Crypto Regulations in the US 2025: Complete AML & Compliance Guide

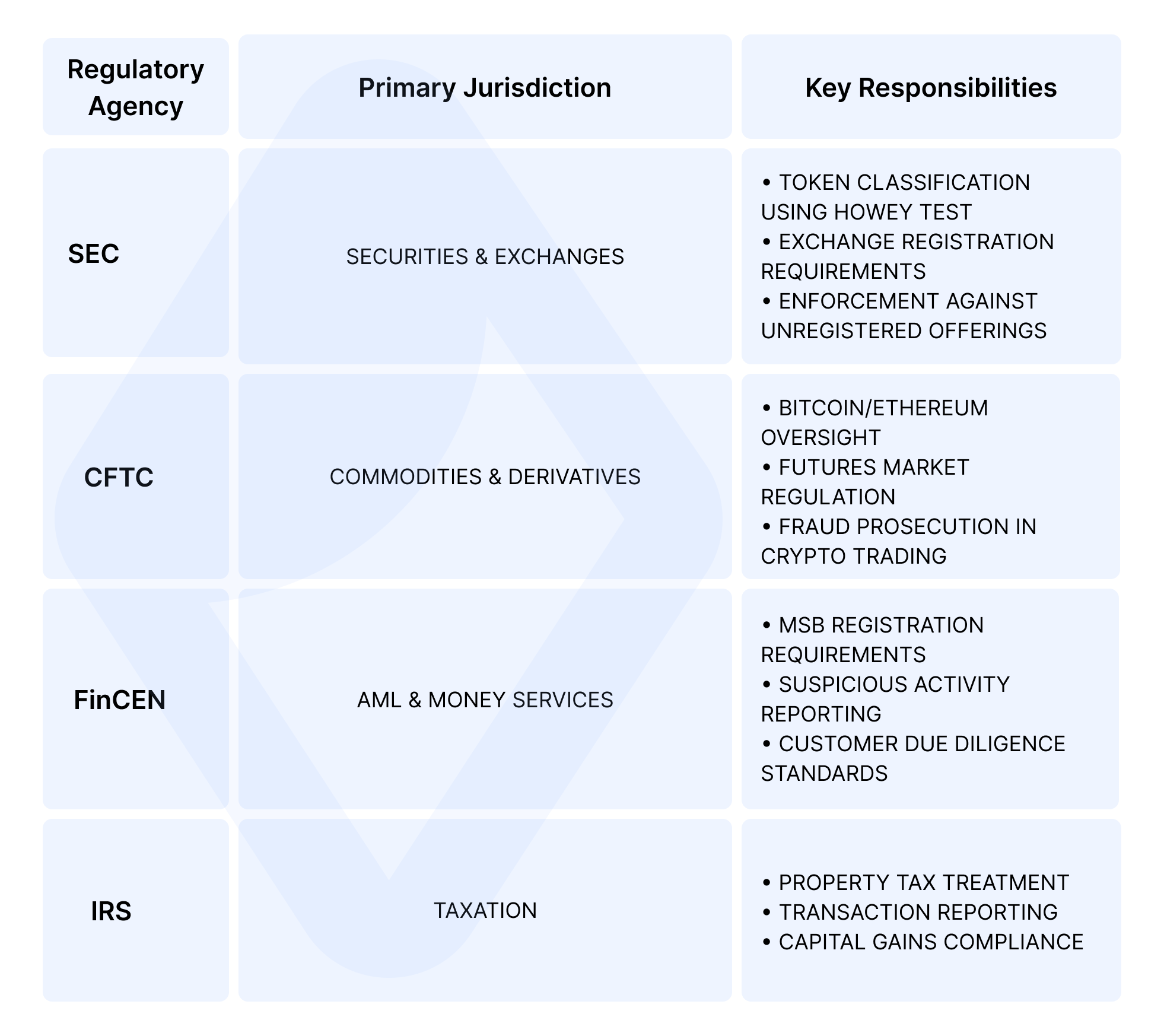

TL;DR: US crypto regulations in 2025 are complex and fragmented, lacking a unified federal framework. Crypto businesses must navigate requirements set by multiple key agencies: the SEC, CFTC , FinCEN (AML/KYC), and the IRS.

Key Compliance Requirements:

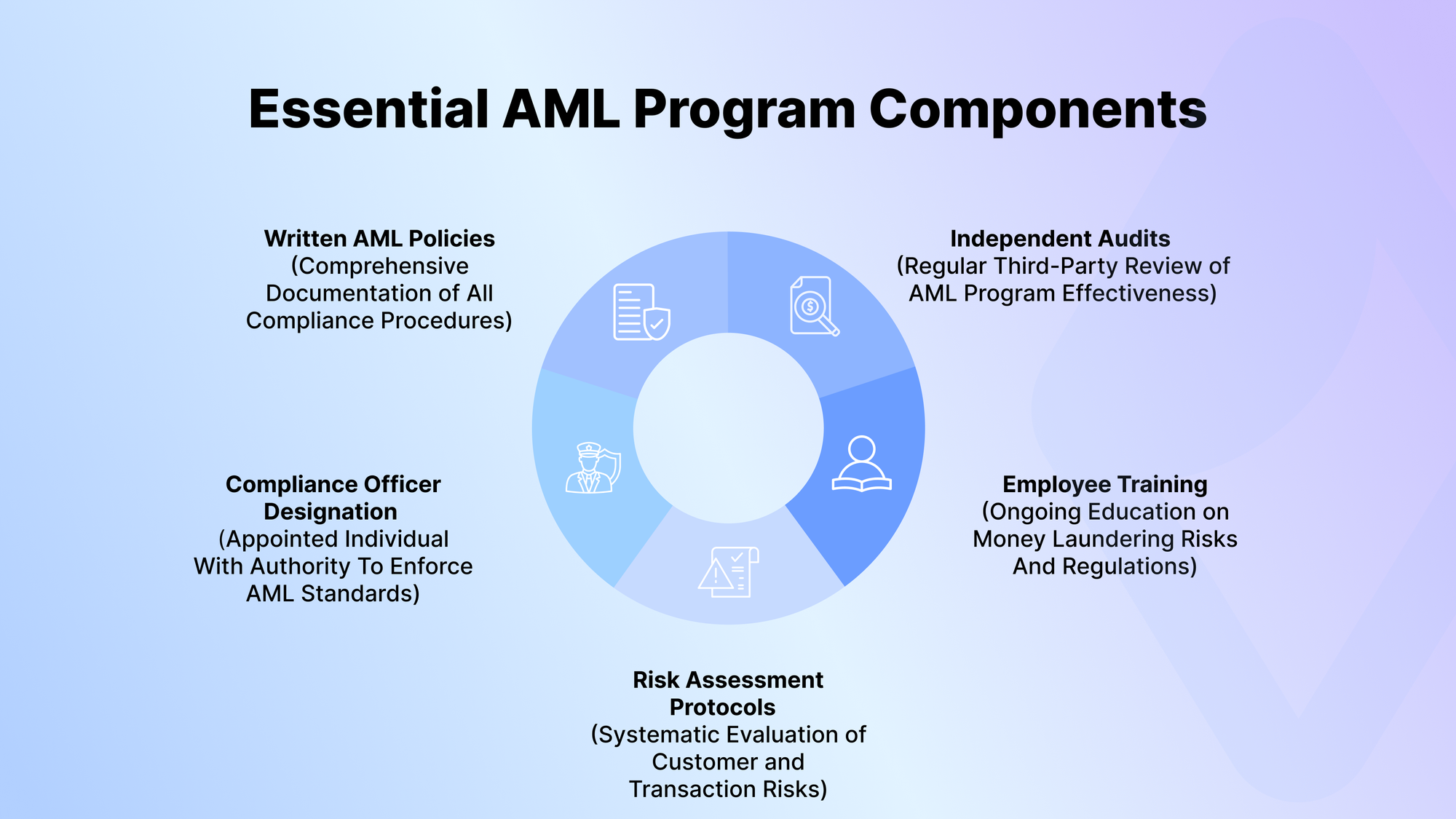

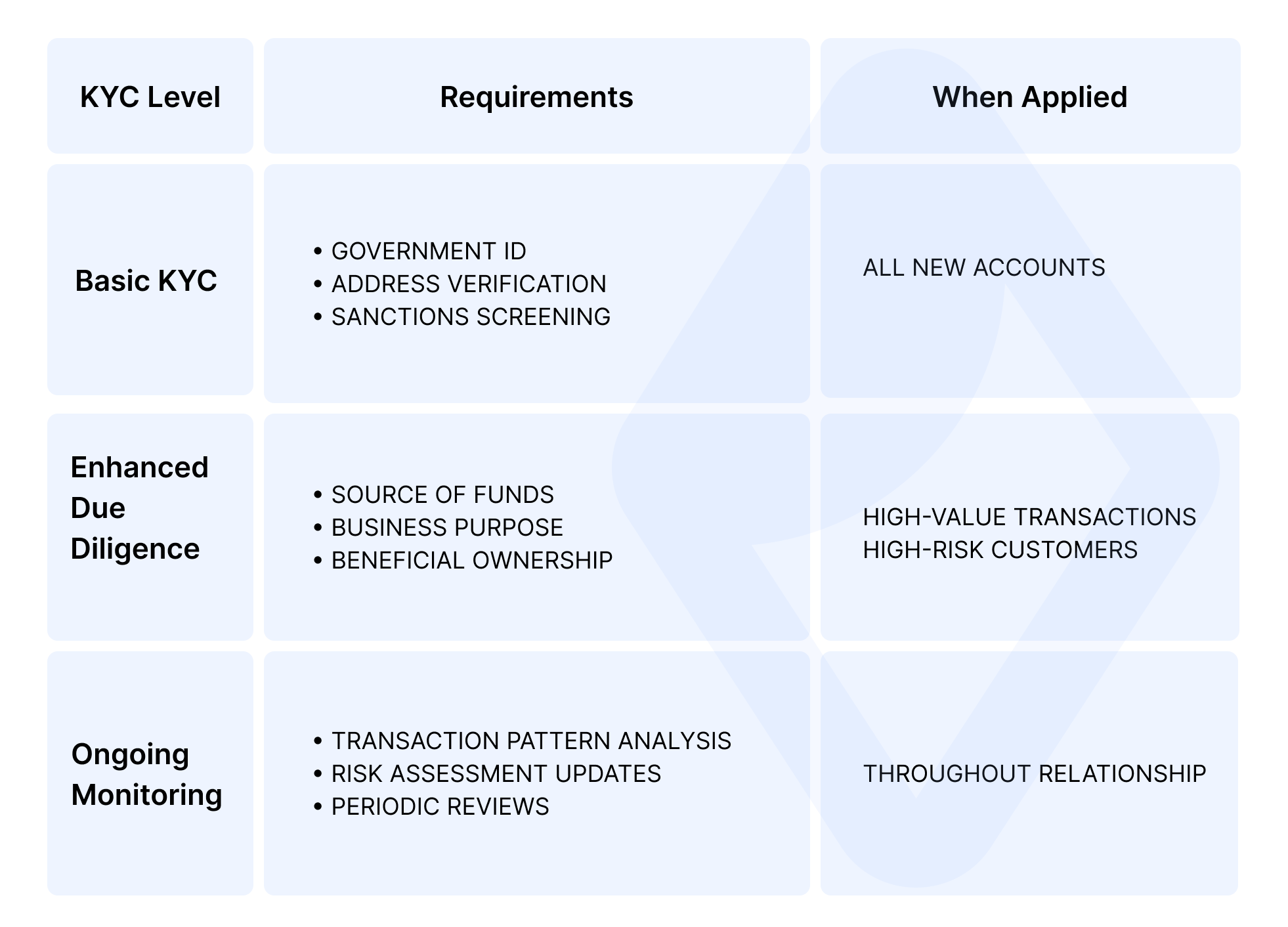

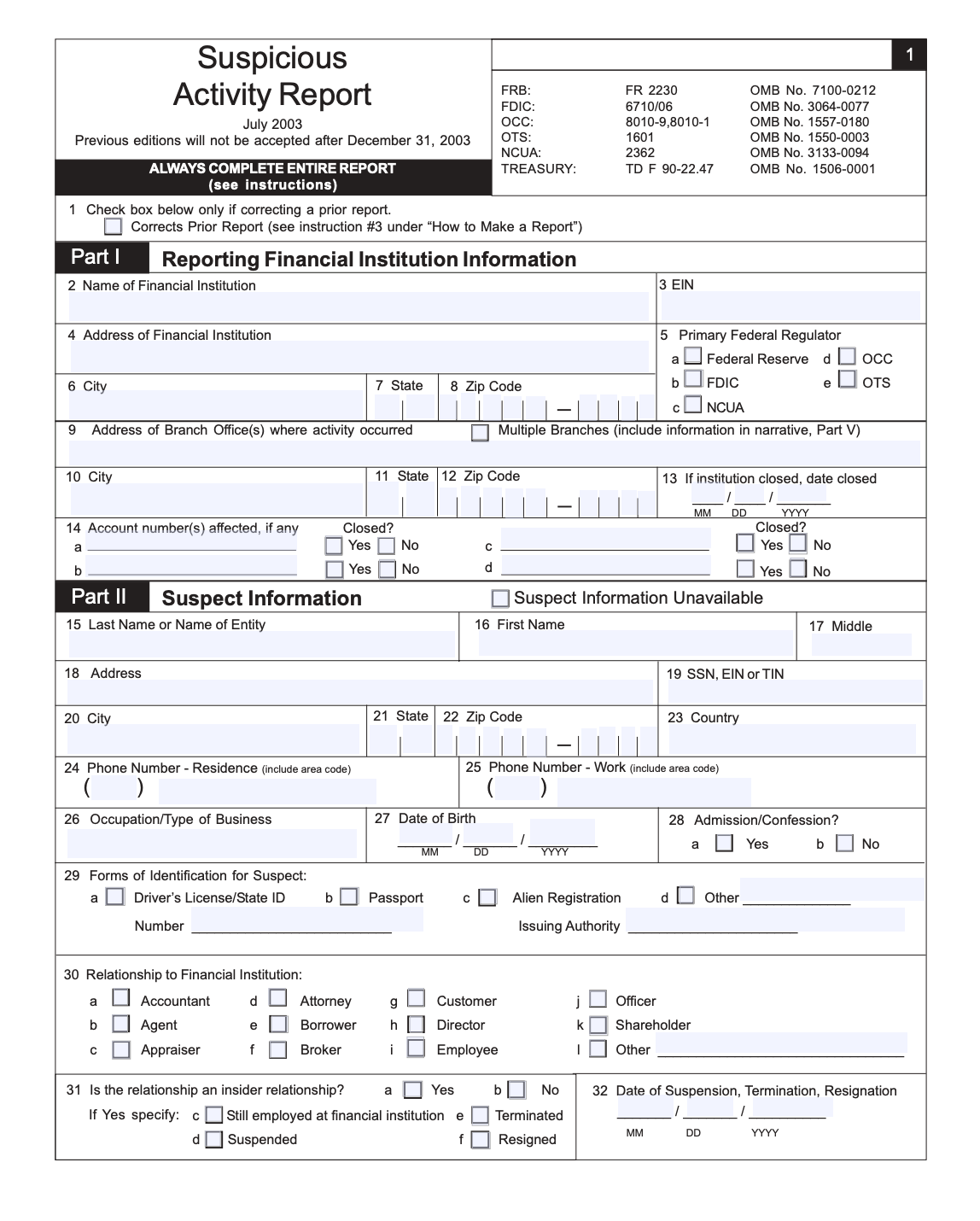

— Businesses must implement Anti-Money Laundering (AML) programs, including independent audits, risk assessment protocols, and the designation of a Compliance Officer. Know Your Customer (KYC) requirements are stringent, demanding Enhanced Due Diligence (EDD) for high-risk customers and transactions. Furthermore, companies must file Suspicious Activity Reports (SARs) for illicit activities exceeding certain thresholds, such as $5,000, within 30 days.

– Federally, most crypto businesses must register as Money Services Business (MSB) with FinCEN. State-level licensing adds complexity, with regimes like New York's BitLicense being restrictive and costly.

– The IRS treats cryptocurrency as property, making all transactions (selling, trading, purchasing goods) taxable events. New Broker Reporting rules mandated by the Infrastructure Act are expanding reporting obligations for platforms and service providers, effective by 2026.

Note: The risks of non-compliance are severe, involving fines and collateral damage such as reputational harm and loss of banking relationships. Looking toward 2026, the regulatory focus will intensify on Stablecoin issuance standards and DeFi protocol oversight. Legislative proposals like the FIT21 Act aim to clarify SEC and CFTC jurisdiction over digital assets. Businesses must invest in Know Your Transaction (KYT), blockchain analytics tools and internal compliance structures to adapt.

Note: None of this information should be considered as legal, tax, or investment advice. While we’ve done our best to ensure this information is accurate at the time of publication, laws and practices may change, so please double-check it.

Crypto regulations in the US continues to evolve as federal agencies and state governments work to establish frameworks for digital asset oversight. In 2025, crypto businesses operating within American borders face an intricate web of compliance requirements spanning AML protocols, licensing obligations, and tax reporting standards. Understanding these laws is essential for any cryptocurrency company seeking to maintain operations while avoiding penalties and enforcement actions.

Overview of Crypto Regulations in the US

The Current Regulatory Landscape In 2025

Crypto regulations in the US remain fragmented across multiple jurisdictions, without a unified federal framework governing digital currency operations. Unlike traditional financial markets with established regulatory structures, the cryptocurrency company sector navigates requirements from various agencies, each claiming authority over different aspects of blockchain-based business activities. This patchwork creates compliance challenges for crypto companies attempting to meet diverse and sometimes conflicting requirements across federal and state levels.

KEY CHALLENGES FACING THE INDUSTRY INCLUDE:

- NO FEDERAL CRYPTOCURRENCY LEGISLATION

- CROSS-BORDER JURISDICTIONS

- CONFLICTING FINANCIAL LAWS

- STATE-LEVEL REQUIREMENTS AND DEFINITIONS

- UNCERTAINTY AROUND DEFI

The lack of specific cryptocurrency legislation in crypto regulations in the US has forced regulators to apply existing financial laws to digital asset markets. This uncertainty impacts how businesses manage their AML operations and compliance programs. A company involved in the industry must stay updated on evolving interpretations of securities laws, commodity regulations, and money transmission rules while preparing for potential legislative changes that could affect compliance obligations.

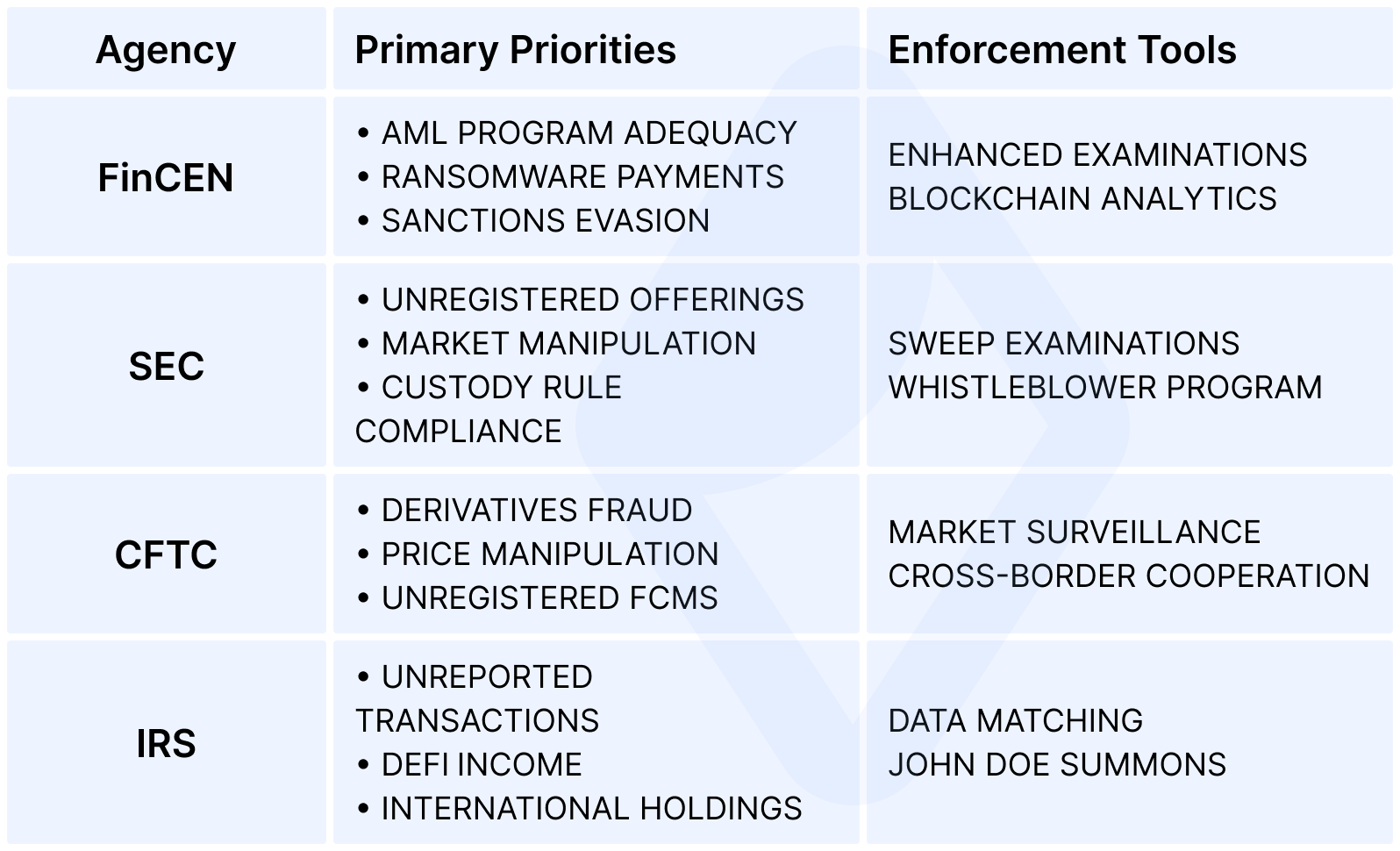

Key Government Bodies Involved (SEC, CFTC, FinCEN, IRS)

– The SEC (Securities and Exchange Commission) oversees digital assets classified as securities, applying the Howey Test to determine if an asset is an investment contract. The SEC mandates registration for issuers and platforms offering these assets and has recently focused its enforcement actions on clarifying its stance on unregistered staking and lending services. Its core goal is to ensure adequate disclosure and protect retail investors.

– The CFTC (Commodity Futures Trading Commission) regulates digital assets classified as commodities, which currently include Bitcoin (BTC) and Ethereum (ETH). The CFTC primarily oversees the derivatives markets for these assets (futures and options) and has the authority to prosecute fraud and market manipulation on the underlying spot markets. The CFTC is advocating for expanded jurisdiction through proposed legislation like the FIT21 Act.

– FinCEN (Financial Crimes Enforcement Network), a bureau of the Treasury Department, enforces Anti-Money Laundering (AML) requirements. It classifies most crypto businesses as Money Services Businesses (MSBs), requiring them to register, implement strict Know Your Customer (KYC) procedures, and file mandatory Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) for transactions that meet certain thresholds. FinCEN’s main objective is preventing financial crime.

– The IRS (Internal Revenue Service) treats virtual currency as property for tax purposes, not currency. This designation means that every transaction—whether it's a sale, an exchange for another coin, or a payment for goods or services—is considered a taxable event. Taxpayers must track and calculate capital gains or losses for each disposition, which creates a significant compliance burden. Taxpayers must also explicitly report their engagement with digital assets on Form 1040.

Federal Vs. State-Level Regulations

State-level crypto regulations in the US add another layer of complexity to compliance requirements, with each jurisdiction implementing unique regimes and operational standards.

KEY STATE APPROACHES INCLUDE:

Most Restrictive States Within Crypto Regulations in the US:

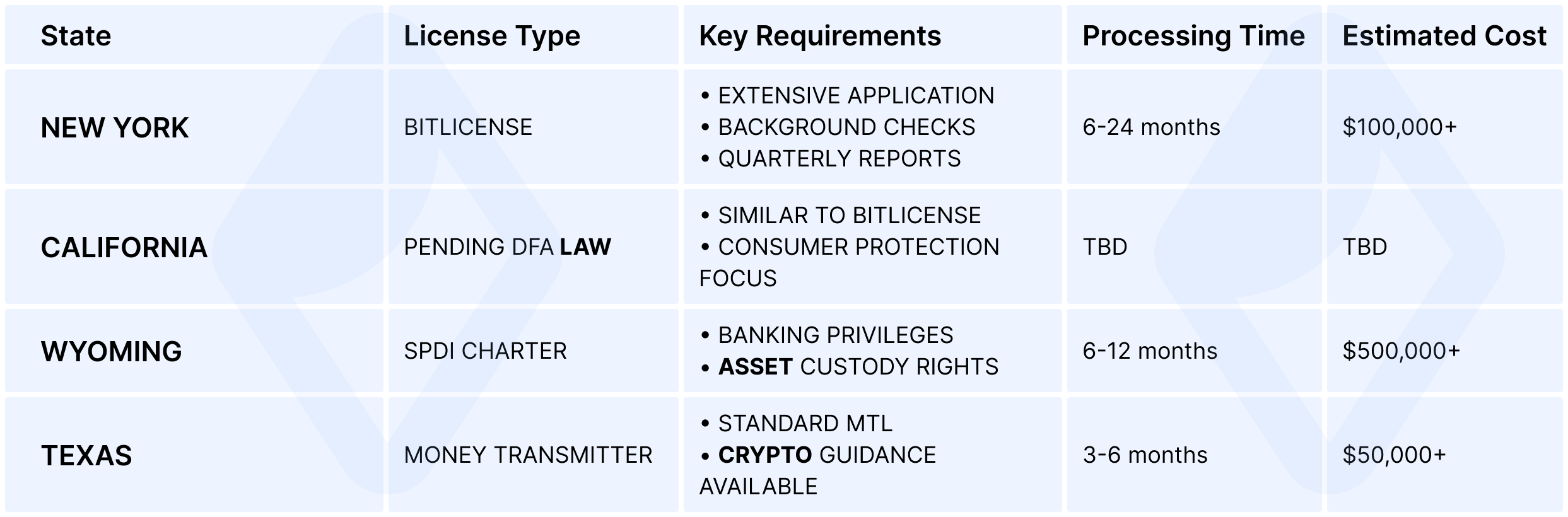

- New York: BitLicense (officially the "Virtual Currency Business Activity" license from the NY Department of Financial Services, DFS) is notoriously complex, expensive, and time-consuming to obtain, requiring extensive documentation regarding cybersecurity, consumer protection, and AML protocols. It is widely considered one of the most burdensome state regulations.

- Hawaii: Hawaii historically required crypto exchanges to maintain fiat currency reserves equal to the aggregate amount of digital currency held on behalf of customers. This effectively made operations impossible for many VASPs. While the state has piloted some regulatory sandboxes to offer relief, the general regulatory environment remains highly restrictive.

- Vermont: Vermont applies its existing Money Transmitter Act stringently to crypto businesses, often requiring licensing and adherence to traditional financial regulations, making it difficult for many crypto startups to operate without compliance overhead.

Crypto-Friendly States Crypto Regulations in the US:

- Wyoming: Wyoming is perhaps the most famous "crypto-friendly" state. It created the Special Purpose Depository Institution (SPDI) charter (sometimes called a "crypto bank" charter) specifically for digital asset businesses. This allows them to operate with banking services and custody digital assets under state supervision, but without the high burden of traditional banks.

- Texas: Texas has passed legislation clarifying that certain activities, such as providing software or validating transactions (mining), do not constitute money transmission, thereby exempting many foundational blockchain activities from heavy licensing requirements. The state's legal climate is generally supportive of crypto and blockchain innovation.

- Florida: Florida has generally adopted a "wait and see" or non-aggressive regulatory approach, focusing on applying existing fraud laws while generally avoiding broad, restrictive money transmission requirements for many crypto activities, promoting a relatively minimal-restriction environment for certain operations.

Federal-state tensions challenge multi-state crypto operations, as businesses navigate varying digital asset definitions, different licensing thresholds, and conflicting AML FATF compliance standards within crypto regulations in the U.S. States adopt either uniform money transmitter laws including cryptocurrency or specialized regulations for blockchain and companies that provide digital currency services.

AML and KYC Requirements for Crypto Businesses

FinCEN AML (Anti Money Laundering) Rules And Obligations For Exchanges

FinCEN mandates that cryptocurrency exchanges implement AML programs meeting Bank Secrecy Act requirements applicable to Money Services Businesses.

AML frameworks require crypto businesses to identify high-risk customers and transactions. Company must develop risk profiles based on location, volumes, and privacy tools within crypto regulations in the US. FinCEN expects cryptocurrency platforms to monitor structuring, mixing service usage, and OFAC-sanctioned addresses. Crypto businesses must implement financial institution-level controls with blockchain-specific monitoring.

KYC And Customer Identification Procedures

Know Your Customer (KYC) requirements for cryptocurrency businesses extend beyond basic Identity Verification to include comprehensive Customer Due Diligence matching traditional banking standards. Essential KYC elements include:

According to the goal of the crypto regulations in the US enhanced Due Diligence is required for high-value transactions, customers from high-risk areas, and suspicious accounts. Crypto companies must document the business purpose of customer relationships, expected transaction volumes, and sources of significant deposits, applying these equally to retail and institutional clients, with diligence varying by risk.

Record Keeping And Suspicious Activity Reporting (SARs)

Cryptocurrency businesses must maintain comprehensive records meeting crypto regulations in the US standards:

Required Transaction Records (5-year retention):

- Blockchain Addresses (Sender and Receiver)

- Transaction Hashes and Confirmation Data

- Timestamp Information (UTC)

- Fiat Currency Value at Transaction Time

- Customer Identification Data

- Transaction Purpose (when available)

SAR Filing Requirements

Crypto platforms must file Suspicious Activity Reports (SARs) for illicit transactions, detailing suspicious patterns, parties, and investigations. FinCEN expects comprehensive reporting on crypto-specific crimes like ransomware and terrorist financing. Currency Transaction Report requirements for cash over $10,000 may apply to cryptocurrency, pending clarification. Businesses need crypto regulations in the US to identify reportable transactions without alerting customers.

Licensing and Registration Requirements

Money Services Business (MSB) Registration under FinCEN

Registration as a Money Services Business with FinCEN represents the foundational federal requirement for cryptocurrency companies conducting exchange services or money transmission activities. The MSB registration process includes:

Registration Requirements:

- Initial Registration. Within 180 days of commencing operations.

- Corporate Information. Detailed company structure and ownership.

- Service Description. Comprehensive outline of crypto offerings and risk assessment.

- Agent List. All authorized delegates and locations.

- Renewal. Every two years through electronic filing.

Beyond initial registration, MSB compliance obligations include maintaining agent lists for businesses operating through authorized delegates, implementing AML programs meeting regulatory standards, and filing required reports including SARs and CTRs.

FinCEN expects cryptocurrency MSBs to maintain compliance programs addressing unique risks of digital asset transactions, including blockchain analytics capabilities and procedures for handling privacy coins. Failure to register or maintain MSB compliance exposes businesses to civil penalties reaching $5,000 per violation per day.

The scope of MSB registration requirements continues expanding as FinCEN clarifies application to various crypto business company models including decentralized exchange operators, wallet providers offering exchange functionality, and platforms facilitating peer-to-peer transactions. Recent enforcement actions demonstrate regulators' position that facilitating cryptocurrency transactions for profit generally triggers MSB obligations, regardless of custody arrangements or technical architecture.

State Licensing Requirements Overview:

New York's BitLicense is the most comprehensive state-level cryptocurrency licensing framework, demanding extensive applications, including business plans, financial projections, compliance policies, and background checks. The process takes 6-24 months and can cost over $100,000, including legal and consulting fees. Licensed entities face ongoing requirements such as quarterly financial reporting, annual compliance certifications, and prior approval for significant business changes.

It creates substantial entry barriers for new crypto businesses and imposes significant compliance costs on established platforms. Companies must maintain separate licenses in each state, with varying requirements. Some businesses avoid heavily regulated states, limiting market access for consumers in those jurisdictions.

Consequences Of Non-Compliance (Fines, Enforcement Cases)

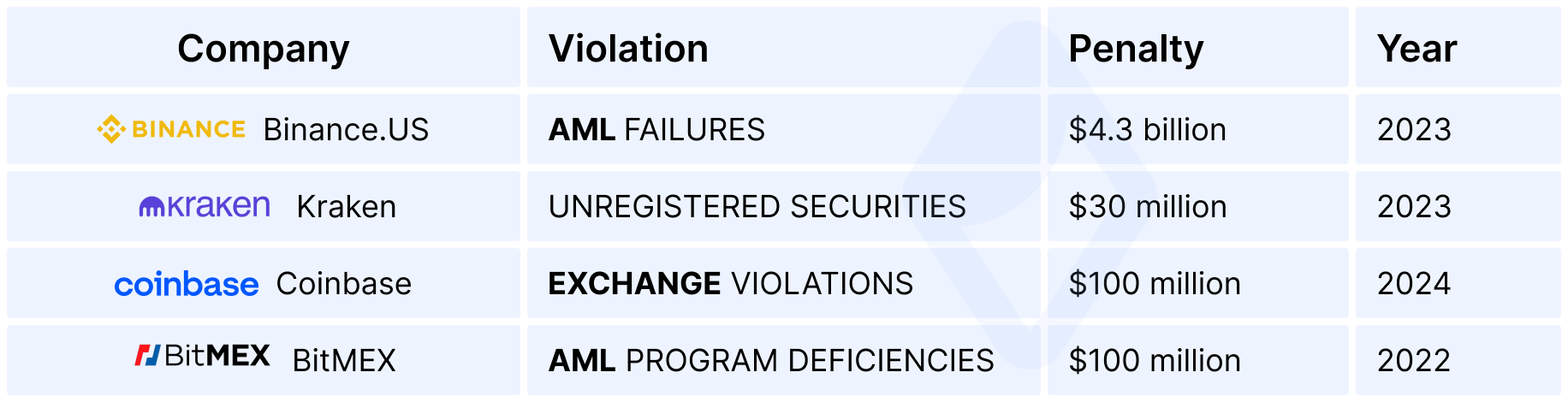

Regulatory enforcement against non-compliant cryptocurrency businesses has escalated, with agencies imposing penalties for AML failures, unregistered securities offerings, and unlicensed money transmission. The SEC has pursued enforcement actions against dozens of cryptocurrency projects for conducting unregistered securities offerings. Such SEC suggestions resulted in disgorgement of profits, civil penalties, and permanent injunctions against future violations.

Recent Major Enforcement Actions:

Consequences Beyond Financial Penalties:

- REPUTATIONAL DAMAGE AFFECTING CUSTOMER TRUST

- LOSS OF BANKING RELATIONSHIPS

- OPERATIONAL DISRUPTIONS FROM ASSET FREEZES

- TRADING SUSPENSIONS ON MAJOR PLATFORMS

- CRIMINAL LIABILITY FOR EXECUTIVES

- DIFFICULTY OBTAINING INSURANCE COVERAGE

- CHALLENGES SECURING INVESTMENT FUNDING

- EXCLUSION FROM PARTNERSHIPS WITH TRADITIONAL FINANCIAL INSTITUTIONS

Taxation and Reporting Obligations

IRS Treatment Of Cryptocurrencies As Property

The Internal Revenue Service classifies cryptocurrency as property rather than currency for tax purposes, creating complex reporting obligations for both businesses and individuals engaging in digital asset transactions within crypto regulations in the US. This FATF classification triggers specific tax events.

Taxable Events in Crypto:

- SELLING CRYPTO FOR FIAT CURRENCY

- TRADING ONE CRYPTOCURRENCY FOR ANOTHER

- USING CRYPTO TO PURCHASE GOODS OR SERVICES

- RECEIVING CRYPTO AS PAYMENT FOR SERVICES

- MINING OR STAKING REWARDS

- AIRDROPS AND HARD FORKS

- DEFI YIELD FARMING RETURNS

Accounting for crypto businesses is complex due to high transaction volumes across multiple blockchain networks. Companies must track the cost basis for all digital asset acquisitions (mining, staking, deposits, purchases) and document fair market values for IRS compliance, posing operational challenges. Tax implications extend to airdrops, hard forks, staking rewards, and DeFi yield farming, requiring careful analysis under existing property tax regulations. According to the crypto regulations in the US businesses need sophisticated tracking for multi-asset swaps, liquidity pools, and cross-chain bridges. Lack of clear guidance necessitates conservative tax compliance approaches.

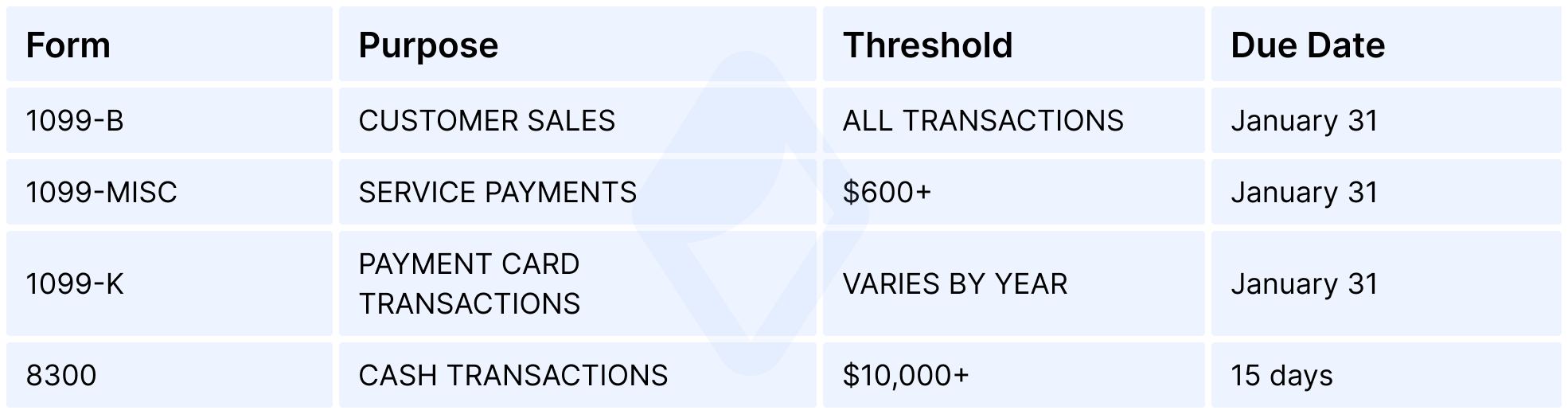

IRS Reporting Forms for Crypto Businesses:

As of 2025, cryptocurrency businesses, including digital asset platforms, decentralized exchange protocols, and non-custodial wallet providers, must report all customer transactions and gross proceeds from crypto sales, as mandated by the Infrastructure Investment and Jobs Act.

Capital Gains Tracking Requirements:

- COST BASIS DETERMINATION USING FIFO, LIFO, OR SPECIFIC IDENTIFICATION

- HOLDING PERIOD TRACKING FOR SHORT-TERM VS. LONG-TERM TREATMENT

- FAIR MARKET VALUE DOCUMENTATION AT ACQUISITION AND DISPOSAL

- TRANSACTION FEE INCLUSION IN BASIS CALCULATIONS

- WASH SALE RULE CONSIDERATIONS (PENDING CLARIFICATION)

The complexity of cryptocurrency tax compliance has spawned specialized software solutions and professional services helping businesses manage reporting obligations. However, companies remain responsible for accuracy regardless of third-party assistance, with the IRS increasing enforcement focus on cryptocurrency tax compliance through data analytics and information sharing agreements with exchanges.

The 2024 Infrastructure Bill And Broker Reporting Rules

The Infrastructure Investment and Jobs Act fundamentally altered cryptocurrency tax reporting by expanding the definition of "broker" to include any person responsible for regularly providing services effectuating transfers of digital assets. This broad definition creates new compliance obligations for:

Newly Classified Brokers by FATF:

- CENTRALIZED CRYPTOCURRENCY EXCHANGES

- DEFI PROTOCOL FRONT-ENDS

- WALLET PROVIDERS WITH EXCHANGE FEATURES

- NFT MARKETPLACES

- MINING POOLS (POTENTIALLY)

- VALIDATORS AND STAKERS (UNDER REVIEW)

New regulations requiring cryptocurrency businesses to collect customer data for self-hosted wallet transactions are controversial due to feasibility and privacy concerns. Companies must prepare for compliance with these expanded FATF requirements. US tax reporting requirements also impact foreign crypto businesses serving American customers, creating compliance challenges for global platforms.

Recent Developments and Future Outlook (2026)

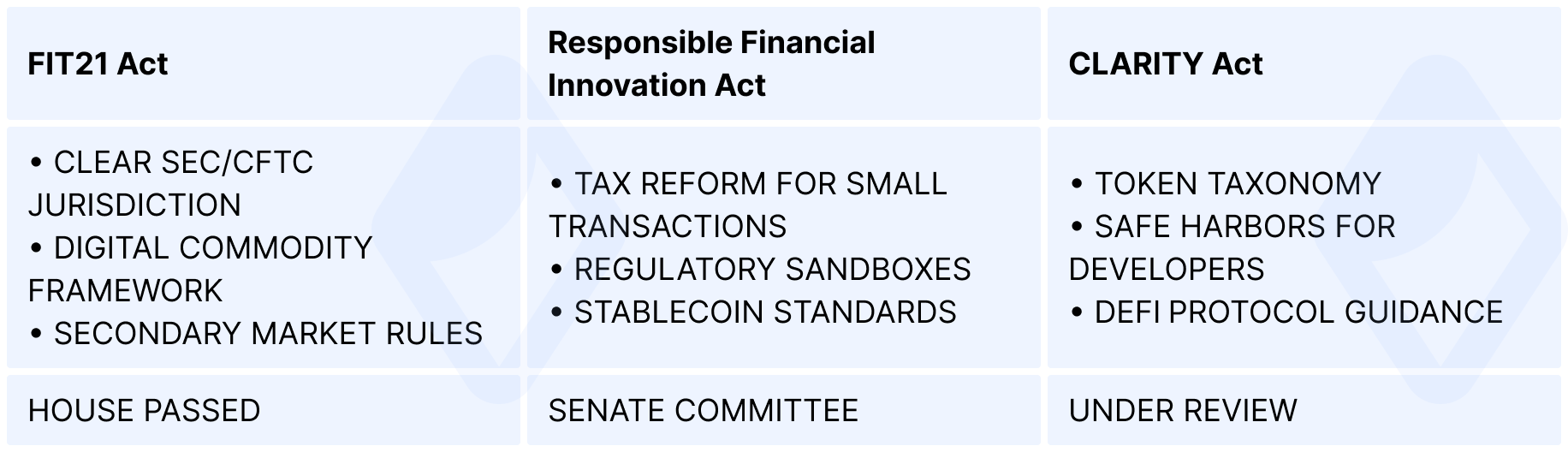

Key Legislative Proposals Expected To Shape 2026 Regulations

Crypto regulations in the US are evolving, with bipartisan support for the Financial Innovation and Technology for the 21st Century Act, aiming to clarify SEC and CFTC jurisdiction over digital assets. Other proposals cover stablecoins, DeFi, and CBDCs. Comprehensive legislation is likely by 2026, requiring businesses to adapt their compliance programs.

Potential Changes In Stablecoin And DeFi Oversight

Expected Stablecoin Regulations:

- FEDERAL LICENSING REQUIREMENTS FOR ISSUERS

- MANDATORY RESERVE COMPOSITION STANDARDS

- REGULAR THIRD-PARTY ATTESTATIONS

- FEDERAL RESERVE OVERSIGHT FOR SYSTEMIC STABLECOINS

- RESTRICTIONS ON PERMISSIBLE RESERVE ASSETS

- CAPITAL AND LIQUIDITY REQUIREMENTS

Stablecoin regulation is expected, with mandatory federal licensing, reserve asset restrictions, and regular attestations proposed by FATF, mirroring traditional banking oversight. DeFi protocols face increased scrutiny, with FATF guidance suggesting developers and governance token holders may be subject to regulatory obligations.

DeFi Regulatory Approaches:

- COMPLIANCE AT FIAT ON/OFF RAMPS

- FRONT-END INTERFACE REQUIREMENTS

- LIQUIDITY PROVIDER RESPONSIBILITIES

- GOVERNANCE TOKEN HOLDER OBLIGATIONS

- BLOCKCHAIN ANALYTICS FOR MONITORING

- SMART CONTRACT AUDITING STANDARDS

2026 Regulatory Focus Areas:

Crypto regulations in the US for 2026 will prioritize AML compliance, with FinCEN focusing on cryptocurrency's role in illicit activities like ransomware and sanctions evasion. Agencies are boosting blockchain analytics and creating dedicated crypto enforcement units. Enhanced information sharing will improve the detection of illicit activities. Risk assessment methodologies are evolving, requiring businesses to develop sophisticated compliance programs for digital assets, invest in technology, and prepare for frequent regulatory examinations within the crypto regulations in the US.

How to Stay Compliant with Crypto Regulations in the US

Core AML Program Elements by FATF:

- Governance Structure

- QUALIFIED COMPLIANCE OFFICER WITH DIRECT BOARD REPORTING

- CLEAR ESCALATION PROCEDURES FOR SUSPICIOUS ACTIVITIES

- REGULAR MANAGEMENT OVERSIGHT AND REVIEW

- Written Policies & Procedures

- CUSTOMER ONBOARDING PROTOCOLS

- TRANSACTION MONITORING THRESHOLDS

- RISK ASSESSMENT METHODOLOGIES

- SUSPICIOUS ACTIVITY ESCALATION PROCESSES

- RECORDKEEPING STANDARDS

- Training Programs

- ANNUAL COMPLIANCE CERTIFICATION

- ROLE-SPECIFIC TRAINING MODULES

- UPDATES ON EMERGING CRYPTO TYPOLOGIES

- BLOCKCHAIN ANALYSIS FUNDAMENTALS

Implementing Ongoing Transaction Monitoring (KYT)

Know Your Transaction tools form the backbone of crypto compliance, providing real-time blockchain analysis to detect suspicious activity and sanctioned entities which is necessary in the crypto regulations in the US.

Core Capabilities:

- CLUSTERING ADDRESSES LINKED TO KNOWN ENTITIES

- RISK SCORING BY TRANSACTION HISTORY

- INTEGRATION WITH THREAT INTELLIGENCE DATABASES

Key Considerations When Choosing KYT Provider:

- BLOCKCHAIN COVERAGE AND DATA DEPTH

- FALSE POSITIVE RATE

- API AND SYSTEM INTEGRATION FLEXIBILITY

Operational Best Practices:

- CALIBRATE ALERT THRESHOLDS TO BALANCE DETECTION ACCURACY VS. ALERT FATIGUE

- ESTABLISH INVESTIGATION WORKFLOWS: BLOCKCHAIN TRACING, CUSTOMER OUTREACH, DOCUMENTATION FOR SARS

- REGULARLY TUNE MONITORING RULES TO REFLECT NEW LAUNDERING TYPOLOGIES

Connecting KYT tools with traditional AML systems enables end-to-end risk assessment, merging on-chain analytics with customer data for detecting complex cross-financial schemes.

Regular audits validate AML program effectiveness and identify control gaps. Select auditors with crypto-specific expertise to ensure blockchain controls are properly evaluated and operate according to crypto regulations in the US. Audit scope should cover:

- GOVERNANCE AND RISK ASSESSMENTS

- CDD AND EDD PROCEDURES

- TRANSACTION MONITORING SYSTEMS

- SAR MANAGEMENT

Summary: What Every Crypto Business Should Know

1. Navigating U.S. Regulatory Complexity

Crypto regulations in the US require mastering a multi-layered regulatory framework that spans federal and state levels. Key pillars of compliance:

- AML Programs aligned with FinCEN standards.

- KYC Procedures tailored to digital asset risks

- KYT Systems for monitoring blockchain transactions.

Because there is no unified federal crypto law, companies must continuously track evolving crypto regulations in the US requirements across multiple agencies (FinCEN, SEC, CFTC, IRS, state regulators) and remain agile as new rules emerge.

2. Registration and Licensing

- Federal Level: Registration as a Money Services Business (MSB) under FinCEN is mandatory for most crypto businesses.

- State Level: Licensing varies by jurisdiction, with New York’s BitLicense among the most demanding.

- Challenge: Maintaining multi-state compliance can create significant operational and legal burdens.

3. Tax and Reporting Obligations

Under IRS property treatment, all crypto transactions are taxable events. Businesses must: track and document all transactions, ensure accurate gain/loss calculations, comply with new broker reporting rules expanding in scope by 2026. This demand of crypto regulations in the US advanced record-keeping systems and proactive tax strategies.

4. Future Outlook (2026 and Beyond)

To stay ahead, you need to invest in compliance technology and have expert teams ready to adapt to the ever-changing nature of U.S. crypto regulations. Upcoming frameworks are expected to target:

- STABLECOIN ISSUANCE AND RESERVES

- DEFI PROTOCOL OVERSIGHT

- ENHANCED AML ENFORCEMENT AND MARKET INTEGRITY LAWS

5. Global Perspective

For businesses operating beyond the U.S., refer to AMLBot’s Global Crypto Regulations Guide — a resource mapping the evolving regulatory landscape worldwide.

Building trust with regulators and customers alike depends on: transparent governance, continuous compliance improvement and long-term commitment to regulatory integrity.

What Are The Main Crypto Regulations In The United States in 2025?

US crypto regulation is fragmented, with no unified federal law. Crypto businesses must comply with FinCEN AML rules, SEC/CFTC classifications, IRS tax reporting requirements, and state-by-state licensing obligations such as the New York BitLicense.

Which Agencies Regulate Cryptocurrency In The US?

Four primary agencies oversee digital assets: FinCEN – AML compliance, MSB registration. SEC – securities classification, exchange registration. CFTC – derivatives, Bitcoin/Ethereum as commodities. IRS – tax reporting, capital gains.

Is There A Single Federal Crypto Law In The US?

No. The US does not have a unified federal crypto framework. Regulations come from multiple agencies applying existing financial laws to digital assets, creating a complex compliance landscape.

Do Crypto Exchanges Need To Register As An MSB with FinCEN?

Yes. Most exchanges and platforms handling cryptocurrency transfers must register as a Money Services Business (MSB), implement an AML Program, file SARs/CTRs, and maintain detailed transaction records.

What Is New York’s BitLicense And Who Needs It?

The BitLicense (NYDFS) is one of the strictest state-level crypto licensing regimes. Companies providing custody, exchange, or transmission of digital assets to New York residents generally require it. The process takes 6–24 months and can exceed $100,000.

What AML Requirements Apply To Crypto Platforms In The US?

Under FinCEN rules, crypto businesses must implement a full AML program, including: written AML policies, appointed Compliance Officer, independent audits, ongoing employee training, risk-based customer monitoring, SAR and CTR filings.

What Are The KYC Requirements For Crypto Businesses?

KYC includes identity verification (ID, address), sanctions screening, and Enhanced Due Diligence (EDD) for high-risk customers. Ongoing monitoring must be applied throughout the customer relationship.

When Must A Crypto Company File A Suspicious Activity Report (SAR)?

SARs are required for: $5,000+ suspected illicit activity (within 30 days), $2,000+ structuring attempts, any amount involving suspected terrorist financing.

What Happens If A Crypto Business Does Not Comply With US AML Laws?

The main consequences include: multi-million dollar fines, loss of banking services, asset freezes, trading restrictions, reputational damage, criminal liability for executives.

How Does the IRS Tax Cryptocurrency?

Crypto is treated as property, not currency. Taxable events include selling, trading, payments, mining, staking, airdrops, and DeFi yield. Companies must calculate cost basis, track transaction history, and report gains/losses.

What Major Crypto Laws Might Pass In 2026?

The US is closer than ever to comprehensive digital asset regulation. The focus in 2026 will be on establishing a clear regulatory framework by defining who regulates what:

– Market Structure Clarity (SEC vs. CFTC): The most anticipated legislative move is a bill based on the principles of the FIT21 Act (Financial Innovation and Technology for the 21st Century Act). This aims to create a definitive taxonomy for digital assets, clearly dividing jurisdiction between the SEC (for securities) and the CFTC (for commodities).

– In addition, Congress is likely to pass a law that codifies the criteria for when a token is considered a digital commodity (regulated by the CFTC) and when it remains a security (regulated by the SEC). It will provide necessary guidance for developers and exchanges.

– Legislation is expected to include common-sense tax provisions, such as small tax exclusions for minor crypto transactions (like those found in earlier versions of the Responsible Financial Innovation Act), simplifying reporting for everyday use.

What Are The Most Crypto-Friendly States In the US?

Wyoming, Texas, and Florida are the most welcoming, offering clear exemptions, simplified licensing, or specialized charters (like Wyoming SPDI).