Emotional “Investments”: The Price of Falling for a Pig Butchering Scam

Pig butchering scams are a cunning blend of romance fraud and approval phishing, designed to “fatten” victims financially and emotionally before draining them dry. These scams begin with casual chats and result in significant financial losses, leaving victims isolated and embarrassed.

What makes pig butchering scams so effective is the combination of emotional manipulation with digital ignorance, particularly among crypto enthusiasts.

A recent investigation by AMLBot uncovered a complex “pig butchering” scheme that started as a romance scam but turned out to involve a vast network of fraudulent platforms and accounts.

The Anatomy of a Scam

The numbers speak to the scale of the problem: crypto activity tied to pig butchering scams has surged 85-fold since 2020. Romance scam revenue doubled from 2022 to 2023, even as other scams saw declines due to the 2023 bear market. In 2023 alone, approval phishing scams, often linked to pig butchering, led to $374 million in suspected losses.

These statistics set the stage for our client’s experience. This dedicated crypto enthusiast was contacted by a woman after attending a conference. Since then, they’ve maintained regular contact online. Here’s how the scam unfolded:

- Building Trust

Over time, our client, and the woman, developed what appeared to be a genuine relationship. Frequent chats and video calls helped establish a sense of trust and familiarity, making our client comfortable and more receptive to her suggestions.

- The “Investment Opportunity”

Eventually, the woman introduced our client to a supposed investment platform. This platform, however, was a fraudulent clone of Paymium, a reputable French cryptocurrency provider. She encouraged him to exchange euros on the OKX platform and then transfer those funds to the fake Paymium clone, confidently assuring him of its legitimacy.

- Reinforcing Trust with Initial Returns

To deepen the illusion, our client was permitted to withdraw a small sum at first. This move further convinced him of the platform’s legitimacy, enticing him to increase his investment.

- Demands for Additional Payments

As soon as he tried to withdraw a larger amount, the situation deteriorated. The platform began demanding additional payments under various pretenses, such as “taxes,” “credit score boosts,” and other fabricated fees. Each new fee seemed justifiable, adding to the mounting financial trap.

- Maintaining the Illusion

Throughout this process, the woman insisted that she, too, was invested in the same platform. She even claimed to be in direct contact with the “Paymium team” to help resolve any issues. These reassurances added layers of credibility, making it increasingly difficult for our client to recognize the fraud.

AMLBot Investigation

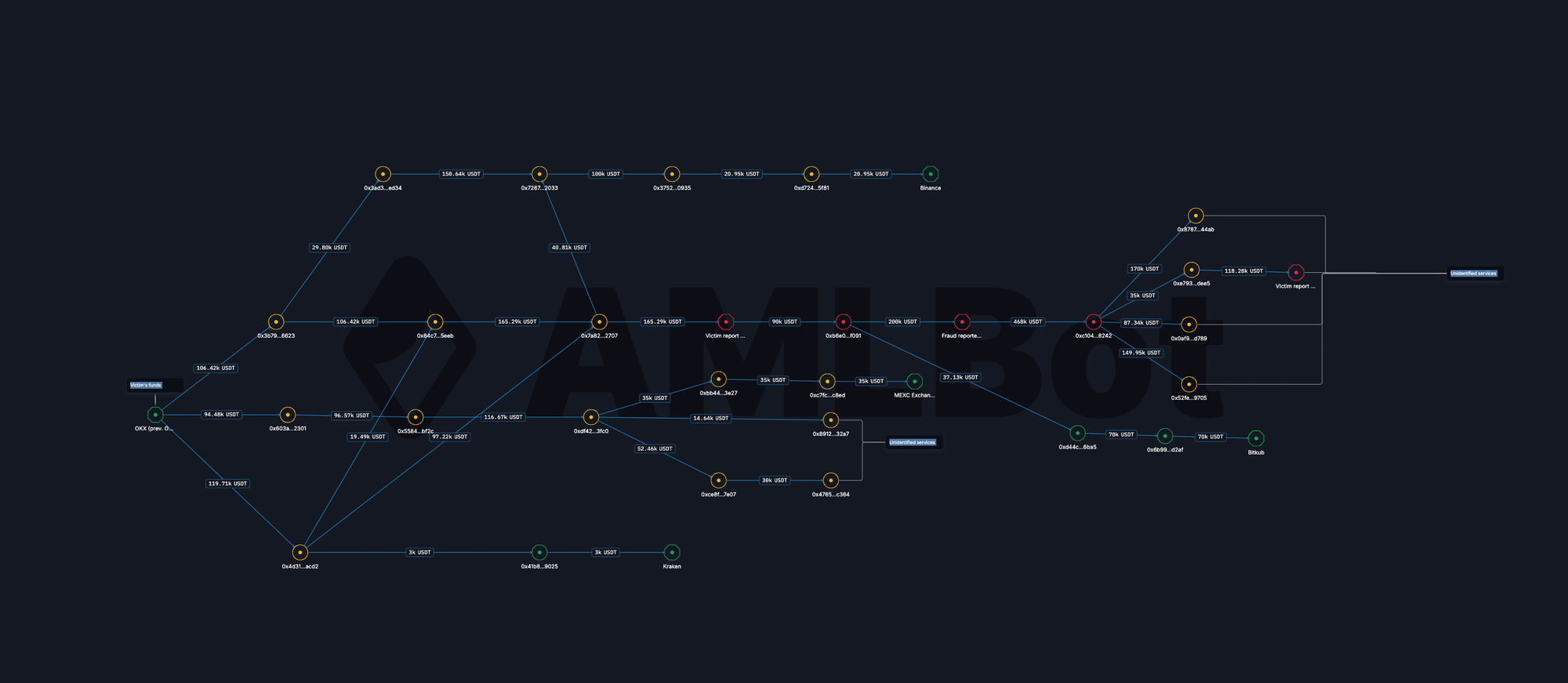

In the course of this investigation, AMLBot uncovered a complex network of wallets and transactions linked to a more extensive, organized scam operation.

Here’s a closer look:

- Connections to a Bigger Scam Network

- The investigation revealed that the wallets were part of a larger network, connected to known fraudulent platforms like CREX24PRO.net and BINGSAUB.com.

- This discovery showed that this scam was just one piece of a much larger scheme, where multiple fake platforms were run by a criminal group.

- Tracking the Flow of Funds

- The stolen funds moved through a chain of wallets, making each transfer harder to track.

- Funds were sent to various exchanges, including Binance, MEXC, and Kraken, along with other unidentified services. This complex movement was designed to hide the origin and final destination of the funds.

- Freezing Assets to Stop the Scam

- Despite the scammers’ attempts to cover their tracks by moving funds through multiple wallets and exchanges, AMLBot was able to trace the flow of money.

- As a result AMLBot successfully froze the victim’s funds across several exchanges, including Binance and MEXC, stopping the scammers from cashing out and protecting further losses.

Through collaboration with major exchanges, we freeze stolen funds, preventing scammers from cashing out. Our advanced tools trace blockchain transactions, map fund flows, and identify connections to broader scam operations, offering clear and actionable insights. Additionally, we detect high-risk wallets and provide detailed scam reports, helping victims build strong cases and minimize future risks. Our mission is to stop fraudulent schemes while protecting and assisting those affected.

How to Protect Yourself Against Pig Butchering?

- Be Cautious with New Connections

Be careful with people you meet online, especially if they start talking about investments. Scammers often build trust first, then introduce their schemes.

- Check Investment Platforms

Always make sure a platform is legitimate before sending money. Scammers create fake websites that look real, so only use verified URLs and go directly to the site.

- Watch Out for Extra Payment Requests

Be alert if you’re asked for extra payments like “taxes” or “account boosts” to access your money. Legitimate platforms usually don’t require these.

- Verify Claims Directly

If someone says they’re handling issues with customer support for you, see it as a warning. Contact the platform’s support team directly to confirm.

Conclusion

AMLBot is committed to protecting the crypto community by uncovering and stopping these scams. Stay vigilant, and if you suspect fraud, reach out to a trusted investigative service. Staying safe starts with caution and knowing where to get help.