How EU AMLR Changes KYC Obligations for Crypto Businesses

Summary

AMLR is now in force and is reshaping how crypto businesses in Europe approach KYC obligations. This article explains why AMLR does not “add KYC from scratch,” but reorganizes existing EU AML requirements into a single, stricter EU regulation — shifting KYC compliance from a one-time onboarding check to a continuous, risk based process tied to customer identity, transaction activity, and ongoing monitoring. It also clarifies how the Travel Rule reinforces traceability expectations and why governance controls and accountability have become central to meeting regulatory expectations under the EU AML framework.

Intro: In 2026, the European Union’s new Anti-Money Laundering Regulation (AMLR) officially came into force, heralding a unified EU AML Framework that reshapes how crypto businesses approach Know Your Customer (KYC) compliance. Unlike previous rules, which varied by country under different EU directives, AMLR creates a single EU standard for Anti-Money Laundering (AML) and Countering Terrorist Financing (CTF).

This means KYC obligations for crypto businesses are now defined at the EU level, bringing consistency and transparency across all member states. The practical enforcement and supervisory expectations under AMLR are still developing, but crypto firms in Europe are already adapting to AMLR as the new normal for compliance.

This article, written from a legal perspective but in clear terms for any reader, explores how AMLR changes KYC duties for crypto service providers – not by introducing KYC from scratch, but by strengthening and reorganizing it as a continuous, risk-driven process within a unified European framework. We’ll see how KYC compliance under AMLR moves from one-off identity checks to ongoing monitoring, ties customer identity to actual transactions (including the Travel Rule for fund transfers), and raises the bar on governance and accountability. Rather than offering a checklist or product pitch, the goal is to provide crypto businesses with context on the regulatory landscape and the regulatory expectations set by AMLR.

Note: None of this information should be considered as legal, tax, or investment advice. While we’ve done our best to ensure this information is accurate at the time of publication, laws and practices may change, so please double-check it.

AMLR and the EU AML Framework — Where KYC Fits Today

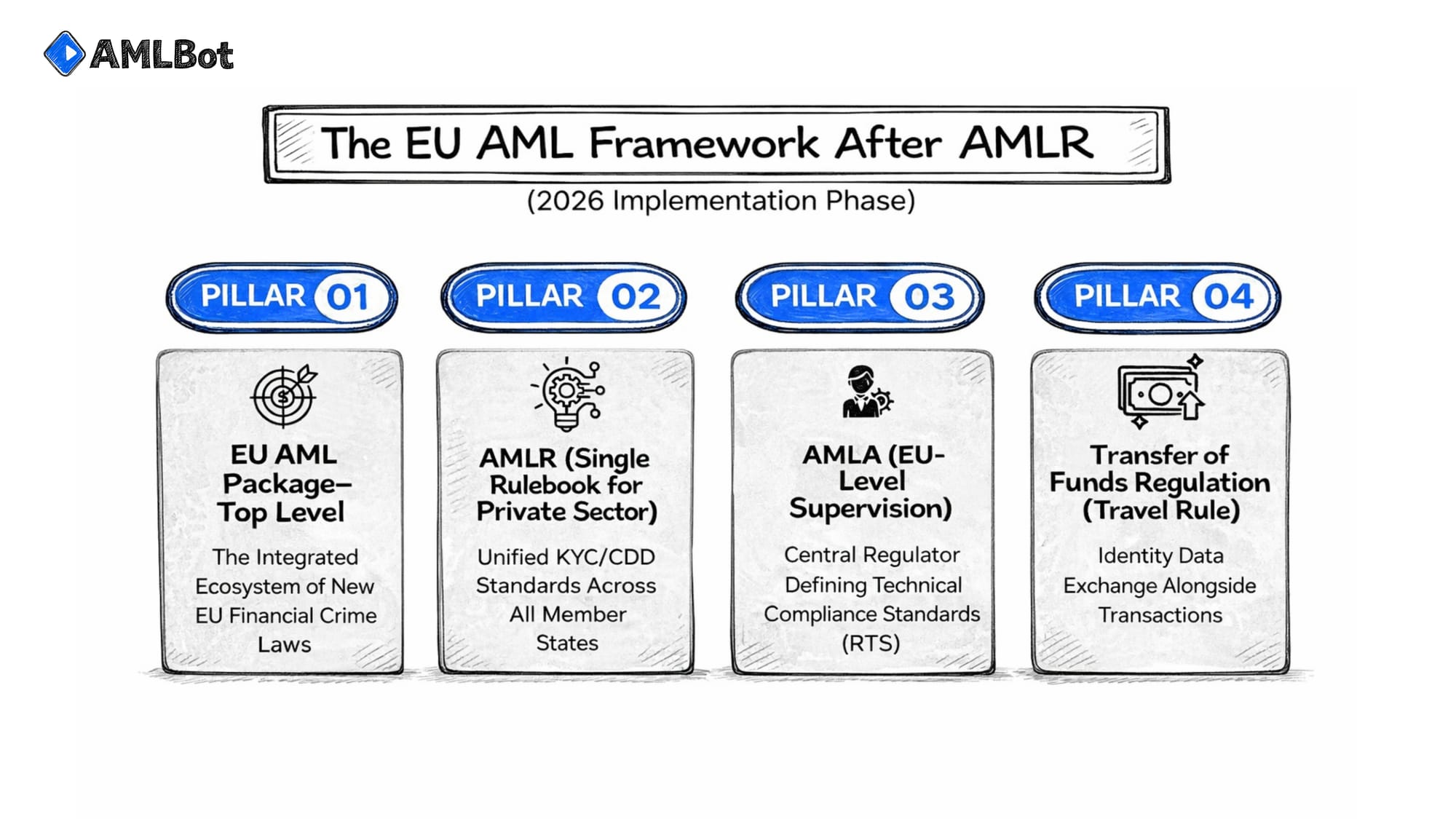

AMLR is a centerpiece of the EU’s recent AML Package (2024–2026), which overhauls Europe’s approach to fighting financial crime. The package includes: a new EU AML Authority (AMLA) to oversee and coordinate supervision; an updated Transfer of Funds Regulation for crypto traceability; and AMLR – a single, directly applicable regulation that compiles all private-sector AML/CFT obligations.

In this new setup, KYC obligations take on a central role. All rules previously set out in national laws under AML directives (such as Customer Due Diligence requirements from the 4th and 5th AML Directives) are now consolidated into AMLR as common EU AML/CFT rules. This directly applicable regulation harmonizes and clarifies expectations for “obliged entities”, ensuring a consistent baseline for KYC compliance across Europe.

Put simply, KYC – the duty to identify customers, verify their identities, monitor transactions, and report suspicions – is no longer just guided by EU directives interpreted differently across countries. Instead, AMLR embeds KYC into a unified EU framework with clear, binding rules for all member states.

Under AMLR, crypto-asset service providers (CASPs) – which include cryptocurrency exchanges, custodial wallet providers, and other crypto businesses – are explicitly listed as obliged entities for the first time in an EU regulation.

Previously, the EU’s 5th AML Directive had already brought certain crypto services under AML rules via national laws, but approaches differed by country. Now that AMLR is in force, the role of KYC in the EU AML framework is firmly established: it is a core obligation applied uniformly to banks, fintech companies, and crypto providers alike. This change reflects the EU’s policy that the crypto sector should no longer operate on the fringes of AML compliance, but instead be fully integrated into the EU AML regime. AMLR’s adoption in mid-2024 and phased implementation through 2025–2026 means that as of 2026, KYC is part and parcel of doing crypto business in Europe’s single market, backed by EU law and overseen by EU and national authorities.

From Fragmented Rules to a Unified AMLR Approach

Prior to AMLR, EU KYC requirements were set out in directives (like 4AMLD and 5AMLD), which each member state transposed into its own national laws. While the overall objectives were shared, this led to fragmentation – different countries imposed slightly different KYC procedures, interpretations, and thresholds.

For crypto firms operating across borders, onboarding, and verification rules could vary from one EU jurisdiction to another. This layered compliance created uncertainty and opportunities for regulatory arbitrage, where bad actors could exploit the weakest link. Now, AMLR replaces that disconnected system with one regulation that applies uniformly across all EU countries, effectively creating a single rulebook for AML/KYC. The EU regulation “exhaustively harmonizes” the rules, closing loopholes and eliminating divergent national approaches.

In practice, this means the core KYC obligations – Customer Identification, Due Diligence, Record-Keeping, Ongoing Monitoring – are defined the same way for all crypto businesses in Europe, whether they operate in France, Germany, or any other member state.

The approach under AMLR reduces compliance inconsistency. Crypto exchanges and other VASPs (Virtual Asset Service Providers, as defined by FATF globally) no longer have to navigate a confusing set of national KYC rules. Instead, they follow a single EU-wide standard.

As the EU Council noted, the new regulation will be applied more consistently and better enforced across the EU. For example, under AMLR, all CASPs must verify customers and report suspicious activity; a crypto business cannot avoid strict KYC by choosing a member state with laxer implementation, because AMLR is directly applicable. The outcome is a more coordinated AML framework where criminals “will have no space left” to exploit gaps between countries. In essence, AMLR has transformed KYC in Europe from a patchwork of local practices into a cohesive, EU-supervised process, marking a new era of unified compliance for the crypto industry.

How AMLR Changes the Structure of KYC Obligations

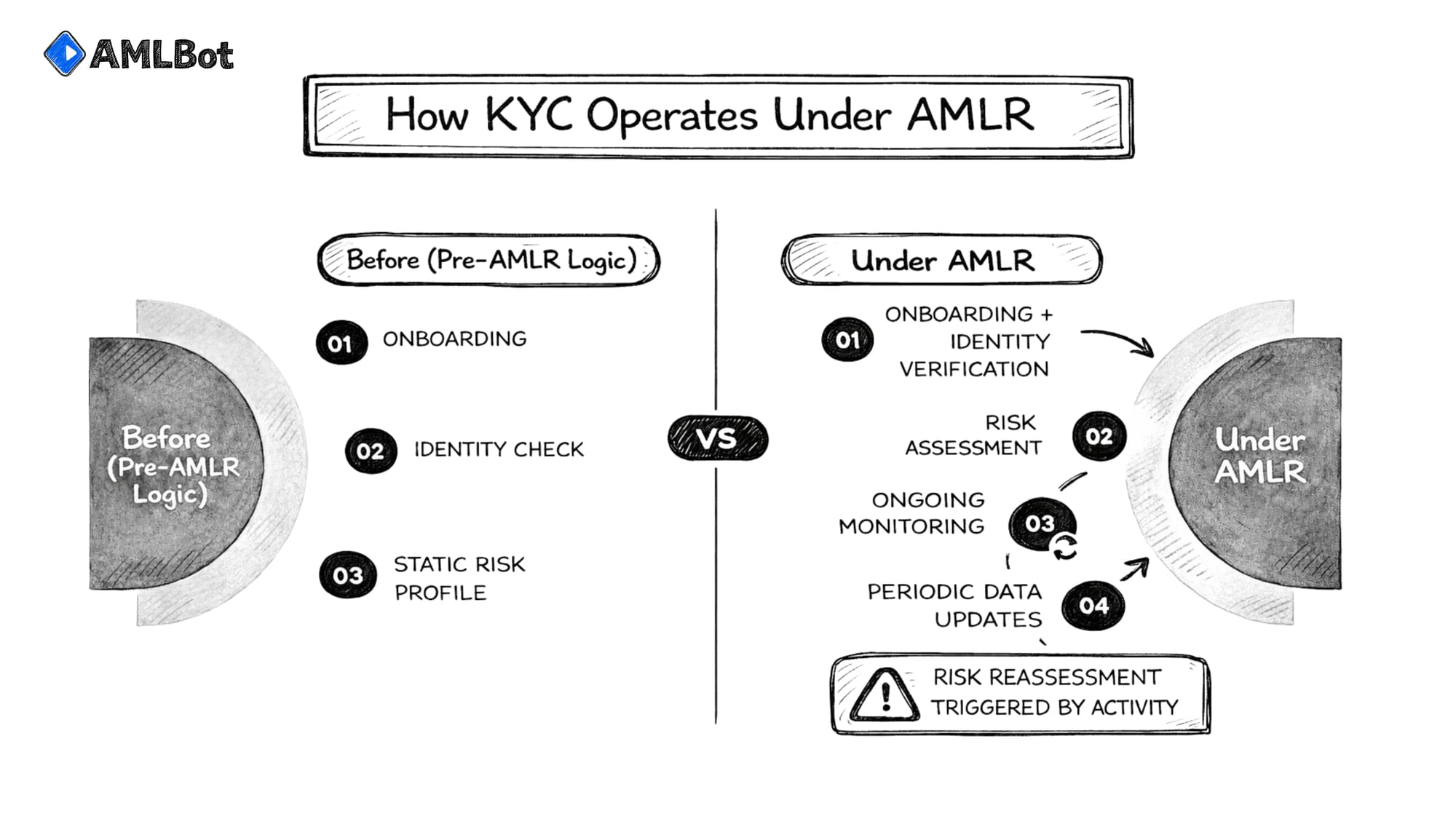

AMLR fundamentally reshapes KYC implementation, moving from a formality at onboarding to a continuous, risk-based process woven into business operations. Under earlier regimes, many crypto companies treated KYC as a one-time event: collect ID documents when registering a new customer, perform basic checks, and then consider the obligation fulfilled unless something obvious triggered a review. AMLR turns that approach on its head. It reconceives KYC as an ongoing obligation that lasts throughout the customer relationship, with intensity proportional to risk. So, compliance in 2026 is about continuously Knowing Your Customer – updating information, monitoring behavior, and reassessing risk as circumstances change.

In this section, we break down three key ways AMLR changes KYC obligations: by enforcing KYC as a continuous risk-based process, by tightening the link between customer identity and customer activity, and by incorporating the Travel Rule to enhance transparency of crypto transactions.

KYC as a Continuous, Risk-Based Process

Risk-Based KYC is at the heart of AMLR. This means crypto businesses must calibrate their KYC measures to the assessed risk of each customer and service – applying more powerful due diligence for higher-risk cases and simpler steps for lower-risk ones. Crucially, AMLR embeds the idea that KYC is not a one-off task at onboarding, but an ongoing process that requires regular review.

The regulation explicitly requires:

“conducting ongoing monitoring of the business relationship,” including scrutiny of transactions over time, “to ensure that the transactions being conducted are consistent with the [company]’s knowledge of the customer, [their] business and risk profile”.

In other words, compliance teams must continuously evaluate whether a customer’s account activity aligns with the information they have about that customer. If a normally low-volume retail customer suddenly starts moving large sums of crypto, the business must notice and react – that could mean updating the customer’s risk rating, requesting additional information, or filing a suspicious transaction report.

To facilitate this, AMLR mandates that customer data and documentation be kept up to date. Companies are obliged to periodically refresh and verify the information they hold on customers, rather than simply archive it after onboarding. According to the regulation, during ongoing monitoring,

“obliged entities shall ensure that the relevant documents, data, or information of the customer are kept up to date.”

This might involve asking customers to reconfirm identity details or provide new proof of address after a certain period, especially for higher-risk accounts.

Additionally, AMLR embraces dynamic risk management:

“Business relationships are likely to evolve as the customer’s circumstances and activities change over time… obliged entities should [periodically] review information from their customers, in accordance with the risk-based approach. Such reviews should also be triggered by changes in relevant circumstances… when facts indicate a potential change in the risk profile or identification details of the customer.”

In practice, this means that a change (e.g., a client’s name change, a spike in transaction volume, or news that the client is being investigated for fraud) should prompt the crypto business to promptly update the client's KYC and risk assessment.

So, this continuous KYC approach requires internal systems. Crypto businesses need to integrate Identity Verification, Transaction Monitoring, and Risk Scoring to generate alerts when deviations from the norm occur.

Instead of a static KYC file gathering dust, AMLR envisions KYC as a living customer profile that is constantly refined. Importantly, being risk-based does not mean being lax – the regulation stresses that the risk-based approach is “not an unduly permissive option” but rather a disciplined, evidence-driven method to effectively target the highest risks. Supervisors will expect crypto companies to demonstrate that their KYC measures are commensurate with the risks identified.

Stronger Link Between Customer Identity and Activity

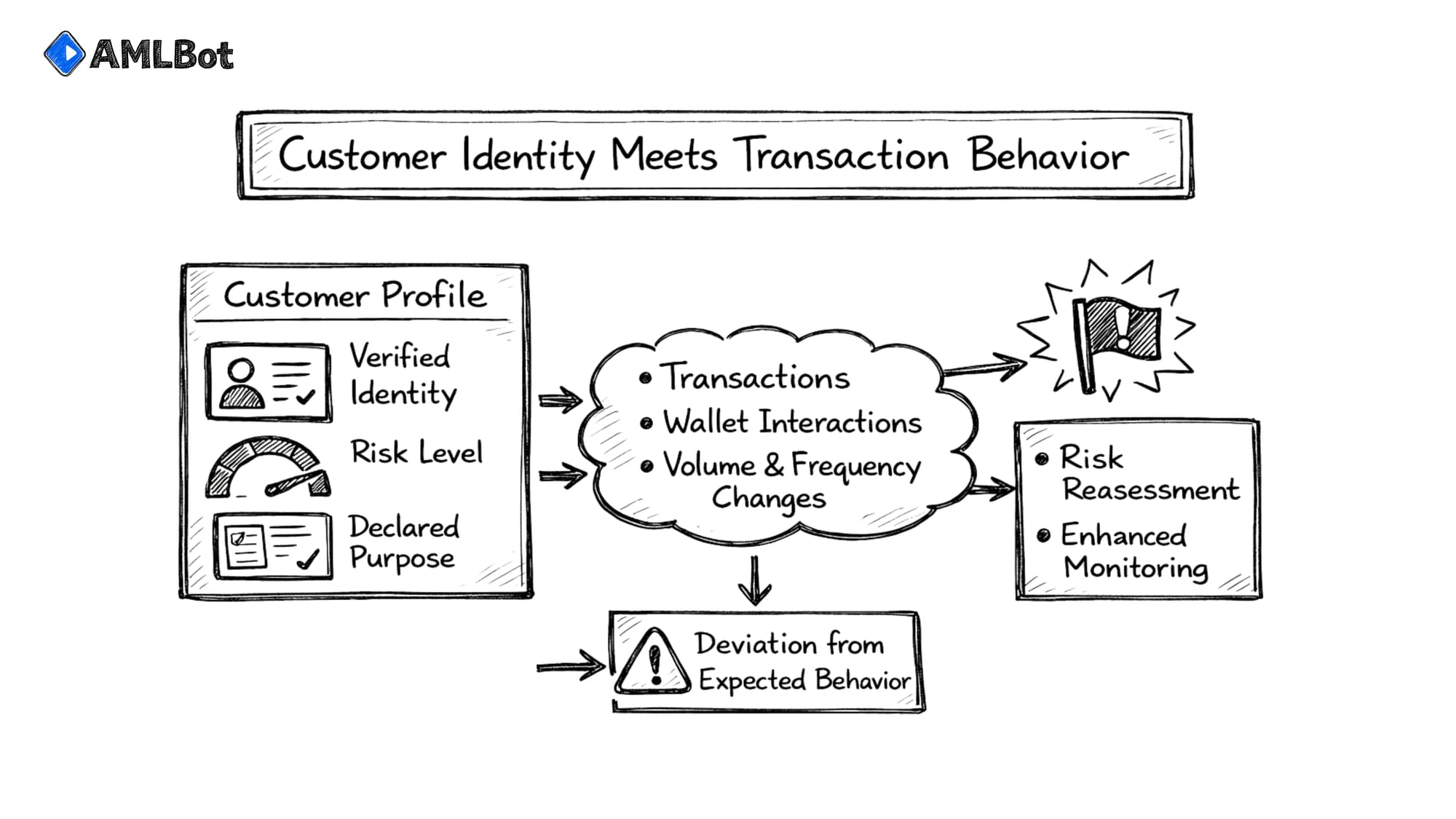

Another structural change AMLR brings is a much tighter link between WHO the customer is (their verified identity and profile) and what the customer DOES (their transactions and usage of the service).

In the past, some crypto providers approached KYC as merely collecting a passport or ID from the user and then considering their job done unless something went wrong.

AMLR makes clear that knowing the customer’s identity is only the first step – that knowledge must inform ongoing scrutiny of the customer’s activities. The regulation requires that customer identity information and customer activity be linked for monitoring. Specifically, businesses must watch the customer’s transactions in light of the customer’s known profile to detect inconsistencies. AMLR’s text mandates:

“ongoing monitoring of the business relationship, including scrutiny of transactions… to ensure that the transactions being conducted are consistent with the obliged entity’s knowledge of the customer, the business, and risk profile, including, where necessary, the source of funds.” This effectively operationalizes the old adage “Know Your Customer, and Know Your Customer’s Transactions.”

For crypto businesses, this means KYC isn’t just about verifying a user’s name and ID once. It means continually asking: Does this transaction make sense for this customer? If, for example, a customer identified as a small investor suddenly receives a large amount of crypto from dozens of wallets, a well-implemented AMLR program would flag this as unusual. The firm would then be expected to investigate – perhaps requesting information on the source of those funds or the purpose of the transactions – and determine if it’s legitimate or suspicious. Under AMLR, customer identity data (like name, birthdate, identity documents, proof of address, business type, etc.) must be meaningfully linked to transaction monitoring. The regulation even emphasizes understanding the nature and purpose of the customer’s business or relationship, so that the compliance team has context for what types of transactions to expect.

By strengthening the identity-activity link, AMLR essentially merges what is sometimes called KYC (knowing who your customer is) with what some dub KYT – “Know Your Transactions” or understanding the customer’s transaction behavior. Crypto firms are expected not only to collect customer identity information but also to use it in risk-monitoring algorithms and reviews.

For instance, if a customer told the exchange during onboarding that they plan to trade at most €5,000 per month, and later they start transacting €50,000 per week, the discrepancy should trigger action. It also implies a feedback loop: if monitoring uncovers new information (say, the customer is actually engaged in a business that they initially didn’t disclose), the firm should update the customer’s profile and potentially re-verify certain customer identity details or apply enhanced due diligence. AMLR therefore creates a more holistic KYC framework, where identity verification, risk profiling, and transaction oversight inform each other within a unified process for AML compliance obligations.

The Role of the Travel Rule in AMLR-Driven KYC

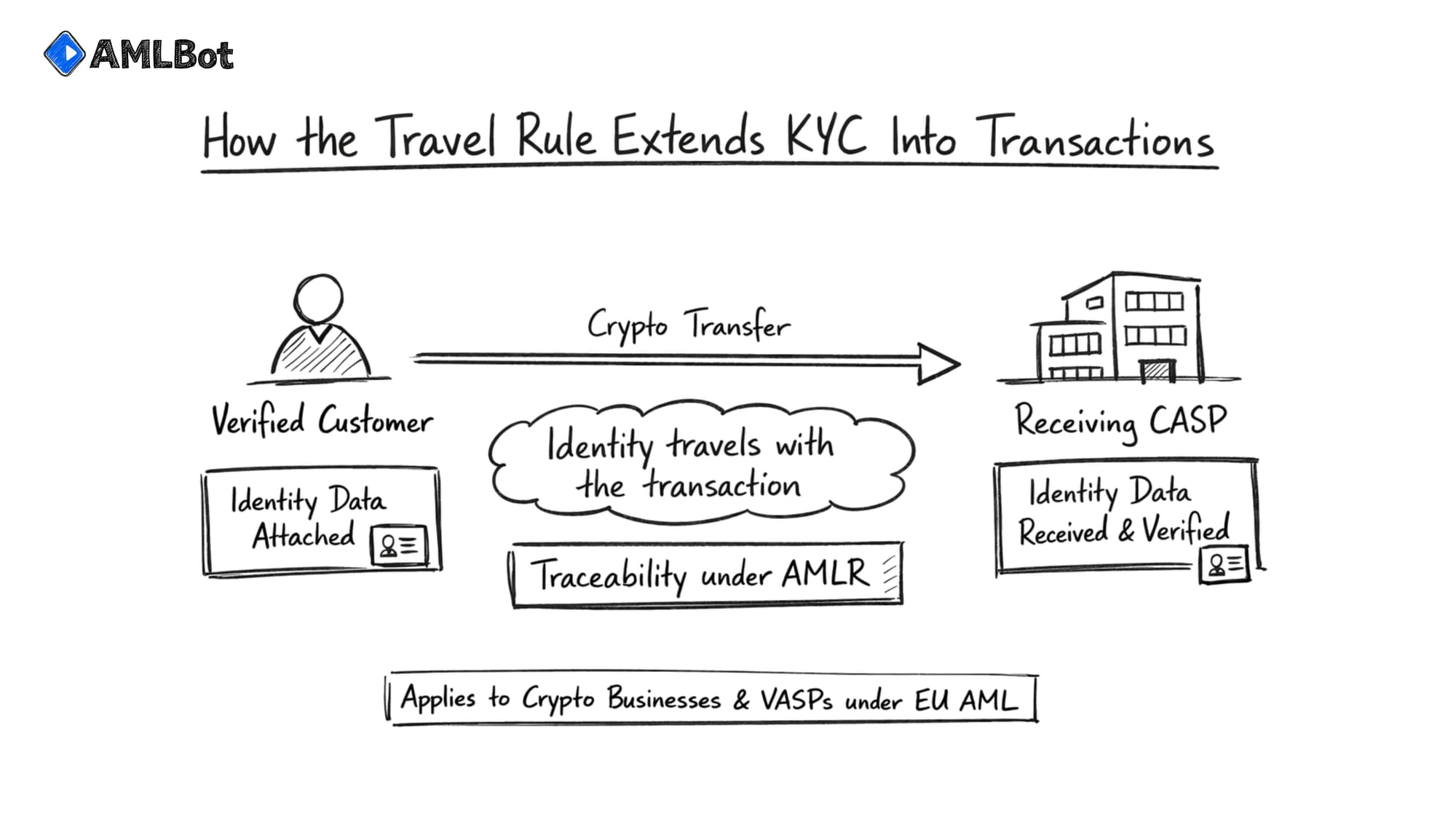

No discussion of AMLR and crypto KYC is complete without mentioning the Travel Rule.

The Travel Rule refers to requirements for financial institutions to include and exchange identifying information about the sender and receiver in payment transfers – a concept long applied to bank wires and now extended to crypto-asset transfers.

In the EU context, the Travel Rule for crypto was implemented through an update of the Transfer of Funds Regulation (TFR), which was part of the same legislative package as AMLR. While technically a separate regulation, the Travel Rule’s implementation works hand-in-hand with AMLR to reinforce KYC obligations. Under the new rules, crypto-asset service providers must collect and make available certain information about the originator and beneficiary of each crypto transfer. This means whenever a customer of a crypto exchange sends crypto to an external wallet or receives crypto, the service provider is obligated to attach identifying information (such as names, account numbers, customer ID, etc.) to that transfer and share it with the receiving or sending institution, just as banks do for wire transfers.

The Travel Rule externalizes KYC. It forces crypto businesses to utilize their KYC data at the transaction level, ensuring that identity information “travels” with the funds.

Practically, for a crypto exchange, this means that if Alice wants to send 1 Bitcoin from her account to Bob’s account at another exchange, Alice’s exchange must transmit Alice’s identifying info (and possibly Bob’s info, depending on the situation) along with the transaction, and Bob’s exchange must verify and retain that info. To comply, crypto businesses need systems to tie verified customer identities to both incoming and outgoing transfers and to securely communicate that data to other institutions or authorities. This increases the importance of upfront identity verification and ongoing data management.

AMLR and associated regulations “ensure crypto-asset transfers are traceable so that it is easier to identify potentially suspicious transactions and block them,” aligning the EU with the “most demanding international standards” in this area.

From a KYC perspective, the Travel Rule means that knowing your customer is not enough. You also have to know the counterparties involved in your customer’s crypto transactions. If a customer is sending crypto to a self-hosted wallet (their own private wallet), AMLR requires exchanges to take risk-based measures, which could include verifying that the wallet is owned by the customer or even prohibiting transfers to high-risk unhosted wallets. If the transfer is to another exchange, both sides share KYC details.

The Travel Rule thus cements the integration of KYC into transaction processing: identity data isn’t just collected and stored in a silo; it actively accompanies transactions and enables traceability.

Globally, this reflects FATF Recommendation 16, and FATF has made clear that VASPs “need to… obtain, hold and securely transmit originator and beneficiary information when making transfers.”

By embedding the Travel Rule, AMLR forces crypto businesses to extend their KYC programs beyond their own customer base to the wider network of transfers. This elevates compliance obligations, as firms must invest in information-sharing technologies and protocols and ensure data accuracy.

What AMLR Means for Crypto Businesses Operating in Europe

For crypto businesses operating in Europe, AMLR’s entry into force signals a new compliance reality. The regulation’s impact is broad, affecting who is covered, what internal controls are needed, and how accountability is enforced. In essence, AMLR brings crypto businesses into line with the standards long applied to traditional financial institutions. Companies that provide crypto-related services in the EU (or to EU customers) now face uniform KYC obligations that are more demanding in their continuity and depth.

This has operational implications: firms must update policies, upgrade compliance infrastructure, and possibly adjust their customer experience to meet the stricter requirements. Below, we outline two major practical dimensions of AMLR’s impact on crypto companies: the scope of which businesses and activities are affected, and the heightened expectations around internal governance, controls, and accountability in AML/KYC compliance.

Scope – Which Crypto Businesses Are Affected

AMLR’s scope encompasses a wide range of crypto-asset services, effectively covering “most of the crypto sector” as obliged entities under EU AML/CFT rules. If you are a business involved in exchanging crypto-assets for fiat or other crypto, operating a crypto trading platform, providing custodial wallet services, facilitating crypto payments, or otherwise intermediating crypto transactions for customers, you are directly subject to AMLR’s KYC and AML obligations.

The regulation applies to all crypto-asset service providers (CASPs) as defined in the EU (a definition closely aligned with the FATF’s “VASPs” concept). This includes: cryptocurrency exchanges (centralized or decentralized providers, if they are entities), crypto ATM operators, brokers and dealers, providers of crypto transfer or remittance services, custodians of crypto wallets or private keys, and even certain NFT or metaverse-related service providers if they fall into the regulated categories.

In short, ANY crypto business that falls under the EU’s Markets in Crypto-Assets (MiCA) categories or provides services analogous to regulated financial services will fall under AMLR’s remit for KYC. There are very few exceptions. Only truly peer-to-peer, non-custodial arrangements that involve no intermediary escape the obligations, and even those are indirectly impacted because regulated firms must treat dealings with unhosted wallets cautiously.

Crucially, being within scope means these crypto businesses must apply customer due diligence measures just like banks and other financial institutions. As the EU Council summarized, “All crypto-asset service providers will need to apply due diligence with regard to their customers. This means they will have to verify facts and information about their customers, as well as report any suspicions to an FIU.”

In practice, upon onboarding a new customer, a crypto firm must identify and verify the customer’s identity, determine the purpose of the business relationship, and assess the customer’s risk profile. They must also screen the customer against sanctions and politically exposed person (PEP) lists. These steps were already standard under the 5AMLD for exchanges and wallets, but AMLR solidifies them and extends them uniformly across the EU. Moreover, whenever a customer’s activity hits certain triggers – for example, a transaction above a threshold or a suspicion of money laundering – the company must perform appropriate due diligence (identifying the parties of a large transaction, asking for the source of funds, etc.). Even occasional customers (e.g., one-off crypto swaps above €1000) are subject to KYC under AMLR.

It’s worth noting that AMLR’s scope also includes some businesses that might not have been strictly covered or consistently treated under prior national regimes. For instance, crypto mining pool operators who intermediate payments, certain decentralized finance (DeFi) platforms if they have a legal entity providing services, and crypto gaming or betting platforms with cash-out functionality could all be pulled into compliance obligations if they meet the definitions. VASPs operating outside the EU but serving EU customers will also need to pay attention – they may need to register or appoint EU-based compliance, as member state laws implementing AMLR could require foreign operators to establish a presence or cooperate with EU authorities.

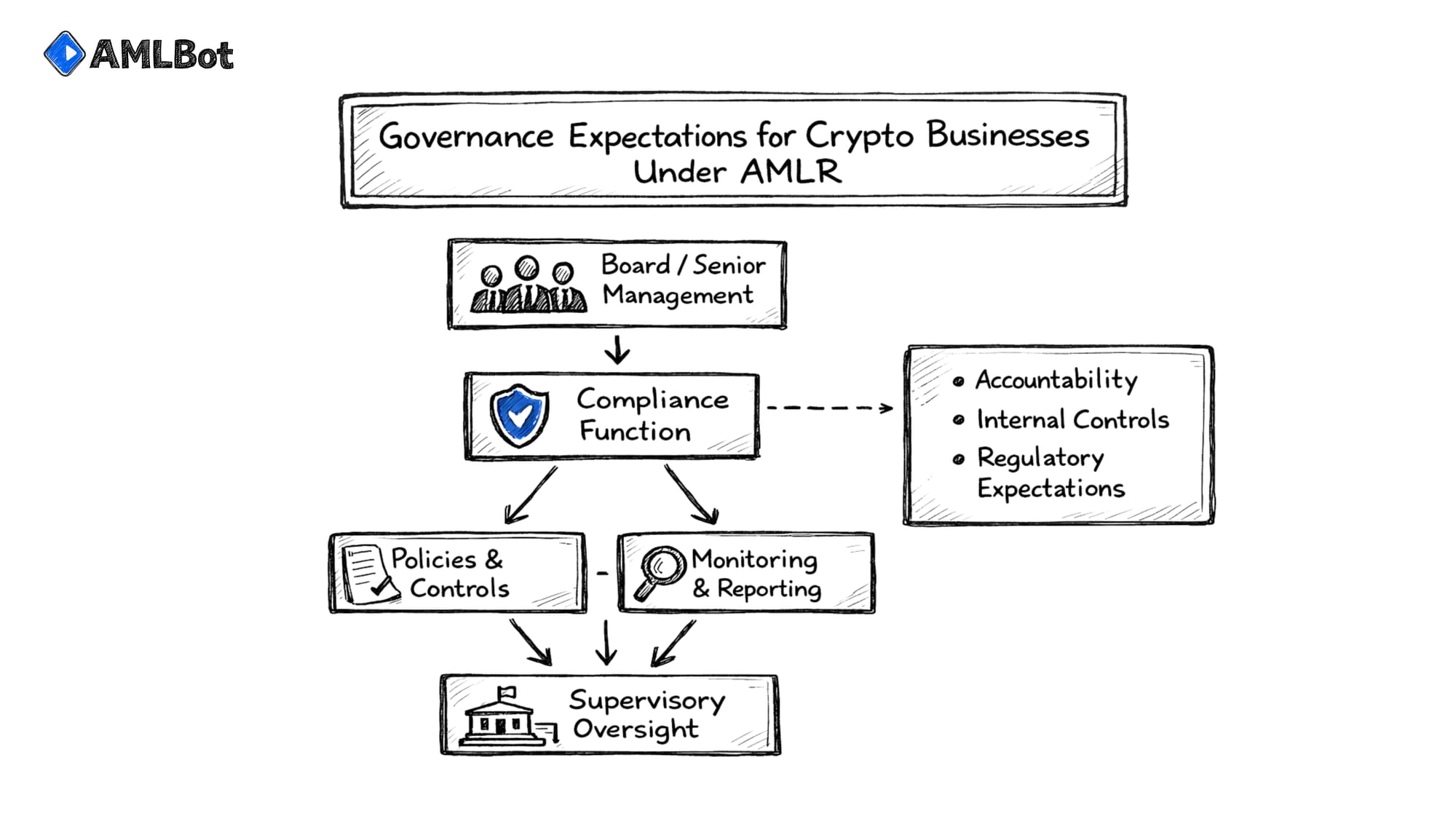

Governance, Controls, and Accountability

AMLR not only dictates what crypto businesses must do regarding KYC, but also raises the bar for how they implement it internally. The regulation places strong emphasis on governance, internal controls, and senior management's accountability for compliance.

Under AMLR, crypto companies must ensure they have a strong compliance infrastructure, including clear internal policies and procedures for AML/KYC, ongoing employee training programs, independent audit functions to test AML systems, and active oversight by the company’s leadership. In fact, AMLR requires that an AML Compliance Officer or function be appointed at the management level of the company.

For example, a crypto exchange should designate a qualified person in its senior management (e.g., a Chief Compliance Officer on the board or reporting to the board) responsible for implementing AMLR requirements and accountable to regulators.

Furthermore, AMLR mandates that compliance functions be given adequate resources and authority. The regulation states that obliged entities must provide their compliance function with “adequate resources, including staff and technology, in proportion to the size, nature, and risks of the entity”. For a fast-growing crypto platform, this could mean hiring more compliance analysts and investigators, investing in stronger KYC/AML software, and ensuring the compliance team has unfettered access to customer data and transaction records.

Simply put, governance controls under AMLR need to be commensurate with the complexity of the business. A small crypto payment startup will not be expected to have a 50-person compliance department, but it must at least appoint responsible personnel and put in place the necessary controls. A large exchange serving millions of users will be expected to have a much more elaborate compliance program. AMLR also encourages a strong “compliance culture” at crypto firms, where management cannot plead ignorance if things go wrong. There are clear expectations that management be aware of AML risks and support mitigation measures. Failures in KYC obligations can lead to significant penalties, and under AMLR, these penalties are being harmonized and strengthened across the EU to ensure they’re dissuasive.

Key compliance obligations on crypto businesses include conducting an enterprise-wide money laundering risk assessment, implementing group-wide AML policies, and establishing internal reporting systems for suspicious activity. Companies must keep detailed records of all KYC information and transactions for at least five years, so they can be provided to regulators or Financial Intelligence Units (FIUs) upon request.

AMLR also makes it easier for regulators to impose personal liability on individuals responsible for compliance when there is willful blindness or gross negligence. This underscores that compliance is a serious corporate responsibility. Crypto businesses will need to foster collaboration between their compliance departments and product/engineering teams to ensure that controls are effectively integrated into their platforms.

How AMLR Aligns EU KYC with Global Expectations

It’s important to view AMLR not as an isolated European quirk, but as part of a broader global trend toward stricter AML/KYC standards for crypto. The Financial Action Task Force (FATF), which sets international AML norms, updated its standards in 2019 to explicitly cover crypto assets and VASPs, urging all countries to impose KYC, record-keeping, and the Travel Rule on crypto service providers. AMLR is essentially the EU’s way of implementing these standards comprehensively and enforceably across member states. By doing so, the EU has vaulted itself to the forefront of crypto AML regulation – in many respects, EU AML requirements on crypto now meet or exceed those in other major jurisdictions.

For example, the Travel Rule that the FATF expects globally is fully implemented in the EU (with a low threshold of EUR 1000 for crypto transfers, and even lower for some risk scenarios), whereas some countries are still catching up. EU regulators are also promoting the concept of ongoing, risk-based KYC, which mirrors FATF’s core Recommendations 10 and 1 (Customer Due Diligence and Risk-Based Approach).

From the perspective of crypto businesses, this means the KYC obligations they face under AMLR are broadly consistent with global expectations and, in some cases, even set a high bar that could serve as a model. These changes complement broader crypto KYC requirements that apply to virtual asset service providers across different jurisdictions.

For instance, customer identity verification is a baseline everywhere – whether a crypto exchange is in the EU, the US, or Asia, it’s now standard to verify users' identities. What AMLR does is ensure that in the EU, this practice is non-negotiable and standardized, whereas previously, one country might have been strict and another more lax.

Similarly, the notion of ongoing monitoring and suspicious transaction reporting is a global one – FinCEN in the US, FINTRAC in Canada, MAS in Singapore, etc., all expect crypto firms to monitor and report suspicious activity. AMLR aligns with these expectations but also pushes them further by mandating unified EU-level supervision (through the upcoming AMLA) to ensure these rules are applied consistently.

The global alignment also means that EU-based crypto businesses will find it easier to demonstrate compliance in multiple jurisdictions. If you comply with AMLR, you’re likely meeting or exceeding the AML/KYC requirements of most countries. This could simplify cross-border operations in the long run. It also contributes to a level playing field internationally – the EU’s move pressures other markets to tighten their crypto KYC rules to avoid becoming havens. FATF has noted that many countries have yet to effectively regulate VASPs, and it continues to call for action. By having AMLR in force, the EU can credibly say it’s implementing the FATF recommendations in full. The AML framework built by AMLR thus stands as part of Europe’s fulfillment of international standards, much like its earlier AML directives did for banks.

Finally, aligning with global standards also protects EU crypto businesses from being perceived as high risk by international partners. Banks and institutions in other countries might be more willing to do business with EU-licensed crypto firms, knowing that they are subject to rigorous EU AML rules. This can help crypto businesses in Europe integrate with traditional finance because their compliance credentials are stronger.

To be sure, AMLR is not a panacea – effective implementation and supervision are key, and those will evolve in the coming years – but it firmly puts the EU on the map as a jurisdiction with some of the most comprehensive KYC compliance requirements for crypto. In doing so, it contributes to the global effort to mitigate money laundering and terrorist financing risks in the crypto space, aiming for a future in which illicit actors find it increasingly difficult to abuse crypto markets worldwide. These changes complement broader crypto KYC requirements in line with FATF Guidelines and other countries’ regulations, positioning the EU as a leader in setting regulatory expectations for the crypto industry worldwide.

Practical Implications for KYC Operations Under AMLR

With AMLR reshaping the rules, what does this mean on the ground for a crypto exchange or wallet provider? In practical terms, crypto businesses will need to adapt their day-to-day KYC operations to meet the new standards. It’s about enhancing and scaling existing ones, and embedding compliance more deeply into operational workflows.

Two critical areas stand out: data quality and consistency, and the use of technology and third-party support to manage the increased compliance workload. High-quality data is the lifeblood of effective KYC – if customer information is inaccurate or outdated, even the best monitoring systems will fail. And given the volume of transactions and users many crypto firms handle, leveraging advanced technology and specialized service providers, such as AMLBot, is often essential to efficiently fulfill KYC obligations under AMLR. Let’s explore each of these areas.

Data Quality, Consistency, and Ongoing Updates

One immediate implication of AMLR’s continuous KYC mandate is that crypto businesses must prioritize the quality and currency of their customer data. It’s no longer sufficient to collect a passport photo during signup and file it away; firms need to ensure this information remains accurate and up to date. For instance, if a customer’s ID expires or their surname changes due to marriage, the business should have a process to update the records. Under AMLR’s ongoing due diligence requirements, companies are expected to periodically review customer information and refresh verification when necessary. This may involve sending customers periodic reminders to update their KYC details or re-verifying their identities after a certain period, especially for higher-risk customers. Data consistency across systems is also vital. Many crypto businesses have multiple platforms or databases. Ensuring that a customer’s identity and risk profile are consistent in all systems – so that, for example, a flagged high-risk status in the compliance database also reflects in the user profile that customer support sees – is an important internal control. AMLR effectively pushes companies toward an integrated view of the customer.

Additionally, ongoing monitoring obligations mean crypto companies should continuously update their picture of each customer. Every transaction or interaction could yield new data – perhaps a new address the customer withdraws to, or a new linked bank account for deposits. Firms should incorporate these data points into the KYC file and risk assessment. If a customer suddenly provides an address in a different country, this could affect jurisdictional risk and tax reporting, which the compliance team should note. AMLR’s risk-based approach suggests that the frequency of data updates can itself be risk-based: low-risk customers might be asked to confirm their details once every few years, whereas high-risk customers or those involved in large volumes might be reviewed annually or more frequently. In all cases, though, data quality is paramount – poor quality data (typos, incomplete fields, lack of verification) can lead to compliance breaches. Therefore, many crypto businesses under AMLR are investing in improving KYC data collection during onboarding.

Technology and Third-Party Support

Complying with AMLR’s stringent KYC and monitoring requirements can be resource-intensive, especially for crypto startups or those experiencing rapid growth. The good news is that technology and specialized service providers can significantly help meet these compliance obligations. In fact, most crypto businesses will find that automation and third-party solutions are indispensable to keep up with the volume and complexity of KYC checks mandated under AMLR.

For example, identity verification, which may involve checking government IDs, verifying liveness (e.g., selfie checks), and cross-referencing databases, can be streamlined with digital KYC providers that offer API-based services. These providers can often perform verification in seconds using machine learning, far faster and potentially more accurately than manual review. As AMLR defines new KYC expectations, many crypto businesses rely on specialized KYC Service Providers to support identity verification and compliance processes. By outsourcing or using SaaS tools for the heavy lifting of document authentication, biometric matching, and even sanction/PEP screening, crypto firms can achieve a higher standard of compliance without reinventing the wheel in-house.

Another area where technology is crucial is transaction monitoring and blockchain analytics. Under AMLR, crypto companies must not only monitor fiat transactions but also monitor blockchain activity for signs of illicit activity or higher risk. Advanced blockchain analytics tools can trace cryptocurrency flows and flag addresses associated with hacks, sanctions, or money laundering. These tools often come from third-party providers specializing in crypto compliance. They continuously update their database of risky addresses. Using these tools, a compliance officer can be alerted if, say, a customer receives crypto from an address that is linked to a sanctioned exchange – at which point the business can freeze funds or escalate the case.

Third-party support can also extend to areas like ongoing customer due diligence. Some crypto businesses engage external firms to enhance due diligence for high-risk customers. While the ultimate responsibility remains with the crypto company, AMLR allows reliance on third parties for certain aspects of CDD under strict conditions, and many firms use this to their advantage to leverage expertise. It’s important, however, that any third-party service or tool is vetted and that the crypto business understands the limitations. Regulators will hold the crypto company accountable if the tech fails or if a third party misses something critical. Therefore, due diligence on vendors and regular audits of their performance are themselves part of good governance.

Finally, technology can help with record-keeping and reporting, which are integral to KYC operations. Many firms are implementing centralized compliance dashboards that track KYC status for each customer and log all actions taken. This not only helps internal coordination but also makes it easier to demonstrate compliance to regulators during inspections. Governance controls in AMLR require companies to provide regulators with evidence of their compliance efforts. A robust compliance IT system can generate reports showing, for instance, that 98% of the customer base has up-to-date KYC info, or listing all the enhanced due diligence measures taken for high-risk clients.

In summary, leveraging RegTech solutions and expert providers is increasingly the norm for crypto KYC. Manual processes simply cannot scale to meet AMLR’s expectations in a timely manner. The cost of these solutions can be high, but they are investments in sustainable compliance. Not only do they help avoid regulatory sanctions, but they also enable a smoother user experience.

How AMLR Builds on Existing KYC Concepts

To understand how AMLR changes KYC obligations, it is important to first define KYC in the context of crypto businesses. In essence, Know Your Customer (KYC) is not a new concept introduced by AMLR; it has been a foundational element of AML regulation for decades, and it already applied to crypto services under the EU’s previous directives (notably 5AMLD, which, since 2020, required EU crypto exchanges and custodial wallet providers to conduct KYC). What AMLR does is build on these existing KYC concepts and reinforce them within a more robust framework. The fundamental pillars of KYC remain the same: customer identification and verification, due diligence (including understanding the purpose of the relationship and, if applicable, the beneficial owner behind a client), and ongoing monitoring of the customer’s transactions and risk profile. AMLR strengthens these pillars by making the rules more detailed, uniform, and enforceable across the EU.

One way to view AMLR is as an evolution from a directive-based regime to a regulation-based regime. The KYC principles under prior EU law (and global standards) – such as verifying a customer’s identity using reliable documents or data, identifying the real person behind accounts (beneficial owners), assessing risk levels, and monitoring for suspicious activity – all carry over into AMLR. However, AMLR codifies them with more granularity and removes the wiggle room that allowed divergent national practices. For example, under previous directives, what constituted “simplified due diligence” for lower-risk cases was somewhat open to interpretation by each country. AMLR now provides clearer criteria, stating that any simplified measures must still respect the overall risk-based approach and cannot omit core requirements (such as identifying the customer). Another example: under 5AMLD, crypto exchanges had to be licensed/registered and apply KYC, but some member states might have had varying thresholds or verification methods. Under AMLR, all CASPs must apply identification measures to essentially all customers, and thresholds are consistent across the EU.

In short, AMLR stands on the shoulders of existing KYC practice, but elevates it. It doesn’t ask crypto businesses to do something fundamentally different from the KYC they might already know; it asks them to do it better, more consistently, and under uniform rules.

Conclusion

The introduction of the EU’s AMLR marks a turning point for crypto KYC requirements in Europe. As of 2026, we are in a new reality where KYC is not just a formality at account opening, but a continuous, risk-managed obligation that crypto businesses must diligently uphold. AMLR has effectively reshaped KYC obligations by unifying them under a single rulebook, making them more risk-based, ongoing, and closely tied to actual transaction activity. For crypto businesses in Europe – from exchanges and payment providers to custody services – this means compliance is now a core function that demands significant attention and resources.

The regulation has reshaped existing KYC obligations rather than creating new ones: it builds on the familiar pillars of customer identification, background checks, and transaction monitoring, but enforces them with unprecedented consistency and rigor across the EU.

In practical terms, companies that adapt to AMLR will likely develop stronger compliance programs: high-quality customer data management, integrated monitoring systems, and clearly accountable compliance leadership. Those that fail to meet the regulatory expectations risk penalties and reputational damage, as European regulators (and the upcoming AML Authority) are poised to take a much more hands-on supervisory role. It’s also important to note that AMLR is not static – while the regulatory text sets the framework, detailed technical standards and guidelines will continue to emerge, and supervisory practices will mature over time. Crypto businesses should therefore view AMLR compliance as an evolving process and stay engaged with regulatory developments.

From a broader perspective, AMLR’s changes tie KYC into the EU’s comprehensive strategy to combat financial crime and bring crypto fully into the regulated financial fold. Ongoing monitoring, traceability of crypto transactions, and cross-border cooperation all contribute to a safer financial system. For legitimate crypto businesses, complying with these higher standards can ultimately be beneficial. It can enhance customer trust and make it easier to work with banking partners and institutional clients who require strong compliance hygiene. In conclusion, AMLR has already begun to reshape the landscape of crypto compliance in Europe. Crypto companies that understand and embrace this – treating compliance as an integral part of their governance and service delivery – will be well-positioned to thrive in the new era of regulated crypto finance, where the EU framework demands both innovation and responsibility in equal measure.

-AMLBot Team

Follow AMLBot:

🔗 Website

🔗 Telegram

🔗 Support Team

🔗 LinkedIn

What Is AMLR, And How Does It Affect Crypto Businesses In Europe?

AMLR stands for the Anti-Money Laundering Regulation, a sweeping EU regulation (effective 2024–2025) that establishes a single set of AML/CFT rules across all member states. It affects crypto businesses in Europe by making them “obliged entities” under these unified rules. In practical terms, crypto exchanges, wallet providers, and other crypto service companies must implement stringent KYC obligations, just like banks do. AMLR requires these businesses to verify customer identities, monitor transactions, and report suspicious activities under a standardized EU-wide framework. It basically pulls the crypto sector into the mainstream of regulated financial services – crypto businesses now have to build robust KYC compliance programs or face regulatory sanctions. The regulation eliminates national variations in crypto AML rules, so crypto companies across Europe all operate under the same EU regulation with direct effect. Overall, AMLR tightens compliance requirements for crypto firms, but also provides clarity by replacing fragmented national laws with a single rulebook.

How does AMLR Change Existing KYC Obligations for Crypto Companies?

AMLR largely reshapes and strengthens existing KYC obligations rather than inventing new ones from scratch. Under previous EU directives, crypto companies already had to do KYC, but requirements varied by country and were often applied only at onboarding. AMLR changes this by enforcing a continuous, risk-based approach to KYC across the EU. Crypto companies must not only identify and verify customers at signup, but also keep customer data updated and monitor their behavior throughout the business relationship. The regulation makes KYC a dynamic obligation. Firms have to conduct ongoing due diligence rather than a one-time check. It also standardizes measures like when to apply simplified vs. enhanced due diligence and how to handle occasional transactions. In short, AMLR takes the familiar KYC steps and requires crypto companies to perform them more rigorously and uniformly. The result is KYC that is continuous, deeply integrated into operations, and guided by a single EU rulebook, replacing the old patchwork of national rules.

Which Crypto Businesses fall under AMLR Requirements in the EU?

Virtually all types of crypto-asset service providers (CASPs) operating in the EU fall under AMLR’s requirements. This includes cryptocurrency exchanges, crypto brokerage services, platforms facilitating crypto-to-fiat or crypto-to-crypto trades, custodial wallet providers, crypto payment processors, and other businesses handling transfers or safekeeping of crypto on behalf of customers. The regulation’s scope was deliberately expanded to cover “most of the crypto sector”, meaning if you are an intermediary dealing with crypto transactions or holding crypto assets for users, you are an obliged entity under AMLR. Even crypto ATM operators, certain NFT marketplaces, and crypto gambling or gaming platforms that allow cashouts can be in scope. Essentially, AMLR treats these crypto businesses similarly to traditional financial institutions – they all must implement KYC, record-keeping, and ongoing monitoring. The only notable exceptions might be fully decentralized platforms with no central operator or very small-scale community projects, but in general, if your business involves crypto transactions for others, AMLR’s compliance obligations apply to you.

How Does AMLR Reinforce a Risk-Based Approach to KYC?

AMLR strongly reinforces the Risk-Based Approach (RBA) to KYC by requiring crypto businesses to tailor their customer due diligence efforts according to the money laundering and terrorism financing risk each customer or activity presents. In practice, this means under AMLR: if a crypto customer or transaction is deemed higher risk, the business must apply enhanced due diligence – gathering more information, doing stricter verification, and monitoring more closely. Conversely, for a low-risk scenario, AMLR allows simplified due diligence, though core identity verification can’t be skipped. The regulation embeds RBA by explicitly stating that firms “shall determine the extent of the [Due Diligence] measures on the basis of an individual analysis of the risks”. It also requires ongoing risk assessments and the ability to demonstrate to regulators that your controls are commensurate with risk.

What Role does Ongoing Monitoring Play under AMLR-Driven KYC Frameworks?

It is a cornerstone of KYC under AMLR. It refers to the continuous surveillance of customer activity and periodic updating of customer information to ensure everything remains consistent with the customer’s risk profile. Under AMLR, ongoing monitoring is a mandatory part of customer due diligence. Crypto businesses must keep an eye on their customers’ transactions in real time or near-real time to spot anything suspicious or anomalous. They also need to ensure that the customer data they have is kept up-to-date. The regulation specifically requires “conducting ongoing monitoring of the business relationship, including scrutiny of transactions… to ensure that the transactions are consistent with the [firm’s] knowledge of the customer”. This means if a customer’s activity diverges from what is expected, the firm should notice and take action. Ongoing monitoring also entails reviewing the customer’s risk category periodically. For instance, doing an annual review for high-risk customers to see if any new information has emerged. In summary, ongoing monitoring is the mechanism that makes KYC a living process under AMLR. It enables firms to detect suspicious patterns and to keep their customer identity information relevant. Without ongoing monitoring, KYC would be static and quickly become outdated.

How Does the Travel Rule Influence KYC Obligations under AMLR?

The Travel Rule bolsters KYC obligations in the crypto space by requiring the sharing of customer identity information alongside crypto transactions – and AMLR, together with the updated Transfer of Funds Regulation, enforces this in the EU. In effect, the Travel Rule extends KYC from the onboarding stage to each relevant transaction. When a crypto business sends crypto on behalf of a customer, it must include that customer’s identifying information with the transfer, and the receiving institution must obtain and retain that info. This ensures that the beneficiaries and originators of crypto transactions are known to the service providers involved, creating a chain of traceability. Under AMLR, complying with the Travel Rule means crypto companies need to have KYC records to draw from. So it indirectly forces thorough initial KYC. Moreover, crypto businesses must have systems in place to detect when a transfer lacks the required info or comes from a non-compliant source and then possibly reject or report that transfer. In practice, the Travel Rule has led crypto firms to upgrade their technology and coordinate with other VASPs to exchange data securely. For customers, it means the privacy they may have expected with crypto transactions is curtailed in the regulated sphere – their name and details travel with their funds, similar to a bank wire. For compliance officers, it means every outgoing and incoming transaction is tied back to a verified customer identity, blending transaction monitoring with KYC. Overall, the Travel Rule’s influence under AMLR is to make KYC an active part of transaction execution, not just account opening.

Does AMLR Introduce New KYC Requirements or Reshape Existing Ones?

AMLR primarily reshapes and unifies existing KYC requirements rather than introducing brand-new concepts. Most of the core KYC elements in AMLR – customer identification, verification, beneficial ownership ascertainment, risk assessment, monitoring, record-keeping – were already present in EU law and global standards. What AMLR does is make these requirements more granular, more stringent, and directly applicable in all member states. For example, under previous directives, a crypto exchange in Country A and one in Country B might both have to do KYC, but how and when they did it could differ. AMLR takes those existing obligations and standardizes them: every obliged crypto firm must follow the same steps and there is less room for interpretation. In some areas, AMLR does extend obligations – for instance, it explicitly requires ongoing updating of customer information, and it covers some new categories of obliged entities. But these aren’t entirely “new” KYC requirements out of thin air. They are expansions ensuring no gaps. Think of AMLR as taking the patchwork of KYC obligations that existed and weaving them into a tighter, more coherent fabric.

How does AMLR Impact Governance and Accountability for Crypto Compliance Teams?

AMLR heightens the governance and accountability requirements for compliance in crypto businesses. Under AMLR, it’s not enough to have KYC procedures on paper. The company’s leadership is expected to take responsibility for effective implementation. The regulation requires that a member of senior management be designated in charge of AML/CFT compliance. This means someone at the board or top executive level must oversee the compliance program, ensuring that the firm is meeting its KYC and AML obligations. The intent is to prevent scenarios where compliance is “siloed” far down in the organization without influence. Instead, it becomes a C-suite concern. Additionally, AMLR mandates internal controls: crypto companies must have clear policies, training for staff, and independent audit functions to test their AML systems. If regulators come knocking, they will assess not just front-line procedures but also how the company’s governance supports those procedures – is the compliance officer empowered? Are enough resources allocated? Did the board discuss and approve the risk assessment?

Accountability is also enforced through potential penalties. AMLR harmonizes sanctioning rules, meaning compliance failures can result in substantial fines and even management sanctions across the EU. A compliance officer or executive could be held personally liable for severe negligence. This directly motivates strong governance oversight.

How Do AMLR-driven KYC Expectations Align with Global AML Standards?

AMLR-driven KYC expectations are closely aligned with global AML standards, particularly those set by the Financial Action Task Force (FATF). In fact, one of the reasons the EU introduced AMLR was to implement FATF recommendations more effectively and uniformly. For example, FATF recommends a risk-based approach to AML and requires that virtual asset service providers (VASPs) conduct customer due diligence and implement the Travel Rule. AMLR incorporates exactly these elements, making KYC continuous and risk-based, and enforcing the Travel Rule for crypto transfers. This means that what AMLR asks of crypto businesses is broadly similar to what regulators in other major jurisdictions are asking, since they all draw from the same FATF framework. If anything, AMLR is the EU’s way of ensuring no member state falls below those global standards.

What Should Crypto Businesses Consider when Adapting KYC Processes to AMLR?

When adapting KYC processes to comply with AMLR, crypto businesses should consider several key aspects: scope of obligations, system upgrades, staff training, and procedural detail. First, they need to thoroughly understand the scope – which customers and activities are covered and what exact information must be collected. Next, businesses should evaluate their current systems and see what upgrades are needed. AMLR’s emphasis on ongoing monitoring and data updating might require new software or integrations. If their current onboarding flow isn’t capturing all required data, they’ll need to tweak it. Importantly, crypto firms should ensure they can collect and transmit Travel Rule data, so adopting a solution for that is a key consideration. Team training is another consideration. Compliance and customer support teams must be trained on the new procedures: how to risk-rate customers, how to handle situations like a customer who doesn’t want to update their KYC, what to do if a transaction triggers an alert, etc. Under AMLR, the compliance team’s role is elevated, and all relevant staff should be aware of the stricter requirements. Another consideration is data privacy and security. With more customer data being collected and shared, companies must safeguard this information. Crypto businesses should also factor in timeline and phasing – AMLR gives a transitional period in some cases (some provisions apply 3 years after entry into force, etc.), but waiting until deadlines is risky. A phased plan to implement changes ahead of time is wise. Finally, businesses might consider getting external advice or audits to test their readiness. A mock regulatory inspection by a third-party could highlight gaps in KYC processes relative to AMLR.