Blockchain Analytics: What It Is and How It Works

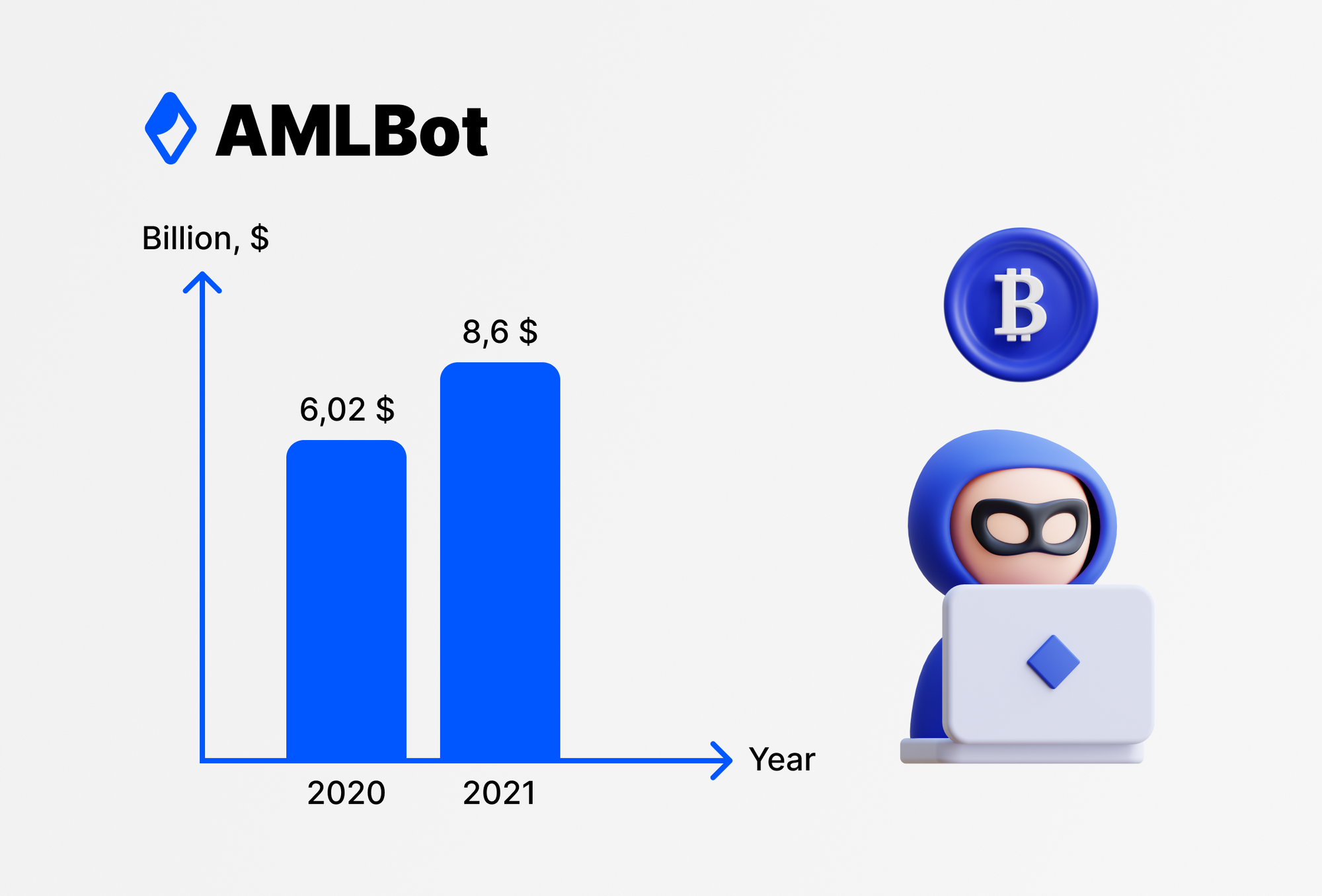

Blockchain technology has revolutionized financial transactions, creating a more efficient and transparent system that has garnered the attention and support of industries ranging from retail to healthcare. Unfortunately, bad actors have also taken note of the potential of cryptocurrency and have exploited the vulnerabilities of the blockchain for criminal purposes. In 2021, criminals around the globe laundered $8.6 billion worth of cryptocurrency, which was a 30% increase over 2020. Blockchain analytics is a critical strategy to reduce criminal activity, increase compliance, and create a more secure space for everyone on the blockchain.

The need for greater awareness of what is happening on the blockchain has never been more important. More than 80% of today's top 100 public companies use blockchain technology, and those who are not taking advantage of blockchain analytics are likely exposing themselves to a very high level of risk. For this reason, it's essential that everyone involved in cryptocurrency understands what blockchain analytics is and how it can be used to strengthen and secure transactions across the board.

What Is Blockchain Analytics?

Blockchain analytics is a form of data science focused on the analysis, identification, and clustering of data on the blockchain, which is a digitally distributed public ledger. In other words, blockchain analytics is a method that companies use to investigate blockchain transactions and flag potentially fraudulent or illicit activities.

The inherent anonymity of blockchain technology is part of what makes it so appealing to legitimate investors and businesses. However, it is also what makes cryptocurrency and other digital assets especially enticing to criminals who feel that they can go undetected while laundering money, financing terrorism, and committing other kinds of fraud. With blockchain analytics, companies can better prepare for, prevent, and react to potential criminal activity. It makes it possible for analytics providers to identify important information about users and their associated transactions through modeling and visually representing data.

Why Is Blockchain Analytics Important?

Because the use of blockchain technology and cryptocurrency is relatively new, there are still countless opportunities for innovation and improvement. Blockchain analytics is one critical development that promises to help the crypto market flourish and thrive.

Reducing & Preventing Illegal Activities

As cryptocurrency gains popularity and fully enters the mainstream, not only for private users but also for major corporations, financial institutions, and even governments, it will become increasingly vital to lower risk and offer protection for all parties involved. While blockchain technology is highly regarded for its level of security, there are nevertheless significant risks. For example, the Federal Trade Commission reported that between January 2021 and June 2022, more than 46,000 people in the United States reported losing over $1 billion to cryptocurrency scams.

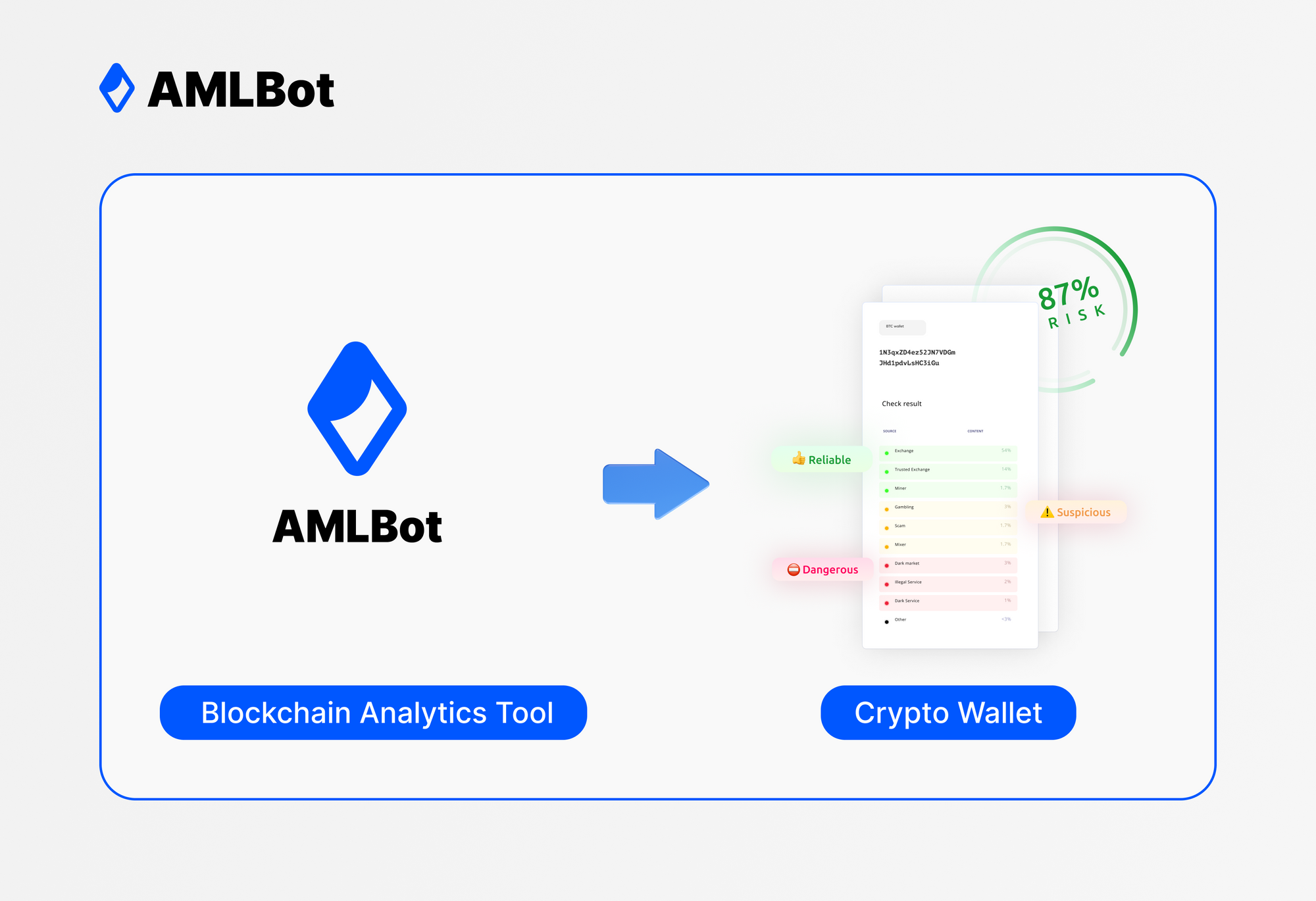

Blockchain analytics tools, such as AMLBot, screen crypto wallets and transactions to identify connections to illicit activities, including money laundering and fraud, in real time and reduce the likelihood of future criminal activity.

Private companies that specialize in blockchain analytics scrape blockchain data, which is all publicly available, to gather the necessary data to match transactions with specific people or organizations. This is key to creating a safer cryptocurrency market.

Improving Compliance

In addition to reducing the risk of fraud, blockchain analytics is also important for companies that want to improve their compliance with cryptocurrency regulations. Legislative bodies worldwide have created and will continue to build upon crypto financial regulation requirements, with the potential for significant penalties for failed compliance. Businesses can implement blockchain analytics in order to identify illicit activity and build a greater sense of transparency and trust with users. In short, crypto transaction monitoring ultimately improves profitability and opportunities for growth while also ensuring that businesses meet the standards set by national and local regulatory agencies.

Enhanced Business Strategies

Finally, blockchain analytics is useful in terms of improving the decision-making processes of businesses. The ability to assess risk levels allows traders, businesses, and institutions to shorten their reaction times and make more informed choices. Having access to actionable data is fundamental to any organization's ability to operate efficiently and intelligently.

How Does Blockchain Analytics Work?

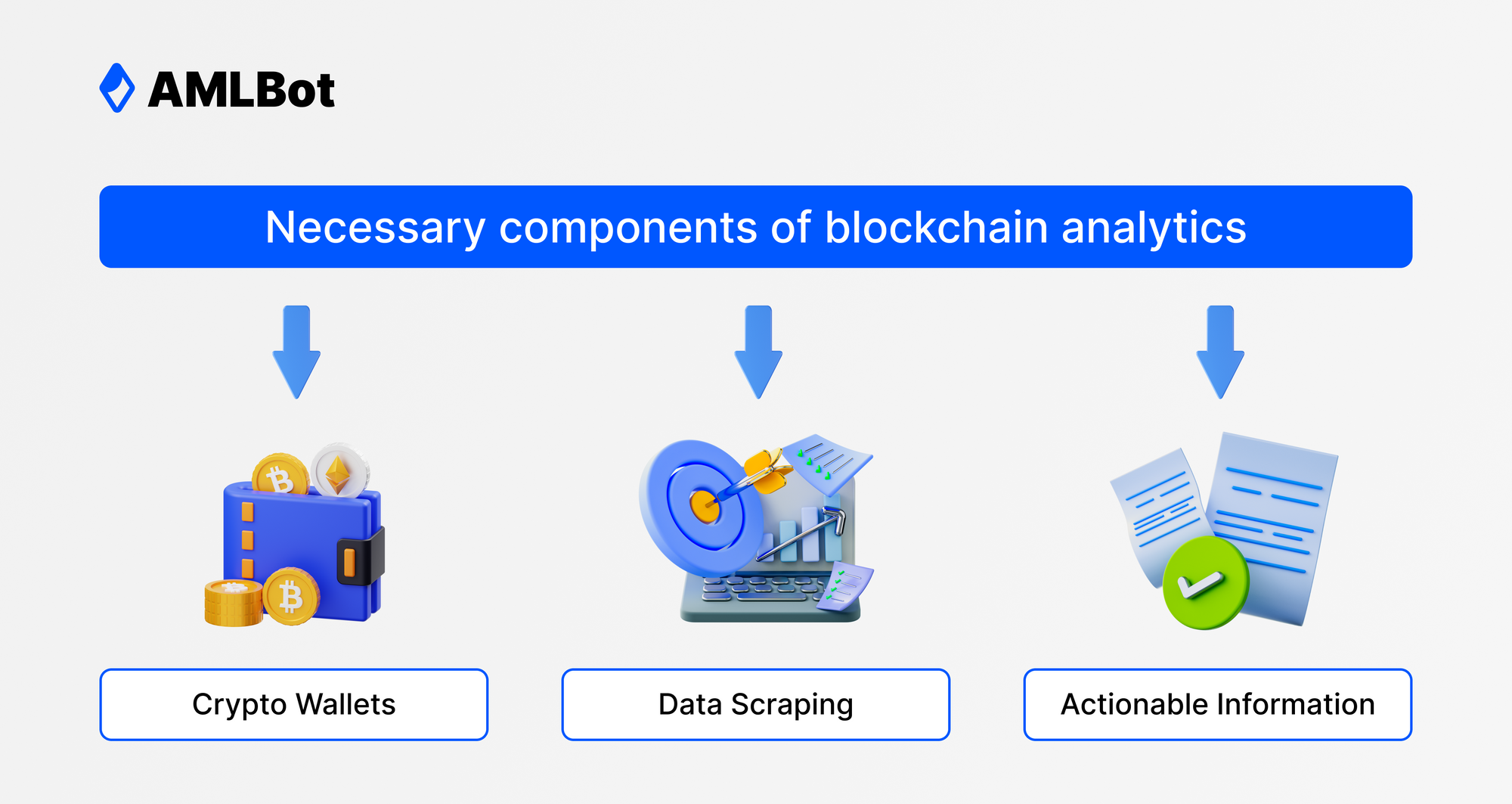

The goal of blockchain analytics is to connect crypto wallets to criminal behavior, but how do they do it? There are several necessary components that must exist in order for analytics providers to offer sound data.

Crypto Wallets

First, it's important to understand the function of crypto wallets. Unlike physical wallets, which can hold a person's paper or coin currency, a customer with cryptocurrency doesn't use a crypto wallet to store funds. Instead, funds are stored on the blockchain, and the crypto wallet holds the private keys that are necessary in order to access a cryptocurrency balance. Many crypto wallets are kept under pseudonyms rather than the name of an actual person or company. However, as a general rule, custodial crypto wallets are set up with a know-your-customer (KYC) onboarding process that requires users to verify their identities before linking them to crypto wallets.

Data Scraping

Data from crypto transactions is permanent and immutable, meaning that it can never be changed or deleted from the blockchain. For this reason, blockchain analytics companies can scrape this data and look for signifiers from every transaction for a particular wallet. Scraping refers to the process of collecting, storing, and updating relevant data, including the crypto wallets that are used in a transaction, the type and amount of cryptocurrency, and the date and time of the transaction.

With this data in hand, the analytics provider can identify suspicious activity. For example, if a crypto wallet was previously linked to criminal activity like terrorist financing, the blockchain analytics company can flag it and assign an elevated risk score. Businesses can work with analytics companies to screen every transaction and evaluate the corresponding risk level for improved decision-making.

Actionable Information

The information that results from the scraping process is useful not only for assessing risk but also for empowering the authorities to tamp down on illicit activity. If blockchain analytics reveals something suspicious, the provider can send the information to the appropriate law enforcement agency, which can then use a Suspicious Activity Report (SAR) to match an anonymous wallet with an actual identity. As government agencies are not yet capable of monitoring illegal activities on their own, this kind of data is vital to establishing the identities of the individuals and organizations who are responsible.

The analytics company can also tag a crypto wallet with a typology that ties it to a certain type of criminal activity, which helps prevent fraud in the future. Taking it a step further, analytics providers can create a database and group transactions with similar typologies into clusters. This is an integral step when discovering both the source and destination of illicit funds.

Where Is Blockchain Analytics Used?

It's clear that blockchain analytics plays a central role in anti-money laundering efforts and fraud reduction. In fact, law enforcement agencies were some of the earliest blockchain analytics customers, as they used and continue to use the data to help identify suspected criminal activity.

However, fraud detection and prevention is not the only possible application. Blockchain analytics is also used for a variety of other purposes:

There will likely be additional uses of blockchain analytics revealed over time, just as there will be increased support for its use for improving security and reducing fraud. For example, in April 2022, Adrienne Harris, the head of the New York State Department of Financial Services, said that all cryptocurrency firms should use blockchain analytics tools to manage financial risks and monitor suspicious activity. More specifically, she argued that blockchain analytics is important for many "effective policies, processes, and procedures, including, for example, those relating to customer due diligence, transaction monitoring, and sanctions screening."

Leveraging Blockchain Analytics

Whether they hope to prevent a potential financial crime, comply with financial regulations, or simply improve their decision-making processes, businesses have a lot to gain from blockchain analytics. As the cryptocurrency market grows and develops, criminal enterprises large and small will seek new ways to attack vulnerabilities. Blockchain analytics is one of the most important developments in reducing and preventing fraud, money laundering, and terrorism financing, and no business that is involved in the crypto market can afford to act without sound data.