AML Training for Crypto Business - Burden or Necessity

In the fast-paced world of cryptocurrencies, where anonymity and cross-border transactions are prevalent, regulatory authorities have imposed stringent AML regulations to combat money laundering, terrorist financing, and other financial crimes. Licensed crypto businesses must undergo AML training at least once a year to ensure they understand and adhere to these regulations. Moreover, unlicensed businesses planning to establish banking relationships or engage with crypto exchanges (CEXs) will also need to prove they undertake AML training.

AML training aims to equip individuals and employees with the knowledge and skills to identify and prevent illicit activities inside their businesses. By providing comprehensive AML training, businesses can foster a culture of compliance and safeguard their operations from reputational and financial risks. Furthermore, AML training is critical for maintaining positive relationships with the financial supervisory authority, banks, CEXs, and other stakeholders who expect stringent AML measures to be in place.

In the following sections, we will delve into the benefits of cryptocurrency AML training, explore its impact on risk mitigation and compliance, and discuss best practices for effective training programs. By the end of this article, it will become evident that AML training is not merely a burdensome requirement but a necessary investment in the success and longevity of crypto businesses.

Compliance with Regulatory Requirements

The regulatory landscape surrounding the crypto industry is evolving rapidly, with authorities worldwide implementing strict cryptocurrency AML regulations to combat money laundering and financial crime prevention. Non-compliance with these regulations can result in severe penalties, reputational damage, and legal consequences for crypto businesses. Therefore, AML training becomes essential to update employees and the management board with new regulatory changes and to ensure further compliance with them.

In recent years, the crypto industry has faced challenges meeting AML compliance requirements. Some businesses have struggled to establish robust AML procedures and systems, leading to potential vulnerabilities and exposure to illicit activities. Instances of crypto businesses inadvertently facilitating money laundering or terrorist financing have emphasized the critical need for comprehensive cryptocurrency AML training.

Risks associated with non-compliance

There are several risks associated with non-compliance in the blockchain field. These risks include regulatory violations, money laundering, terrorism financing, fraud, scams, security breaches, investor losses and lack of consumer protection, and tax evasion. Non-compliance in the blockchain field can have severe consequences, leading to the termination of businesses or sanctions. Two prominent cases exemplify the gravity of these situations.

Suex crypto exchange case

Suex crypto exchange became the first-ever crypto exchange sanctioned by the US government for its purported role in enabling illegal cryptocurrency transactions involving ransomware attackers. The imposition of sanctions resulted in restricted access to financial markets and damaged the exchange's standing within the cryptocurrency community. Other crypto exchanges may also avoid any association with the sanctioned entity.

Garantex case

The second example is Grantex, a crypto exchange licensed in Estonia. Garantex was sanctioned by the USA. The sanctions were imposed due to its alleged involvement in facilitating illegal cryptocurrency transactions related to dark markets and ransomware attacks. It led to license revocation by the Estonian Financial Intelligence Unit and the closure of business for European and West markets.

Regarding compliance audits in the blockchain field, they are usually conducted by financial supervisory authorities or external auditors to ensure that businesses are adhering to the relevant laws and regulations. The frequency and scope of these audits can vary depending on the industry and the specific applicable regulations. For example, financial institutions may be subject to regular audits by government agencies to ensure compliance with anti-money laundering and counter-terrorist financing laws. Other industries may have their own regulatory authorities that conduct regular checks to ensure compliance with industry-specific regulations.

AMLBot AML Training

Our dedicated team of AMLBot experts has developed two comprehensive training programs to address the critical challenges crypto businesses face in today's ever-evolving landscape. With the increasing risks of money laundering and terrorist financing, regular AML training has become an essential pillar for the success and sustainability of crypto companies.

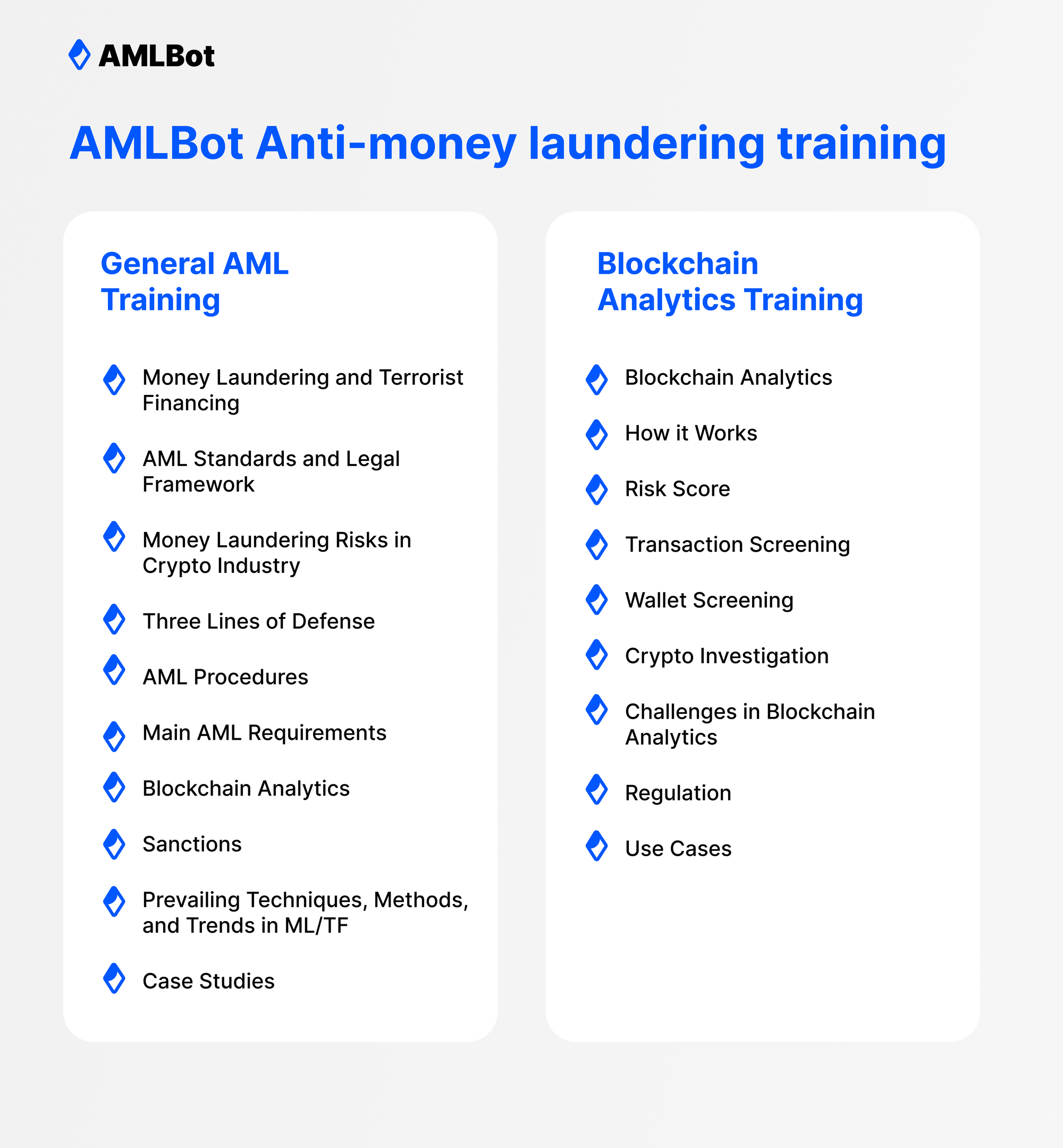

Agenda of General AML Training

Our General AML Training equips participants with the knowledge and tools to combat financial crimes effectively. From understanding the intricacies of money laundering to navigating the global AML standards specific to the crypto industry, this training provides a solid foundation for compliance. AML training delves into the risks unique to cryptocurrencies guides businesses in implementing robust AML processes, and explores the powerful potential of blockchain analytics to detect suspicious activities. Through case studies and real-life examples, participants gain practical insights into the prevailing techniques, methods, and trends in money laundering and terrorist financing.

Money Laundering and Terrorist Financing: Understanding the concepts, techniques, and indicators of money laundering and Terrorist Financing Activities.

AML Standards and Legal Framework: Familiarizing participants with global AML standards, regulations, and legal obligations specific to the crypto industry.

Money Laundering Risks in Crypto Industry: Identifying the inherent risks of cryptocurrencies, such as anonymity, cross-border transactions, and using digital assets for illicit activities.

Three Lines of Defense: Exploring the roles and responsibilities of different stakeholders in the AML framework, including management, compliance officers, and internal auditors.

AML Procedures: Providing guidelines and best practices for implementing effective AML procedures within crypto businesses, including customer due diligence (CDD), transaction monitoring, and suspicious activity reporting.

Main AML Requirements: Understanding the specific AML requirements imposed by regulatory authorities, such as record-keeping, reporting obligations, and risk assessment methodologies.

Blockchain Analytics: Introducing participants to blockchain analytics tools and techniques for monitoring and analyzing transactions on the blockchain to detect suspicious activities.

Sanctions: Educating participants on international sanctions regimes and the importance of screening transactions and entities against sanctioned lists.

Prevailing Techniques, Methods, and Trends in ML/TF: Keeping participants informed about the latest trends, tactics, and methods employed by money launderers and terrorists to adapt AML measures accordingly.

Case Studies: Working on practical assignments, allowing participants to apply their knowledge and problem-solving skills.

Agenda of Blockchain Analytics Training

For a deeper understanding of blockchain analytics and its practical application, our specialized Blockchain Analytics Training offers a comprehensive journey. Participants gain insights into the historical development of blockchain analytics, learn about the underlying technology and algorithms, and acquire skills to assess risks and trace transactions. By understanding crypto investigations and overcoming challenges, participants become proficient in identifying illicit behavior in the blockchain world.

Blockchain Analytics: Exploring the history and development of blockchain analytics as a tool for monitoring and investigating transactions on the blockchain.

How it Works: Understanding the underlying technology and algorithms used in blockchain analytics to trace and analyze transactions.

Risk Score: Learning what a risk score is and how to interpret it.

Transaction Screening: What is this, and how it impacts the business.

Wallet Screening: Discuss methods for screening wallets to track funds and detect suspicious behavior.

Crypto Investigation: Introducing participants to crypto investigations, including tracing transactions, identifying owners of wallets, and collaborating with law enforcement agencies

Challenges in Blockchain Analytics: Highlighting the limitations and challenges faced in analyzing blockchain data, such as privacy-enhancing technologies and the use of mixers or tumblers.

Regulation: Exploring the regulatory landscape for blockchain analytics and the compliance requirements imposed by authorities.

Use Cases: Working on practical and real case assignments

By the end of this training, participants will have a comprehensive understanding of their roles and responsibilities in cryptocurrency AML compliance, the importance of maintaining robust AML/CFT systems, and the potential risks associated with non-compliance. They will also learn about the latest developments in AML/CFT regulations and best practices for identifying and reporting suspicious transactions.

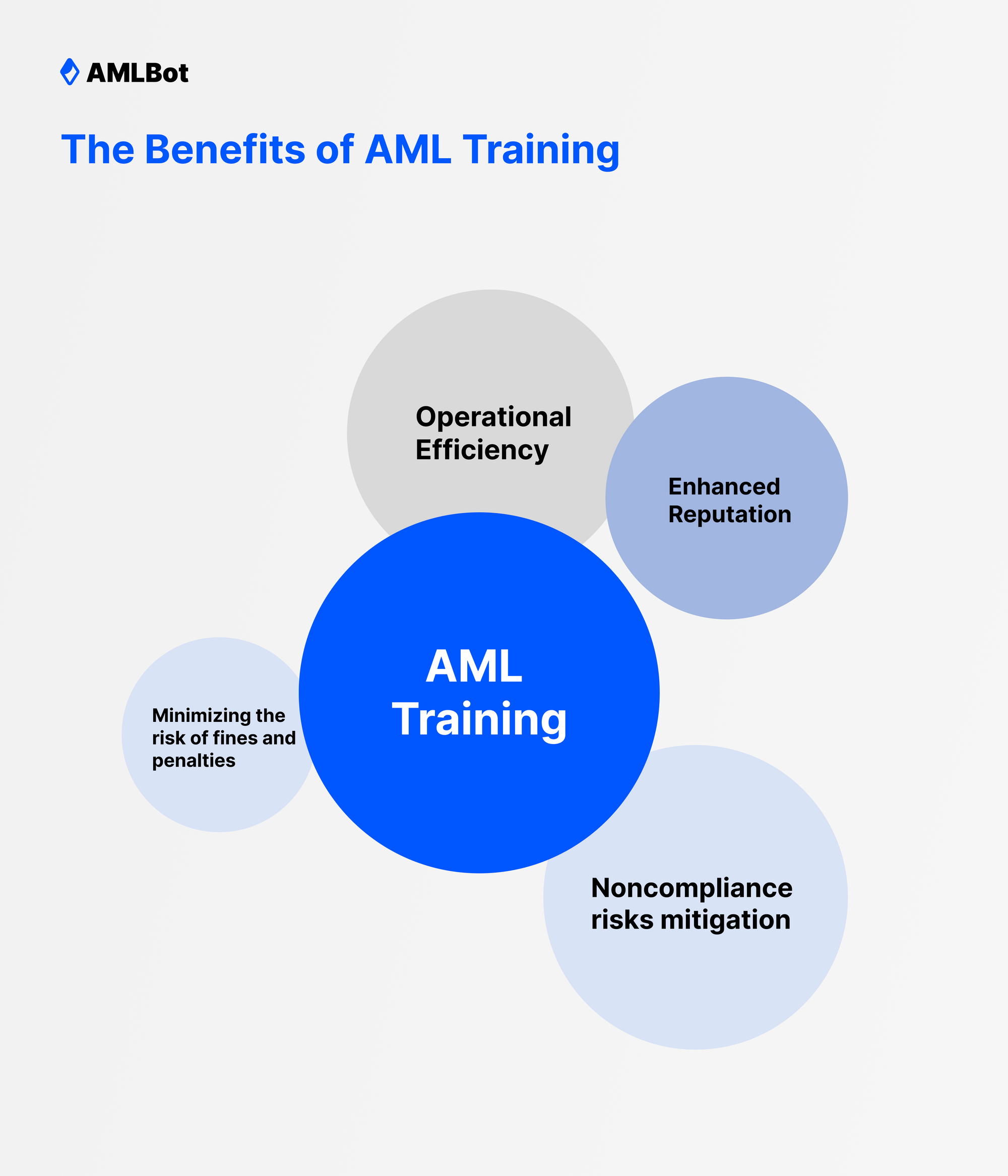

The Benefits of AML Training: Empowering Businesses for a Secure Crypto Environment

In this chapter, we delve into the numerous benefits of AML training and explore how it empowers businesses to create a secure and trusted crypto environment. From fraud prevention to operational efficiency and reputation enhancement, AML training offers a range of advantages that go beyond mere compliance. By understanding the pluses of AML training, businesses can unlock its potential to bolster their security measures, streamline operations, and build a strong foundation of trust within the crypto industry.

Operational Efficiency and Cost Savings:

AML training can improve operational efficiency by streamlining compliance processes. By providing employees with a thorough understanding of AML regulations and best practices, businesses can ensure that their compliance processes are efficient and effective. Trained employees are better equipped to implement AML controls and procedures, reducing the number of false positives and unnecessary delays. This can help to speed up the compliance process, allowing businesses to focus on their core operations.

In addition to improving operational efficiency, AML training can also result in cost savings for businesses. Businesses can avoid the financial consequences of regulatory violations by preventing fines, penalties, and reputational damage associated with non-compliance. Furthermore, by reducing the number of false positives and unnecessary delays, businesses can save time and resources that would otherwise be spent on resolving compliance issues.

Overall, AML training is an essential investment for businesses that want to improve their operational efficiency and reduce their compliance costs. By providing employees with the knowledge and skills to implement AML controls and procedures effectively, businesses can streamline their compliance processes and avoid the potential consequences of non-compliance.

Enhanced Reputation and Trust

Reputation is vital in the crypto industry. With the rise of cryptocurrencies and blockchain technology, there has been an increase in fraudulent activities and scams. As a result, consumers are becoming more cautious when choosing which businesses to trust with their investments. A strong reputation for security and compliance can help businesses to attract and retain customers, as well as to build trust with regulators and other stakeholders.

AML training can help businesses to maintain a strong reputation by demonstrating a commitment to security and compliance. By providing employees with the knowledge and skills to implement AML controls and procedures effectively, businesses can show that they take their compliance obligations seriously. This can help to build trust with customers, regulators, and other stakeholders, enhancing the business’s reputation in the crypto industry.

By demonstrating a commitment to security and compliance, businesses can attract and retain customers and avoid the potential consequences of non-compliance.

Continuous Adaptation to Evolving Risks

Money laundering and the regulatory landscape are dynamic in nature, with new risks and challenges emerging all the time. As a result, businesses need to adapt continuously to evolving risks by staying up-to-date on the latest developments in the field.

Ongoing Anti-money laundering training is essential for businesses to stay updated on emerging risks and regulatory changes. Regular training sessions can help employees to understand the latest trends in money laundering and terrorist financing, as well as learn about new regulations and best practices. This knowledge can then be applied to the business’s AML strategies and processes, enabling the business to adapt to evolving risks and stay compliant with relevant laws and regulations.

In summary, continuous adaptation to evolving risks is crucial for businesses operating in the crypto industry. By investing in ongoing AML training, businesses can stay up-to-date on emerging risks and regulatory changes, enabling them to adapt their AML strategies and processes accordingly.

Conclusion

AML training is important for both licensed and unlicensed crypto companies. By investing in AML training, businesses can reap a wide range of benefits, including improved compliance, risk mitigation, enhanced reputation, increased operational efficiency, and the ability to adapt to evolving risks continuously.

Crypto businesses need to view AML training as a necessity rather than a burden. The long-term benefits of AML training far outweigh the short-term costs, both for the individual company and for the industry as a whole. By demonstrating a commitment to security and compliance, businesses can build trust with customers, regulators, and other stakeholders, enhancing their reputation and competitiveness in the crypto industry.

FAQ

Is AML training mandatory for all businesses in the crypto industry?

- Yes, AML training is mandatory for licensed and unlicensed crypto companies in many jurisdictions. However, the specific requirements may vary depending on the country or region

How often should AML training be conducted?

- AML training should be conducted regularly to ensure employees are current with the latest developments. The frequency may vary depending on industry standards, regulatory requirements, and the company's risk assessment.

Are there any certification programs for AML professionals?

- Yes, there are various certification programs available for individuals seeking to specialize in AML compliance. These certifications validate the knowledge and expertise of professionals in the field. As licensed professionals in the field, AMLBot provides participants with a certification upon completing AMLBot trainings, further enhancing their credentials in AML compliance.

Where can businesses find reputable AML training providers?

- Reputable AML training providers can be found through industry associations, regulatory bodies, and specialized training organizations. It is essential to choose a provider with a strong track record and expertise in AML compliance.