What Are AML Audits and Why Do Businesses Need Them?

The word audit is enough to strike fear and dread in any manager or business owner. It can inspire nightmarish visions of paperwork and penalties, and it's something many organizations do their best to avoid. An AML audit, however, is actually an excellent way for businesses to bolster their operations and ensure that they are meeting regulatory requirements.

Anti-money laundering (AML) compliance is a vital component of every financial institution's practices, including cryptocurrency businesses. With the proper knowledge and preparation, an AML audit can serve as a source of support rather than anxiety.

What Is an AML Audit?

The general definition of an audit is an inspection of a business's accounts, typically by an independent party. While this explanation certainly applies to AML audits, they are somewhat different from what people typically envision when they hear the term.

Differentiating Between Financial and AML Audits

In order to fully understand AML audits, it's necessary to first examine how they differ from financial audits. Both types of inspections are central to a business's ability to detect and correct potential weaknesses and vulnerabilities, but they have very distinct purposes. During a financial audit, an accounting firm conducts a review to determine whether financial documents, such as bank statements, invoices, and receipts, are accurate and conform to industry standards.

AML audits may not be as familiar, but they are no less important. During this kind of review, an auditor evaluates a company's AML program, which is a system of monitoring for, preventing, and responding to money laundering activity. The auditor determines first whether such a program exists within the business and, assuming it does, that it fully complies with regulations and is being properly implemented.

The Pillars of AML Compliance

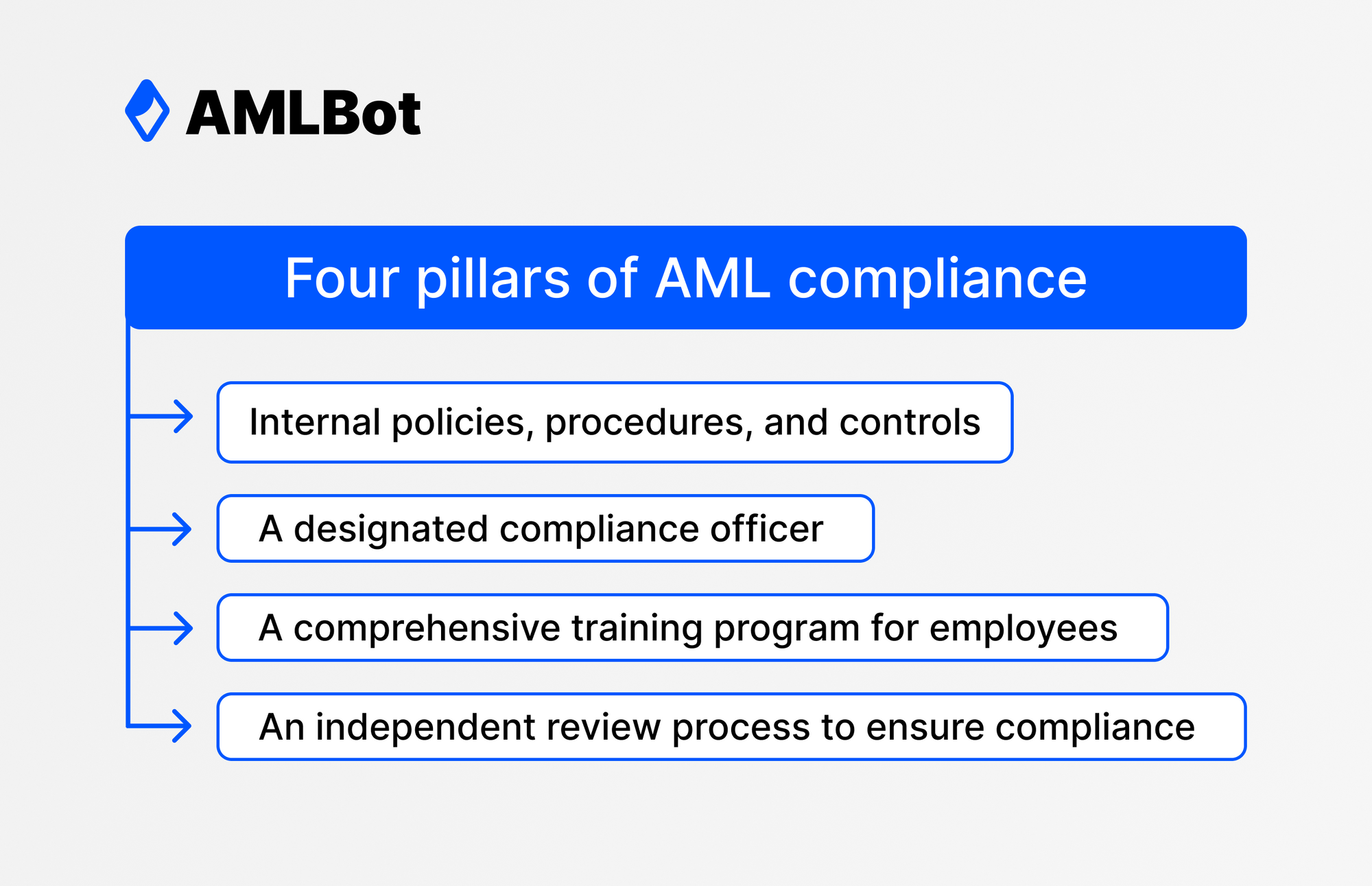

The Bank Secrecy Act (BSA) establishes the standards that businesses must meet within their AML programs. As the policy explains, financial institutions must have four pillars of AML compliance:

A business might have an excellent AML program with strong security measures, thorough documentation, and successful training. Unfortunately, if that program is not also audited and tested, it is still insufficient by BSA standards.

Why Does Your Business Need an AML Audit?

Regulators take AML compliance very seriously, and they have good reasons for doing so. Criminals use money laundering to fund a wide range of illegal activities, including terrorism. As a result, it's vital for businesses that could be exploited for corrupt purposes to protect their customers, communities, and themselves.

Regulatory Compliance

The development of cryptocurrency markets has raised many questions about regulations and requirements. Specifically, companies that deal with virtual assets like cryptocurrencies have been forced to determine where they fall in the scope of financial institutions and the standards that apply to them. Fortunately, guidance on these issues has become clearer over time, and it's now well-established that even if businesses believe it's unlikely that their services will be targeted by money launderers, conducting regular AML audits is still a necessity.

Important legislative and regulatory developments clarified the AML requirements for crypto companies:

- The Financial Action Task Force (FATF) released guidance in 2012 that included AML audits as a core procedure for financial institutions, and they have since updated their recommendations to include Virtual Asset Service Providers (VASPs) in this category.

- In 2013, the Financial Crimes Enforcement Network (FinCEN), which is part of the U.S. Treasury, stated that businesses that exchange or administer virtual currencies qualify as money services businesses (MSBs), which means that they must abide by the regulations laid out by FinCEN and the Bank Secrecy Act.

- Congress reinforced this position with the Anti-Money Laundering Act of 2020, which explicitly identified businesses that transmit or exchange virtual currencies as regulated entities.

In practical terms, this means that, along with all other financial institutions, crypto companies must register with FinCEN and also create and implement an AML program to satisfy compliance requirements, including conducting an annual independent AML audit. Unfortunately, this way of looking at an AML audit may make it seem like a burdensome process imposed by the government with little benefit to the business in question. In reality, an AML audit is a means of protecting a company from the natural risk that occurs when a business facilitates financial transactions.

By conducting AML audits, businesses can improve their compliance policies and procedures so that they always meet regulatory requirements. An audit provides a perfect opportunity to test your current AML program, analyze it for weaknesses or vulnerabilities, and make changes as needed. An audit also helps businesses ensure that they are up-to-date on regulations, which are frequently reviewed, altered, and updated. This is particularly true for businesses in the cryptocurrency space, where regulations are not as clearly defined.

Financial Protection

What happens to companies that do not meet regulatory AML standards? Nothing good. A business that does not follow AML requirements to the letter can suffer significant financial damage. Consider these examples of crypto companies that have faced financial penalties in the past two years:

- In October 2020, FinCEN assessed a $60 million penalty against Larry Dean Harmon for violating the BSA.

- In August 2021, the Commodity Futures Trading Commission (CFTC) ordered BitMEX, a cryptocurrency derivatives trading platform, to pay $100 million for operating without approval and failing to implement an effective AML program.

- In August 2022, the Department of Financial Services (DFS) in New York announced a $30 million penalty on Robinhood Crypto for violating AML, cybersecurity, and consumer protection regulations.

As cryptocurrency becomes more mainstream, it is likely that regulators will pay even closer attention to compliance and penalize companies harshly for violations. In short, it's more important than ever for businesses to ensure that they meet all of the necessary standards.

Reducing the risk of fines is not, however, the only benefit of conducting an audit. The results of an AML audit can also serve as proof of your compliance, which you can present to important parties, including banks, investors, and finance providers. Definitive evidence of this nature helps reassure stakeholders and partners that their investments are well-protected.

What Does the AML Audit Process Look Like?

In addition to knowing why an AML audit is necessary, it's also important for financial institutions to have an idea of how the process works. This knowledge can help them fully prepare and prepare appropriate documents so that their audit runs as smoothly and efficiently as possible.

Who Conducts the Audit?

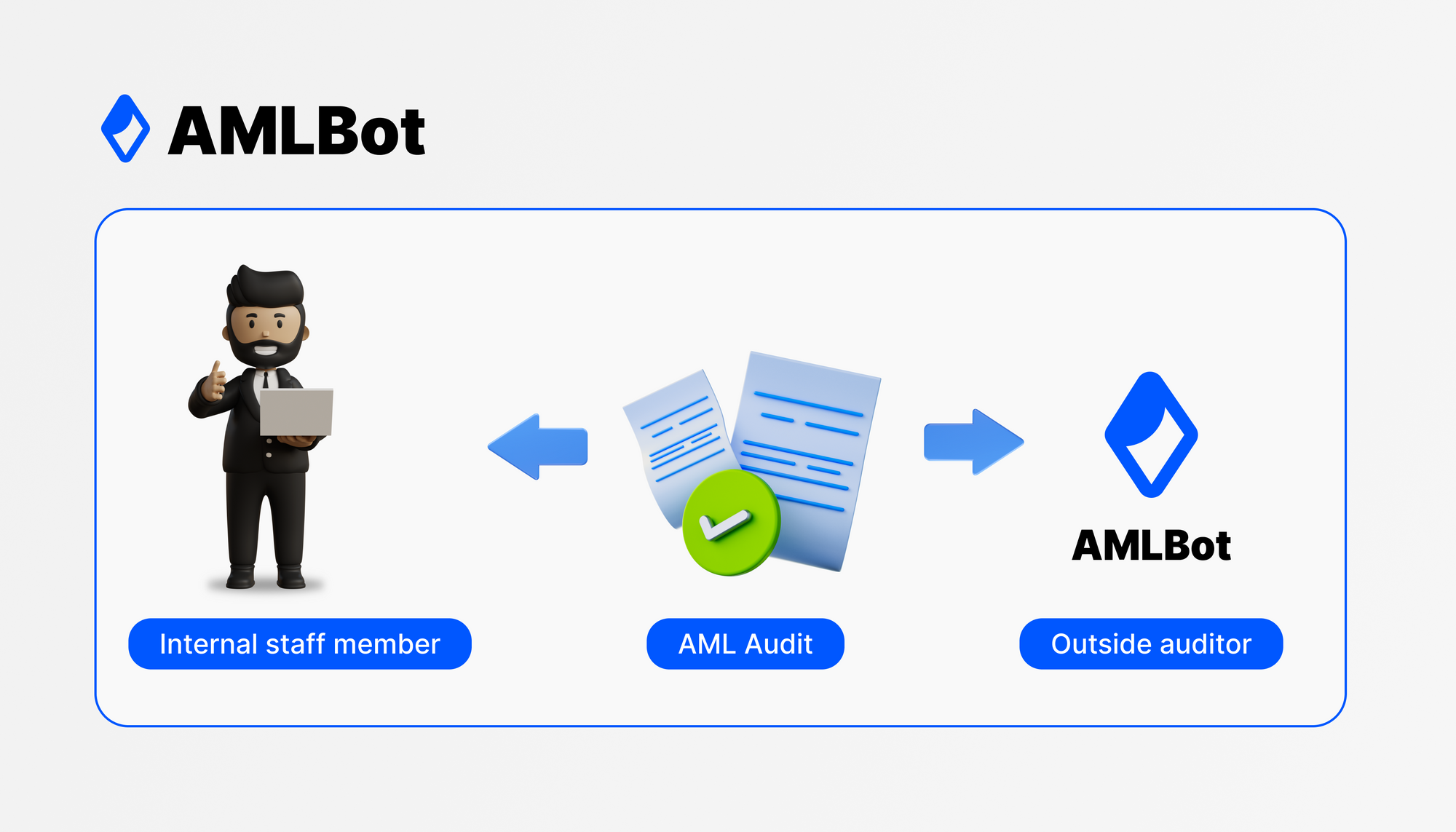

To a certain degree, the choice of who conducts your business's AML audit is up to your discretion. If you feel so inclined and have the necessary personnel, you can opt to have an internal staff member conduct the review. However, this person must work in a department that is entirely separate from areas that are exposed to money laundering risks. AML compliance officers, and employees under their supervision, are also prohibited from conducting the audit.

Many businesses, particularly smaller ones that do not have the budget to employ dedicated staff for audits, choose to hire external third parties. Bringing in an outside auditor can also help ensure that the process will be objective and fully independent. Companies like AMLBot can conduct an accurate and comprehensive audit to assess whether your business's AML program complies with FATF guidance.

What Is the Process?

The goal of an AML audit is to determine whether your company has an appropriate AML program and whether employees are following the required policies and procedures. To make this determination, an auditor will need to speak to stakeholders and review relevant files, systems, and documents.

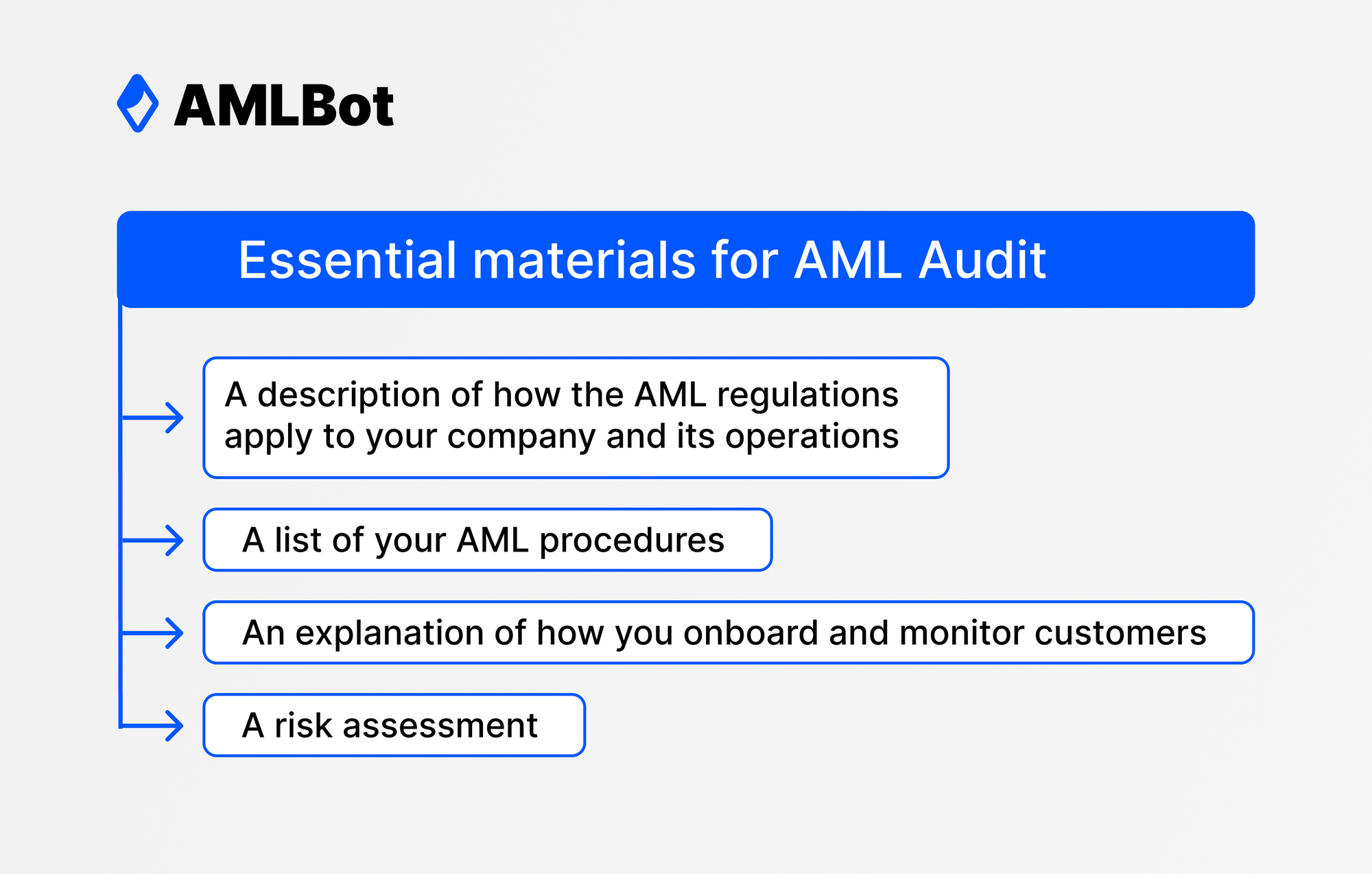

To prepare for your audit, it's helpful to gather some essential materials, including:

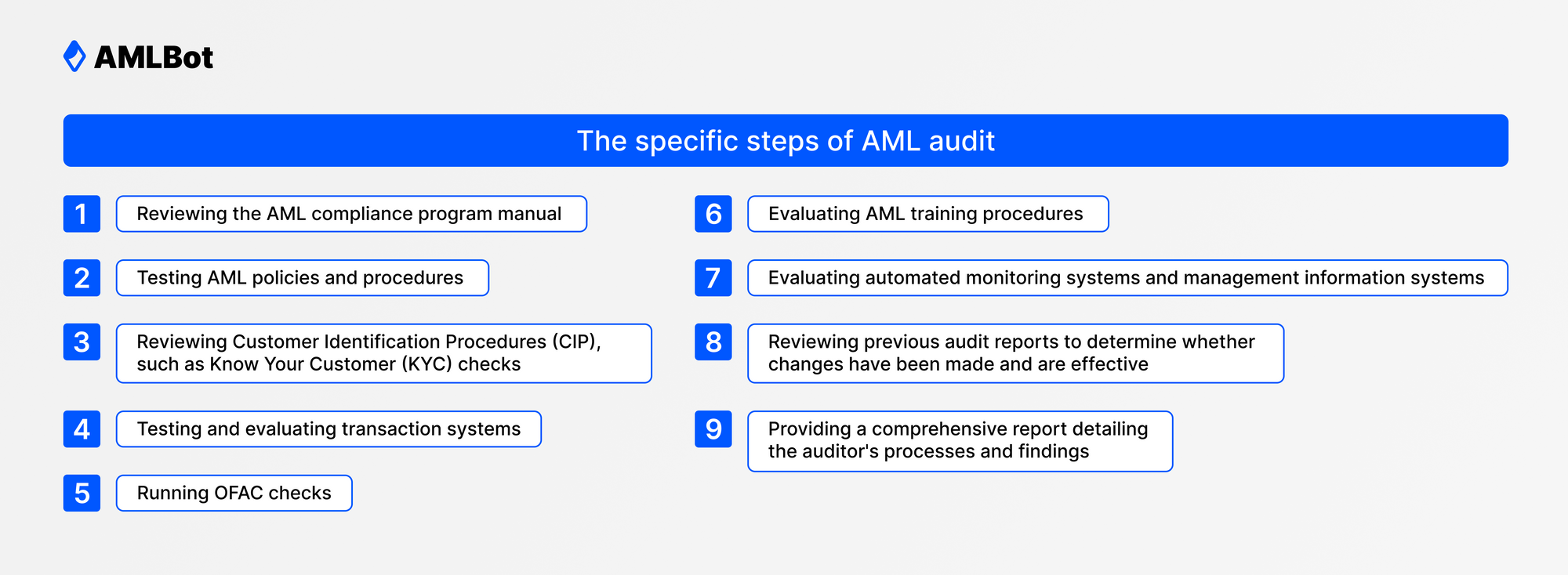

This documentation will help the auditor establish whether your daily operations align with the procedures that you have described. This will require testing your AML program, examining a sample of client files, and evaluating your transaction monitoring systems. The specific steps that generally occur in an AML audit include:

Once you have received your report, the audit is officially complete, and you can move on to implementing any recommended changes.

What Should Businesses Do When an Audit Is Complete?

It's not uncommon for an AML audit report to reveal that the auditor has flagged problems, including potential violations or vulnerabilities. Your next steps depend on the severity of these issues and how you can address them.

No matter what the audit has uncovered, it is generally wise to provide the final report to the company's Board of Directors and BSA Compliance Officer. These individuals will be responsible for analyzing the weaknesses that the auditor identified and developing a plan of corrective action. The insights from the report can be incredibly valuable as the audit gives an outside party the opportunity to offer creative solutions that can strengthen your AML controls.

After reviewing your report, you may determine that you need to use better tools to ensure your compliance and protect your business from financial crimes. For example, AMLBot can screen crypto wallets and transactions to identify the sources of funds and improve risk assessment. Once you have enacted these and other changes as described in the audit report, it's best practice to conduct a review to ensure that they are fully in place and functioning correctly.

Embracing Audit Outcomes and Leveraging AML Solutions

An AML audit may sound menacing, but it's actually an opportunity for growth. By conducting a full review of your AML policies, procedures, and controls, you can better protect your business from exposure to criminal activity, reduce the likelihood of compliance violations, and instill your partners and stakeholders with confidence in your business. Most importantly, you can get a clear understanding of your AML program's strengths and weaknesses so that you can make improvements.There are valuable AML solutions available that you can leverage to improve your compliance, either to better your outcomes on an upcoming AML audit or correct an issue that has already been identified. Reach out to the experts at AMLBot for a free consultation or to learn more about how the right cryptocurrency monitoring tools can strengthen your business.