Stablecoin Freezes 2023–2025: A Data-Backed Analysis of USDT vs USDC by AMLBot

Summary:

A new data analysis of stablecoin freezing activity from 2023 to 2025 reveals major differences in scale and approach between the two leading issuers, Tether (USDT) and Circle (USDC).

In this new report, AMLBot analyzes stablecoin freezes across Ethereum and TRON to map how USDT and USDC have been used in real investigative workflows throughout 2023–2025. The findings show not only how often freezes occur, but why they happen, what patterns they follow, and how they support victim restitution, coordinated law-enforcement actions, and major enforcement operations around the world.

The full report goes deeper into freeze mechanics, timeline patterns, cross-chain discrepancies, burn-and-reissue cycles, and what these signals reveal about illicit finance trends. To download the report, fill out the form below👇🏻

This report is based exclusively on newly collected data on stablecoin freezing actions between 2023 and 2025. Previously, AMLBot conducted a dedicated study focused on illicit activity associated with USDT and USDC, where we analyzed how these stablecoins are used across Ethereum and Tron, their exposure to high-risk clusters, and the scale of funds linked to illicit flows. That research combined transaction-level analysis with clustering and risk attribution to quantify both absolute illicit volumes and their share relative to total stablecoin activity. USDT was associated with significantly higher illicit exposure than USDC, both in absolute terms and as a percentage of total volume, particularly on the Tron blockchain. The current report adds a separate enforcement-level perspective by examining how these risks materialize in practice — through actual freezing actions taken by stablecoin issuers.

Key Numbers (2023–2025):

7,268 Blacklisted USDT Addresses

$3.29B Frozen USDT

$1.75B USDT Frozen on TRON

372 Blacklisted USDC Addresses

$109M Frozen USDC

30× Scale Difference in Value and Address Count

Key Data:

Tether (USDT) demonstrates a significantly larger, more proactive enforcement footprint:

Tether (USDT) has blacklisted addresses holding a combined $3.29 billion in frozen assets across Ethereum (ERC-20) and TRON (TRC-20). The TRON Network alone accounts for $1.75 billion of frozen USDT. Tether's freezing and reissuance mechanisms have returned millions of dollars to victims and helped authorities seize funds tied to terrorism, human trafficking, and fraud. For instance, USDT freezes exceeded $130 million in July 2024, including $29.6 million frozen on the TRON network linked to the Huione Group in Cambodia. Tether has blacklisted 7,268 addresses globally.

Circle (USDC) maintains a highly focused, reactive model: Circle has frozen $109 million in USDC across its blacklisted addresses. Circle has blacklisted 372 addresses. Circle only denies access to addresses to comply with applicable laws, regulations, or explicit court orders, resulting in fewer, larger, and judicially anchored freezing events.

Scale Differential: USDT freezes exceed USDC's by approximately 30× in address count and ~30× in asset value.

Tether collaborates with over 275 law enforcement agencies across 59 jurisdictions and blockchain intelligence firms, often freezing tokens preemptively when deemed "prudent" or upon notification from authorities, even without explicit court orders, to protect users from hacks. Tether’s unique model allows it to burn frozen tokens and reissue clean replacements for victim restitution, a capability demonstrated by major spikes in destroyed tokens in late 2025 (exceeding 25-30million). However, this highly centralized power raises privacy and censorship concerns. It has resulted in legal challenges, such as a lawsuit filed after Tether froze 44.7 million USDT at the request of the Bulgarian Police Department.

Circle's policy is anchored to formal legal triggers and mandates, such as court-ordered seizures or sanctions compliance. This order-driven approach leads to activity appearing in tall but rare spikes (batch actions), in contrast to USDT’s more continuous daily flow of enforcement. Circle does not support a burn-and-reissue mechanism. Frozen funds remain static until formal legal approval is received to unfreeze them.

Executive Summary

According to AMLBot’s updated Dune Dashboard (2023–2025), which includes data for both ERC-20 and TRC-20, Tether (USDT) has blacklisted 7,268 addresses across Ethereum and TRON, with a combined $3.29 billion frozen. Circle (USDC), by contrast, has blacklisted 372 addresses with $109 million frozen. With TRON data included recently, the scale difference becomes even clearer: USDT freezes exceed USDC by more than 30× in address count and ~30× in asset value.

The difference originates from different approaches to asset freezing: Tether takes a proactive view, working with law enforcement and blockchain intelligence firms, while Circle responds only to judicial orders and regulatory sanctions.

Different Freezing Approaches (USDT & USDC)

How Tether Freezes USDT

USDT is issued on multiple blockchains (Tron, Ethereum, Solana, and others). On major blockchains (e.g., Ethereum and TRON), the USDT contract includes a built-in blacklist function that allows Tether to freeze transfers from a designated address. The contract also supports fund destruction (burn) and token reissuance (mint) in cases of verified illicit activity or victim restitution. Notably, frozen addresses may sometimes be removed from the blacklist and resumed normal transfers, and not all freeze events result in immediate burn/reissue.

In its Terms of Service, Tether reserves the right to suspend access or freeze any tokens held by users “as required by applicable law or where Tether, in its sole discretion, determines it is prudent to do so”.

Tether’s wallet-freezing mechanism also depends upon a multi-signature wallet. When a freeze is requested, multiple Tether signatories must approve the transaction. In our 2025 Report, which Decrypt cited, we found that the freezing process creates a delay between when a freeze request is submitted and when it is actually executed. During this “window of opportunity,” illicit actors have sometimes withdrawn funds, resulting in approximately $78 million in losses since 2017.

After we published the report, Tether confirmed that a delay exists but argued that it stems from its multi‑signature governance model, which requires multiple approvals to prevent unilateral freezes. Tether framed this delay as a trade-off: it helps protect a $100 billion-plus system from abuse while still enabling the company to collaborate with law enforcement agencies worldwide. The company noted that it had already frozen or reissued more than $2.7 billion in illicit funds.

And, before we dive in deeper, credit where it’s due: Tether has taken a more proactive stance on USDT freezes. Even with occasional execution delays, the posture is clear and merits recognition.

When and Why Tether Freezes Tokens

Once law enforcement identifies suspect wallets, it issues a legal request to Tether. Tether blacklists addresses, preventing transfers. It then burns the frozen USDT and reissues new tokens to the requesting agency or to victims. For example, a 2024 fraud case described by TRM Labs shows that the FBI traced stolen Bitcoin to Tron addresses, requested Tether to freeze them, and then had Tether mint new USDT to return funds to the victim.

Tether cooperates with over 275 law enforcement agencies across 59 jurisdictions. Its policy aligns with the U.S. Office of Foreign Assets Control (OFAC) Specially Designated Nationals (SDN) List and other sanctions legislation. Tether states that it will freeze wallets upon notification from authorities or when wallet addresses appear on sanctions lists.

In addition, Tether noted that over 5,000 wallets have been blocked, with more than 2,800 freezes coordinated only with U.S. agencies. Tether’s Law Enforcement Request Policy requires a “proper legal process” before it will freeze tokens. Although the full policy is not public, Tether’s Terms confirm that it may suspend or freeze tokens “as required by applicable law”.

However, what is more intriguing is that Tether sometimes freezes tokens to protect users who have been hacked, even without court orders. When a CEX user reported a hack in July 2025, Tether froze $85,877 in the victim’s wallet. Tether’s CEO stated that the ability to track transactions and freeze illicit funds distinguishes it from traditional finance. However, such active intervention raises privacy concerns in the crypto community and highlights the power of a centralized issuer. One person on X, following the story, noted that “centralized control has its moments.”

A recent legal dispute highlights the potential downside of highly proactive freeze policies. In April 2025, Tether froze approximately $44.7 million USDT at the request of the Bulgarian Police Department. Subsequently, Riverstone Consultancy Inc., a Texas-based firm, filed a lawsuit claiming the freeze was executed without due legal process and is seeking either release of the funds or damages. The lawsuit argues that Tether failed to follow the formal international procedures required under the Bulgarian judicial-assistance framework and that the freeze blocked legitimate investment opportunities. While the outcome is yet to be determined, this case illustrates a key tension: issuers may aggressively mitigate illicit-flow risk, but face legal, reputational, or operational exposure when freeze actions are questioned.

Tether’s ability to freeze USDT reflects a hybrid philosophy at the crossroads of crypto’s decentralization ideals and the realities of real-world compliance. On one hand, Tether’s freeze‑reissue mechanism has returned millions of dollars to victims of scams and helped authorities seize funds tied to terrorism, human trafficking, and fraud. It even demonstrates that blockchain‑based money can be more traceable and accountable than traditional cash systems. On the other hand, the centralized control required for such interventions raises concerns about censorship, privacy, and the erosion of the core principles of decentralization — principles that lie at the very heart of the philosophy behind why cryptocurrency was created in the first place. And, technical vulnerabilities, such as the freezing delay exploited by criminals, further complicate the narrative.

As stablecoins move into regulated financial frameworks, Tether (and other issuers) refine their asset-freezing policies.

The central question is whether the cryptocurrency industry can develop models that combine effective consumer protection and law enforcement cooperation with minimal centralized control.

How Circle Freezes USDC

The USD Coin (USDC) stablecoin is issued by Circle Internet Financial and governed by USDC smart‑contract code together with Circle’s Stablecoin Access Denial Policy. The policy states that Circle does not freeze individual USDC tokens. Instead, it can block or “deny access” to specific addresses on any blockchain where USDC circulates. When an address is blacklisted, it cannot send or receive USDC, effectively freezing all coins at that address until the restriction is lifted.

Circle says it will only deny access in two situations: (a) to protect the security or integrity of the network (for example, if minting keys are compromised) or (b) to comply with applicable laws, regulations, or court orders. Circle also commits to publicly reporting all frozen addresses, the amount of USDC frozen, and corresponding fiat reserves, and the policy states that the freeze can be reversed when the underlying legal order or security issue is resolved. For example, in July 2020, CENTRE (the governance body for USDC) blacklisted an Ethereum address containing $100,000 USDC. Etherscan records show a call to the blacklist function of the USDC contract, and CENTRE stated that the freeze was executed in response to a law enforcement request. Once blacklisted, the address could no longer send or receive USDC. The CENTRE explained that such freezes require approval by its board of managers and can be reversed once the legal obligation is lifted.

How USDC Freezing Works

- Smart‑Contract Design. The USDC smart contract includes administrative functions that allow Circle to control the token supply and enforce freezes. Beyond standard ERC-20 functions, the contract supports mint and burn functions for issuing or potentially destroying tokens. In practice, while minting is actively used, publicly documented cases of burn-after-freeze for USDC are limited. A pause function to halt all transfers, and blacklist and unBlacklist functions that add or remove addresses from an internal blacklist. Transfer functions are modified with a notBlacklisted modifier, so transfers check whether either the sender or the recipient is blacklisted; if either is, the transfer reverts. As a result, a blacklisted address cannot send or receive USDC.

- Implementation of a Freeze. Circle’s Compliance Team holds the private keys necessary to invoke these administrative functions. When a trigger occurs (e.g., a court order), Circle can call the blacklist function on the relevant blockchain to block an address. This process is recorded on‑chain and publicly visible. The freeze leaves the tokens in the address but prevents them from being transferred.

- Reasons for Freezing. According to Circle’s Access Denial Policy and subsequent explanations, freezes are used only for:

- Legal Investigations Or Law‑enforcement Requests: Court‑ordered asset seizures, civil forfeiture cases, etc.;

- Security Incidents. Such as hacks or exploits, where immediate action is needed to prevent stolen funds from moving;

- Sanctions and Regulatory Compliance. For example, when the U.S. Office of Foreign Assets Control (OFAC) sanctions an address.

- Effect of a Freeze. Once an address is blacklisted, the USDC contract will not process transfers to or from it. The address can still hold other tokens, but all USDC in it is frozen. Circle’s policy states that the freeze is temporary and can be lifted when the relevant legal or security issue no longer applies.

- Public Reporting And Oversight. Circle pledges to maintain a public list of frozen addresses and the amount of tokens blocked, which will be audited by its accounting firm. The process is designed to provide transparency and reassure users that freezes are not carried out without justification.

Jurisdiction Note. Circle operates within a U.S. regulatory context, which typically ties freezes to explicit legal authority and narrows unilateral options. Tether, historically based in the BVI and now domiciled in El Salvador, faces a different regulatory posture. That difference helps explain why USDT actions can appear more agile or preemptive, even though neither issuer “reverses” settled blockchain transactions in the literal sense.

USDT vs USDC Freezing Onchain Analysis

In this section, we analyze on-chain behavior using AMLBot’s Dune Dashboard (covering ERC-20 and TRC-20, snapshot October 7, 2025).

ERC-20 Freeze Activity: Historical Trends and Patterns

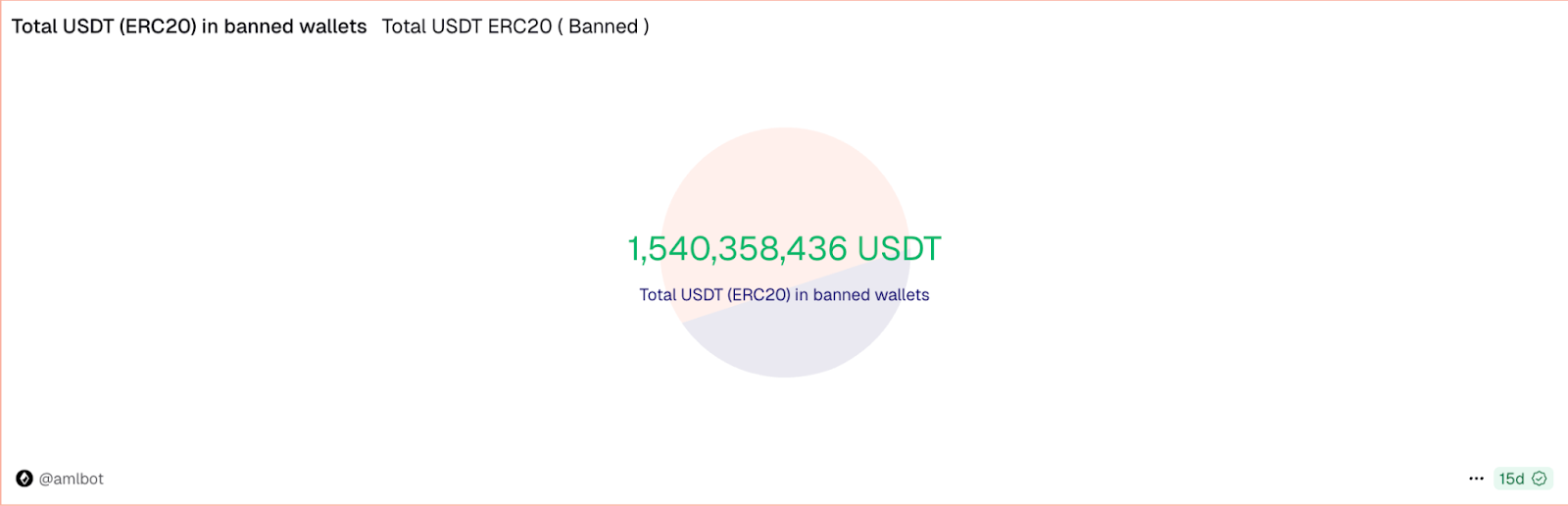

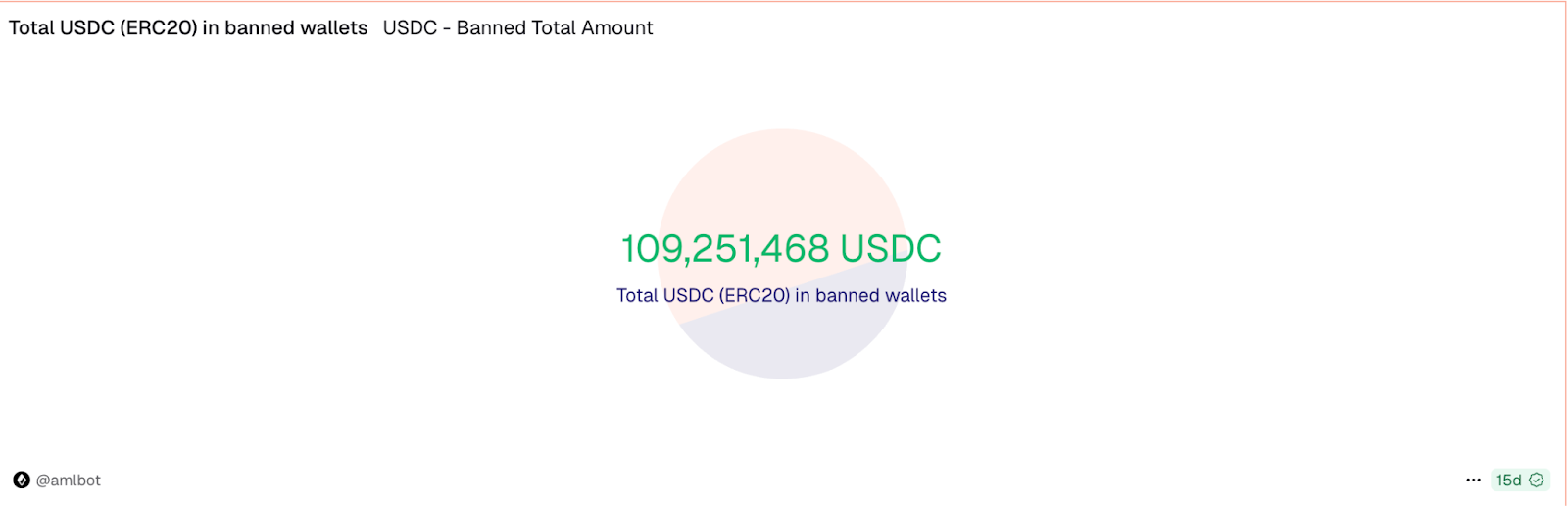

Figure 1 shows the total value currently held in blacklisted ERC-20 wallets. At this snapshot, approximately $1.54 billion in USDT (ERC-20) is frozen, compared to $109 million in USDC (ERC-20), a gap of roughly 14× on Ethereum alone.

Note: These figures reflect only the Ethereum-based freezes. In the following sections, we incorporate TRON (TRC-20) data to present a more complete cross-chain picture of how stablecoin issuers respond to enforcement requests.

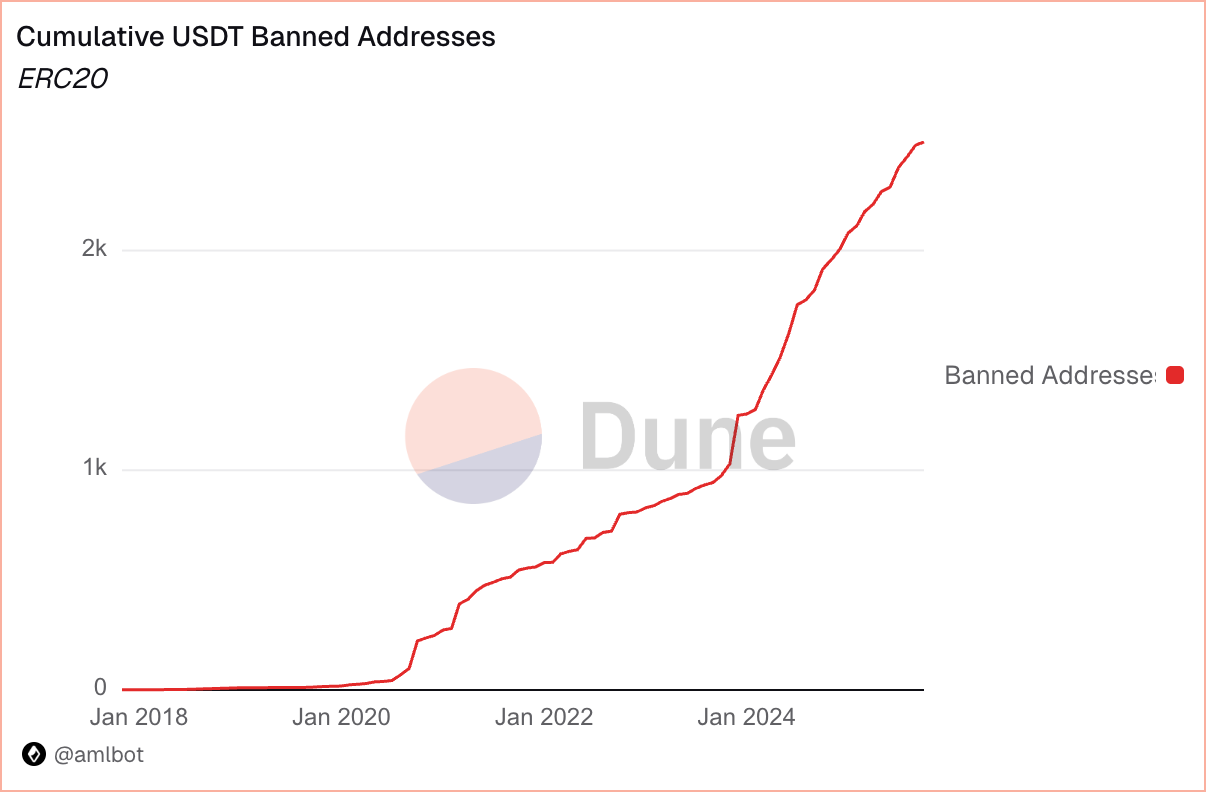

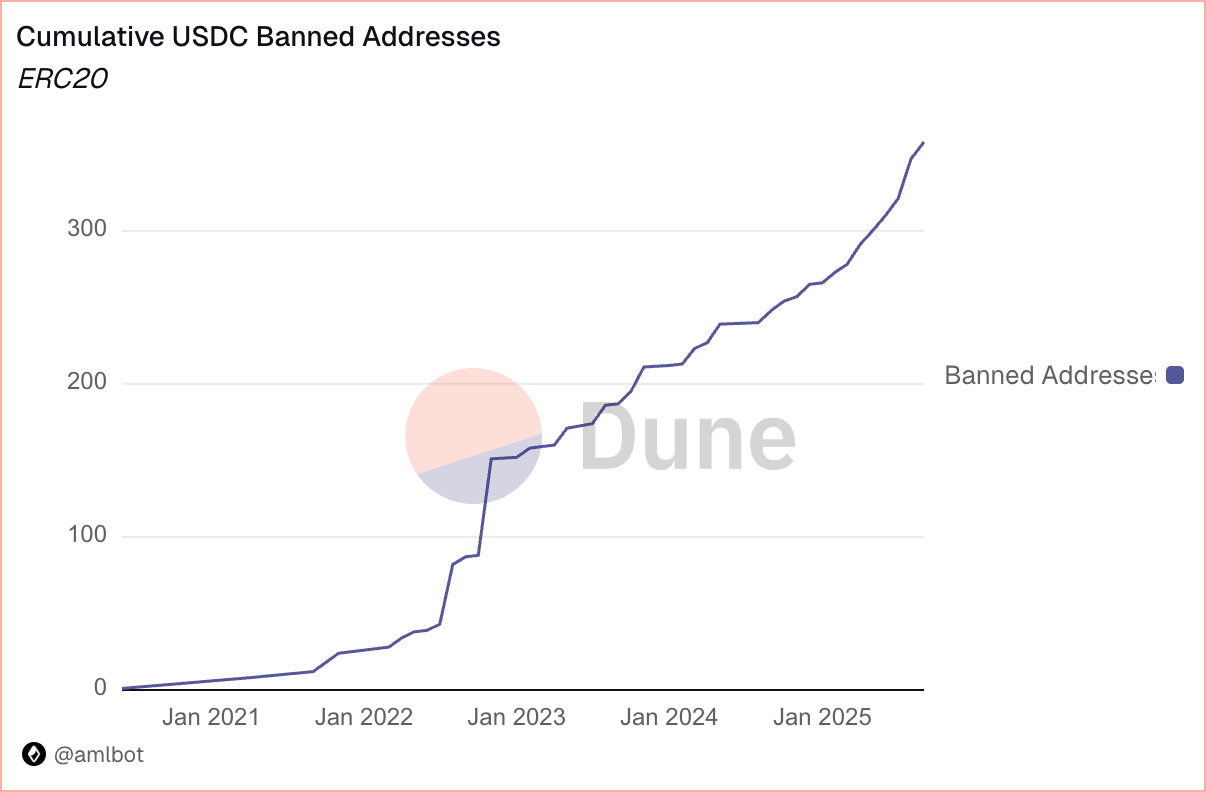

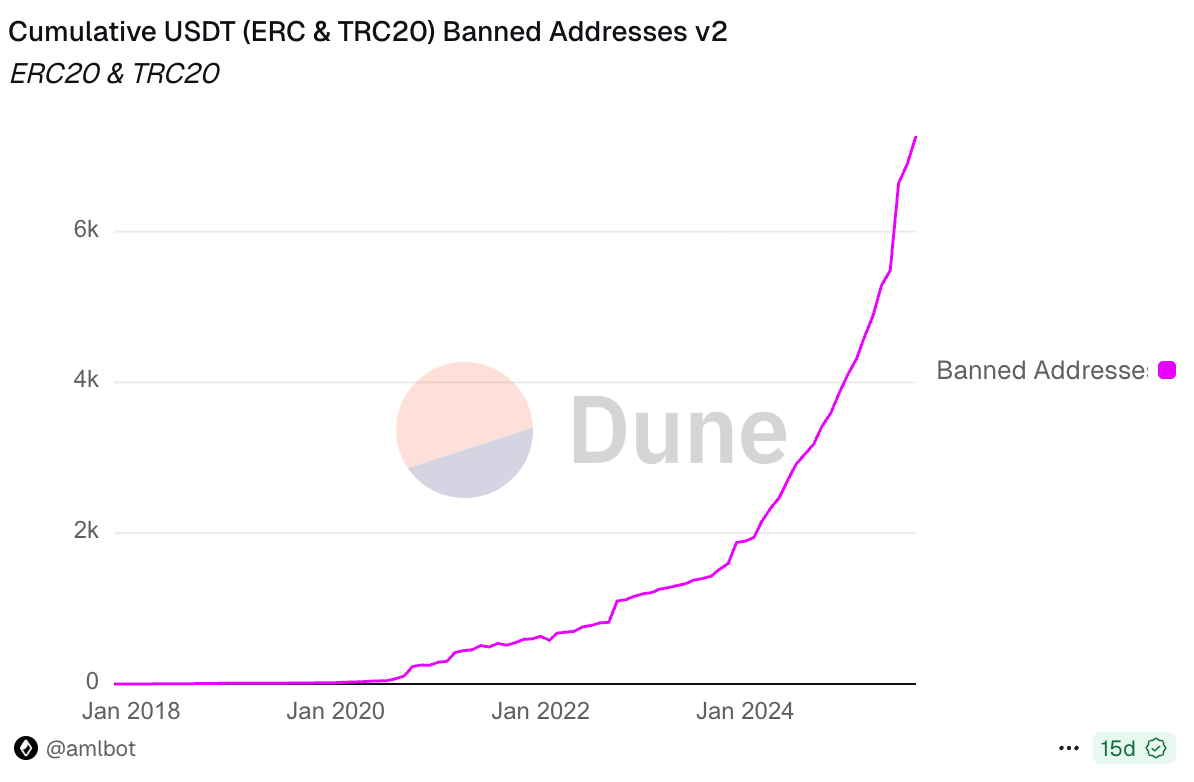

The cumulative address curves (Figure 2) illustrate the number of wallets frozen over time. In the ERC-20 data, USDT began blacklisting addresses as early as 2018 and gradually increased until late 2023. After that, the curve becomes almost vertical, with blacklisted addresses climbing from the low hundreds to more than 2,000 by mid-2025. USDC’s curve begins later (around 2020) and rises in steps. The total is expected to remain in the low hundreds by 2025.

The difference is not only in scale but also in tempo. USDT’s curve steepens continuously, while USDC’s shows long plateaus punctuated by sudden jumps.

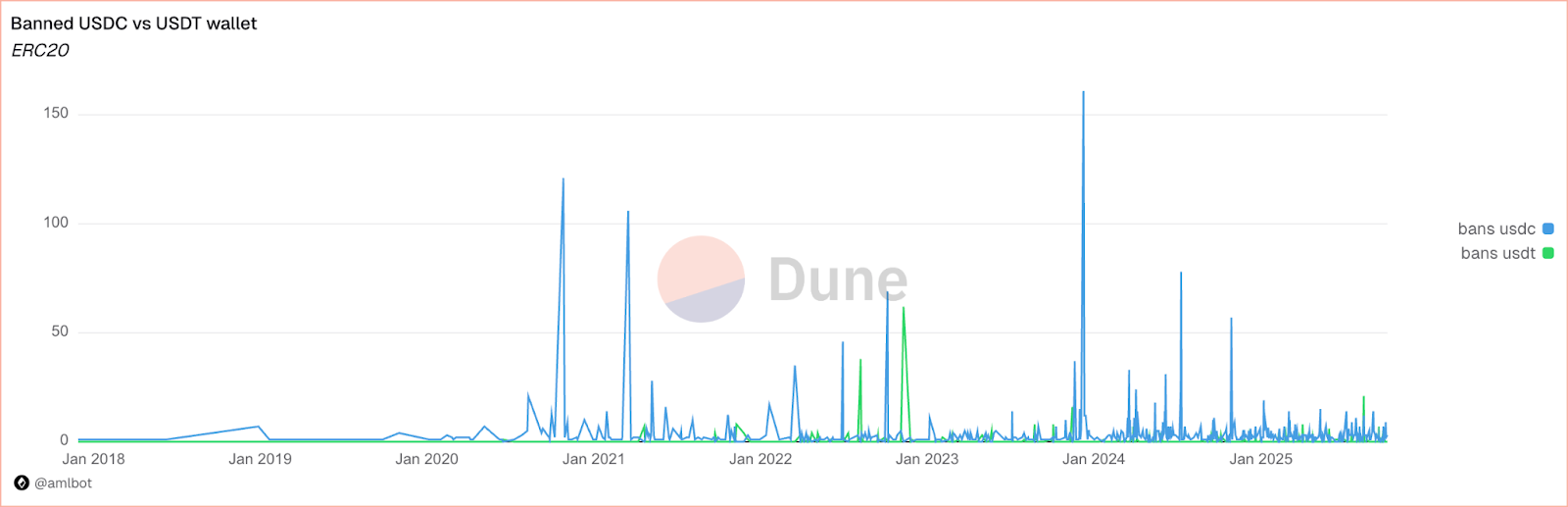

Figure 3 shows daily additions over time. USDC shows tall but rare spikes, while USDT – lower peaks but a consistent baseline. It clearly tells us that USDC actions arrive in batches tied to specific legal events. USDT actions occur more frequently, though activity can spike occasionally.

That aligns with the “philosophies” from the prior section: USDC’s order-driven model naturally groups actions when legal triggers arrive, while USDT’s more proactive posture produces a continuous flow as investigations progress and coordination with law enforcement adds new addresses regularly.

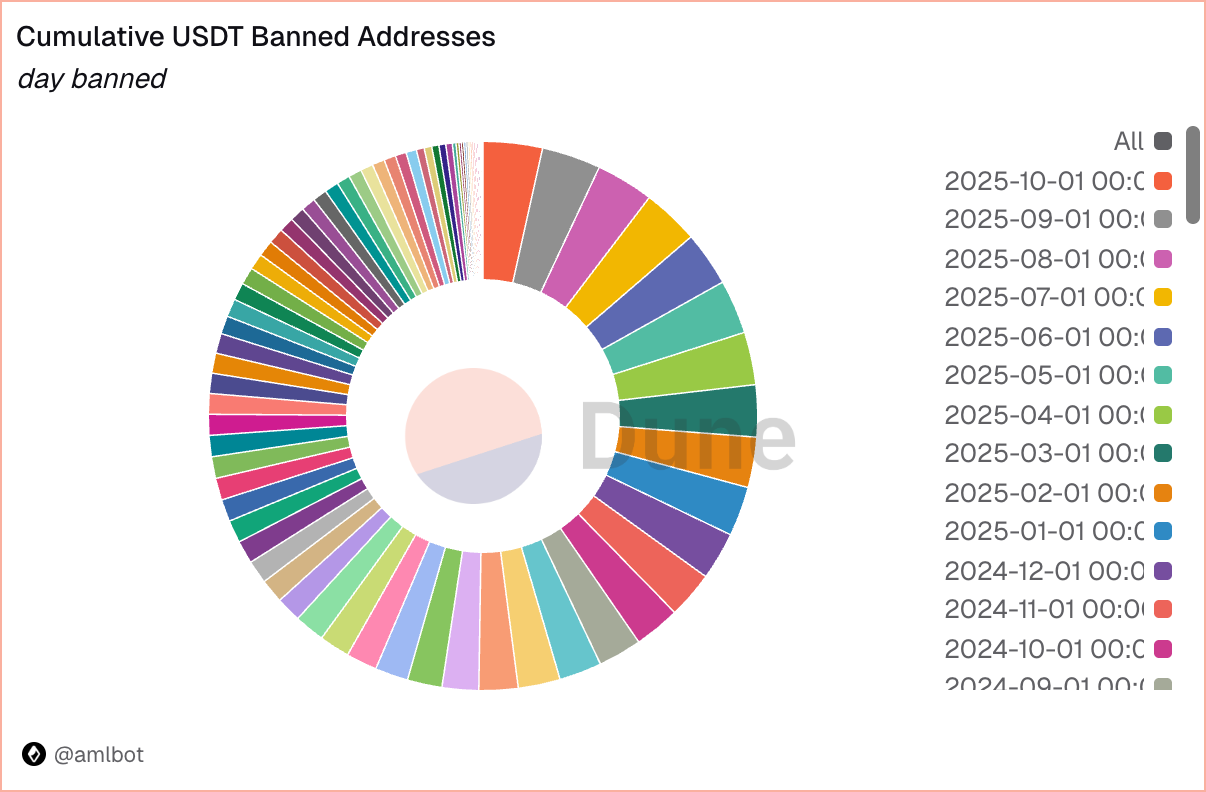

Figure 4 Donut Charts allocating bans by month show that the largest portions of freezes occurred in 2024–2025 for both assets. Segments for earlier years are much smaller. This recent concentration indicates that the majority of enforcement activity has taken place in the past two years, not early in the assets’ lifespans.

TRON (TRC-20) Freeze Activity: On-Chain Dynamics

While ERC-20 data reveals clear differences in how USDT and USDC implement freezes, it represents only part of the enforcement picture. With the addition of TRON (TRC-20), the primary network for USDT circulation, the dataset expands significantly, providing a more complete view of stablecoin blacklist activity across chains. The TRON segment is particularly important because it accounts for a substantial share of real-world USDT usage in Asia, OTC markets, P2P platforms, and high-velocity cross-border settlements.

The TRON dataset shows 1.75 billion USDT held in blacklisted TRC-20 wallets (Figure 5).

This value alone exceeds the ERC-20 portion, underscoring TRON’s central role in mitigating USDT-denominated illicit flows.

The cumulative address curve for TRC-20 USDT (Figure 6) displays:

- minimal activity from 2021 to late 2022,

- a clear acceleration beginning in mid-2023,

- and a sharp, near-exponential rise throughout 2024–2025, surpassing 4,000 banned addresses by October 2025.

This mirrors ERC-20 trends (also steepening in late 2023) but at a larger scale due to TRON’s higher transaction volumes.

Figure 7 shows a day-level distribution of TRC-20 freeze events. Each ring segment represents a specific date on which one or more addresses were blacklisted. The chart clearly illustrates that certain days account for disproportionately large portions of total TRON enforcement. These appear as wider segments, corresponding to high-volume freeze events. Surrounding them are numerous smaller segments, reflecting days with only a handful of frozen addresses. This pattern indicates that TRC-20 freezes occur both as isolated daily actions and as occasional high-impact enforcement days, where many addresses are blacklisted at once.

In conclusion, the on-chain data reveals clear differences in the freezing patterns of USDT and USDC.

USDT shows larger scale, continuous additions, and cluster-style freezes across both Ethereum and TRON, with TRON contributing the majority of high-value events. USDC exhibits smaller-scale, court-triggered actions, while TRON shows almost no additional freeze cases, reinforcing Circle’s narrow enforcement model. These patterns align with the issuers’ philosophies — Tether’s broader and more proactive authority to freeze and reissue, and Circle’s reliance on formal legal triggers.

Enforcement Mechanics: How USDT and USDC Manage Blacklists

The operational differences between Tether’s USDT and Circle’s USDC are among the most defining factors behind the enforcement practices observed across ERC-20 and TRC-20 networks. Although both issuers maintain blacklist mechanisms, their approaches diverge in scale, timing, and the overall lifecycle of enforcement. It directly influences how freeze activity appears on-chain between 2023 and 2025.

USDT Blacklist Lifecycle

USDT shows an active blacklist lifecycle marked by continuous updates and strict intervention management.

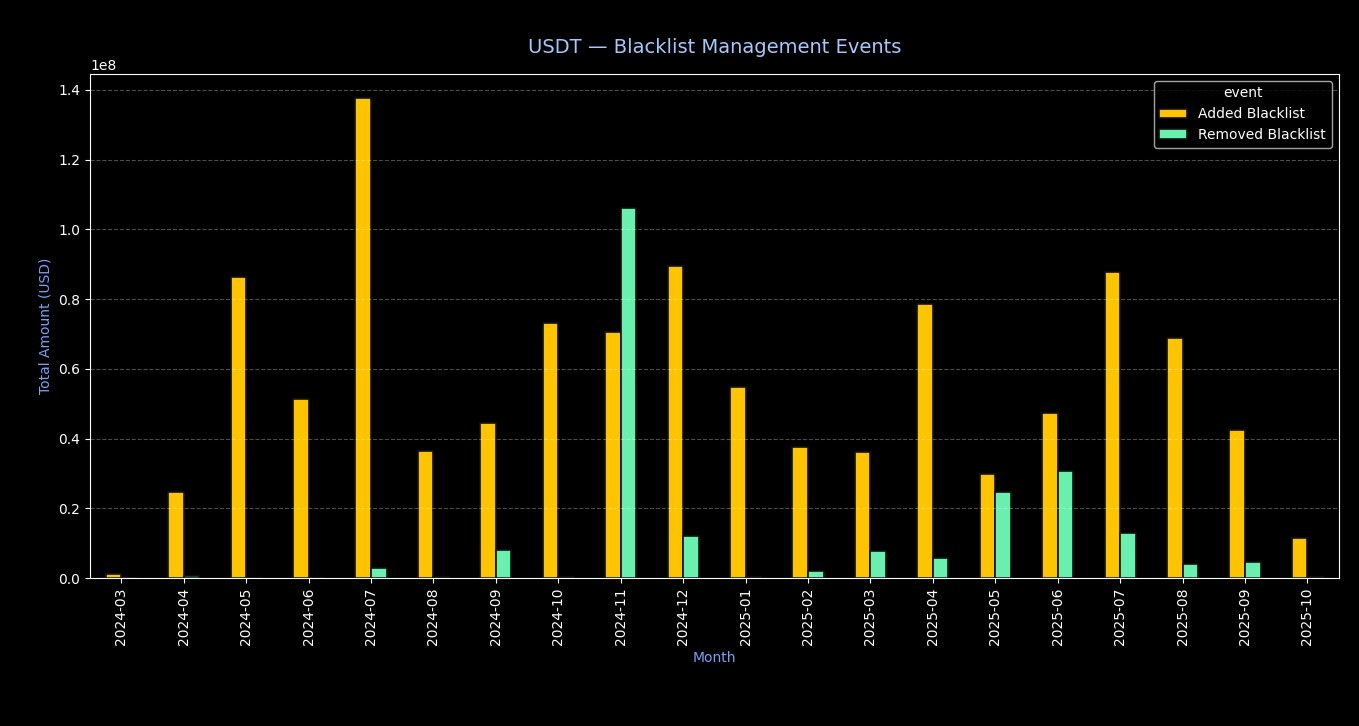

On-chain data shows large monthly volumes of newly blacklisted funds, often reaching tens or even over a hundred million dollars in certain periods. These freezes are typically linked to investigations of scam networks, stolen funds, illicit OTC and P2P clusters, and OFAC-connected nodes. While the majority of blacklist actions result in permanent freezes, Tether occasionally removes addresses from the blacklist once investigations conclude or when false positives are verified. A distinctive feature of the USDT enforcement pipeline is the ability to burn frozen tokens and reissue clean replacements to verified victims. This adjustment mechanism becomes particularly visible in months with unusually large “removed blacklist” volumes, such as November-December 2024, which correspond to high-value restitution events.

The tight correlation between freeze volume and real-world enforcement is especially notable. Activity surged throughout 2024 during coordinated crackdowns on Southeast Asian scam infrastructures. A prominent example occurred in July 2024, when Tether froze $29.6M in USDT on the TRON network linked to the Huione Group in Cambodia. In that same month, USDT freezes exceeded $130M, marking one of the highest enforcement peaks recorded across chains. These cases illustrate that USDT enforcement is not merely reactive to court orders, but often integrated into ongoing investigative processes.

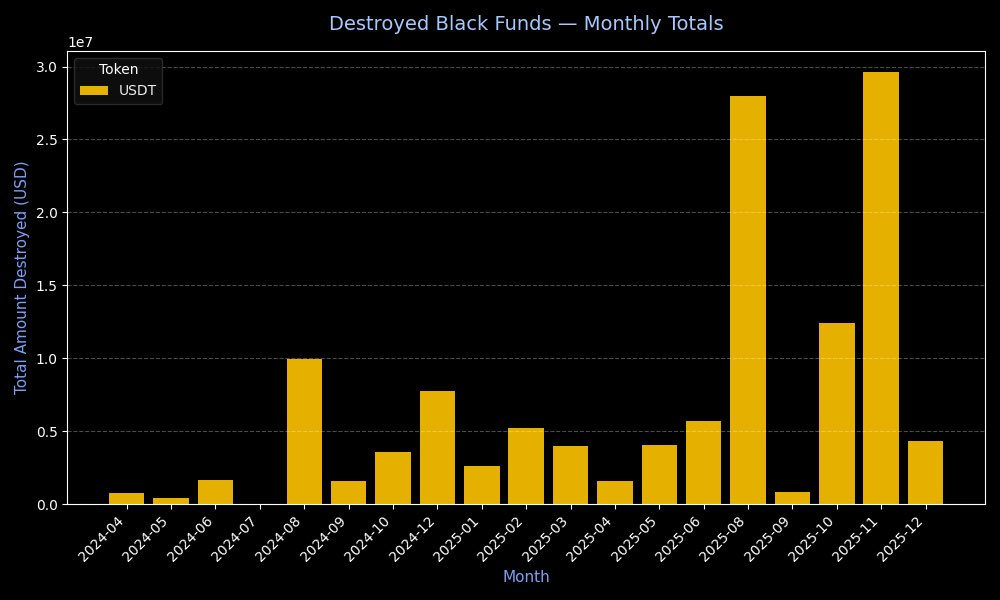

The burn-and-reissue dataset supports this interpretation. Monthly destroyed-funds charts reveal recurring remediation cycles, with values ranging from several hundred thousand to tens of millions of dollars.

Major spikes in September and November 2025, exceeding $25-30M in destroyed tokens, demonstrate how Tether finalizes freeze cases by permanently removing compromised assets from circulation and minting replacements for victims. This capability fundamentally distinguishes USDT’s model, creating a full operational loop: freeze, investigate, remediate, and reissue.

USDC Blacklist and Unblacklist Events

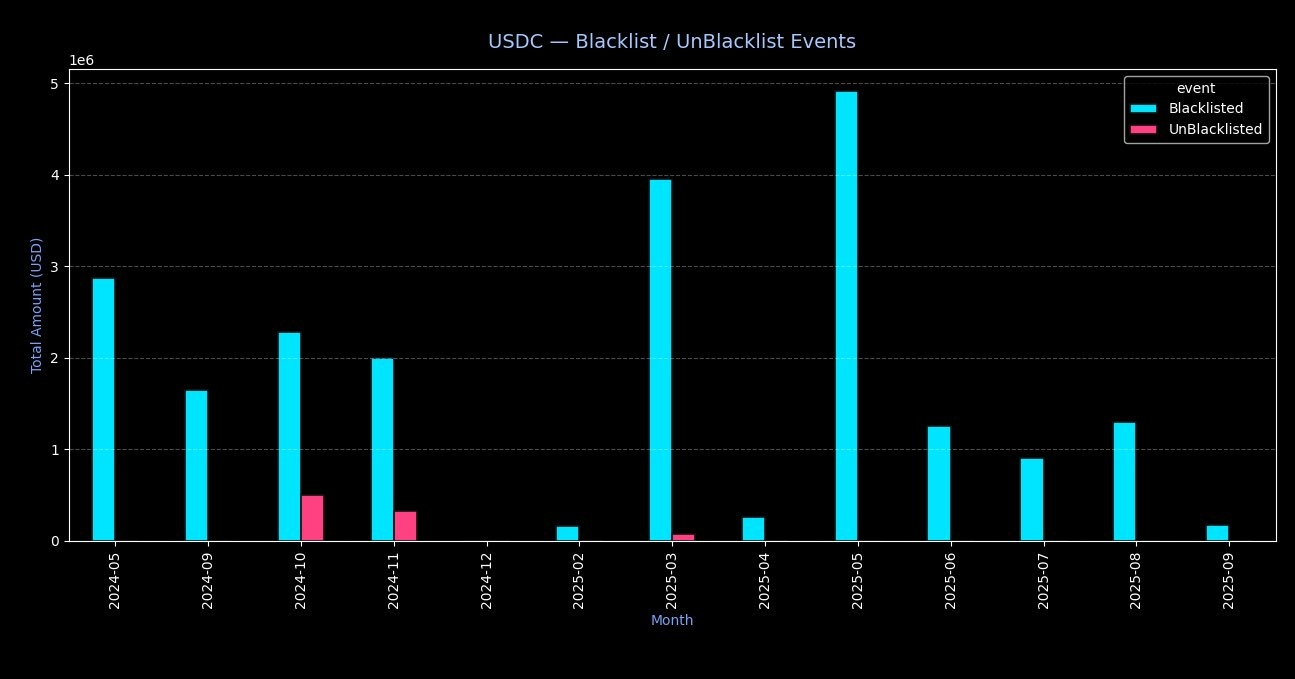

USDC, in contrast, follows a narrower and more judicially anchored enforcement model. Freeze events occur far less frequently and involve considerably smaller amounts, typically between $1 and $5 million per active month. The dataset shows that USDC blacklist actions cluster around specific periods, such as October–November 2024 and March–May 2025, rather than forming a continuous trend.

Unblacklist events occur only occasionally and at relatively modest values, reflecting strict procedural constraints. Circle does not support any burn-and-reissue mechanism, so frozen funds either remain frozen indefinitely or are released only after formal legal approval. As a result, USDC enforcement produces a smaller, more static footprint, with fewer operational touchpoints than USDT.

Together, the datasets, once again, reveal two different philosophies. USDT operates as a proactive and high-engagement system, frequently freezing addresses in coordination with intelligence partners, conducting internal reviews, and restoring funds through token reissuance. USDC, on the other hand, primarily acts in response to explicit judicial mandates and limits its intervention to freezing and, occasionally, unfreezing actions.

-AMLBot Team

Connect with AMLBot:

🔗 Website

🔗 Telegram AML Bot

🔗 AMLBot Support Team

🔗 AMLBot LinkedIn

🔗 Our Blog

Why Does Tether (USDT) Freeze Wallet Addresses?

Tether freezes addresses to comply with law-enforcement requests, regulatory requirements, sanctions lists, or when it considers an action prudent to protect users from hacks or illicit activity. The mechanism is built into USDT smart contracts on Ethereum and TRON.

How Much USDT Has Been Frozen Between 2023 and 2025?

According to AMLBot’s on-chain analysis, more than $3.29 billion in USDT was frozen across Ethereum and TRON from 2023 to 2025, involving 7,268 blacklisted addresses.

Does Tether Burn and Reissue Tokens after a Freeze?

Yes. Tether can burn frozen USDT and mint clean replacement tokens for victim restitution, a process visible in on-chain burn data. This is unique to USDT’s enforcement model.

Does Circle (USDC) Freeze Wallets in the Same Way as Tether?

No. Circle uses a more judicial model. It freezes addresses only in response to explicit legal triggers such as court orders, sanctions compliance, or security incidents. It does not support a burn-and-reissue mechanism.

How Much USDC Has Been Frozen From 2023 to 2025?

Circle froze approximately $109 million in USDC across 372 addresses during the same period, based on AMLBot’s Dune Dashboard dataset.

Why are USDT Freeze Events More Frequent Than USDC?

USDT supports proactive coordination with more than 275 law-enforcement agencies across 59 jurisdictions and may freeze addresses pre-emptively. USDC actions cluster around single legal events, resulting in rare but larger spikes.

Is Stablecoin Freezing Legal?

Yes. Freezing is legal when executed to comply with regulatory mandates, investigations, sanctions, or court orders. The authority depends on each issuer’s jurisdiction and smart-contract policies.