Reducing Crypto Fraud: Automated KYC Best Practices

Automated KYC is one of today's biggest crypto security trends, and for good reason. By switching from manual to automatic know-your-customer (KYC) checks, companies in the cryptocurrency space can achieve better customer outcomes. They can also avoid expensive penalties for violating anti-money laundering (AML) regulations.

If the concept of an automated KYC system is new to you, you probably have a lot of questions about how it affects your customers, improves your security, and benefits your cryptocurrency business. This guide will cover all those issues and tell you everything you need to know to successfully implement KYC automation.

Crypto Fraud and the Need for KYC

Fraud is always a concern for cryptocurrency companies and investors. Bad actors and criminal enterprises have targeted users and businesses, including exchanges and wallets, by taking advantage of vulnerabilities and lax cryptocurrency security protocols. Fortunately, there's been good news on this front in recent months.

CoinDesk estimates that cryptocurrency users lost around $2 billion to fraud and hacking in 2023, half the total from the previous year. Likewise, a study by Chainalysis found that revenue from crypto scamming fell 29% from 2022 to 2023.

The amount of crime may have reduced over the past year, but that doesn't mean that cryptocurrency companies should relax. Instead, it underscores that strict security protocols can make a real difference in protecting businesses and their customers.

Combining blockchain and KYC technologies is central to that effort. KYC checks mitigate the risk of fraud by confirming each new customer's identity and rooting out any potential associations with criminal activity, such as money laundering. This occurs before a customer conducts any cryptocurrency transactions, helping reduce your business's liability and making it less likely that your customers will fall victim to fraud.

Automated KYC in Cryptocurrency

KYC checks are vital, but they can also be tedious. In traditional KYC systems, companies have to manually review a customer's information, including their identification documents, verify that it's accurate, and check their information against watchlists or databases. In addition, they have to assign employees to monitor customer accounts and watch for suspicious activity. This approach is time-consuming and riddled with errors.

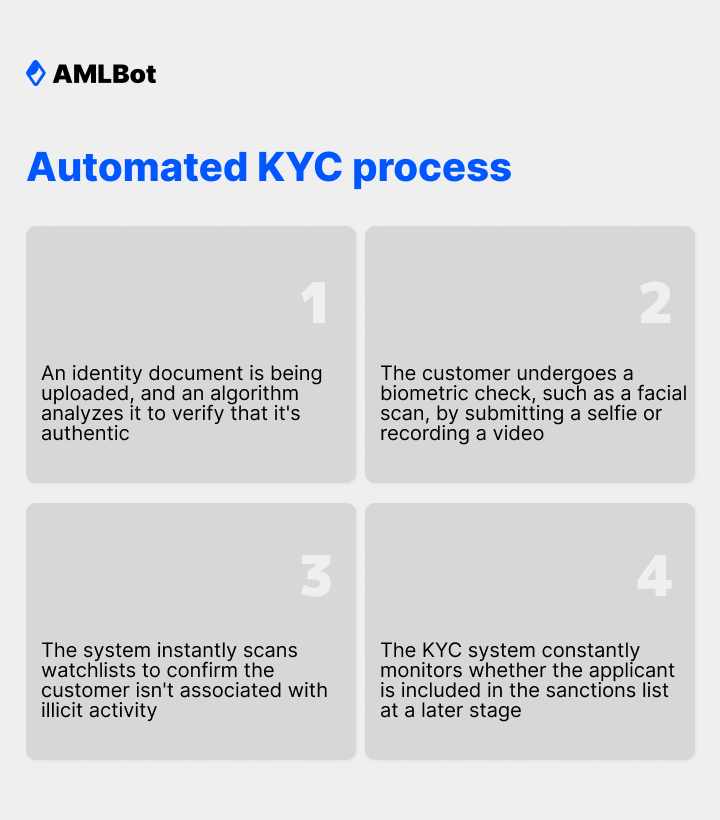

Automated KYC takes the burden of crypto fraud prevention and places it on technology rather than on human shoulders. With automation, the KYC process usually looks something like this:

- An identity document is uploaded, and an algorithm analyzes it to verify that it's authentic.

- The customer undergoes a biometric check, such as a facial scan, by submitting a selfie or recording a video.

- The system instantly scans watchlists to confirm the customer isn't associated with illicit activity.

- The KYC system can do ongoing monitoring to verify if an applicant is not included on a Sanctions/PEP list at a later stage.

From start to finish, this process takes only a few minutes of the customer's time, and it's a hands-off experience for your employees. At the same time, it helps you achieve better compliance with crypto regulations and makes real-time fraud monitoring more practical.

Best Practices in Implementing Automated KYC

Knowing how to put KYC automation in place can help you avoid pitfalls that could cause problems down the line.

- Assess and address your needs: Look at the specific regulation requirements you have to meet and identify areas that your company could improve. Choose a solution that helps you achieve those goals and takes an individualized approach to KYC automation.

- Train your staff: Give your team access to resources and training for your automation solution. Offer them ongoing support when they have questions or concerns.

- Monitor and review: Once your automated KYC system is up and running, don't assume that it's working properly. Periodically evaluate its performance and ensure that it aligns with current regulations.

- Strike a balance between security and ease-of-use: Consider both the user's experience and necessary security measures. Using KYC automation that's too cumbersome or confusing will alienate your customers, but an oversimplified system probably won't be thorough or prioritize data privacy.

These steps are key to your ability to seamlessly integrate KYC automation into your platform and roll it out to customers.

Case Studies: Success Stories of Automated KYC in Reducing Fraud

Automated KYC sounds great in theory, but it's helpful to see what it looks like in practice. These organizations have effectively used automation to limit fraud within their platforms.

Binance

Binance certainly has a checkered history when it comes to AML compliance. In November 2023, they agreed to pay more than $4 billion to resolve charges related AML compliance violations. Since then, they've vowed to take a more stringent approach to security, including transaction monitoring and identity verification, with technologies such as KYC automation. Binance's current system involves entering detailed personal information, submitting documentation, and recording a short live video.

Coinbase

Coinbase, on the other hand, is a long-standing KYC leader in the cryptocurrency world. They began using automation as far back as 2019 when they patented their system and scoring mechanism to identify questionable accounts and suspicious activity. They always require customers to provide valid identification, such as a passport and driver's license and may ask them to take selfies or record selfie videos.

Challenges and Considerations in Automated KYC

Implementing an automated KYC system seems like an obvious choice, but it's not always easy. There are a number of factors to consider when you decide to use automation, including:

- Cost: Some solutions are expensive, making it difficult for businesses to build them into their budget, so look for a provider that offers KYC automation at a reasonable price.

- Integration: Syncing a KYC system with your existing cryptocurrency platform can be difficult, but some providers will take care of integration for you.

- Privacy and data security concerns: Customers give you access to their most sensitive information, and a KYC solution with inadequate security measures could expose them to serious risks, including identity theft.

- Evolving regulatory landscapes: AML regulations and standards for KYC measures regularly change, but a good automated KYC provider will stay up-to-date on crypto compliance regulations.

These are all valid concerns, but don't let them stop you from making the switch to automated KYC. AMLBot addresses these problems head-on, providing an affordable tool for identity verification and ongoing monitoring. In addition, AMLBot is easy to integrate and takes security seriously, protecting your interests and your customers' identities.

What's Next for Automated KYC

Automation has already revolutionized digital finance security. It enables your business to be more productive, makes the customer experience smoother, and empowers you to maintain AML compliance. Moving forward, providers of automated KYC solutions will continue to embrace new technologies and use them to enhance their existing services.

You can expect to see artificial intelligence (AI) play a greater role in automated KYC, helping boost productivity and reduce customer outreach. In addition, the use of digital KYC profiles — and the approach to retrieving and sourcing data to build them — is likely to expand.

No matter where these changes take the crypto industry, it's clear that automation will play a prominent part in curbing fraud. To learn more about how the right solution can provide the fraud detection cryptocurrency companies need, book a free demo of AMLBot's automated KYC verification system.

Why is KYC important in the crypto industry?

KYC verifies customer identities and flags individuals associated with criminal activity. This is critical to reducing fraud and maintaining compliance with cryptocurrency regulations around the world.

How does Automated KYC differ from traditional methods?

Automated KYC uses advanced technology, including machine learning and algorithms, to screen customer documentation, confirm that it's authentic, and monitor transactions. Traditional methods require employees to do these tasks manually, which is time-consuming and less accurate.

What challenges does Automated KYC solve?

Automated KYC makes identity verification faster and more efficient. It also allows cryptocurrency companies to scale and build a larger customer base without sacrificing security.

How can businesses balance user experience with stringent KYC processes?

By choosing a user-friendly KYC solution, businesses can give customers a good experience while also meeting regulatory requirements. The best automated KYC tools require very little time and effort on the part of your customers.

What are the potential risks of not implementing KYC in crypto platforms?

Automated KYC solutions that don't have strict security protocols could put your customers' personal information at risk. It's essential to find a provider that prioritizes customer privacy.

How does Automated KYC ensure data privacy?

Automated KYC ensures data privacy by using secure technology systems to collect and review details about customers. It also puts fewer human eyes on a user's information.

What role does regulatory compliance play in Automated KYC?

Automated KYC is an excellent way to ensure that you follow AML regulations. It enables you to identify suspicious customers and transactions more quickly, reducing the chances of fraud.

Are there any limitations to Automated KYC systems?

The limitations of an automated KYC system largely depend on what tool you choose. AMLBot's solution encompasses all the verification processes you need to fully evaluate a customer's background and confirm their identity.