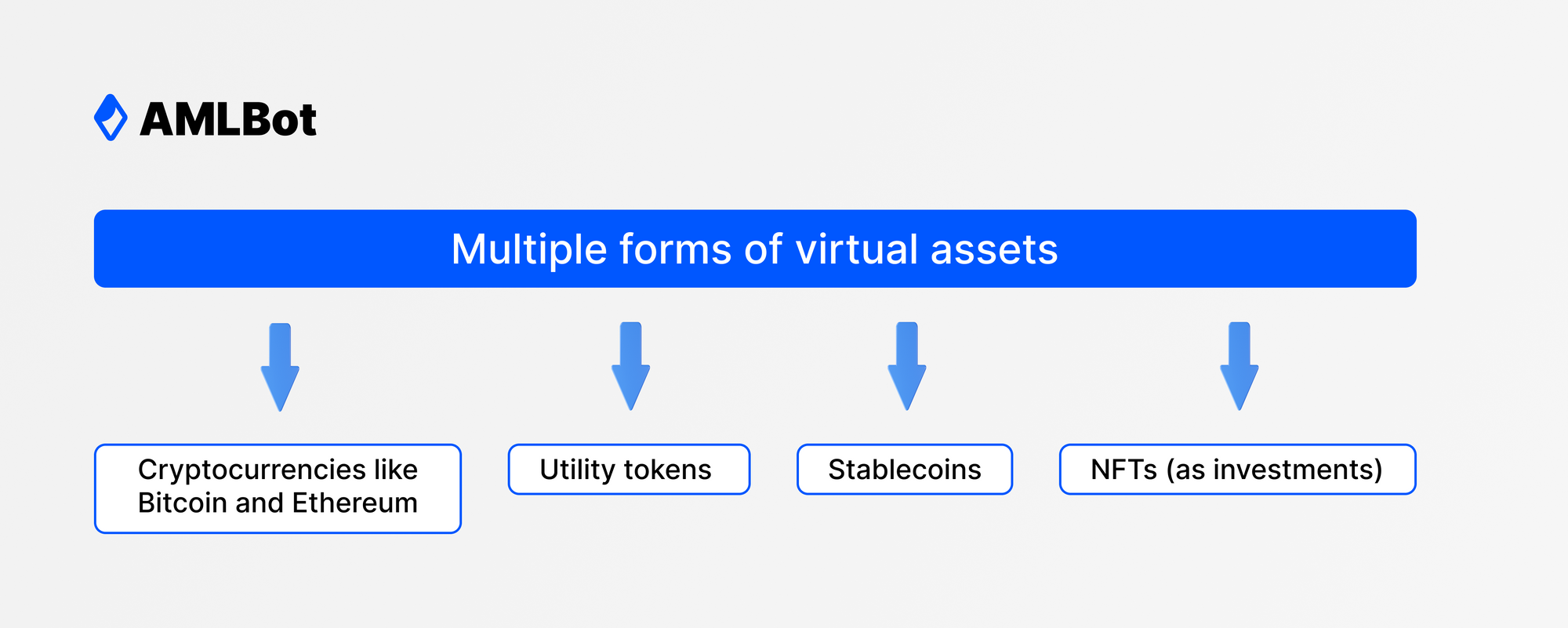

When blockchain technology was created in 2008, it brought with it a new vision of a decentralized financial system that was inherently transparent and verifiable. The transactions that occur on a blockchain rely on the use of some kind of digital or virtual asset. Over the past decade, multiple forms of virtual assets have emerged, including:

Central bank digital currency (CBDC), on the other hand, is not considered a virtual asset because it is not privately created. Similarly, the FATF and regulatory bodies do not categorize digital representations of securities as virtual assets.

What Is a VAS?

Building on the notion of a virtual asset is the concept of a virtual asset service (VAS). In the most basic terms, a VAS is some sort of activity that is performed for or on behalf of another person or business. Activities that qualify as virtual asset services, as outlined by the FATF, include:

- Exchanging virtual assets for fiat currencies, and vice versa

- Exchanging virtual currency from one form to one or more other forms

- Transferring virtual assets

- Holding and/or administration of virtual assets or instruments that enable control over virtual assets

- Participating in and providing financial services related to an issuer's offer and/or sale of a virtual asset

If these kinds of services seem familiar, that's because they are very similar to the types of services that banks, credit unions, and other financial institutions provide for legal tender like the dollar. For example, you can use a bank to transfer funds from one account to another, exchange currencies, and hold funds until you need them.

What Is a VASP?

With these explanations in mind, the definition of VASPs should become much clearer. To clarify things even more, it may be helpful to compare them to an everyday experience that all people are likely to encounter at some point.

Imagine that you are ill and visit a doctor's office, where medical professionals administer tests, make a diagnosis, and prescribe medication. Your doctors are healthcare providers, and you receive their services. In any transaction, including medical treatment, there is some form of provider. The same is true in the world of crypto, but rather than offering x-rays and medicine, providers offer services related to the sale, trade, and exchange of virtual assets.

Examples of VASPs

The question of whether an entity qualifies as a virtual asset service provider (VASP) comes down to whether it performs any of the previously mentioned virtual asset services. Both people and businesses can be VASPs if they offer or enable any one or more of these activities. In short, any provider of a VAS is a VASP. There are some entities that may unexpectedly qualify as VASPs based on the services that they provide, which makes it impossible to provide an entirely exhaustive list. However, there are some common categories of VASPs that are easily identified.

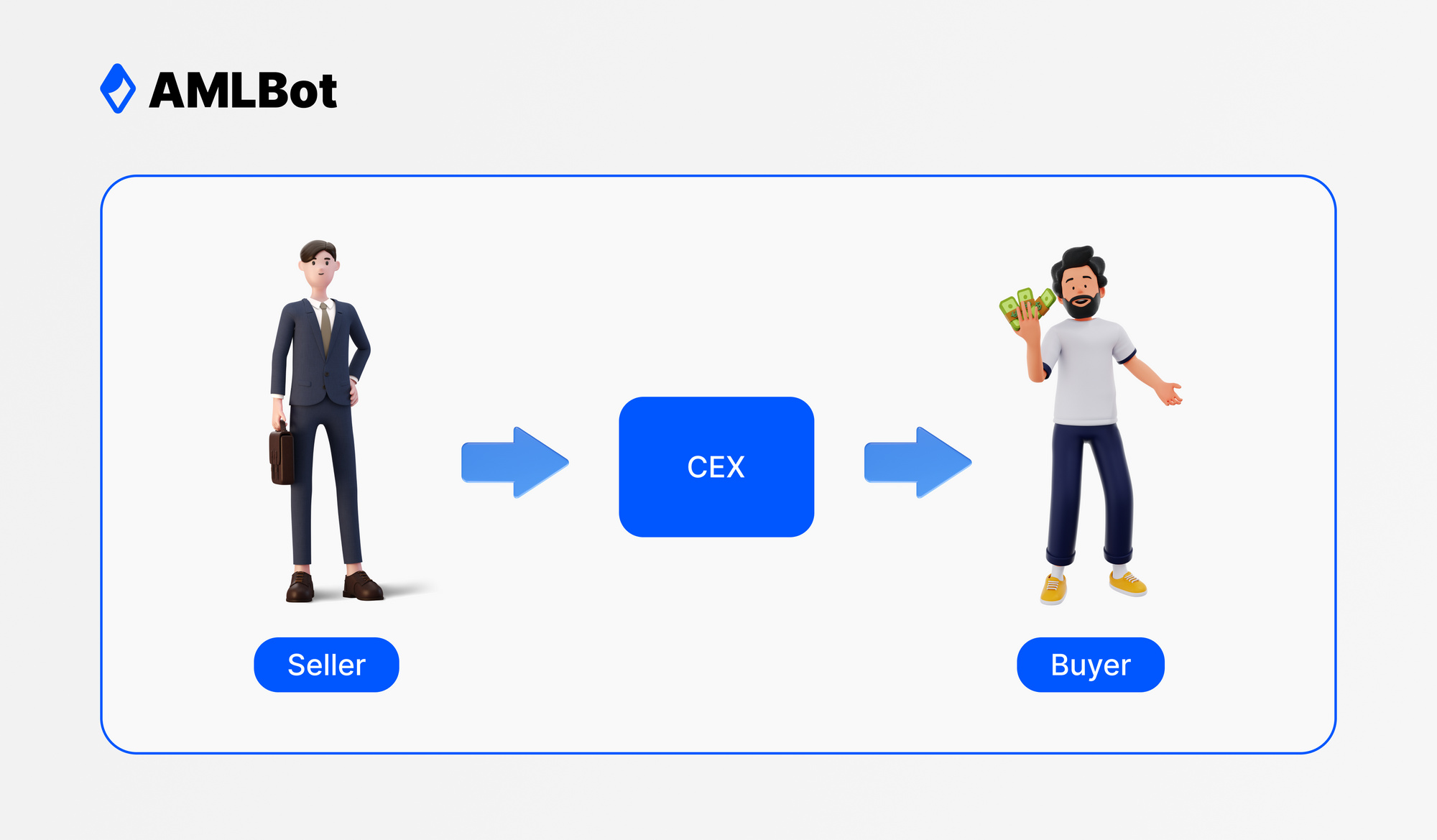

Centralized Exchanges

A centralized cryptocurrency exchange, also known as a CEX, serves as an intermediary between buyers and sellers, much in the same way that investors and companies connect through stock exchanges. CEX platforms generally charge fees or earn commissions in exchange for their services.

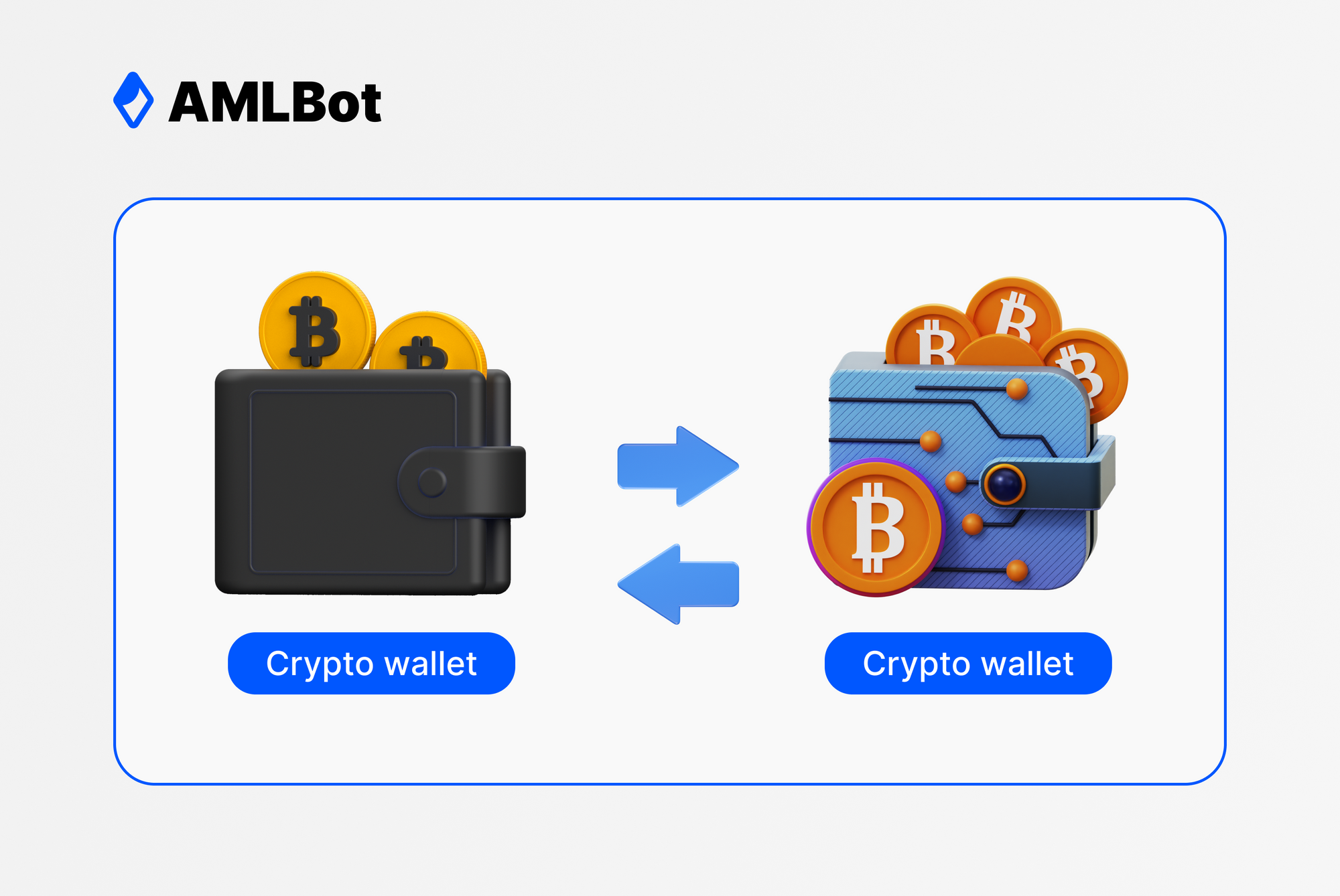

Decentralized Exchanges

In contrast, a decentralized exchange, or DEX, involves no intermediaries in crypto transactions. Instead, money can be moved directly from one digital wallet to another. To facilitate the transaction, a DEX often relies on the use of smart contracts. These are programs stored on a blockchain that can automate the completion of a transaction as long as specific conditions, such as releasing funds, are met.

Escrow Services

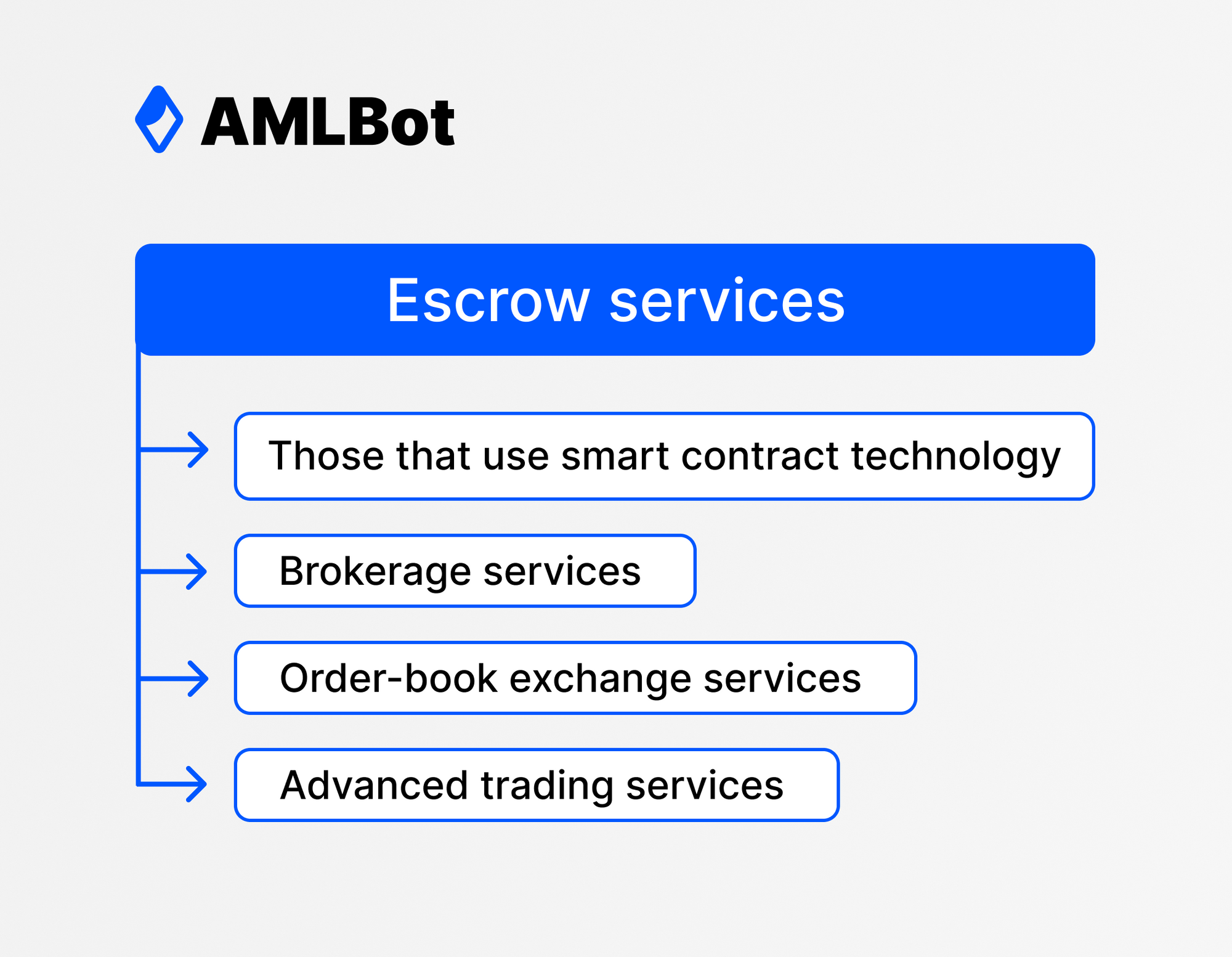

In the realm of virtual assets, an escrow service serves the same purpose as in other kinds of financial transactions. When funds are placed in escrow, a neutral third party holds them in an account until a certain obligation has been met. Working with an escrow service can be especially useful when there is a question of trust between two users involved in a digital transaction. According to the FATF, escrow services that are classified as VASPs include:

Although the transaction is not necessarily reliant on an escrow service and it is not an exchange, it still meets the FATF's definition of a VASP because it holds virtual assets on behalf of a person or business.

Other Types of VASPs

In addition to these providers, there are other entities that the FATF classifies as VASPs. They include:

- Cryptocurrency wallet providers

- Mining pools

- Investment vehicles

It's likely that, as virtual assets play a greater role in more kinds of transactions, the list of businesses that fall under the umbrella of VASPs will continue to expand. This is why it's vital to consider not only pre-identified categories but also the FATF's criteria that determine whether an entity qualifies for the VASP label.

Entities That Are Not VASPs

One key point to remember is that not everyone involved in the crypto market is a VASP. In general, the classification does not apply to individuals who are acting independently rather than for or on behalf of someone else. Entities that are not VASPs include:

- Individual crypto miners

- People who are part of a cryptocurrency mining pool

- Individual traders

- Central banks

Because these entities are not VASPs, they are exempt from certain expectations and requirements on the part of regulators and the FATF.

Why Is It Important to Know About VASPs?

Understanding VASPs is important from multiple perspectives. For individuals and businesses who are participating in, but not facilitating, virtual asset transactions, it is important to have at least some knowledge of the platform that is being used. More importantly, owners of crypto businesses must be aware of how VASPs are classified because of the need for regulatory compliance.

The guidelines developed by the FATF have been incredibly influential on a global scale, and many governments have used them as models for their own regulations. For example, in the United States, the Financial Crimes Enforcement Network (FinCEN) has a travel rule that is very similar to the one created by the FATF. The most notable difference between them, and one that is important for businesses to recognize, is that FinCEN uses the terms convertible virtual currency (CVC) and money services business (MSB) rather than VA and VASP.

Entities that fit the definition of VASPs must comply with regulations, such as the United States travel rule, within their jurisdictions. These requirements may include:

- Officially registering with the appropriate government agency

- Implementing an AML program

- Conducting due diligence to lower the risk of criminal activity

- Undergoing governmental monitoring and supervision

VASPs that fail to meet these requirements can face harsh legal and financial penalties. In the United States, for instance, a VASP that fails to register with the Department of the Treasury faces a civil penalty of $5,000 for each violation. This number is dwarfed, however, by the potential fines that a company can face for violating AML program regulations. For serious violations, there is the potential for devastating multimillion-dollar penalties.

VASPs and DeFi

One of the struggles with the regulation of cryptocurrencies and other virtual assets is that it sometimes remains murky, in large part because of rapid changes in technology. While guidance from the FATF has helped outline a clear path for many kinds of VASPs, the situation for decentralized finance (DeFi) is still somewhat ambiguous. There are a few key facts that are important to know when discussing DeFi:

- Decentralized applications (DApps) are software programs that operate on a blockchain or similar technology.

- When DApps offer financial services, such as those offered by VASPs, they are commonly referred to as decentralized finance (DeFi).

- DeFi involves peer-to-peer transactions, including trading, investing, and borrowing, that take place on a blockchain.

On its face, all of this would seem to suggest that DeFi applications would qualify as VASPs, but it's not quite that simple. The FATF states that these applications are not VASPs under their standards because the standards "do not apply to underlying software or technology." However, in 2021, the FATF issued an update explaining that creators, owners, operators, and maintainers of DeFi applications "who maintain control or sufficient influence in the DeFi arrangements" may be VASPs if they are facilitating the activities that fall under their definition of virtual asset services.

Ensuring Compliance for VASPs

While the notion of a Virtual Asset Service Provider is relatively new, as the public's use of virtual assets grows, it may become a part of everyday language in the same way that Internet Service Providers (ISPs) have. For now, however, it is imperative that companies using blockchain technology determine whether they qualify as VASPs. If they do, taking the appropriate steps to comply with FATF guidelines, as well as jurisdictional regulations, is essential for long-term success.

For businesses and individuals who manage or facilitate virtual asset transactions, and thus are VASPs, there are resources and tools available to help ensure compliance, including the VAS and VASPs experts at AMLBot. They can alleviate your anxiety by helping your business achieve FATF compliance. Schedule a free consultation to learn more.