Crypto KYC Requirements in 2025: Regulatory Standards for VASPs

The global regulatory net has tightened significantly. According to FATF’s Latest Targeted Update, only 99 jurisdictions have passed or are implementing the FATF's Travel Rule, which mandates the sharing of originator and beneficiary data for virtual asset transfers. However, a critical gap remains: 75% of assessed jurisdictions are still only partially compliant or non-compliant with the standards, and supervision remains low globally.

This “Sunrise Issue” creates dangerous compliance gaps and arbitrage opportunities that criminals exploit. For Virtual Asset Service Providers (VASPs), the strategic challenge is to build compliance systems that assume the strictest interpretation of the rules, treating every cross-border transfer as if data sharing is mandatory.

The 'Sunrise Issue' refers to the delayed and staggered implementation of the FATF Travel Rule across different countries and regions. More than 99 countries have enacted or are working on Travel-Rule. However, not all have enforced it yet. This has left a patchwork of rules worldwide. It creates compliance gaps that make cross-border transactions challenging.

Doing so requires a strong KYC foundation. KYC is the internal process through which a VASP identifies and verifies its customers. The Travel Rule is an external data‑exchange requirement between VASPs. The two are complementary. Without reliable customer identification, the information exchanged under the Travel Rule loses its value. Effective KYC provides the verified names, account numbers and addresses needed for Travel‑Rule reporting, guaranteeing that shared data is accurate.

As outlined in the article Crypto KYC Requirements in 2025: Regulatory Standards for VASPs, KYC Service Providers play a key role in helping crypto businesses meet evolving global compliance standards.

This article explores the meaning of KYC (Know Your Customer), surveys the global regulatory environment — from the FATF's Travel Rule mandates and EU Anti-Money Laundering (AML) directives to US, UK, Asian and Middle Eastern frameworks — and demonstrates how regional requirements converge and diverge. The piece also examines the operational challenges posed by inconsistent rules and compliance costs, before outlining best practices for building risk‑based programs, standardizing procedures and training teams.

Note: None of this information should be considered as legal, tax, or investment advice. While we’ve done our best to ensure this information is accurate at the time of publication, laws and practices may change, so please double-check it.

What Is KYC in Crypto?

Know Your Customer (KYC) in the cryptocurrency industry is the legally mandated process for VASPs to identify and verify their clients to prevent illicit activities like Money Laundering and Terrorist Financing.

As of 2025, this is a non-negotiable requirement in most major jurisdictions, driven by global standards from the FATF and enforced by national laws like the US Bank Secrecy Act and the EU's AML Directives. The FATF's updated Recommendation 15 (R.15) explicitly extends the full scope of AML/CFT obligations to the virtual asset sector, treating VASPs with the same rigor as traditional financial institutions. This requires VASPs to implement a risk-based AML/CFT program that includes Customer Due Diligence (CDD), record-keeping, transaction monitoring, and reporting suspicious activity.

Global KYC Regulatory Requirements

FATF and the Travel Rule

The Financial Action Task Force (FATF) sets global Anti‑Money‑Laundering (AML) standards, and its Travel Rule has become a cornerstone of crypto compliance. FATF’s Recommendation 16 mandates that virtual asset service providers collect and transmit originator and beneficiary information during transfers above certain thresholds. This means that when a VASP sends a cryptocurrency to another VASP, it must share the sender’s and recipient’s names, account numbers and identifying information. According to a 2025 guide, the Travel Rule applies to all transfers of digital assets and requires VASPs to obtain and exchange Know Your Customer data to combat money‑laundering and terrorism financing.

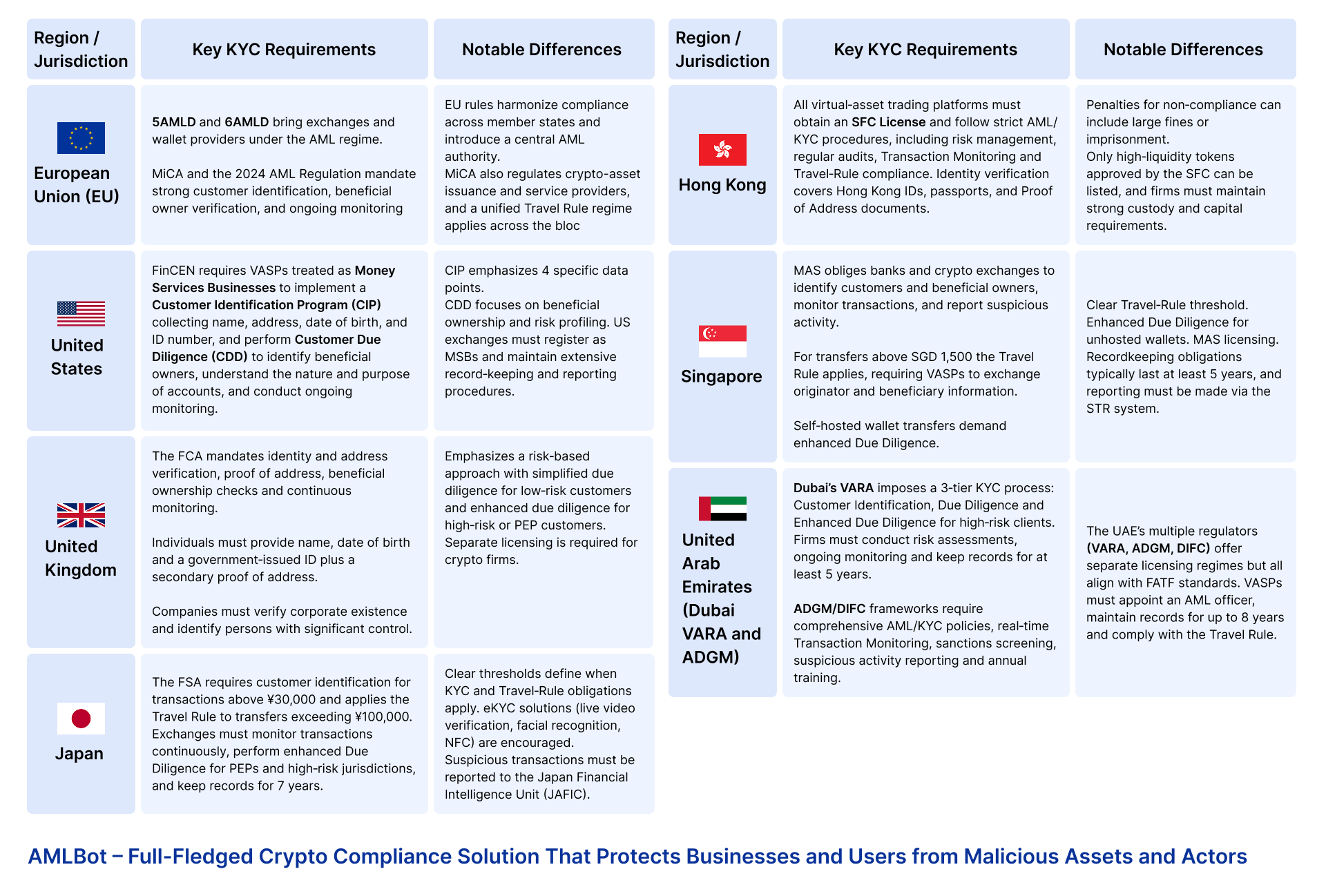

KYC Requirements in the EU (AMLD, MiCA, AMLR)

The European Union introduced 5AMLD and 6AMLD to bring cryptocurrency exchanges and wallet providers under its AML regime. These directives require VASPs to perform KYC for account openings, collect and verify identity information, and report suspicious transactions. The Markets in Crypto‑Assets Regulation (MiCA) harmonizes rules across EU member states and introduces authorization, supervision, and disclosure requirements.

In 2024 the EU further adopted the Anti‑Money‑Laundering Regulation (AMLR), extending due‑diligence rules, refining beneficial‑owner identification and empowering a new EU AML authority. These regulations mean that every European VASP must implement identity verification and ongoing monitoring, core elements of Crypto KYC Requirements, to operate legally.

KYC Requirements in the US (FinCEN)

In the United States, the Financial Crimes Enforcement Network (FinCEN) classifies many crypto exchanges as Money Services Businesses (MSBs). They must follow the Customer Identification Program (CIP) and Customer Due Diligence (CDD) rules.

The CIP requires businesses to collect four key pieces of information: name, address, date of birth and government‑issued identification number, and verify them to a reasonable belief. CDD rules, updated by FinCEN’s 2018 final rule, mandate that financial institutions identify and verify beneficial owners of legal entities, understand the nature and purpose of customer relationships, and conduct ongoing monitoring to detect suspicious activity. FinCEN also enforces record‑keeping and reporting requirements, and VASPs risk penalties if they fail to maintain a comprehensive KYC process.

KYC Requirements in the UK (FCA)

The United Kingdom Financial Conduct Authority (FCA) sets its own regulatory framework for VASPs. Firms must implement KYC processes covering identity and address verification, beneficial ownership checks and continuous monitoring. According to a 2025 KYC guide, individual clients must provide full name, date of birth, residential address, a government‑issued ID, and a secondary proof of address such as a utility bill.

Companies must verify corporate existence and identify persons with significant control. The FCA emphases a risk‑based approach: simplified due diligence for low‑risk customers and enhanced checks for high‑risk profiles, including politically exposed persons (PEPs). To satisfy Crypto KYC Requirements in the UK, exchanges and custodians must maintain detailed records, update information regularly and report suspicious activities.

KYC Requirements Asia‑Pacific (Singapore, Hong Kong & Japan)

Singapore: The Monetary Authority of Singapore (MAS) requires banks, payment service providers and crypto exchanges to implement KYC and AML programs. Institutions must identify and verify customers and beneficial owners, monitor transactions, and report suspicious activities. For virtual asset transfers above SGD 1,500, VASPs must exchange originator and beneficiary information in compliance with the Travel Rule. Self‑hosted wallet transactions require enhanced due diligence: verifying ownership of the wallet, recording KYC information and maintaining risk‑based analysis.

Hong Kong: Since June 2023, all virtual asset trading platforms operating in or marketing to Hong Kong investors must obtain a licence from the Securities and Futures Commission (SFC) and comply with the Anti‑Money Laundering Ordinance. Licensees are required to follow strict AML/KYC procedures, including risk management, regular audits, transaction monitoring and adherence to the Travel Rule. KYC checks involve verifying identity documents such as Hong Kong identity cards or passports and proof of address documents like utility bills.

Japan: The Japanese Financial Services Agency (FSA) enforces a KYC framework. Exchanges must collect customer information during onboarding, monitor transactions continuously and report suspicious activity. Enhanced due diligence is mandatory for high‑risk clients, including politically exposed persons and those from high‑risk jurisdictions. The FATF Travel Rule applies to transactions exceeding ¥100 000; KYC checks are required for amounts above ¥30 000. Records must be kept for seven years and suspicious transactions reported immediately to the Japan Financial Intelligence Unit.

KYC Requirements UAE (Dubai – VARA & ADGM)

The United Arab Emirates has been established as a global crypto hub, but it has also implemented stringent KYC regulations. Dubai’s Virtual Assets Regulatory Authority (VARA), established under Law No. 4 of 2022, requires VASPs to obtain permits and follow a three‑tier KYC process: Customer Identification through official documents, Customer Due Diligence to build risk profiles, and Enhanced Due Diligence for higher‑risk clients. Businesses must conduct detailed risk assessments, monitor transactions continuously and keep records for at least five years.

The Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) also enforce strict compliance. According to regulatory summaries, crypto companies must implement KYC/AML policies, real‑time transaction monitoring, cybersecurity measures and obtain a license. VASPs must perform CDD and EDD, carry out ongoing monitoring, screen against sanctions lists, submit suspicious activity reports via the go AML platform, keep records for eight years, appoint an AML officer and provide regular training. These requirements align with global FATF standards and ensure that UAE‑based providers uphold international best practices.

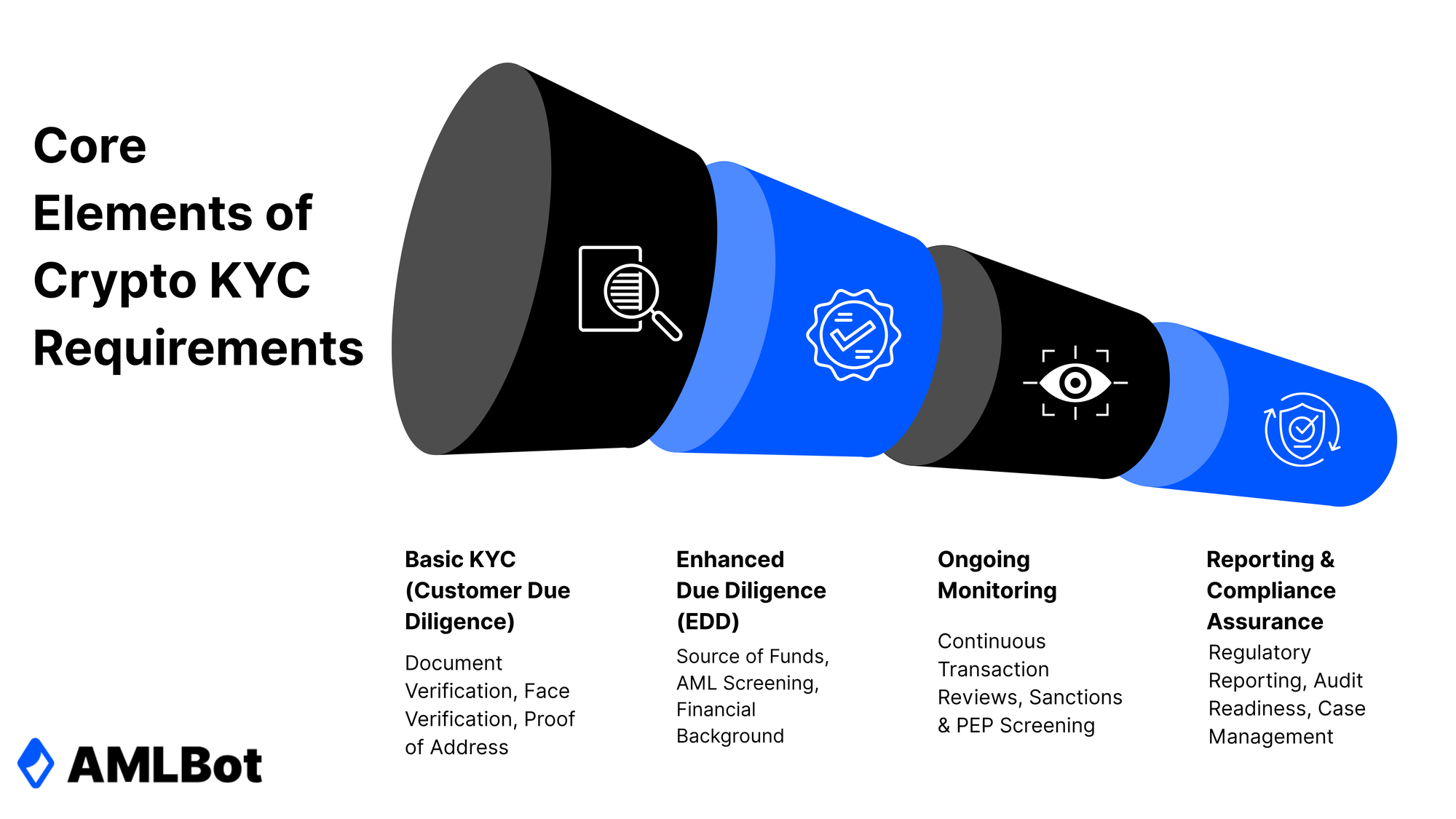

Core Elements of Crypto KYC Requirements

The fundamental KYC process for a VASP involves four main stages. This workflow is designed to establish a customer's identity and create an initial risk profile that informs all following compliance actions.

Basic KYC (Customer Due Diligence)

(a) Customer Due Diligence: Document + Biometric Standards. Customer Due Diligence (CDD), or basic KYC, is the foundation of any compliance program. Best practice in 2025 involves a multi-layered approach combining:

- Document Verification: Checking the authenticity of a government-issued ID (Passport, National ID).

- Biometric Verification: Using a "selfie-with-liveness" check to match the user to their ID and prevent spoofing.

- Address Proof: Verifying residential address with documents like utility bills. This process is required not only at onboarding but also for occasional transactions exceeding the jurisdictional threshold (e.g., the FATF's recommended USD/EUR 1,000).

Enhanced Due Diligence (EDD)

(b) Enhanced Due Diligence (EDD) is a deeper investigation required for higher-risk customers. Common Triggers:

- Identifying a customer as a Politically Exposed Person (PEP).

- Transactions With High-Risk Jurisdictions.

- Unclear Or Complex Source Of Funds/Wealth.

Ongoing KYC Monitoring & Reporting

(c) Ongoing Monitoring: Integrating On-Chain Analytics with Behavioral Rules. KYC is not a one-time check. Ongoing monitoring is a continuous, risk-based process of scrutinizing customer activity to identify suspicious patterns. In 2025, this means moving beyond simple rule-based alerts. Leading VASPs integrate on-chain data (Transaction Monitoring) with off-chain behavioral analytics (e.g., Unusual Deposit Patterns), as explicitly mandated by regulators like Dubai's VARA.

When suspicious activity is detected, VASPs are legally required to file a Suspicious Transaction Report (STR) or Suspicious Activity Report (SAR) with their national Financial Intelligence Unit (FIU).

PEP and Sanctions Screening

(d) PEP & Sanctions Screening: Reducing False Positives with AI.

It is critical to carry out ongoing KYC functions, such as screening customers against Global Sanctions Lists (e.g. OFAC, UN, EU) and lists of PEPs. This must also include screening against adverse media and known blacklisted wallet addresses.

A major operational challenge is the high rate of false positives from these systems. Advanced VASPs are now using AI and Machine Learning to refine screening algorithms, reducing the number of false alerts that require manual review and allowing compliance teams to focus on genuine risks.

Compliance Challenges for Crypto Businesses

Different Jurisdictions, Different Rules

Across jurisdictions, KYC requirements diverge based on local interpretations of the FATF framework and regional AML laws. Although FATF provides the overarching standard, each market applies its own interpretation. As a result, a single VASP must adapt its onboarding workflows to meet different KYC obligations in each region.

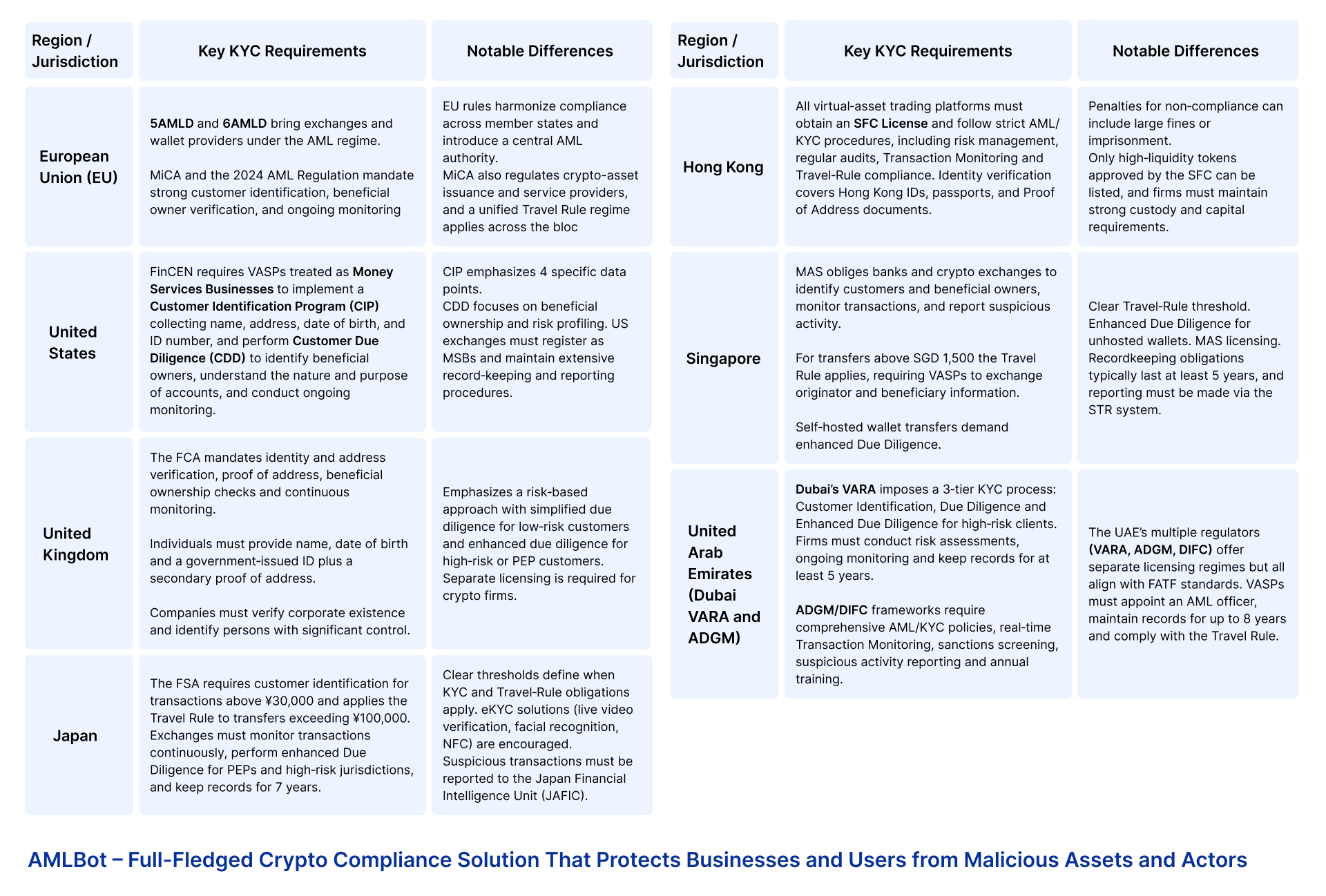

Here are the main KYC requirements in the key jurisdictions, summarizing the section on Global KYC Regulatory Requirements:

Global KYC Regulatory Requirements

Balancing UX and Security

Users want instant access to cryptocurrency services, but strict KYC checks can create friction. Onboarding processes that are too cumbersome cause drop‑off. Statistics show that one in four users abandon onboarding due to KYC friction. At the same time, regulators demand comprehensive verification to prevent fraud. Crypto companies must therefore balance user experience with security by automating checks, simplifying interfaces, and offering step‑by‑step guidance. Modern identity solutions leverage biometric verification and AI to expedite the process without compromising compliance.

False Positives and Manual Reviews

False Positives are instances when automated AML and KYC systems incorrectly flag legitimate users or transactions as suspicious, prompting unnecessary manual reviews.

In the crypto, these misclassifications often stem from fuzzy-matching of names and addresses, outdated or incomplete sanctions and PEP lists, and rigid threshold rules that fail to account for typical blockchain behavior. For example, multiple internal transfers between a user’s wallets can resemble structuring designed to evade reporting limits, while slight variations in a company’s name may match a sanctioned entity.

False Alarms impose costs on crypto firms. Every manual review consumes analyst time and resources, extending the customer journey and damaging conversion rates. Potential users may abandon onboarding if asked to verify information multiple times. To reduce these inefficiencies, organizations should enrich screening data with secondary identifiers, such as: date of birth, nationality, and full address, to refine matching accuracy. They must also adopt a risk-based approach, tightening controls for high-risk profiles while relaxing thresholds for known low-risk customers.

Rising Costs of Compliance

The cost of maintaining KYC and AML Programs has become a growing burden for crypto companies. As stated in some reports, a majority of firms are planning increases in their identity-verification budgets, with 55% of crypto businesses indicating they will allocate additional funds to KYC processes in the near term. Beyond technology investments, companies must hire dedicated Compliance Officers, train staff, conduct regular audits, and update policies across multiple jurisdictions. For start-ups and smaller VASPs, these cumulative expenses can be prohibitive. Investing in scalable, automated solutions is therefore crucial to avoid hefty fines and reputational damage.

AMLBot provides a compliance platform designed to the needs of small and mid-sized crypto businesses. It converges every critical AML/KYC function into a single, easy-to-deploy solution, eliminating the complexity and expense of integrating multiple point tools. The unified dashboard nd API-first design enable implementation and scaling as transaction volumes grow, avoiding the typical license and integration fees charged by legacy vendors.

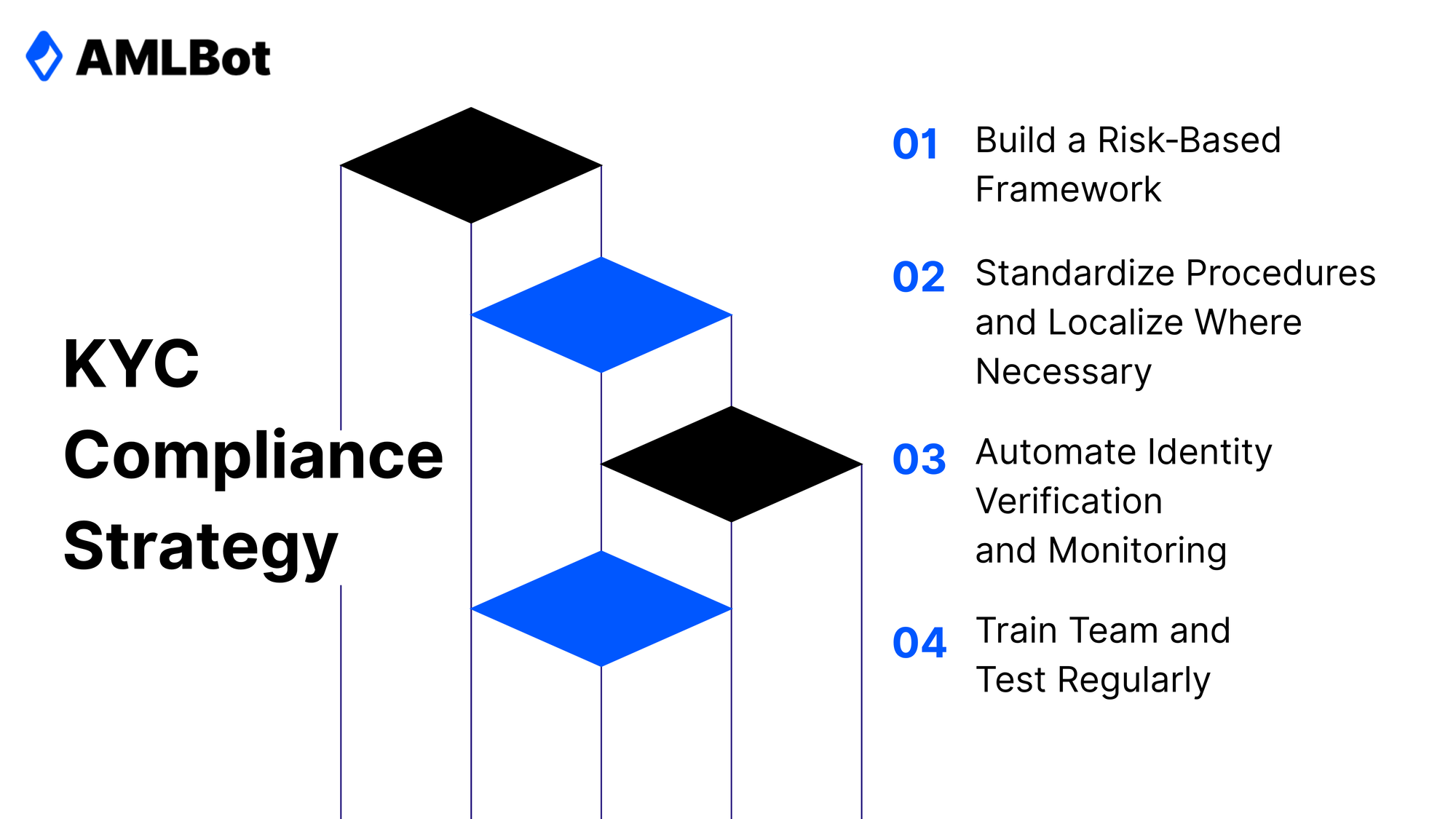

Best Practices for Staying Compliant

Building a Risk‑Based Approach

A risk‑based approach tailors the KYC process to the risk profile of each customer. Low‑risk users may undergo simplified due diligence, while high‑risk clients require enhanced checks. Best practices include implementing comprehensive Customer Identification Programs, utilizing document verification and biometric technologies, performing risk profiling during onboarding, and employing AI-driven transaction monitoring to detect anomalies. By focusing resources where they matter most, VASPs can meet compliance obligations efficiently and reduce friction for legitimate users. Tools that offer dynamic risk scoring and adaptive workflows help in achieving this goal.

Standardizing KYC Procedures Across Jurisdictions

For global exchanges, standardizing KYC procedures wherever possible simplifies operations. Establishing a core framework aligned with FATF recommendations and layering jurisdiction‑specific requirements allows a provider to scale while remaining compliant. This includes harmonizing document verification procedures, adopting common risk categories, and using technology platforms that support multiple regulatory configurations. Standardization reduces errors, accelerates onboarding, and ensures a consistent user experience across markets. Firms should also stay updated with regulatory changes and integrate modifications promptly.

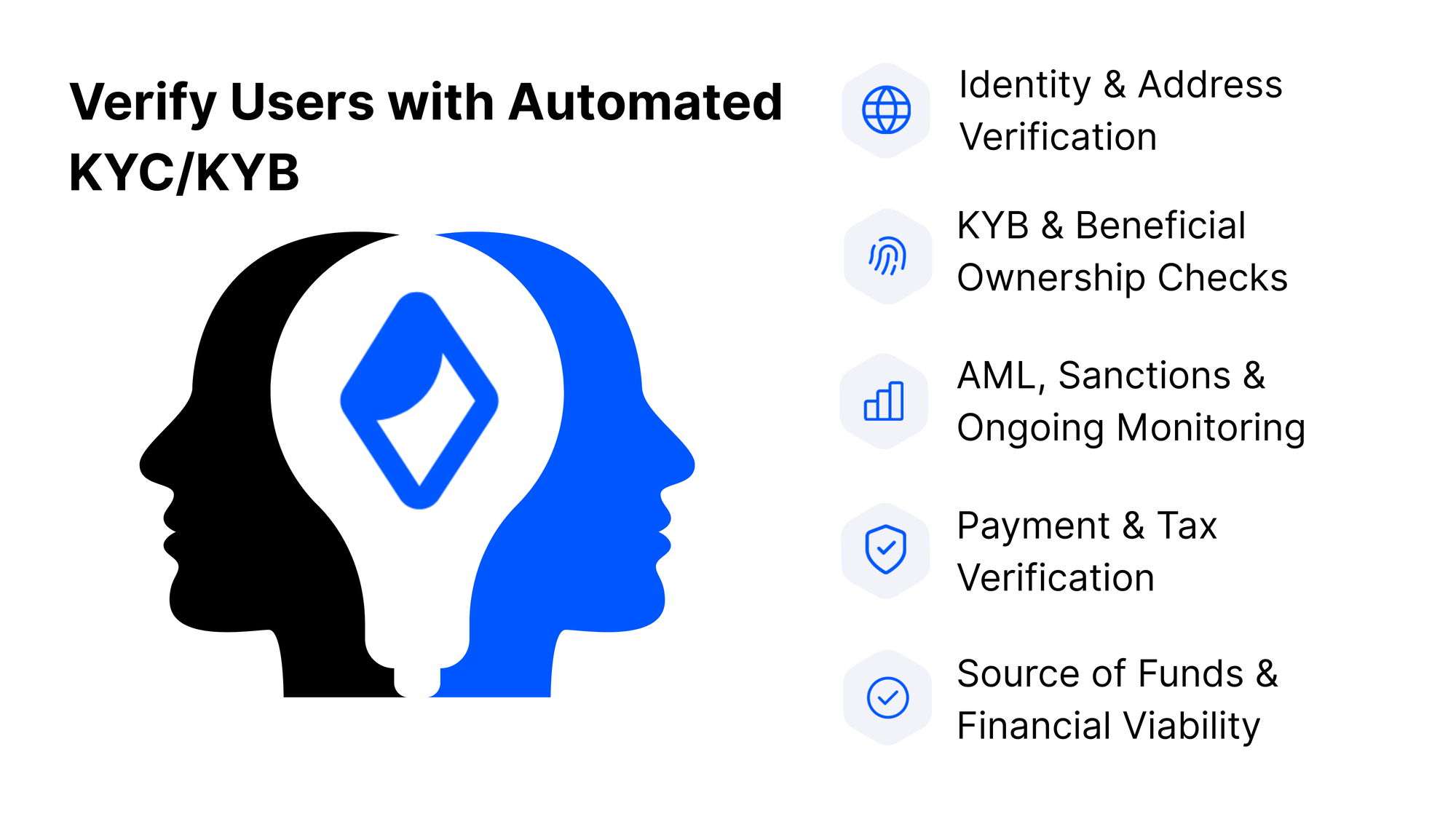

Automate Identity Verification and Monitoring

Modern KYC platforms for VASPs go far beyond manual checks. They embed a fully automated verification flow that aligns with regulatory requirements, allowing businesses to verify addresses and payment methods, conduct biometric face‑matching and document authenticity checks, confirm proof of funds and even assess company structures and ultimate beneficial owners in one seamless process.

Training Compliance Teams & Regular Audits

Human expertise remains critical. Modern regulatory frameworks demand not only compliance tools but also continuous training for professionals. Сompliance Officers, Analysts, and Investigators must stay up to date with evolving laws, sanctions regimes, and financial crime techniques. Investing in professional development and third‑party assessments mitigates the risk of non‑compliance and fosters a culture of diligence.

AML Fundamentals for Crypto Business Training & Certification

The AML Fundamentals for Crypto Business Training & Certification equips specialists with a solid foundation in Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) tailored to the crypto industry.

Participants gain practical knowledge of AML Standards, Customer Due Diligence, Transaction Monitoring, Sanctions Screening, and Blockchain Analytics. By completing this course, professionals will: strengthen their ability to detect and mitigate financial crime risks specific to cryptocurrencies; build confidence in applying AML frameworks and regulatory requirements to day-to-day compliance operations; and develop skills valued by regulators and employers, demonstrating a proactive approach to compliance and internal expertise building.

How AMLBot Stands Out Among Crypto KYC Providers

Global Coverage for VASPs

One of AMLBot’s strengths is its global coverage. The platform incorporates regulatory rules from the US, EU, UK, Asia, and the UAE, allowing VASPs to scale across borders. This global perspective means that exchanges do not need separate systems for each market; AMLBot’s unified interface adapts to local regulation while following FATF standards. The service provides customized risk scoring based on multiple data sources, ensuring that providers remain audit-ready. By covering diverse jurisdictions, AMLBot helps VASPs meet Crypto KYC Requirements worldwide.

One‑Stop Compliance (KYT Transaction Monitoring, KYC/KYB Verification, Blockchain Analytics Tool, AML Training, etc.)

AMLBot is more than a KYC provider. It offers a full suite of AML solutions. These capabilities allow businesses to rely on a single provider for all their compliance needs. For VASPs seeking a competitive edge, having a one‑stop compliance solution allows them to focus on building innovative services while remaining secure and compliant.

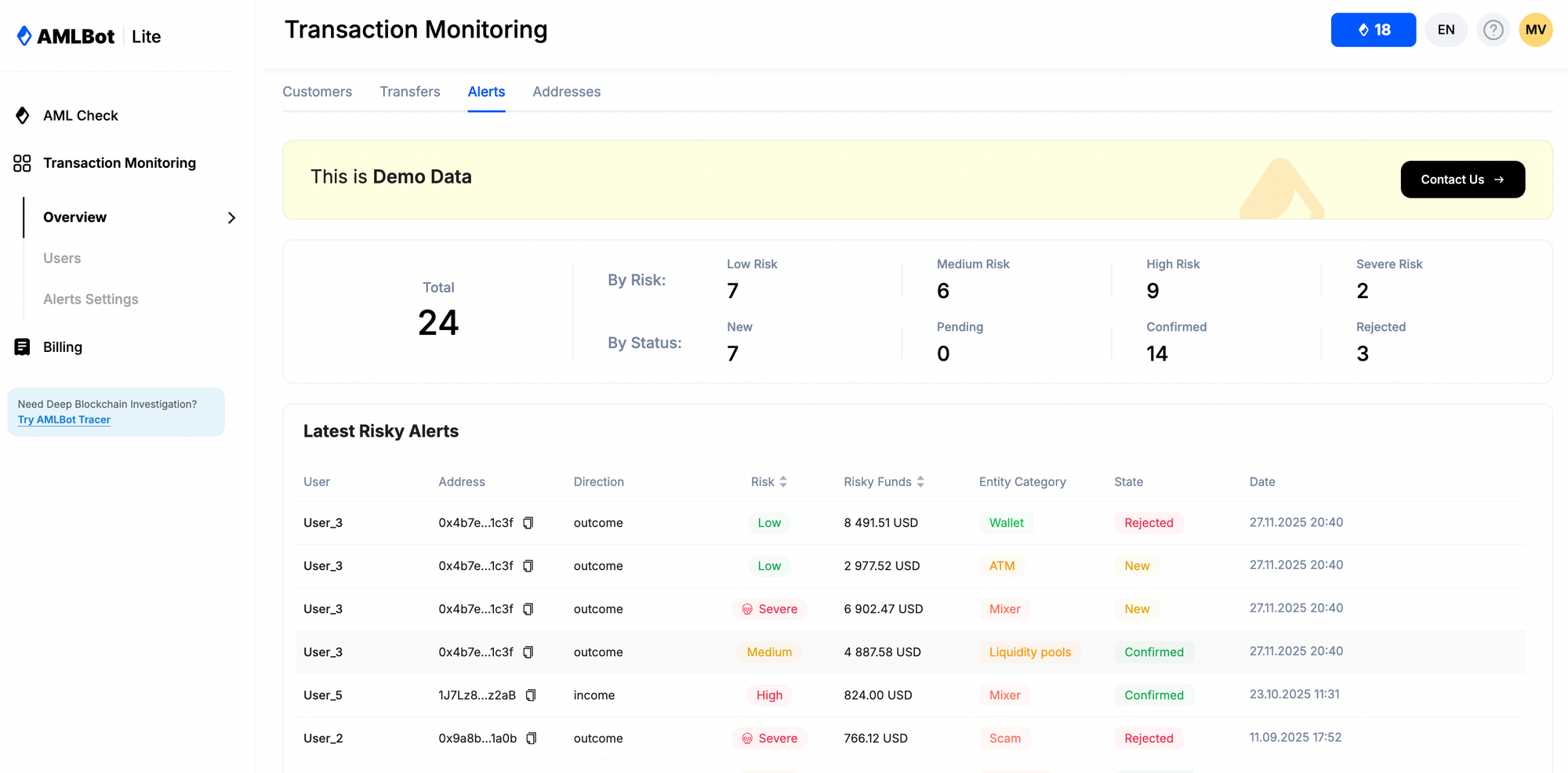

Real-Time Transaction Monitoring & Risk Alerts

It is a comprehensive Know Your Transaction (KYT) solution designed to provide continuous, automated oversight of cryptocurrency transactions across multiple blockchain networks. This system operates around the clock to flag high-risk transactions the moment they occur and ensures that suspicious activities are detected instantly without requiring manual oversight from compliance teams.

The platform uses advanced risk intelligence to continuously reassess transaction data. It employs automated re-checks that use the latest threat databases to identify new risks. So, even transactions that were initially deemed safe can be flagged if they later become associated with suspicious entities or activities. It also supports major blockchain networks including Bitcoin, Ethereum, Solana, BNB Chain, and others. The monitoring solution connects to multiple government-initiated databases maintained by national agencies and coordinated globally with various industry players.

Additionally, the platform features customizable risk thresholds, allowing organizations to set their own parameters and receive alerts precisely when needed.

Central to the system is an Compliance Dashboard that consolidates everything from user profiles to transaction histories and alert statistics into a single, comprehensive interface. The dashboard allows users to track customer activity, transfers, and alerts in one location, making it easy to spot patterns and refine compliance strategy.

KYC/KYB API for Seamless Integration

KYC/KYB Verification by AMLBot is an automated identity verification solution designed to make the onboarding of customers easier while ensuring full compliance with regulations.

The system conducts comprehensive verification procedures including address verification, payment method validation, facial recognition checks, personal document authentication, and proof of funds. The verification system can process over 4,000 different document types from 240 countries worldwide, allowing businesses to onboard customers from virtually any location. Additionally, the solution operates under safety standards, backed by ISO certification and regular security audits to maintain the highest levels of data protection and operational integrity. The platform holds certification from the European Institute of Management and Finance.

The platform offers flexible conditions and an individualized approach to meet specific business requirements. Through direct consultation, the service can be customized to fit unique operational needs, tailored to particular compliance obligations and customer demographics.

Blockchain Analytics Tool (AMLBot Tracer)

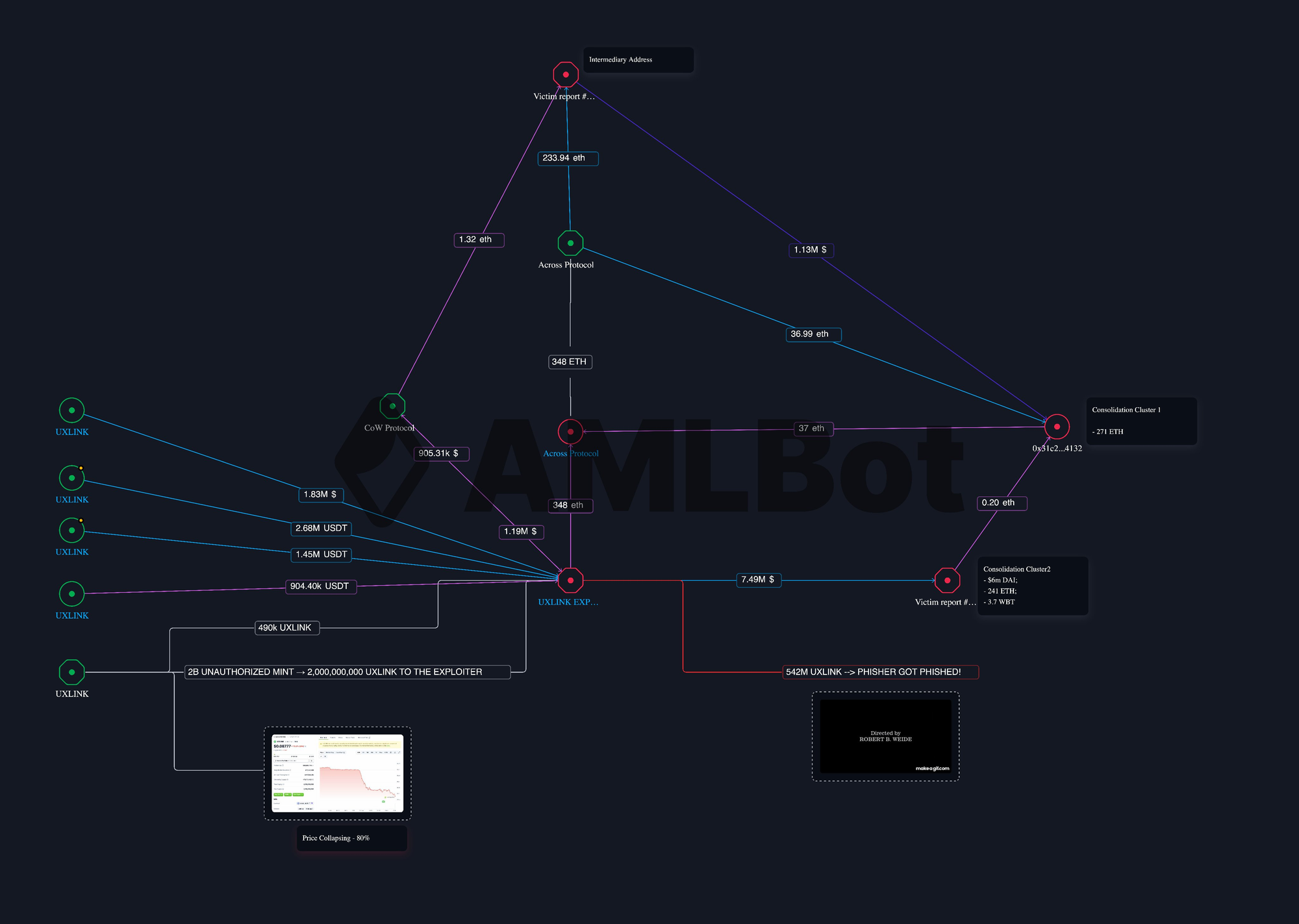

AMLBot Tracer is a blockchain analytics tool created to empower investigators and compliance teams with comprehensive on-chain intelligence capabilities. It integrates multiple top-tier databases from leading AML providers alongside its intelligence database, creating deep analytical resources available in the market.

It also supports a wide range of popular blockchain networks and continuously expands its coverage to include emerging technologies, so investigators can track transactions across various blockchain infrastructures effectively. The system provides clear data visualizations that allow professionals to interpret complex transaction patterns and relationships. The analytics tool connect cryptocurrency addresses and transactions to verified real-world entities such as exchanges, OTC desks, darknet markets, and other identified services.

Investigators can build detailed reports and documentation based on AMLBot Tracer information, that can support legal proceedings, regulatory submissions, and internal compliance reviews.

Crypto Recovery and Blockchain Investigation

It is a specialized professional service created to help victims of cryptocurrency theft locate and potentially recover stolen digital assets through comprehensive blockchain forensics and strategic intervention processes. It combines advanced blockchain investigation techniques with legal expertise to maximize the chances of asset recovery while providing victims with clear insights into what happened to their funds.

The forensic team provides clear documentation of fund movements that can be used for legal proceedings and regulatory submissions. When stolen funds are traced to centralized exchanges or other compliant service providers, the team actively communicates with these platforms to request immediate freezing of the compromised assets. This response capability is crucial for preventing further movement of stolen funds and creating opportunities for recovery before criminals can successfully launder or cash out the proceeds.

The service includes comprehensive legal support and guidance for victims navigating the complex process of cryptocurrency crime reporting. The team assists clients in preparing and submitting police reports, provides ongoing support throughout any subsequent investigation processes, including assistance with subpoenas and other legal procedures necessary for asset recovery.

Backed by membership in multiple industry organizations including INATBA, CDA, ATII, LSW3, EVA, and FTAHK, the service operates with professional credentials and industry recognition that demonstrate expertise and credibility in the cryptocurrency investigation and recovery space.

Discover How AMLBot Can Help Your Business Meet Global KYC Requirements And Simplify Compliance

Conclusion

By 2025, Crypto KYC Requirements have evolved from a basic formality into a framework for trust and transparency. Regulators across the EU, the US, the UK, Asia, and the UAE require rigorous identity verification, ongoing monitoring, and enhanced due diligence to combat financial crime. For VASPs, meeting these requirements is not optional. It is a prerequisite for operating legally and attracting customers. Compliance challenges abound, from navigating diverse regulations and striking a balance between user experience and security to managing false positives and rising costs. Adopting best practices — such as risk-based approaches, standardized procedures, and continuous training — is ESSENTIAl to stay ahead.