Binance processed $7.8 Billion worth transactions for Iranian crypto exchange Nobitex despite US sanctions

Binance is a leader in global cryptocurrency exchange services. Being a centralized exchange, it operates legally in several jurisdictions where it was granted the license to conduct its business. Regulatory oversight tries to keep crypto trading venues, like Binance, in check, keeping them from indulging in risky behavior with user funds or subjecting the users to send and receive funds from shady and sanctioned sources.

However, it looks like Binance cannot catch a break. Most recently, the platform witnessed its users withdrawing stored funds to the tune of billions when it revealed its proof of reserves to the world. Some time ago, it got accused of allowing the flow of cryptocurrency stored in wallets and exchanges from Iran – a country sanctioned by the US government.

Cryptocurrency and blockchain analysis firm, Chainalysis, showed that the exchange facilitated crypto transactions worth up to $8Bn for Iranian individuals and firms in 2018. Out of the $8Bn, $7.8Bn worth of cryptocurrency got routed along Nobitex, Iran's biggest crypto exchange.

As a result, the company faces a legal investigation for allegedly allowing the laundering of funds from a sanctioned state and can be subject to primary and secondary sanctions, along with massive fines.

US Sanctions Over Iran

The US has had sanctions placed over the Islamic Republic, Iran, ever since the existence of its nuclear program came to light in the later parts of the 1970s. After that, the sanctions started bleeding into all facets of the Islamic Republic's trade, commerce, and finance. However, with the nuclear deal of 2015, the sanctions were mostly lifted. That was until 2018, when the US government withdrew itself from the deal and reinstated previous sanctions over the state.

With those sanctions in effect, 2019 and 2020 saw additional sanctions reining, adding eighteen of Iran's most prominent banking institutions to the OFAC's (Office of Foreign Asset Control) sanction list. Further, the US warns all financial institutions from every country to prevent enabling the flow of Iranian funds from the sanctioned institutions, to prevent facing secondary sanctions and sanction violation penalties themselves.

Presently, the US government strictly prohibits individuals and businesses in its jurisdiction from interacting with Iran in any financial capacity because it deems the state to sponsor terrorism.

Why This Is an Issue For Binance

Here is where the issues start to stem for Binance. Nobitex, although not a sanctioned entity, still operates within the state of Iran. According to the US Department Of Treasury, US and foreign companies are prohibited from offering services or doing business with any Iranian individual or company. So you can understand why Binance finds itself in hot waters with US authorities by failing to prevent transactions with Nobitex and other Iranian entities. Additionally, an exchange like Nobitex is categorized as a 'very high risk' exchange because of the kind of transactions taking place and, more importantly, the jurisdiction in which it operates.

Binance can face sanction in violations of the primary and secondary degree, depending on which one of its entities was involved in the activity. A Reuters article suggests that the larger Binance entity and its US-based domestic subsidiary are involved in the sanction violations. Regardless, we investigated to identify the flow of crypto assets from Iran-based mega exchange Nobitex to the even bigger Binance exchange.

AMLBot Investigation

The AMLBot team conducted a thorough analysis of the transactions occurring to and fro on Binance, trying to identify if it could find any links between the exchange and its risky counterpart in the sanctioned state of Iran. The comprehensive investigation proved that there are indeed transactions linking Binance to Nobitex. The transactions involved BTC, ETH, and TRON being used to transfer funds to or from risky wallets associated with illicit activity.

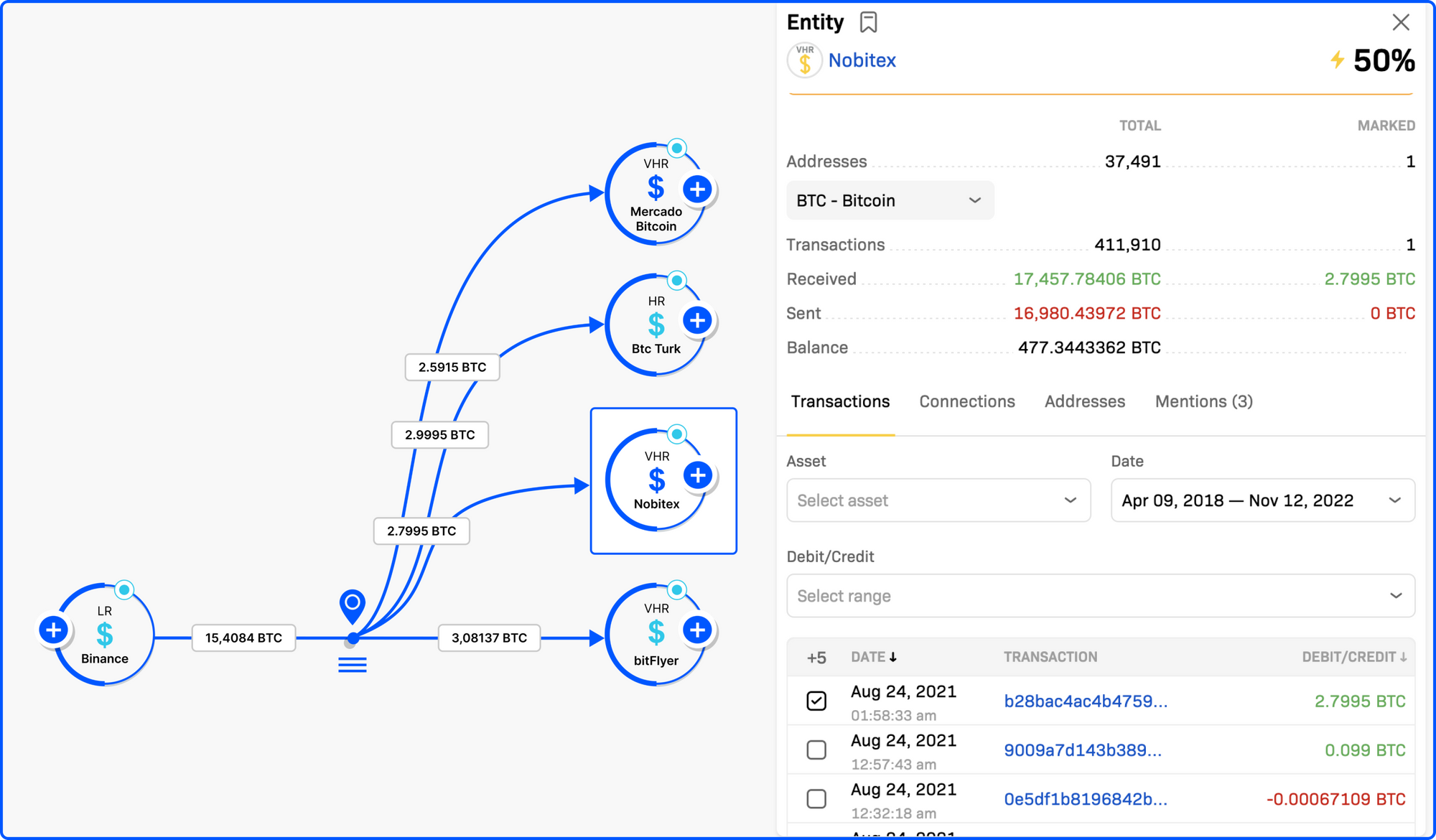

We identified a BTC transaction, sending funds from a BTC wallet on Binance to BTC wallets on multiple platforms. The transaction involved the transfer of about 15.4084 BTC from a Binance account, out of which 2.7995 BTC was moved to an account on the Nobitex exchange.

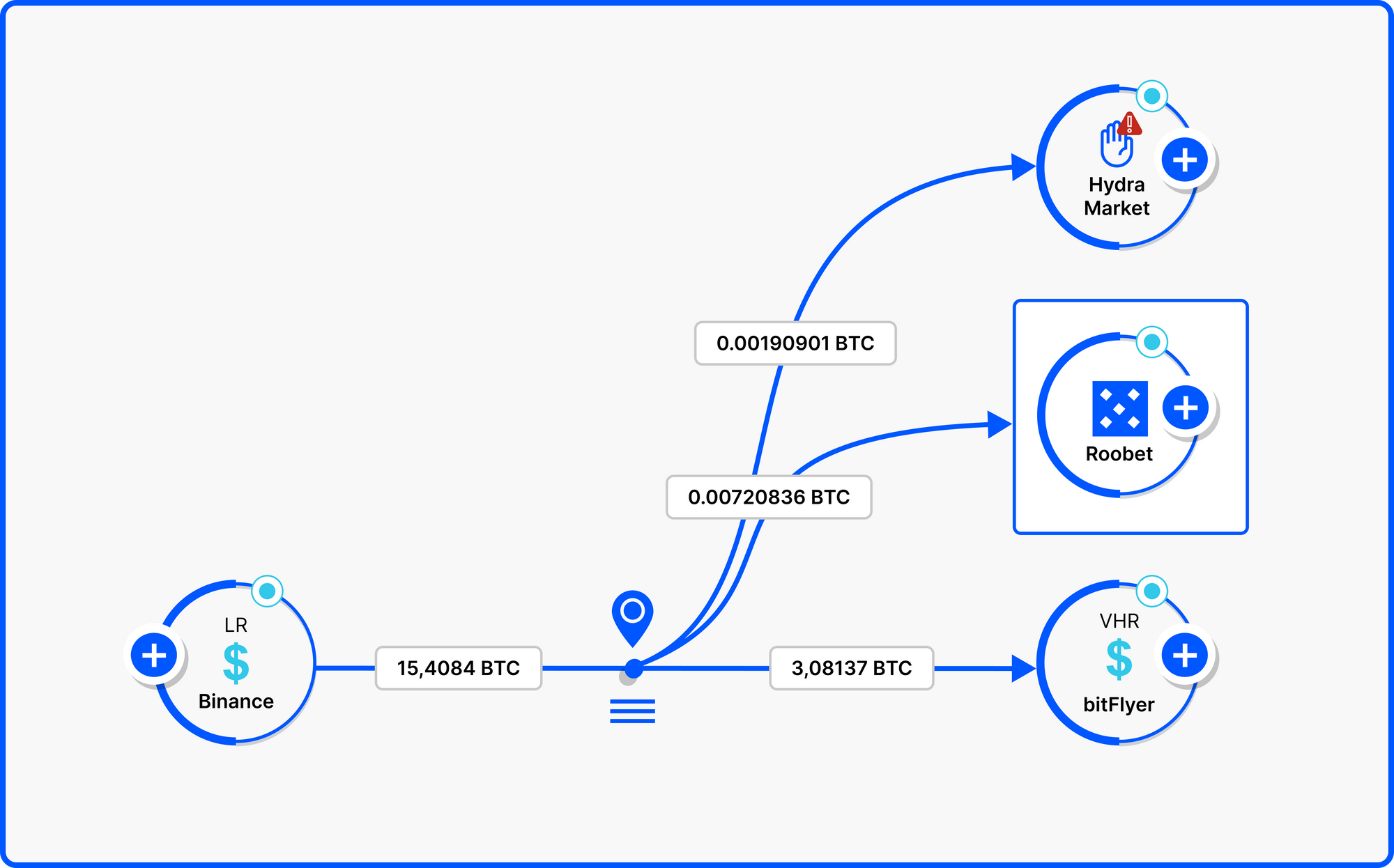

It is also relevant to state that our analysis showed us that 0.00190901BTC from the same transaction got routed to a wallet linked with activity on the Hydra Marketplace. Hydra is a darknet marketplace that facilitates the acquisition of drugs, stolen bank credentials, and many other things. The marketplace, too, is sanctioned by the US Department of Treasury's OFAC.

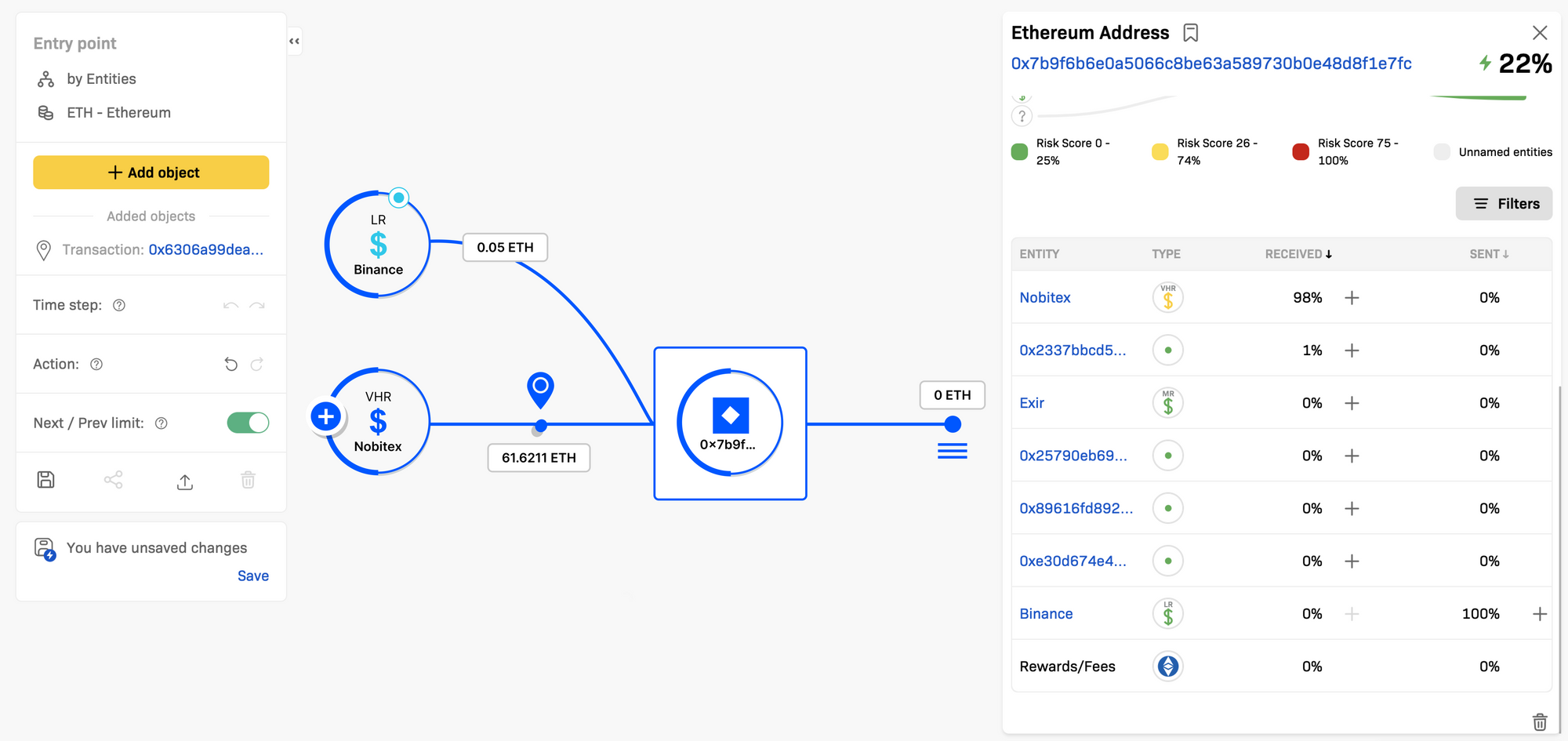

Our investigation also identified an ETH transaction from a Binance account directed toward Nobitex. The Ethereum wallet received an amount of 0.05 ETH from the Binance account, along with funds sent to it from different sources. The wallet then proceeded to transfer 61.6211 ETH to a destination on the Nobitex exchange.

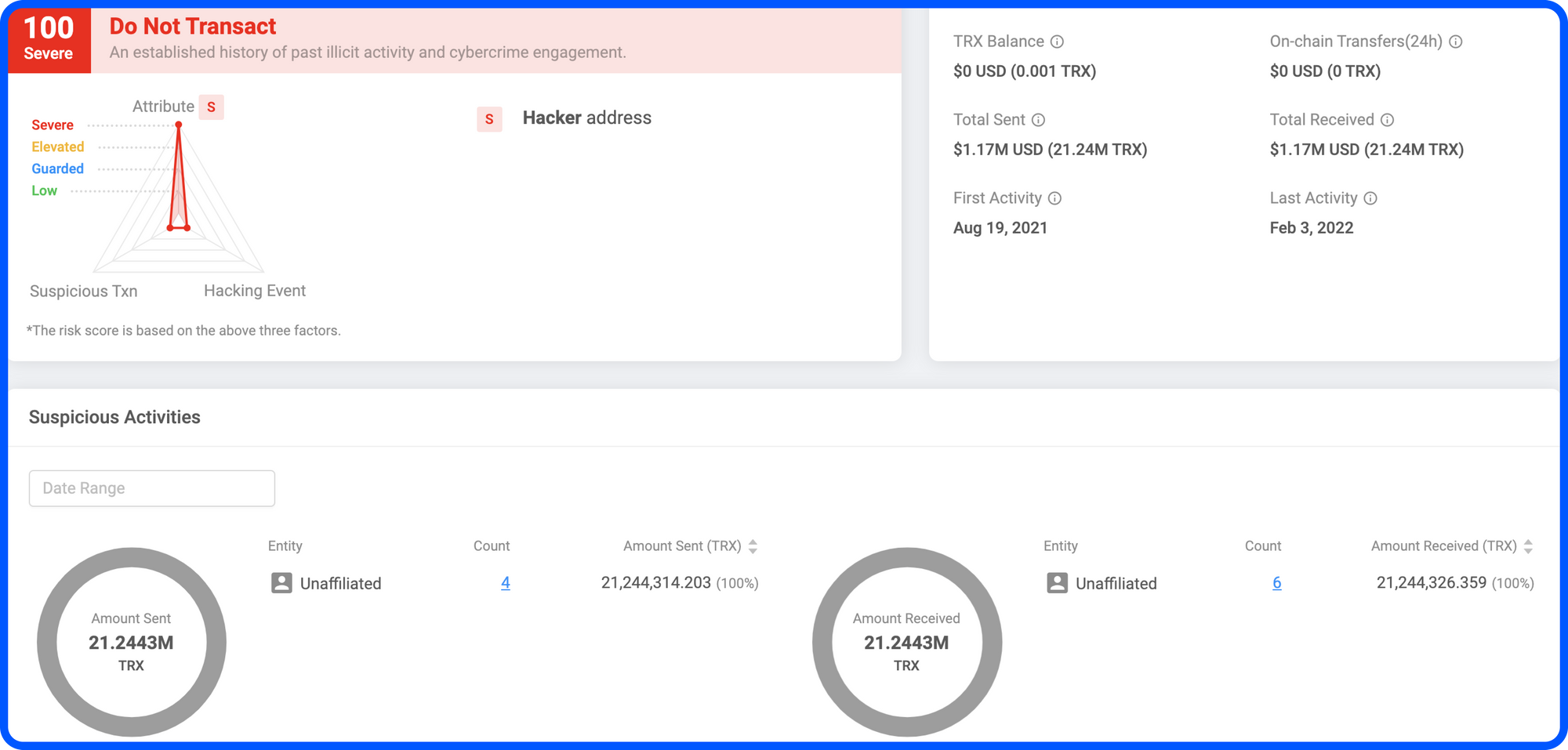

The investigation uncovered more in the form of a wallet related to the TRON network. Of course, TRON is the most used cryptocurrency in Iran for exchanging value overseas and accounts for three-fourths of all value moved between Nobitex and Binance so far. We identified a risky TRON wallet after scanning multiple ones, looking for wallets linked to illicit activity. The wallet address has been involved with highly illicit activity, leading us to conclude that it is severely risky and should not be transacted with. Not only could transacting with such wallet addresses land users in deep trouble, but it shows that wallets exhibiting severely risky behavior are allowed to transact on Nobitex.

Conclusion

Regulations exist to keep financial service providers and platforms from indulging in risky behavior. Cryptocurrency platforms, too, are being subjected to regulations worldwide. Violating economic sanctions, therefore, also apply to cryptocurrency exchanges like Binance. Measures like AML frameworks are implemented for specific reasons like this – preventing transactions with high-risk actors and companies from high-risk jurisdictions. A platform the size of Binance needs to be on top of such happenings. Presently, the US Department of Justice is investigating Binance's practices and if it has enabled money laundering on its various platforms. We will know soon about the consequences the company will face.