MiCA and the Main Requirements of the New Crypto Regulatory Framework: A Guide for Crypto Businesses

The Markets in Crypto assets regulation (MiCA) was approved by the European Council on October 5, 2022. MiCA regulation will come into force in the middle to the end of 2024, and once it does, it will establish a harmonized framework governing the crypto industry in the European Union.

At the moment crypto-assets regulatory framework remains a sore spot in European financial legal affairs, which MiCA is expected to ameliorate. In the given material, it will be explored how MiCA will affect the crypto industry in the European Union.

What is MiCA and Why Crypto Regulation Is Vital for the Industry?

MiCA should provide a comprehensive and harmonized regulatory framework for crypto-assets that are not financial instruments, in particular stablecoins, e-money tokens, and utility tokens. With MiCA, the EU is leading the way and realizing its ambition to turn the European ecosystem into an attractive place for crypto service providers for doing business.

According to Article 53 of the MiCA, there will be a uniform licensing regime within the EU for CASP (Crypto-Asset Service Providers), without the need for any national implementing laws. This means that CASPs will not have to go through a licensing process in every EU country to offer their services in selected jurisdictions within the EU. Oversight of organizations that fall within the scope of the MiCA will be carried out:

- By national authorities located in EU Member States;

- By the European Banking Authority for ARTs;

- Both by national authorities and the EBA or e-money tokens.

Purpose of MiCA

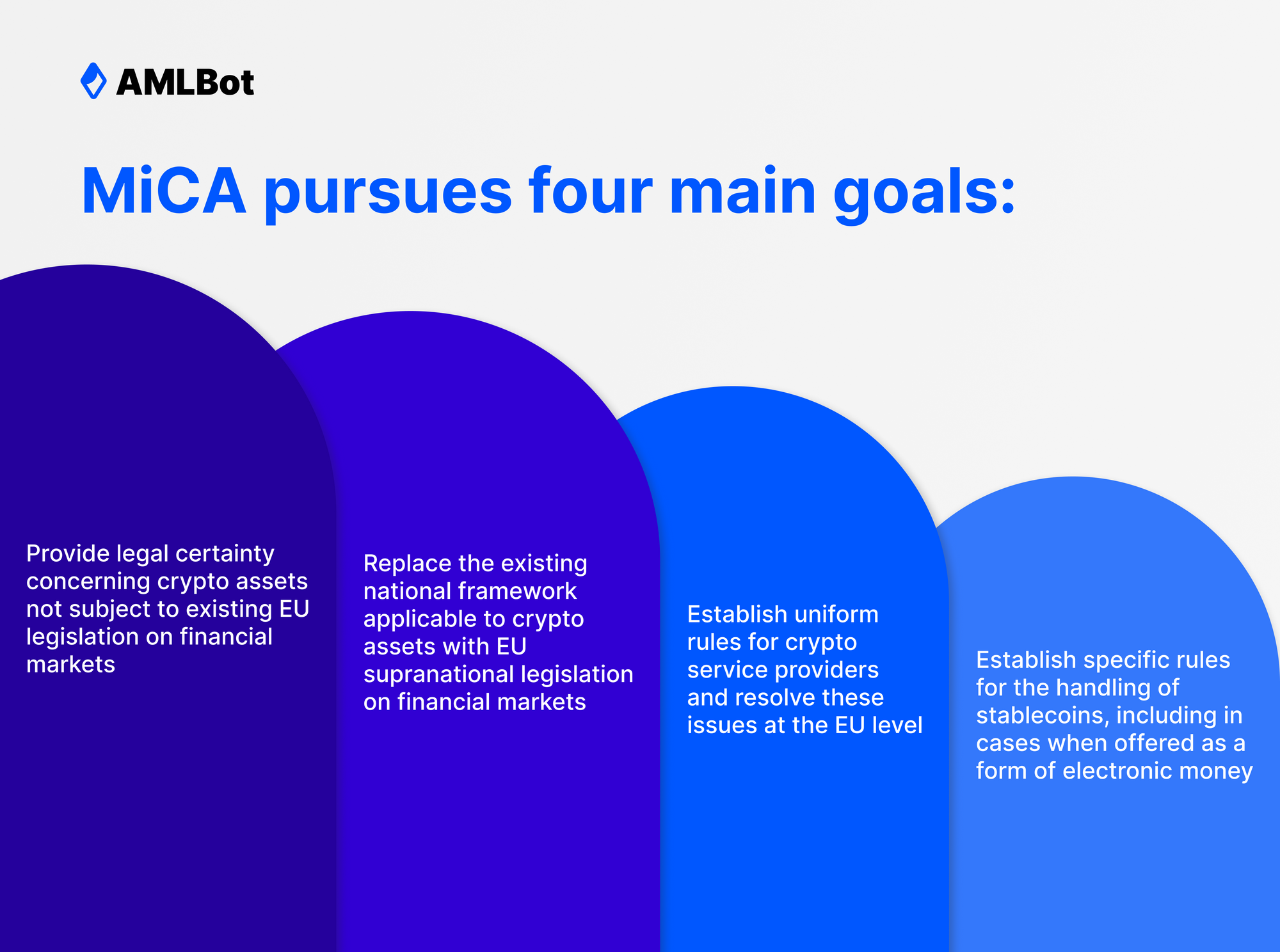

At its core, MiCA pursues four main goals:

- Provide legal certainty concerning crypto assets not subject to existing EU legislation on financial markets;

- Replace the existing national framework applicable to crypto assets with EU supranational legislation on financial markets;

- Establish uniform rules for crypto service providers and resolve these issues at the EU level;

- Establish specific rules for the handling of stablecoins, including in cases when offered as a form of electronic money.

Categories of Crypto Assets under MiCA

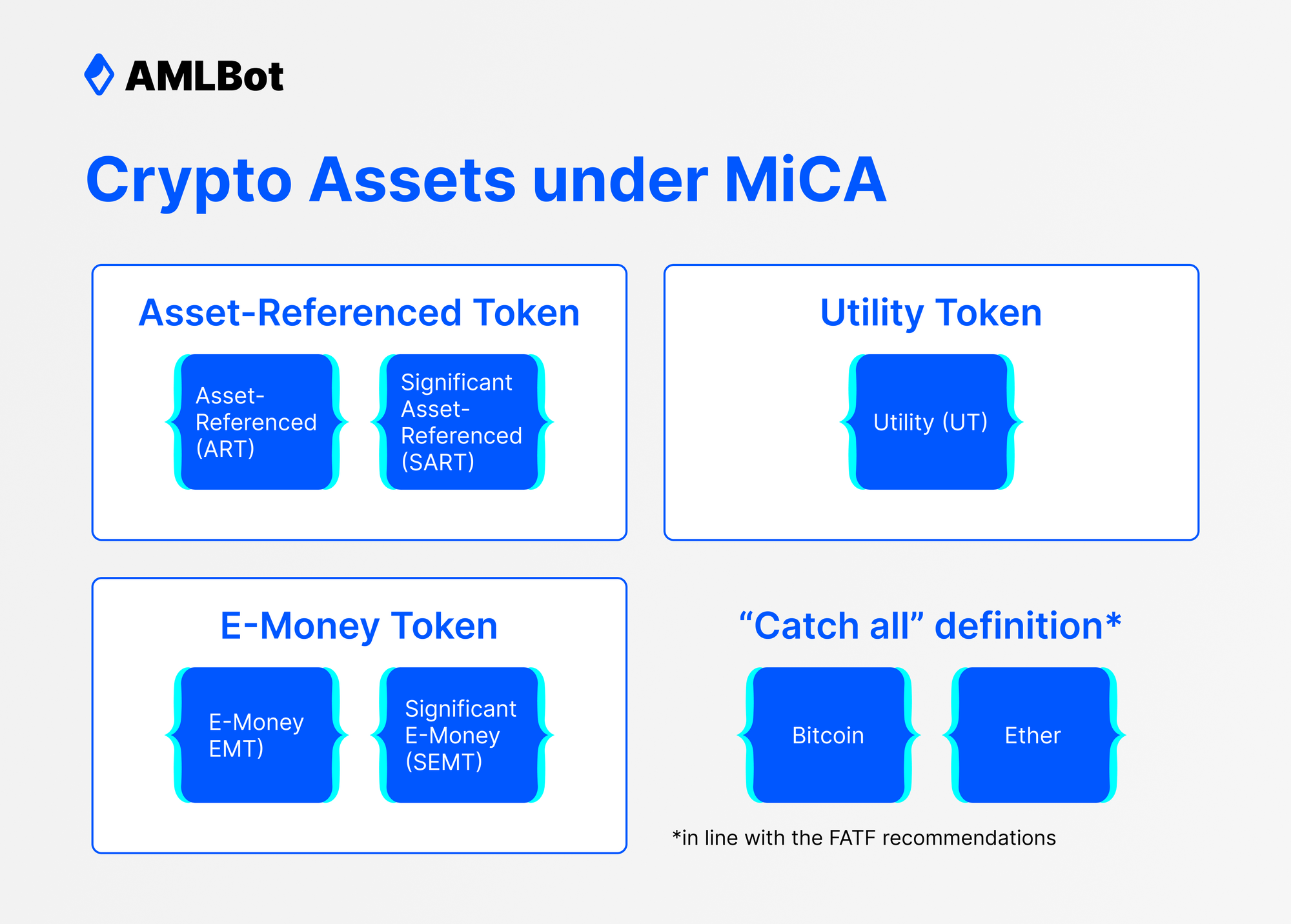

MiCA applies to persons using DLT technologies engaged in the issuance of crypto assets or providing services related to crypto assets in the EU. MiCA establishes three distinct categories of crypto assets:

- Asset-referenced tokens (ART) refer to crypto assets whose primary purpose is to be used as a medium of exchange and intended to maintain a stable value by referring to the value of multiple fiat currencies, commodities, crypto-assets, or a combination of such assets.

- Electronic money tokens (EMT) refer to a type of crypto assets whose primary purpose is to be used as a medium of exchange and which is intended to maintain a stable value by denominating it in a fiat currency. For example, it can be USDC, etc.

- The third sub-group is a catch-all category for all other crypto assets that are not EMTs or ARTs. Primary, it covers payment tokens (BTC, ETH) or utility tokens. Utility tokens are defined as crypto assets that are intended to provide digital access to an application, service, or resources available in a distributed registry, and are accepted only by the issuer of this token to provide access to such an application, service, or available resources.

Issuers of stablecoins with asset-pegged coins and e-money tokens will be subject to liquidity requirements and require a physical presence in the EU. In addition, issuers of such assets will be under the supervision of the European Banking Authority.

Asset-pegged tokens and e-money tokens can additionally qualify as value tokens (such as Tether ). In this case, such issuers are subject to more stringent requirements. The “value” of any tokens must be assessed by the European Banking Authority, taking into account the following factors:

- The number of users is over 10 million;

- The presence of reserves of over 5 billion euros.

What does MiCA not apply to?

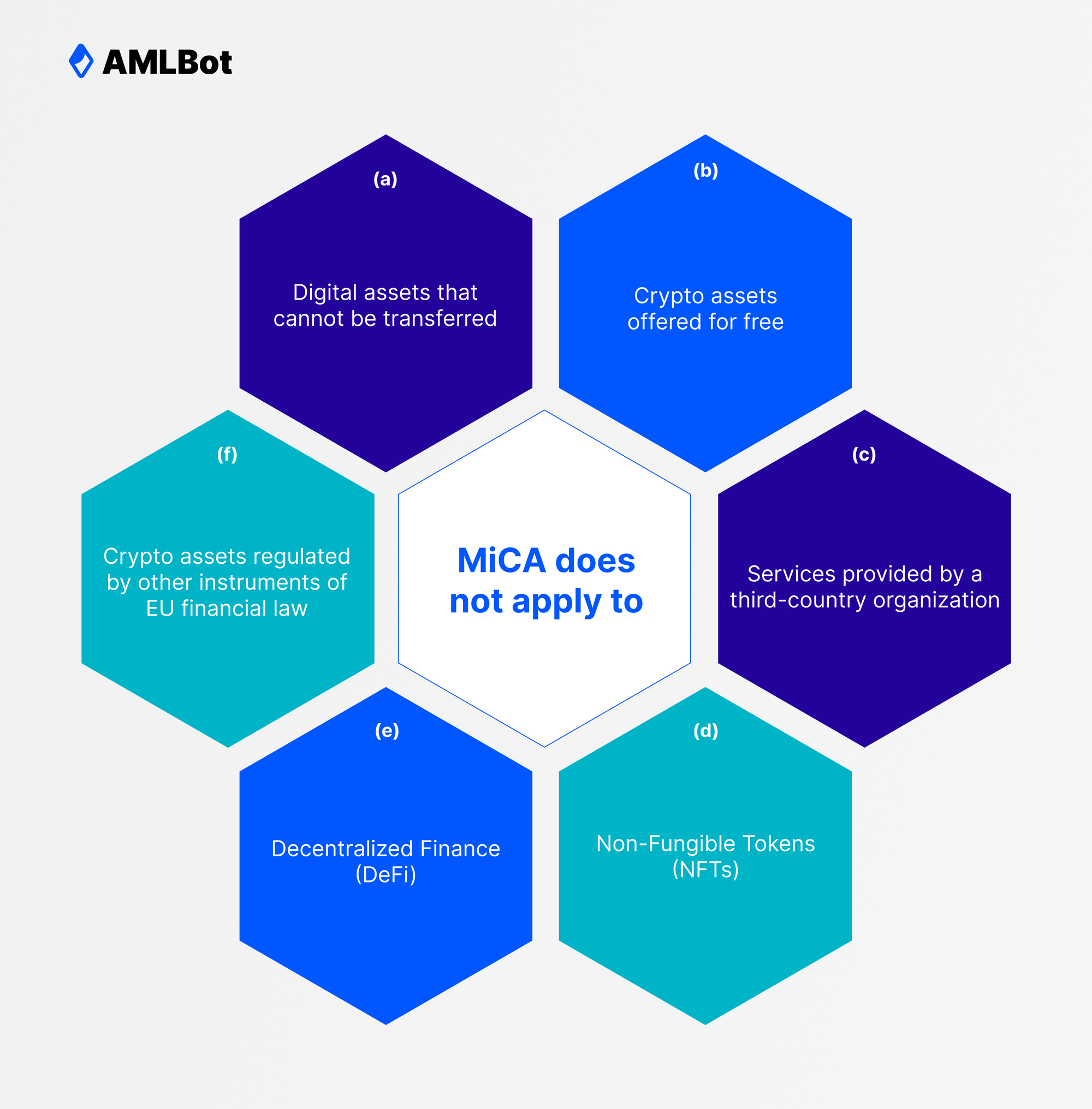

In addition, if the European Central Bank has concerns about the legitimacy and credibility of a stablecoin, it can forbid its issuance. MiCA does not apply to the following types of assets:

MiCA does not apply to crypto assets regulated by other instruments of EU financial law. Therefore, crypto assets that qualify as financial instruments, such as security tokens or e-money, except for e-money tokens, will not be subject to MiCA regulation.

Why Crypto Businesses Have to Abide by MiCA?

MiCA stipulates that Crypto Asset Service Providers are defined to be any person whose profession or business is to provide to third parties one or more crypto asset services on a professional basis, namely:

- Holding and administering crypto assets on behalf of third parties;

- Maintaining the operation of a trading platform for crypto assets;

- Exchanging crypto assets for a fiat currency which is legal tender;

- Exchanging crypto assets for other crypto assets;

- Executing orders for crypto assets on behalf of third parties;

- Placing crypto assets;

- Accepting and transmitting orders for crypto assets on behalf of third parties;

- Providing advice on crypto assets.

Accordingly, any entity involved in the provision of the given set of services will be required to comply with MiCA.

How MiCA Will Affect Crypto Businesses Operating in the EU?

At the moment, there is legal uncertainty regarding the services of crypto asset providers licensed by third countries. It is yet unclear whether they can provide services to EU residents or not. MiCA clarifies this moment allowing CASPs from third countries to provide crypto assets services on a reverse solicitation basis. If a CASP from a third country does not undertake active marketing in the EU and a customer, who is an EU resident, reaches out to such CASP on its own initiative, there is no need to apply for MiCA license.

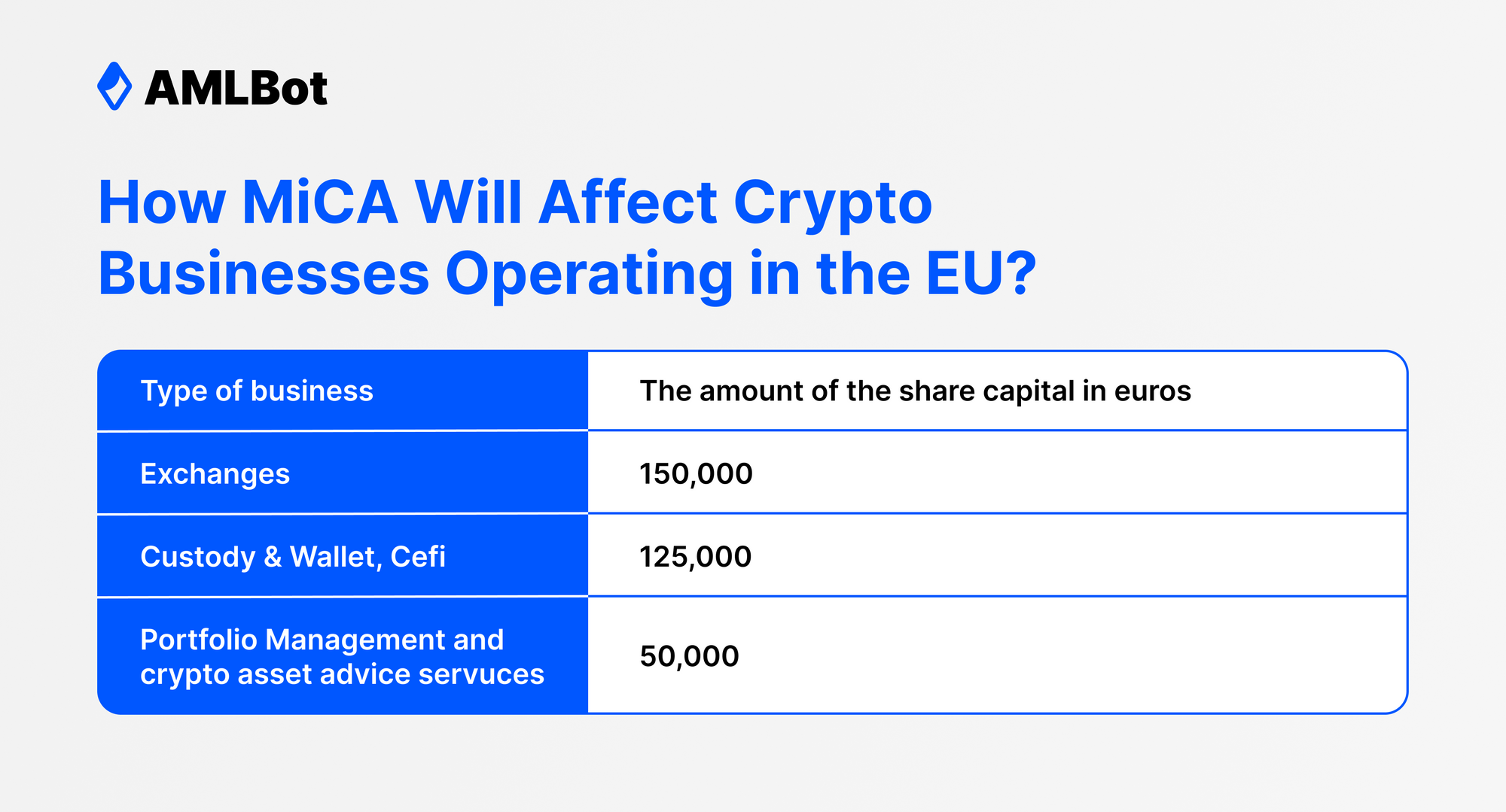

In case a CASP from a third country is marketing its services in the EU, such CASP will need to apply for a license and comply with the following share capital requirements described in Table 1 below.

Table 1

Such entities will have to maintain a representative office in one of the EU member states. As for separate categories of crypto businesses, the requirements will be as such:

ICOs

Utility tokens issuers must offer such crypto assets to the public in the EU, or seek the admission of such crypto assets to trading on a crypto assets trading platform until the following conditions are met:

- Incorporation as a legal entity in an EU country;

- Presence of a white paper on crypto assets in relation to these crypto assets, as required by Article 5 of MiCA;

- Notification of the competent authorities of the white paper;

- Publication of the white paper on the official service website.

ART

Issuers of ART will be subject to licensing requirements. In order to offer ART to the general public in the EU or be allowed to trade on a crypto platform, an ART issuer must be incorporated and licensed in the EU. An ART issuer is also required to put in place strong governance mechanisms with clearly defined, transparent, and consistent lines of responsibility. Reserve assets must be held in custody under certain prescribed conditions and may only be invested in highly liquid financial instruments.

EMT

E-money tokens can be only issued by the EU credit institutions and e-money institutions authorized under the EU e-Money Directive. Such tokens must represent a claim on the issuer, which must be redeemed at par value. Funds received by issuers of electronic money tokens in exchange for electronic money tokens, if invested, must be invested in assets denominated in the same currency as the currency to which the electronic money token refers.

Significant stablecoins will be under the regulation of MiCA and the relevant authorities, including in relation to liquidity maintenance, recovery, and redemption planning. The authorities will have a separate right to demand stablecoins to introduce a minimum denomination or limit the number of issued coins to reduce the use of such tokens.

Decentralized finance (DeFi) and Non-Fungible Tokens (NFTs) are largely exempt from MiCA. However, fungible ownership of NFTs is subject to MiCA, e.g. issuing NFTs in a large series or collection should be considered as an indicator of their interchangeability. Such an issuance turns NFTs into investment assets and puts such crypto-assets within the framework of MiCA regulation. Assigning a unique NFT identifier alone is not sufficient to classify it as a unique or non-fungible asset.

What about AML and KYC?

MiCA does not touch upon this topic, therefore a CASP will need to comply with the KYC/AML requirements of the jurisdiction where a CASP is incorporated and licensed. However, there are two separate EU regulations under discussion at the moment which focus to harmonize the AML framework all around EU. The first one is the Transfer of Funds Regulation (TFR) is to be extended to CASP meaning the CASP will need to comply with FATF “Travel Rules”. The second regulation is the EU Anti-Money Laundering Regulation which will cover CASP as defined by MiCA and will have some special requirements for a crypto industry where blockchain analytics and crypto screening tools will be an essential part of the AML regime of each licensed CASP.

Key Takeaways

Considering the significant requirements on transparency and compliance stipulated by MiCA and the future TFR and AMLR, crypto businesses operating in EU member states will need a reliable solution for implementing financial and AML/KYC procedures. AML Policies and KYC procedures will be an integral part of every license application for crypto asset services under MiCA.

AMLBot has extensive expertise in bringing AML procedures and transaction monitoring in line with the requirements of the EU AML framework. Learn more about AMLBot services here.