Restoring Trust in Crypto Projects

Trust is the most expensive asset in the crypto sphere. Hard to gain — easy to lose.

Unfortunately, issues such as "dirty" funds, regulatory consequences, and damaged reputations can quickly turn a promising project into a crisis. According to industry data, cryptocurrency-related crimes accounted for nearly $9.5 trillion USD in losses in 2025, with illicit transactions linked to scams, hacks, and money laundering. When even a small percentage of dirty funds reaches a project, the impact can be catastrophic.

Investors, often wary of regulatory crackdowns and reputational risks, may withdraw their support, causing token values to drop and communities to fall apart. Additionally, regulatory bodies across the globe are increasingly alert, enforcing stricter charges and investigations for projects failing to comply with AML standards.

In this article, we explore how to avoid reputational risks, manage crises, and restore trust with proven strategies, tools, and solutions.

Key Takeaways

- Dirty crypto funds can severely damage a project's reputation.

- Reputational risks impact trust, investor confidence, and regulatory standing.

- Preventive measures like AML for crypto projects, KYC checks, and blockchain analytics tools can protect projects.

- Corrective actions, including investigation processes, public relations efforts, and remediation plans, help restore trust.

- AMLBot provides reputation management tools to safeguard project integrity and rebuild confidence.

"Dirty" Funds in Crypto

The crypto industry faces many challenges in providing legitimacy to funds. Let’s explore the issue of the “dirty” funds and the risks they pose to the projects.

Define "Dirty" Crypto Funds

Dirty funds refer to assets acquired by illegal activities such as fraud, hacking, or money laundering, often involving activities like drug trafficking, tax evasion, and corruption. These funds are typically hidden in complex networks of transactions to look legitimate, making them difficult to detect without robust compliance measures. When such funds infiltrate a crypto project, even unknowingly, the consequences can be severe. Reputational damage can spread quickly across investor communities, media, and regulators, leading to accusations of fraud. A single transaction involving hidden assets can ruin a project's address history, trigger investigations, and undermine trust among stakeholders. Addressing these risks requires AML (Anti-Money Laundering) guidelines and KYC (Know Your Customer) compliance to ensure the integrity and transparency of all transactions.

Impact on Reputation and Trust

Project reputation management in the crypto industry extends beyond immediate stakeholders to include external audiences such as regulators, potential partners, and the general public. When a project is linked to dirty funds, even unintentionally, the ripple effects of reputational damage can be severe and far-reaching.

- Media Perception: Negative media coverage spreads quickly, overshadowing positive achievements and amplifying public distrust.

- Regulatory Scrutiny: Associations with illicit funds invite investigations, fines, and potential shutdowns, making recovery challenging.

- Partnerships: Collaborators distance themselves to protect their own reputations, limiting growth and strategic opportunities.

- Community Trust: Controversy undermines trust, making it difficult to rebuild support among the community and wider audiences.

- Long-Term Viability: Reduced funding and disengaged communities threaten the project’s ability to sustain operations.

Why Reputational Risks Matter in the Crypto Industry

A project’s reputation is key to attracting investment and meeting regulatory expectations. The impact of reputational damage goes far beyond the immediate losses, often affecting a project's long-term viability and credibility. It is therefore important to distinguish and address these issues proactively.

Trust and Investor Confidence

Trust is the cornerstone of investor confidence, directly influencing the decisions of those who provide the financial backbone of a crypto project. Once trust is broken, the effects are swift and profound, often cascading into financial instability and community disengagement.

- Investor Actions:

- Loss of trust leads to panic sell-offs, resulting in sharp declines in token value.

- Even long-term investors may withdraw support, fearing reputational risks or financial losses.

- Market Impact:

- Lack of investor confidence creates volatility, which can deter potential new investors.

- A project's token may struggle to recover in value, regardless of its underlying fundamentals.

- Community Support:

- Disillusioned community members disengage, reducing the organic growth and network effect critical for crypto projects.

- Loyal supporters may hesitate to promote or advocate for the project due to perceived reputational risks.

- Barriers to Future Investment:

- Investors are less likely to reinvest in a project that lacks transparency or has unresolved issues.

- Securing institutional or large-scale funding becomes challenging when confidence is low.

Consequences With Regulators

Regulators are particularly vigilant with crypto projects linked to dirty funds, as these associations pose significant risks to financial integrity and compliance frameworks.

Non-compliance with AML (Anti-Money Laundering) laws and KYC (Know Your Customer) regulations often leads to severe consequences. These include:

- Fines and legal penalties, which can reach millions of dollars and significantly strain a project's financial resources.

- Freezing of assets, potentially halting operations and damaging investor confidence irreparably.

- Long-term damage to the project's viability, as regulatory investigations and sanctions deter new investments, erode stakeholder trust, and create lasting barriers to market re-entry.

Such regulatory actions not only destabilize the targeted project but also send a clear message to the broader market about the importance of maintaining compliance and ensuring the legitimacy of all financial activities.

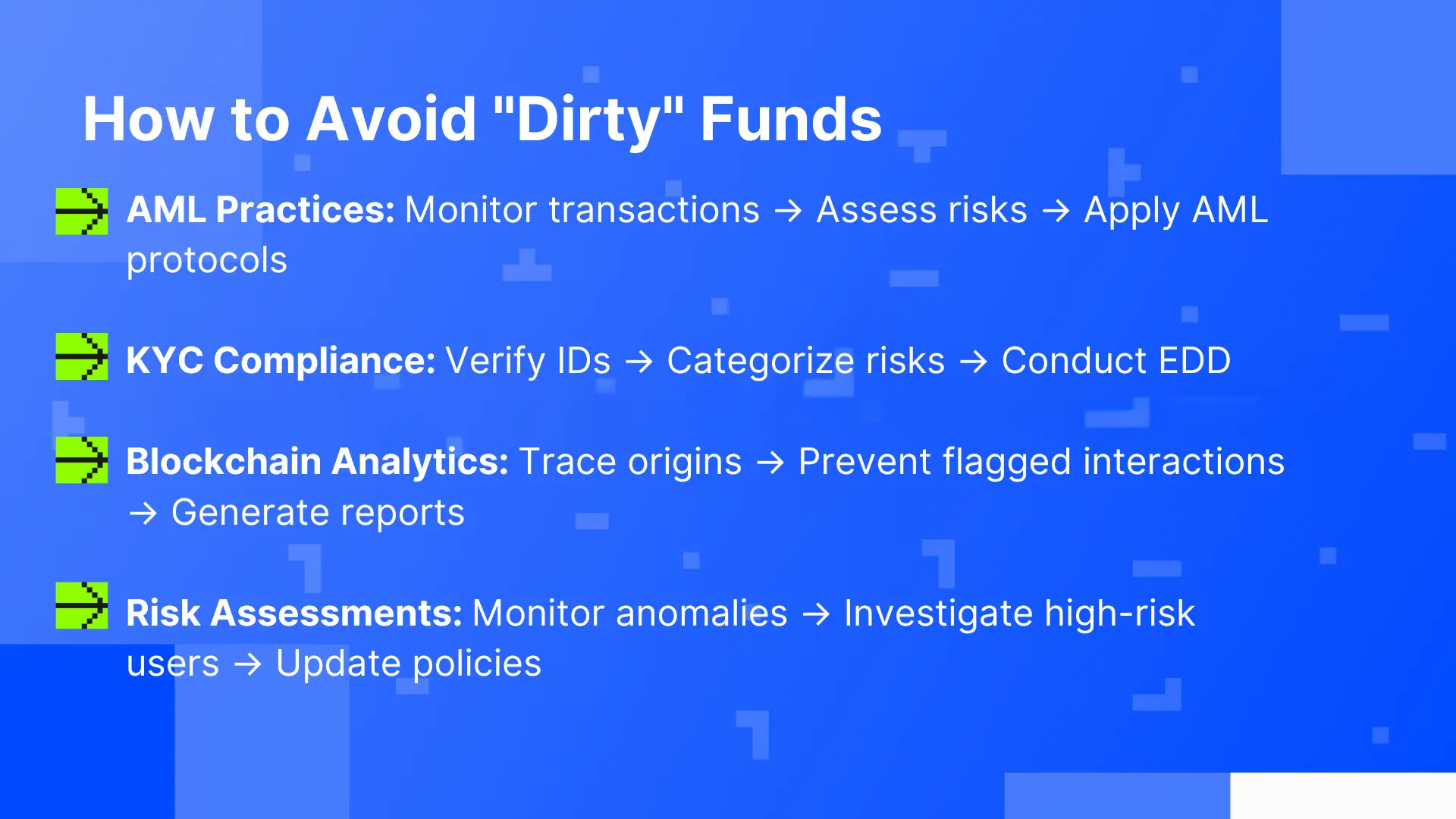

How To Avoid "Dirty" Funds

There are a number of necessary practices and measures to prevent reputational damage and solve existing problems. Among them there are AML practices, KYC compliance, blockchain analytics tools, and regular risk assessment.

AML (Anti-Money Laundering) Practices

AML practices are essential for ensuring the legitimacy of incoming funds. These practices encompass a multi-layered approach involving the following key steps:

- Transaction Monitoring: Continuous screening crypto transactions for anomalies and suspicious activity.

- Risk Assessment: Identifying and categorizing transactions and users based on their risk profiles.

- KYC and AML Compliance: Implementing Know Your Customer and Anti-Money Laundering protocols to validate the legitimacy of transactions.

- Blockchain Analytics: Leveraging advanced analytics tools to trace fund origins and prevent interactions with flagged addresses.

This structured methodology ensures a robust defense against illegal activities and enhances the transparency in crypto. Projects must:

- Implement screening tools to check all incoming transactions against global sanction lists, watch lists, and flagged wallet addresses. These tools not only ensure compliance but also provide detailed transaction histories for added transparency.

- Partner with AML service providers like AMLBot, which offer real-time analytics, automated checks, and comprehensive reporting features that make it easier for projects to maintain a robust compliance framework.

- Train team members in identifying suspicious activities and staying updated on changing regulations to ensure the project’s AML procedures remain effective.

KYC (Know Your Customer) Compliance

KYC procedures verify the identity of investors and participants, ensuring transparency and preventing dirty funds from entering the ecosystem. Proper KYC compliance in blockchain projects involves:

- Document verification, where users submit government-issued IDs and other relevant documentation to confirm their identity.

- Risk assessments, classify investors into low, medium, and high-risk categories based on their transaction behavior, geolocation, and background checks.

- Enhanced Due Diligence (EDD) for high-risk users, including deeper investigations into source-of-funds documentation and regular monitoring of their activities to detect anomalies.

By combining these steps, projects create a transparent and secure environment for investors and participants, significantly enhancing their crypto project reputation management.

Blockchain Analytics Tools

Using blockchain analytics tools like AMLBot helps projects monitor, analyze, and identify suspicious transactions in real time. These tools are indispensable for:

- Providing a clear and immutable history of fund origins, allows projects to trace transactions back to their source and verify their legitimacy.

- Preventing interactions with flagged wallet addresses that are known for illicit activities.

- Generating detailed compliance reports, which can be shared with regulatory bodies to demonstrate the project’s commitment to legal and ethical standards.

- Offering predictive analytics, enabling projects to identify patterns that may indicate potential money laundering activities before they occur.

Risk Assessment

Regular risk assessment in project ensures that:

- All transactions are monitored for suspicious activity, using advanced algorithms and machine learning tools to flag irregularities in real time.

- High-risk investors undergo enhanced due diligence (EDD), which may include verifying their financial history, geolocation restrictions, and cross-referencing their information against global databases for criminal activity.

- Policies and procedures are updated regularly to reflect new regulatory requirements and emerging risks within the crypto ecosystem.

By adopting these comprehensive measures, crypto projects can minimize the damage caused by dirty funds, build trust among their investors, and establish themselves as responsible and compliant players in the blockchain space.

Corrective Actions for Reputation Recovery

Reputation recovery strategy normally includes the following stages:

- Investigation process;

- Public relations efforts;

- Remediation plans.

Investigation Process

After identifying dirty funds in crypto:

- Conduct a detailed investigation to uncover the source.

- Use blockchain tools to trace the flow of assets.

- Publish findings to maintain transparency.

Public Relations Efforts

Rebuilding trust requires an effective PR strategy:

- Issue a formal statement explaining the situation.

- Highlight steps taken to remove tainted funds.

- Use press releases and media outreach to rebuild credibility.

Remediation Plans

To repair reputation damage:

- Return dirty funds to the original investor (if possible).

- Implement stricter AML and KYC protocols.

- Obtain certifications from AML service providers like AMLBot.

Case Study

A crypto startup arranged a public token sale to attract investments and raise funds for its development. However, during the fundraising process, the project unknowingly accepted tainted funds crypto linked to illicit activities. This triggered a reputational crisis as blockchain analytics exposed the issue, leading to widespread accusations of fraud and severely undermining investor confidence. In one such case, a promising crypto startup unknowingly accepted tainted funds during its token sale. These funds, linked to illicit activities, jeopardized the project’s reputation when blockchain analytics uncovered the issue. Accusations of fraud spread quickly across social media and the press, undermining trust and triggering market instability.

The fallout was immediate and severe. Marketing efforts became ineffective, investor confidence eroded, and community support waned. Regulatory scrutiny intensified, further amplifying the crisis. All efforts to build a solid reputation were overshadowed by the chaos, and the project’s future seemed uncertain.

How AMLBot Resolved the Crisis:

- Prevention Through Advanced Analytics: For projects approaching AMLBot before active operations, integration of AMLBot’s analytics systems allows the checking of all incoming transactions. By using API integration, startups ensure that all investments are screened for origin and purity of funds even before they are accepted.

- Investigation and Remediation: In this case, AMLBot initiated an in-depth investigation to trace the "dirty" funds. Blockchain analytics mapped the wallet’s connections to suspicious addresses and detailed the flow of illicit assets. This information was crucial in identifying the exact source of the issue.

- Transparency and Public Assurance: The startup publicly presented the findings, issued refunds to affected investors, and showcased its commitment to ethical practices. A detailed report was shared with stakeholders to maintain accountability.

- Certificate of Compliance: AMLBot provided a certificate confirming that all remaining funds within the project were clean, verified, and compliant with AML regulations. This certification became a cornerstone for restoring trust.

- Proactive Public Relations: To rebuild confidence, the project launched a targeted PR campaign. It highlighted the steps taken to resolve the issue, ensuring transparency and accountability while addressing concerns within the broader community.

As a result, the startup not only restored its reputation but also attracted new investors due to its commitment to transparency and compliance.

How AMLBot Can Help in Managing Reputational Risks

AMLBot offers a robust set of services tailored to help crypto projects navigate and mitigate reputational risks while maintaining compliance with global standards. These tools and processes not only safeguard project integrity but also enhance investor trust and regulatory adherence.

AMLBot services for crypto include:

- AML/KYT Screening: AMLBot provides API-based solutions to verify transactions in real-time. This ensures alignment with AML and FATF requirements, reducing risk exposure and protecting a project’s reputation.

- KYC for Business: Through automated systems, AMLBot helps businesses onboard customers efficiently, minimizing risks tied to identity fraud or illicit activity.

- AML/KYC Procedures: AMLBot’s expert consulting services guide projects in implementing effective AML and KYC frameworks, supporting compliance and risk management.

- Blockchain Investigations: For cases involving suspicious transactions, AMLBot conducts in-depth investigations to trace funds, identify culprits, and provide actionable insights for resolution.

- Corporate Account Support: AMLBot aids businesses in establishing secure accounts on centralized exchanges (CEX) and electronic money institutions (EMI), ensuring smooth operations while adhering to regulations.

Benefits of AMLBot for Project Integrity:

- Preventing Dirty Crypto Funds: By screening all incoming transactions, AMLBot helps crypto projects avoid inadvertently accepting illicit funds.

- Maintaining Transparency: Demonstrating compliance and ethical operations fosters greater trust among investors and stakeholders.

- Swift Crisis Resolution: AMLBot’s investigative tools allow projects to respond quickly to potential threats, protecting their reputation and assets.

- Ensuring Regulatory Compliance: AMLBot’s services enable projects to meet global compliance standards, avoiding penalties and fostering long-term stability.

With AMLBot’s comprehensive solutions, crypto projects can focus on innovation and growth while confidently addressing reputational and compliance challenges.

Final Words

In the competitive crypto market, reputation is everything. Businesses must prioritize preventive measures like AML screening, KYC compliance, and blockchain analytics. In cases where dirty funds have entered the system, swift corrective actions and expert tools like AMLBot can help restore trust and integrity.

By maintaining transparency and proactive communication, crypto projects can navigate challenges, protect their reputation, and build lasting success.

FAQ

What Should a Crypto Project Do if It Has Tainted Funds?

Projects should:

- Conduct an investigation using blockchain analytics tools.

- Publish findings and return dirty funds to the source.

- Implement stricter AML and KYC protocols to prevent future incidents.

- Obtain compliance certification to rebuild trust.

What Are Signs of Reputational Risk in Crypto?

The reputational risk in cryptocurrency includes:

- Declining investor confidence.

- Accusations of fraud or money laundering.

- Regulatory investigations or fines.

- Negative media coverage and community backlash.