Stablecoin Report: USDT and USDC Illicit Activity Study

Executive Summary

The report is focused on comparing the two most popular stablecoins by market share - USDT issued by Tether Limited Inc. and USDC issued by Circle Internet Financial, LLC - in terms of the magnitude of illicit activity associated with both stablecoins. This is done utilizing blockchain analytics in which transaction activity is examined in cluster interactions among users of those stablecoins on specified blockchains where they’re present.

UPDATE:

Introduction

Background on the Rise of Stablecoins, Specifically USDT and USDC

What a stablecoin is and what USDT and USDC are? Stablecoins are a form of cryptocurrency pegged to a stable asset, such as the U.S. dollar. As with other cryptocurrencies, companies use smart contracts to create, manage, and redeem stablecoins. However, their values remain relatively steady, whereas the value of crypto tokens such as Bitcoin can fluctuate widely.

USDT and USDC are two of the most popular stablecoins on the market. USDT was launched by the company Tether Limited Inc. in 2014, and it’s pegged to the U.S. dollar at a 1:1 value. Tether states that they have a high level of transparency, as the company publishes daily reports about its reserves and the number of outstanding USDT tokens. USDT is available on many of the largest crypto exchanges.

USD Coin, better known as USDC, is another stablecoin pegged to the U.S. dollar. It was created by Circle Internet Financial. As such, it can be stored in a crypto wallet or transferred to a blockchain such as Ethereum. Unlike USDT, which is only partially collateralized, USDC is fully collateralized. This means that every USDC token is backed by the same number of U.S. dollars in reserve.

Why have stablecoins become popular among crypto users? Stablecoins are a type of cryptocurrency designed to maintain a stable value, typically pegged to a fiat currency such as the U.S. dollar. They aim to eliminate the volatility seen in other cryptocurrencies, such as Bitcoin or Ethereum, making them suitable for everyday transactions. Stablecoins are often backed by real-world assets, such as currencies, commodities, or securities, ensuring their value remains stable over time. There are several reasons stablecoins are popular, including speed, efficiency, cost-effectiveness, security, and privacy.

Stablecoins are used not only by regular users but also by criminals. Criminals exploit stablecoins by taking stolen funds and moving them through exchanges with a lack of KYC and AML rules. In these exchanges, they can convert stolen funds into stablecoins. Subsequently, they proceed to exchange stablecoins for traditional fiat currency, effectively "cleaning" the money in the process. This process allows criminals to obfuscate the origins of their funds and make them appear legitimate.

Methodology

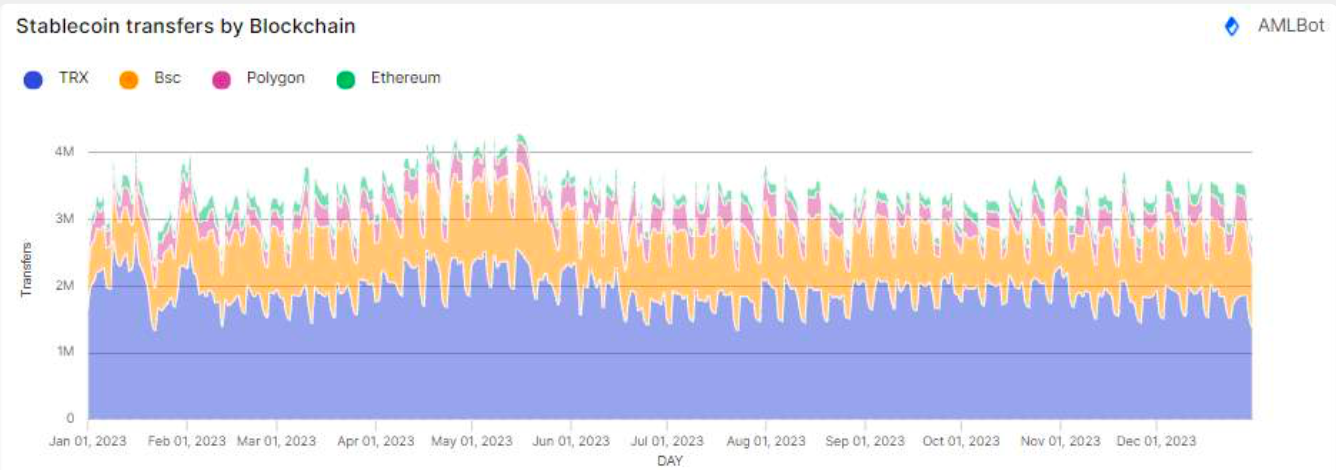

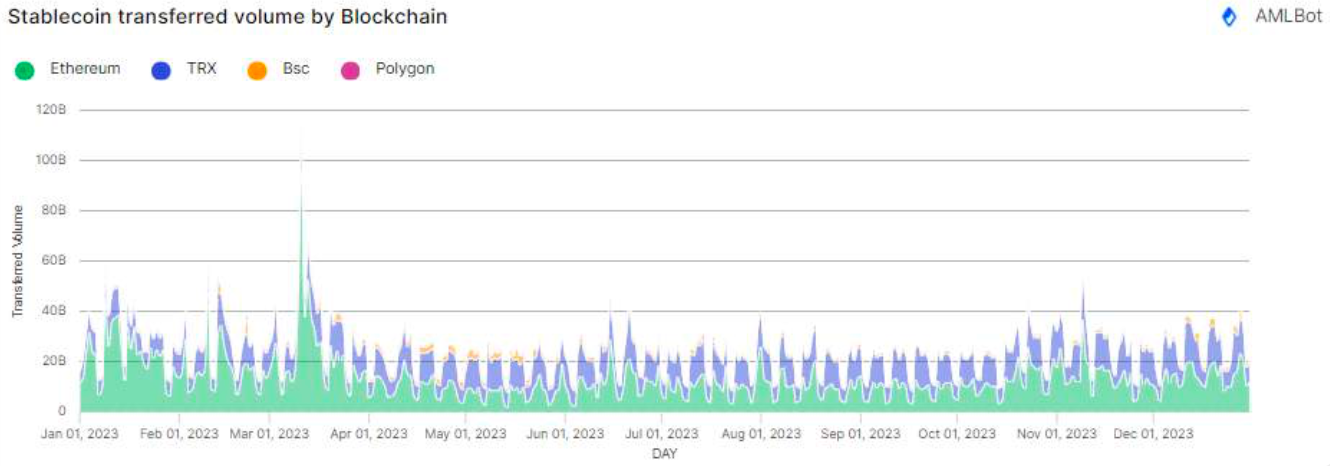

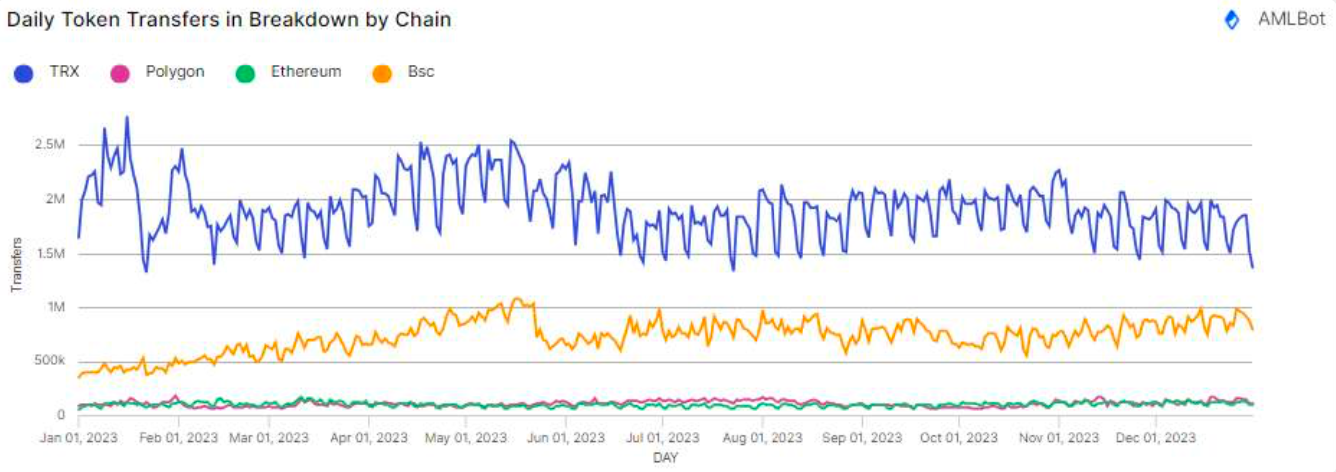

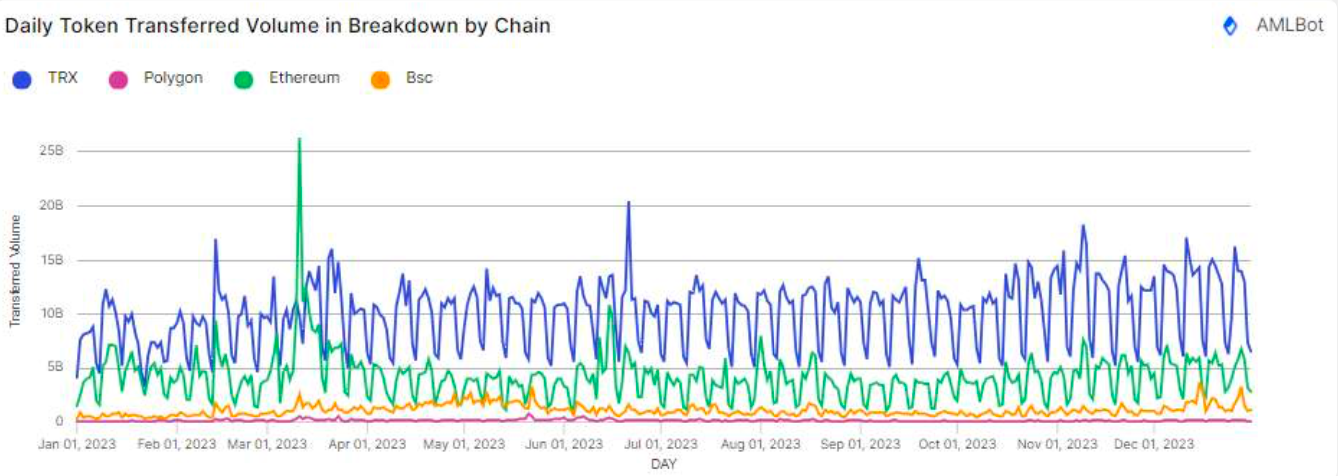

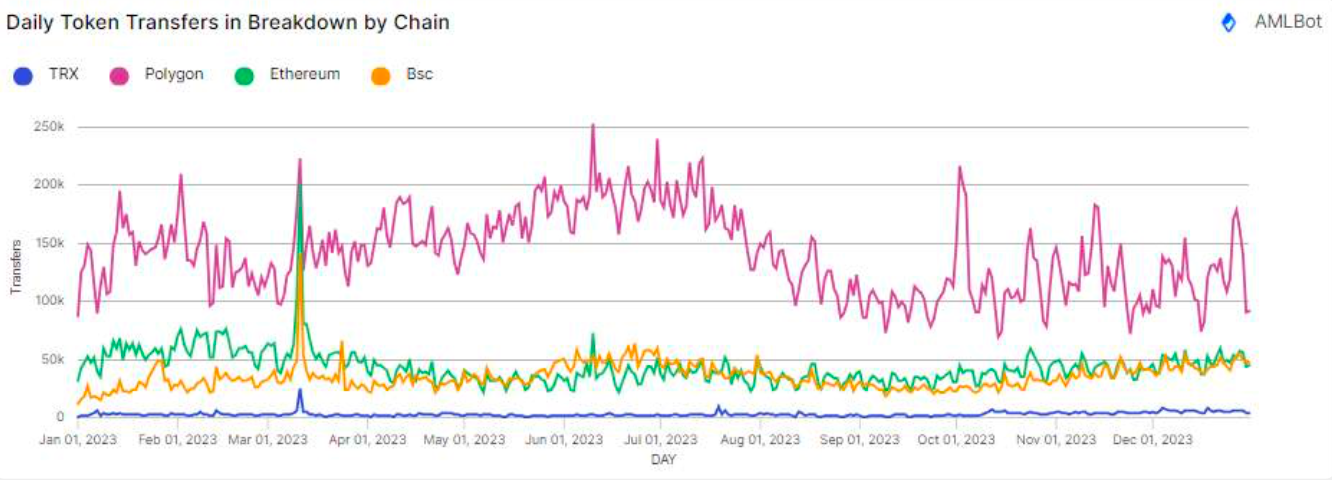

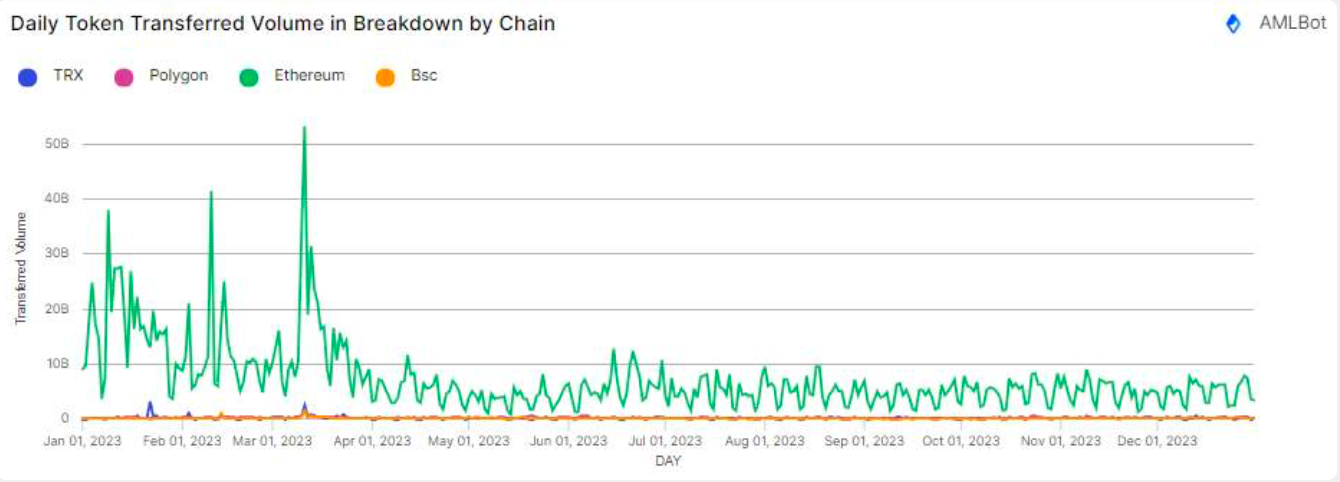

Both USDT and USDC are present on multiple blockchains as tokens, including ERC20, TRC20, BEP20, etc. However, the number of transfers and the transaction volume vary drastically depending on the blockchain. In addition, not all blockchains have sufficient clustering data, which limits analysis of illegal activity on the selected stablecoins. Due to that, it makes sense to analyze the blockchains for USDT & USDC, which are the most active in transferred volume and number of transactions. After performing on-chain data analysis of USDT & USDC activity on various blockchains using Flipside (Source), ETH & TRX blockchains were selected. It is worth noting USDC on Tron blockchain has comparatively low activity compared to USDT & USDC on Ethereum, as well as USDT on Tron, as the graphs show below. Due to that, USDC TRC 20 was not analyzed.

Overall Stablecoin Activity

USDT Activity per Blockchain

USDC Activity per Blockchain

Further, to perform the desired compression analysis of USDT ERC20 & USDT TRC20 vs. USDC ERC20, blockchain analytics tools, such as AMLBot, were used. Such tools have various clusters attributed with a risk level - low, medium, and high. For example, cluster Exchange has a low risk level. In comparison, the cluster Dark Market has a high risk level. For analysis purposes, several clusters from each risk level were selected for stablecoins on both blockchains, and the exposure of those clusters (both direct and indirect) to the other high-risk clusters was analyzed. In the end, the total high-risk exposure of such clusters was compared and analyzed in terms of both U.S. dollar and percentage values.

USDT Overview

Tether (USDT) is a cryptocurrency stablecoin pegged to the U.S. dollar, and it's fully backed by Tether's reserves. The company behind Tether, iFinex, also owns the BitFinex crypto exchange. Tether was initially introduced as RealCoin in July 2014 but later rebranded as Tether in November 2014. While it initially operated on the Bitcoin blockchain, Tether has expanded its support to various other blockchain protocols, including Bitcoin's Omni and Liquid, Ethereum, TRON, EOS, Algorand, Solana, and Bitcoin Cash. As of January 2023, Tether stood as the third-largest cryptocurrency in market capitalization, following Bitcoin (BTC) and Ethereum (ETH). It has held the distinction of being the most substantial stablecoin with a market capitalization of close to $68 billion. In 2022, Tether's USDT was a significant component of the total trading volume in the cryptocurrency markets, surpassing even Bitcoin by value. Tether's unique position as a widely used stablecoin makes it a key player in the crypto ecosystem and financial markets.

(a) Backing and Issuance: Tether claims each USDT token is backed by one U.S. dollar held in reserve. The issuance of USDT is supposed to correspond to the amount of USD held in reserves, which can include cash, cash equivalents, and sometimes other assets or receivables from loans made by Tether to third parties.

(b) Minting Process: When an entity wants to acquire USDT, they send USD to Tether's bank account. In return, Tether mints or issues an equivalent amount of USDT to the entity.

(c) Redemption and Burning: Conversely, if someone wants to convert their USDT back into USD, they send the USDT to Tether, which then supposedly destroys (or 'burns') the tokens and sends back USD from its reserves.

(d) Transparency and Audits: There have been controversies and legal issues regarding the transparency of Tether's reserves. Periodic audits and reports are released to show the backing of USDT, but these have been subject to scrutiny and skepticism.

USDC Overview

USD Coin (USDC) is a fully reserved stablecoin designed to maintain price parity with the U.S. dollar, ensuring stability in a volatile market. USDC is a type of stablecoin, which is a digital asset pegged to a fiat currency, in this case, the U.S. dollar. USDC was created in 2018 by Boston-based Circle and Coinbase exchange, part of the Centre Consortium. It promises each USDC in circulation corresponds to one U.S. dollar reserved, essentially tokenizing the dollar for easy use on the internet and public blockchains. It exists as an ERC-20 token, the most widely used standard for blockchain applications, making it compatible with Ethereum-based decentralized applications (DApps). However, it's not limited to Ethereum; USDC can function on various blockchain networks, including Solana, Avalanche, TRON, Algorand, Stellar, Flow, and Hedera. USDC has become a vital stablecoin in the market, boasting substantial liquidity and active trading on both centralized and decentralized exchanges worldwide.

(a) Backing and Issuance: USDC is issued by regulated financial institutions. Each USDC is claimed to be backed one-to-one by a U.S. dollar held in a segregated bank account.

(b) Minting Process: Similar to USDT, when U.S. dollars are deposited into a bank account managed by Circle (the company behind USDC), an equivalent amount of USDC is minted and issued to the depositor.

(c) Redemption and Burning: Redemption involves sending USDC to Circle, which then 'burns' the USDC tokens and transfers USD from the reserve bank account to the redeemer's bank account.

(d) Transparency and Audits: USDC is known for higher transparency compared to USDT. It undergoes regular audits by independent accounting firms to verify each USDC is indeed backed by a U.S. dollar, and these reports are made public.

Illicit Activities Associated with USDT

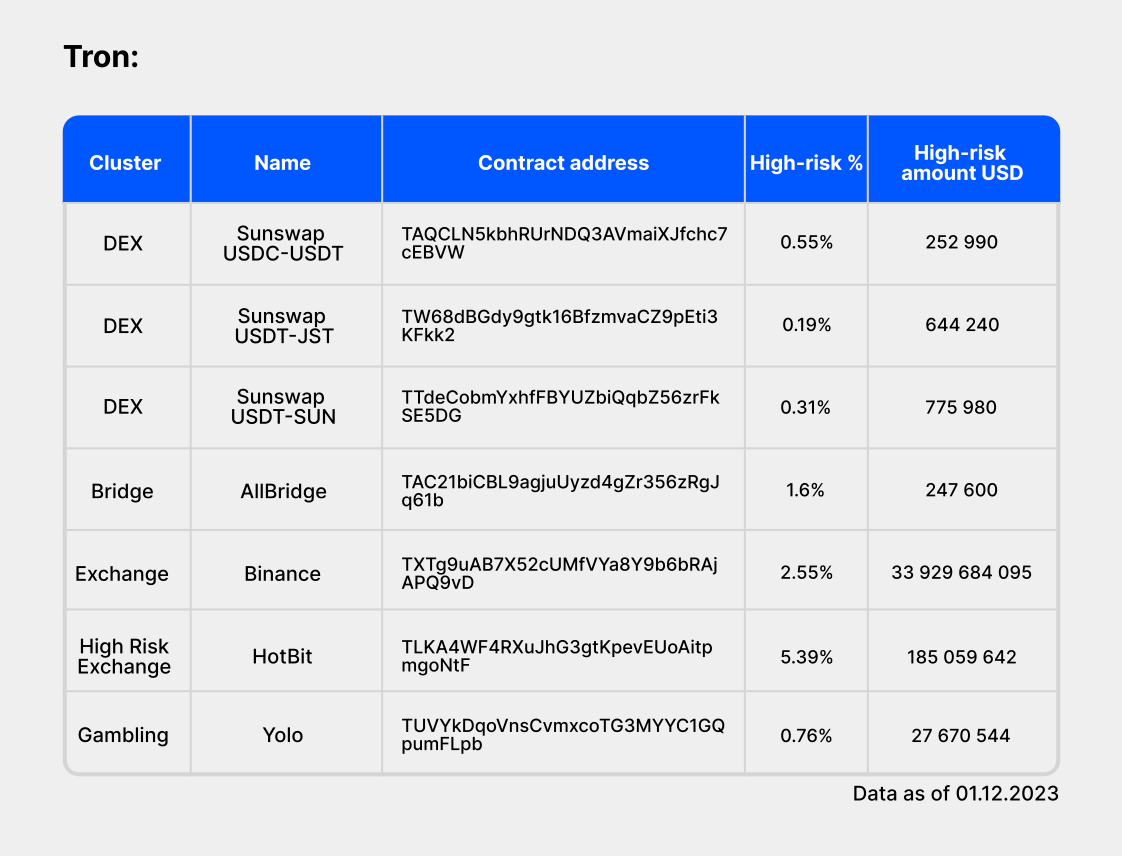

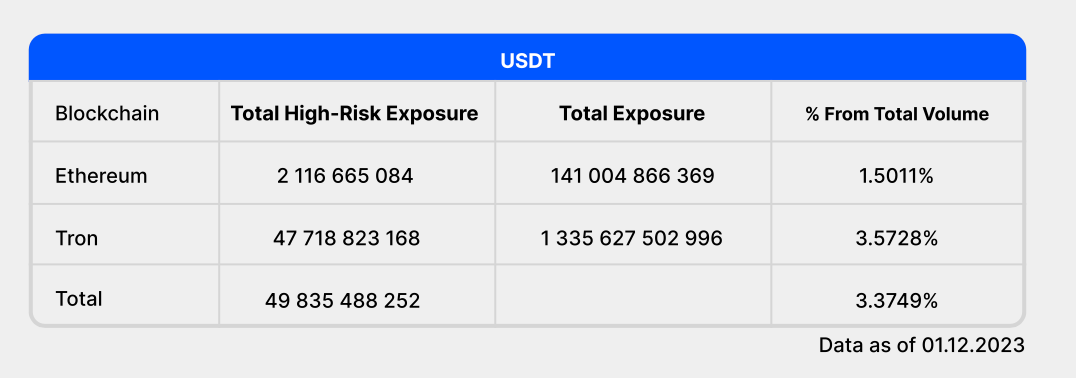

The following table shows an analysis of illicit activities associated with USDT ERC20 and USDT TRC20 within different selected clusters.

How Tether Prevents Money Laundering - Freezing Mechanism

The freezing mechanism allows Tether to restrict the transfer and use of USDT funds associated with specific addresses. This capability has been implemented to comply with regulatory standards and combat potential misuse of the stablecoin for illegal activities. The decision to modify the policy on December 9, 2023, highlights Tether's commitment to adhering to regulatory requirements. By proactively blocking addresses linked to individuals sanctioned by the Office of Foreign Assets Control (OFAC), Tether aims to prevent its stablecoin from being used in violation of international sanctions. To date, over 1200 addresses have been blocked, collectively holding a total amount of $823 million.

Case Study

Police in China's Shanxi Province have uncovered a $54 million Tether (USDT) money laundering scheme, leading to 21 arrests across multiple cities. The suspects purchased discounted USDT through crypto trading services and illegally profited by selling them at inflated prices via WeChat and money laundering platforms. The scheme was discovered when abnormal fund flows were noticed in one account, prompting suspicion of money laundering. Police seized 40 cell phones, over 1 million yuan ($138,000) in USDT, and more than 200,000 yuan in cash. All 21 suspects have reportedly confessed to the crime, and the case is under investigation. (Source)

On December 15, 2023, Tether released a letter stating they had voluntarily frozen $435 million worth of USDT to assist law enforcement. These funds were spread across approximately 326 wallets. Tether’s letter also indicated they have onboarded the Federal Bureau of Investigation (FBI) and the Secret Service onto their platform so they can more successfully identify and investigate illicit activity. (Source)

Illicit Activities Associated with USDC

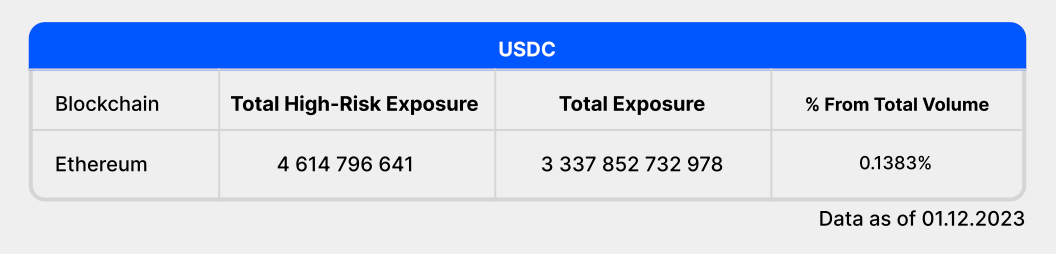

The following table shows an analysis of illicit activities associated with USDC ERC20 within different selected clusters.

How Circle Prevents Money Laundering - Freezing Mechanism

Similar to Tether, Circle, the issuer of USDC USD, also possesses the capability to freeze or suspend accounts. USDC is issued by regulated financial institutions, and its operations are governed by a set of guidelines to comply with regulatory requirements.

Case Study

The U.S. Treasury Department has imposed sanctions on Tornado Cash, a crypto mixer, targeting 38 Ethereum-based addresses holding Ether and USD Coin. Tornado Cash, known for obscuring blockchain transaction trails, was used by cybercriminals and state- backed hackers, including North Korea's Lazarus Group, to launder the proceeds of crypto service hacks, such as the $620 million Ronin Bridge hack and the $100 million theft from Harmony Bridge. Notably, Elliptic's analysis revealed over $1.54 billion in criminal proceeds were laundered through Tornado Cash, and the platform processed more than $7 billion in crypto assets. These sanctions are significant because Tornado Cash operates through decentralized smart contracts, making it challenging to shut down. Circle, behind the USDC stablecoin, froze approximately $75,000 belonging to Tornado Cash users and 149 USDC received as donations. (Source)

Comparative Analysis

Volume of Transactions Linked to Illicit Activities for Both USDT and USDC

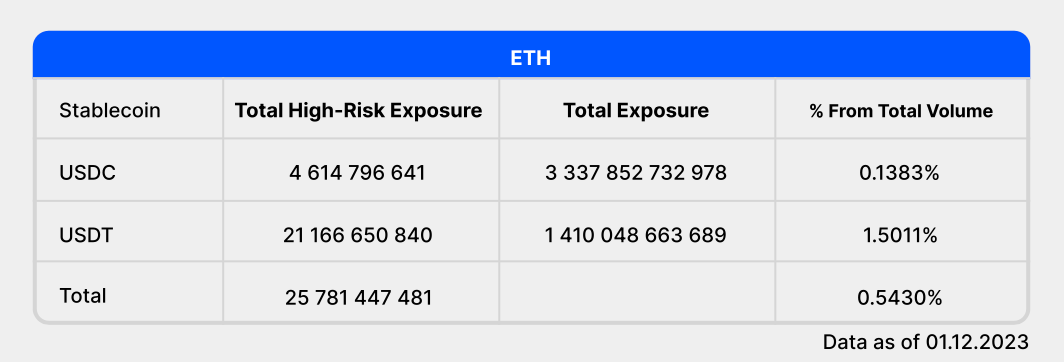

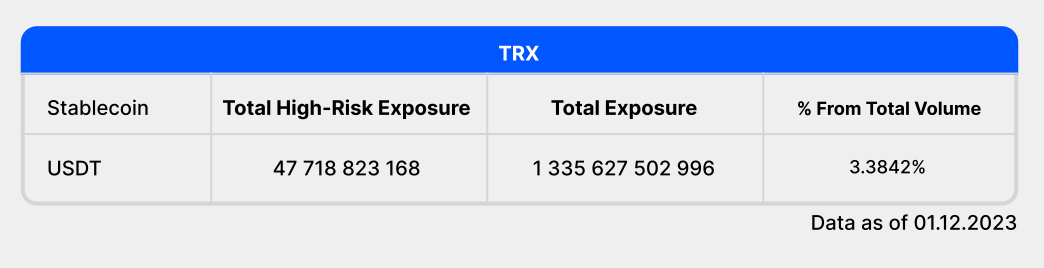

Based on the overall analysis, USDT seems to have a higher degree of illicit activity, totaling 3.37%(49 835 488 252 USD) overall, compared to only 0.14%(4 614 796 641 USD) for USDC. When comparing risk levels exclusively on Ethereum, the difference is less extreme, as USDT totals 1.50% versus 0.14% for USDC. However, the combined results suggest illicit activity, such as money laundering, is more likely to occur with USDT.

During analysis of high-risk transactions for USDT on Ethereum and Tron blockchains, Ethereum reveals a lower absolute high-risk exposure (2.12 billion USDT) and a smaller percentage of high-risk transactions (1.5011%) compared to Tron (47.72 billion USDT and 3.5728%, respectively). However, it's crucial to note that Tron demonstrates a higher overall exposure, totaling 1.34 trillion USDT.

In an analysis of high-risk transactions for USDC on the Ethereum blockchain, data indicates a total high-risk exposure of 4.61 billion USDC, accounting for a minimal percentage of 0.1383% from the total volume of 3.34 trillion USDC. This suggests a relatively low level of risk associated with USDC transactions on the Ethereum blockchain.

In terms of high-risk transactions for stablecoins on the Ethereum blockchain. USDC has a total high-risk exposure of 4.61 billion USDC, representing a minimal 0.1383% of the total volume of 3.34 trillion USDC. On the other hand, USDT demonstrates a higher total high- risk exposure at 21.17 billion USDT, accounting for 1.5011% of the total volume of 1.41 trillion USDT. Collectively, stablecoins on the Ethereum blockchain exhibit a total high-risk exposure of 25.78 billion USDC, equivalent to 0.5430% of the overall volume.

Throughout review of stablecoin transactions on the Tron blockchain, with a specific focus on USDT, data discloses a total high-risk exposure of 47.72 billion USDT. This constitutes a noteworthy 3.3842% of the total volume of 1.34 trillion USDT. These findings underscore a significant level of risk associated with USDT transactions on the Tron blockchain.

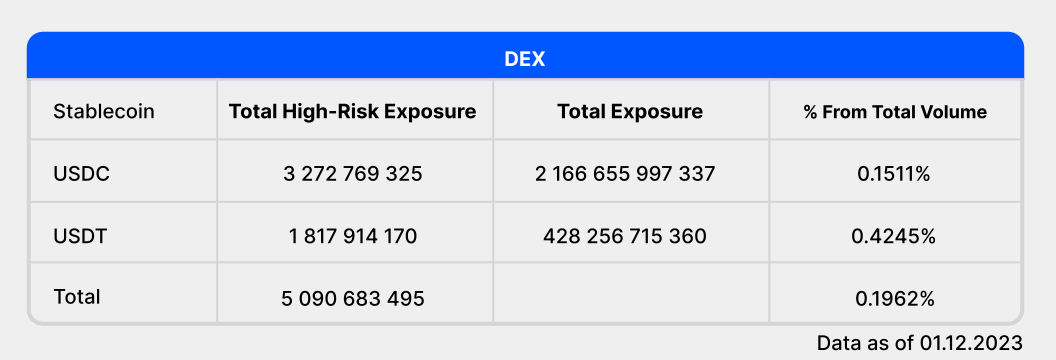

In evaluation of stablecoin transactions within decentralized exchanges (DEX). For USDC, total high-risk exposure amounts to 3.27 billion USDC, representing a minimal percentage of 0.1511% of the total volume of 2.17 trillion USDC. Meanwhile, USDT demonstrates a lower total high-risk exposure at 1.82 billion USDT, accounting for 0.4245% of the total volume of 428.26 billion USDT. Collectively, stablecoin transactions within DEX platforms show a total high-risk exposure of 5.09 billion USDC, equivalent to 0.1962% of the overall volume.

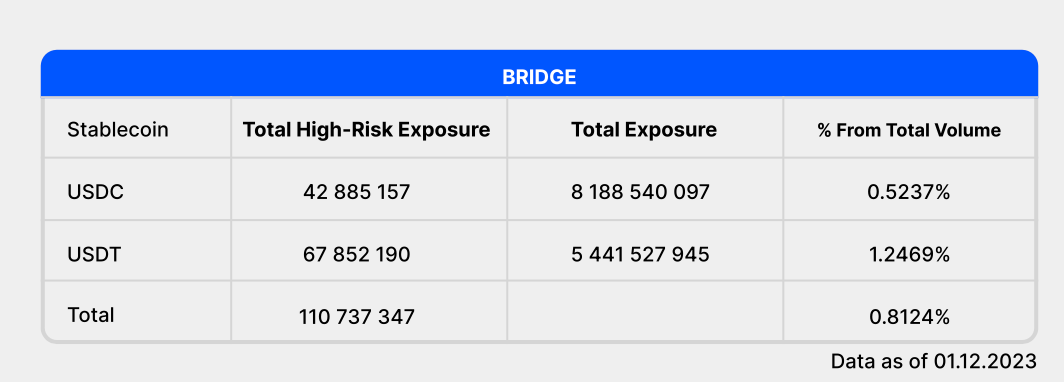

In the context of stablecoin transactions facilitated through a bridge. USDC has a total high-risk exposure of 42.89 million USDC, constituting 0.5237% of the total volume of 8.19 billion USDC. On the other hand, USDT demonstrates a higher total high-risk exposure at 67.85 million USDT, representing 1.2469% of the total volume of 5.44 billion USDT. Cumulatively, stablecoin transactions via the bridge display a total high-risk exposure of 110.74 million, equivalent to 0.8124% of the overall volume.

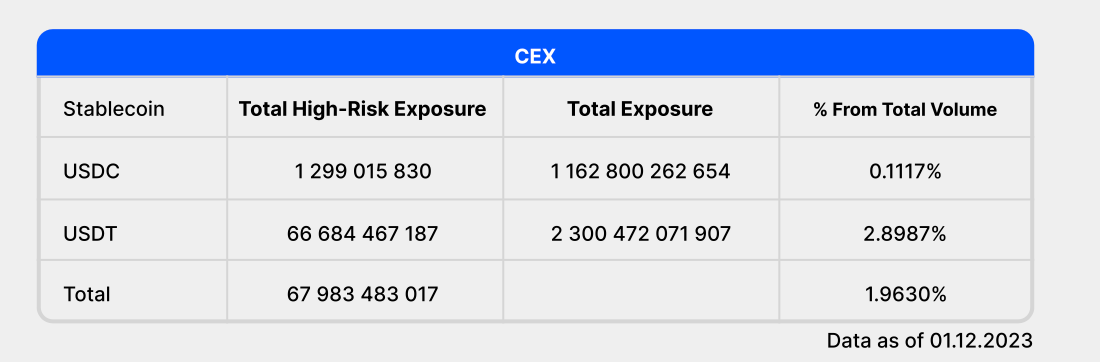

Considering stablecoin transactions within centralized exchanges (CEX). USDC has a total high-risk exposure of 1.30 billion USDC, representing 0.1117% of the total volume of 1.16 trillion USDC. In contrast, USDT demonstrates a notably higher total high-risk exposure at 66.68 billion USDT, accounting for 2.8987% of the total volume of 2.30 trillion USDT. Combined, stablecoin transactions within CEX platforms exhibit a total high-risk exposure of 67.98 billion, equivalent to 1.9630% of the overall volume.

In examination of stablecoin transactions within the gambling sector. In this context, USDC has a total high-risk exposure of 1.27 million USDC, constituting 0.1970% of the total volume of 642.99 million USDC. Meanwhile, USDT demonstrates a total high-risk exposure of 30.75 million USDT, representing 0.9996% of the total volume of 3.08 billion USDT. Collectively, stablecoin transactions within the gambling sector exhibit a total high-risk exposure of 30.76 million, equivalent to 0.9994% of the overall volume.

In evaluation of stablecoin transactions within high-risk centralized exchanges (CEX). USDC has a total high-risk exposure of 125,062 USDC, representing 0.0603% of the total volume of 207.29 million USDC. In contrast, USDT demonstrates a significantly higher total high-risk exposure at 126.87 million USDT, accounting for 4.7405% of the total volume of 2.68 billion USDT. Combined, stablecoin transactions within high-risk CEX platforms exhibit a total high-risk exposure of 127 million, equivalent to 4.4041% of the overall volume.

Interpretation of Results

As the results show, USDT is a riskier stablecoin compared to USDC. This should come as no surprise, as USDC’s issuing company, Circle, is based in the USA, which is deemed more regulated. USDC also undergoes more frequent audits. The lower degree of illicit activity with USDC stablecoins is also consistent across centralized and decentralized exchanges, as well as bridges. The fact that this same result is repeated to varying degrees underscores that USDC’s lower degree of illicit activity is inherent to the stablecoin itself.

When examining illicit activity for USDT, Tron has more than double the volume compared to Ethereum. This is largely because more USDT activity occurs on Tron due to its lower transaction fees.Regardless of the reason, it’s a noteworthy distinction for stablecoin users.

Lastly, among the analyzed clusters, the high-risk centralized exchange has the highest volume of illicit activities associated with analyzed stablecoins. This serves as "confirmation" that its "high- risk" labelling is appropriate and accurate. Stablecoin users who use high-risk centralized exchanges should be aware that illicit activity is significantly more common than on other exchanges and platforms.

Further, if we look at freezing activity, Tether (USDT) has been more active than USD Coin (USDC). Tether has blocked over 1200 addresses, collectively holding a total amount of $823 million. In contrast, USD Coin has only blocked 211 addresses on the Ethereum network, with a total frozen amount of $75 million. This suggests Tether has more illicit activity and implemented its freezing mechanism more extensively compared to USD Coin. It's important to note the reasons for freezing addresses can vary, and the policies of Tether and USD Coin may differ. Freezing addresses is typically done to comply with regulatory requirements, prevent illicit activities, and ensure the stability and legality of the stablecoin.

Regulatory Landscape

Current regulations targeting money laundering with cryptocurrencies

Regulatory bodies around the globe have taken action to prevent illicit activity related to stablecoins. Many of their policies are based on the recommendations of the Financial Action Task Force (FATF), which has closely examined potential risks associated with stablecoins and other virtual assets. However, most countries have not yet developed a comprehensive set of regulations specifically for stablecoins, instead deferring to existing standards that apply to cryptocurrencies as a whole. (Source)

Anti-Money Laundering (AML) and Know Your Customer (KYC) policies are pivotal, and they’re primarily aimed at preventing money laundering within the cryptocurrency ecosystem. AML measures are designed to detect and report suspicious activities, thwarting the illicit flow of funds associated with money laundering and financing illegal activities. Under the FATF’s guidelines, virtual asset service providers (VASPs), including stablecoin issuers, must have dedicated AML compliance officers who oversee their organizations’ transaction monitoring programs. They’re also responsible for reporting suspicious activity to the appropriate authorities or regulatory bodies.

KYC policies, in turn, mandate that crypto businesses verify identities of their users, thereby increasing transparency and accountability. This involves rigorous collection and verification of personal information, such as identification documents and addresses, to confirm true identities of individuals. The identifying information companies collect during their KYC checks makes it easier for investigators to identify the source of illicit activity if and when it occurs. In the context of cryptocurrency, AML and KYC serve as critical tools to safeguard against the use of digital assets for illegal financial activities, ensuring transactions adhere to legal and regulatory standards while also countering the pervasive threat of money laundering within the crypto space.

Effectiveness of These Regulations

AML and KYC regulations serve as a significant deterrent to criminals who might consider using cryptocurrencies for illicit purposes. The prospect of being identified and prosecuted for money laundering, terrorist financing, or other illegal activities dissuades many from attempting such actions within the crypto space. Many reputable cryptocurrency exchanges and service providers have implemented rigorous AML and KYC procedures to meet regulatory requirements. This commitment to compliance ensures a substantial portion of cryptocurrency transactions follows these regulations, making it increasingly difficult for criminals to exploit the system. Some crypto firms may not fully grasp the risks associated with non-compliance or partial compliance with crypto regulations. This lack of understanding can lead to serious legal, financial, and reputational consequences. To avoid these repercussions, comprehensive compliance is essential.

Recommendations for Strengthening Regulatory Oversight

Regulations for stablecoins remain under debate and development. For example, in the United States, Congress has written several bills that attempt to address concerns about stablecoins. This includes the Clarity for Stablecoins Act, which establishes the country’s first federal regulatory framework for stablecoins. While the bill has not yet been made law, it’s an important indicator that reflects how seriously legislators are taking stablecoins as a mainstream form of currency. (Source)

MiCA (Markets in Crypto Assets) regulation in the European Union is widely regarded as one of the most comprehensive frameworks for the crypto industry. It stands out as a prime example of robust regulatory standards. MiCA is designed to provide a consistent and harmonized approach to crypto assets, encompassing rules for issuance, trading, and custody. This comprehensive framework places a strong emphasis on investor protection and market integrity, setting a high bar for responsible and secure crypto market operations. While the regulatory landscape continues to evolve, MiCA's approach is widely seen as a positive step toward providing clarity and stability in the crypto space within the EU.

Conclusion

Stablecoins are an increasingly popular type of cryptocurrency. They provide the same benefits as other cryptocurrencies without their excessive volatility. Two of the most widespread stablecoins, USDT and USDC, have made inroads in making stablecoins more practical and accessible for everyday use. However, illicit activity remains a pressing concern for stablecoin issuers, exchanges, and users alike. This study analyzed the amount of illicit activity that occurs with USDT and USDC. The results showed USDC is superior in terms of risk, as rates of illicit activity were much lower than those for USDT, totaling 0.14% and 3.37%, respectively. This is a reflection of USDC’s commitment to safety and security, as well as the fact that USDT is more widely used. USDT’s rate of illicit activity was higher on Tron than Ethereum, primarily because it had a greater number of total transactions.

Awareness of illicit activity is vital to investors’ decision-making processes. Risk-averse stablecoin users may be better served by USDC. However, Tether has shown recent signs that they’re adopting a more proactive stance in curbing illicit activity.Both USDC and USDT are associated with some degree of money laundering and other criminal behaviors. This is why it’s so important for organizations to adopt stringent policies and procedures to identify and report suspicious activity. As the regulatory landscape continues to shift, it’s imperative that stablecoin companies and cryptocurrency exchanges take their AML and KYC policies seriously, thereby protecting themselves and users throughout the market.

Follow AMLBot:

🔗 Website

🔗 Telegram

🔗 Support Team

🔗 LinkedIn