How to Recover Stolen Cryptocurrency: 5 Practical Steps

Few things are more stressful than discovering your digital funds are gone. A scam or theft in cryptocurrency can trigger panic, leaving every victim with one burning question: how to recover stolen cryptocurrency?

According to AMLBot’s data, monthly losses across different fraud categories show a clear trend: while centralized exchange breaches account for the largest single spikes, social engineering attacks such as phishing, impersonation, and investment scams remain the most persistent threats.

While no method guarantees full recovery, there are proven steps that raise your chances to recover. From spotting the first signs of stolen assets to involving legal services and using blockchain forensic services. Quick action is KEY.

In this guide, we will discover every step. From recognizing the theft and acting quickly, to contacting your exchange or wallet provider, reporting the theft to the authorities, using blockchain forensics to trace the funds, and finally coordinating with exchanges, law enforcement, and legal experts. Each of these actions builds upon the other to maximize your chances of recovering stolen cryptocurrency and protect your digital assets from future scams.

If you were affected by a crypto-related incident, please complete the form above to get immediate help.

Step 1 – Recognize the Theft and Act Quickly

When crypto goes missing, time is your most valuable asset. Hackers and scammers often move funds across multiple chains or mixers within hours, making recovery harder.

Signs Your Crypto Has Been Stolen

Before diving into the checklist, it helps to understand that stolen cryptocurrency often leaves noticeable traces. Victims of a crypto scam or wallet theft usually notice suspicious behavior across their accounts, and recognizing these early can significantly increase recovery chances. Detecting the theft, understanding the fraud patterns, and acting fast are all part of how to recover stolen cryptocurrency. Some of the most common red flags include: unexpected outgoing transactions in your wallet, access attempts from unknown devices or locations, password or recovery phrase changes you didn’t authorize, news of a scam or exchange hack affecting platforms you use.

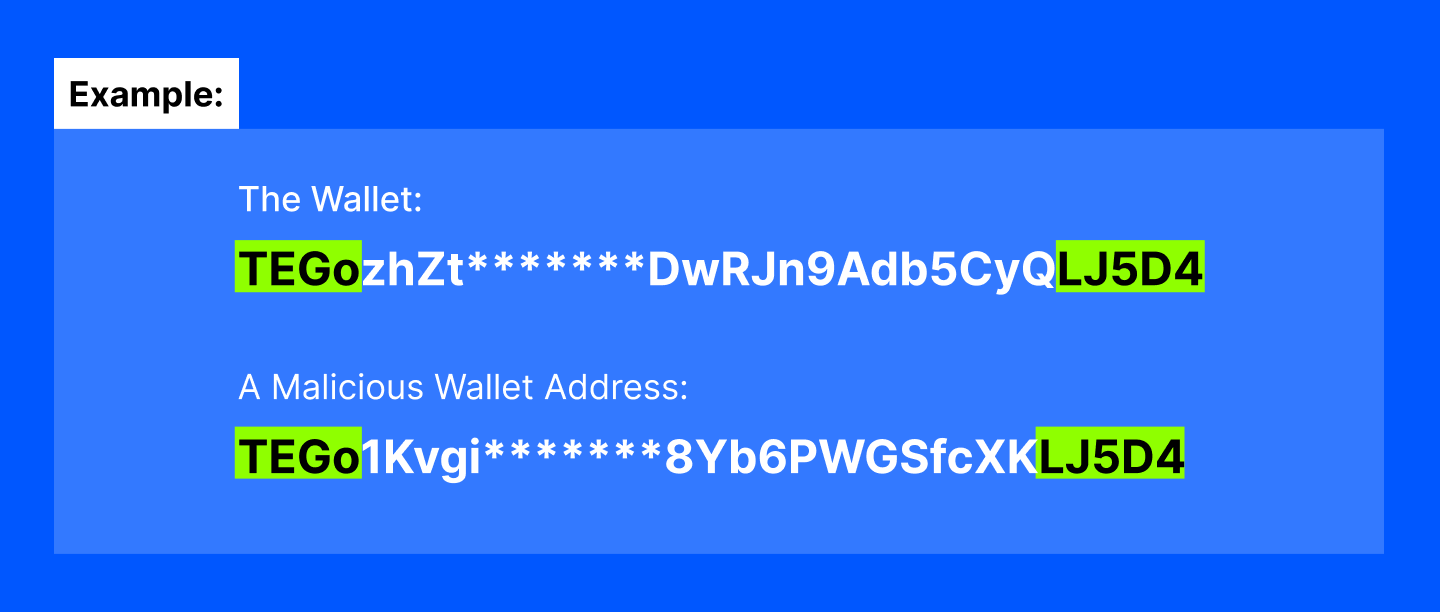

For example, earlier this year, a company fell victim to an address poisoning scam scheme. The scam exploited the company’s operational routine, targeting its treasury wallet and leveraging address similarities to divert funds to a malicious actor’s wallet.

This type of attack is especially difficult to spot in the early stages, as the fraudulent address looks almost identical to the real one, exploiting a moment of human inattention. However, the sooner such anomalies are noticed, the faster an investigation can begin, and in the crypto industry every hour matters when it comes to asset recovery.

How to Get Stolen Crypto Back: First Actions

If you suspect theft, immediately take these critical steps to improve your chances to recover stolen cryptocurrency:

- Stop Using the Compromised Device. Continuing to log in from a hacked phone or computer could expose even more of your wallet or assets to a scam.

- Record Suspicious Transactions. Save transaction hashes, times, and amounts. This information will help forensic services and legal authorities trace the stolen cryptocurrency.

- Secure Other Accounts Linked to Your Crypto. Update passwords, activate two‑factor authentication, and review linked emails to protect against further theft.

- Begin Documenting Everything. Keep detailed notes and screenshots. This will later help forensic experts, police, and legal services build a strong case for recovery.

Step 2 – Contact Your Exchange or Wallet Provider

Before moving to authorities, your first line of defense after recognizing a scam or theft is to reach out to the exchange or wallet service directly. Quick reporting of stolen cryptocurrency can help exchanges trace funds, freeze suspicious accounts, and sometimes even recover assets for the victim. This step is critical in how to recover stolen cryptocurrency because service providers often cooperate with legal teams and forensic experts.

Can You Recover Stolen Crypto Through Exchanges?

In many cases, yes — if you act fast. Centralized platforms sometimes freeze funds linked to scams or stolen cryptocurrency. The sooner you notify customer support, the better the chance. You must provide: transaction hashes, timestamps, and screenshots. Even if the service can’t guarantee recovery, reporting theft may trigger an internal investigation or fraud insurance review. If your provider is offshore or unregulated, recovery becomes harder—making this step even more urgent.

Step 3 – Report the Theft to Authorities

Reporting stolen cryptocurrency is not just about seeking justice. It is a practical step that connects the victim to official legal structures, cybercrime services, and global investigators. Creating a case file ensures that the theft is registered, scams are tracked, and victims gain access to help from authorities who are increasingly experienced in dealing with digital asset crime.

Can Stolen Crypto Be Recovered with Police Help?

Many victims skip this step, but it’s essential. Filing an official complaint makes the case legal, adds credibility, and often helps unlock cooperation between exchanges and investigators. Police reports not only document the theft of digital assets but also show that the victim is serious about pursuing justice. This step can also help connect individual cases of stolen cryptocurrency to larger organized crime investigations.

In 2025, authorities worldwide are taking crypto scams more seriously. The FBI, Europol, and specialized cybercrime units have successfully helped recover stolen cryptocurrency in several cases, from large exchange hacks to personal wallet theft. Such cooperation often requires coordination between multiple services—forensic experts, legal teams, and financial investigators—to trace and eventually recover stolen assets.

Even if your case is small, reporting creates a paper trail that could connect to larger investigations, ensure that scams are tracked, and provide the foundation for legal action that might one day help you recover your funds.

Step 4 – Use Blockchain Forensics to Trace the Funds

Blockchain forensics has become one of the most effective tools for victims of crypto scams and wallet theft who want to recover stolen cryptocurrency. Unlike traditional finance, every transaction on the blockchain is recorded permanently, which means professional services can analyze the path of stolen assets, even when criminals try to hide behind mixers, cross-chain bridges, or complex DeFi protocols.

However, conducting this type of investigation on your own is almost impossible without advanced expertise and access to professional tools. That’s why victims are strongly advised to work with specialized firms such as AMLBot, which provides dedicated support in tracing stolen funds, building evidence, and assisting with law enforcement requests. Adding this step into your recovery process ensures that legal authorities and exchanges have strong, verifiable data to act upon — significantly increasing the chances of a successful outcome.

Is It Possible to Recover Stolen Crypto with Forensics?

Yes. The advantage of cryptocurrency is transparency. Every transaction leaves a digital trace. So, forensic services use advanced tools like clustering, network mapping, and transaction graph analysis to follow the money. With AI-powered scams rising 456% between 2024–2025, forensic experts are also constantly upgrading methods to track stolen funds across mixers, cross-chain bridges, and DeFi protocols.

A Good Forensic Service Can:

- Map Stolen Transactions

- Identify Addresses Controlled by Bad Actors

- Provide Evidence to Law Enforcement and Exchanges

- Support Legal Claims in Court

While success rates vary, professional help can dramatically improve recovery chances.

Step 5 – Coordinate with Exchanges, Law Enforcement and Legal Experts

When crypto is stolen, no single action is usually enough. Victims often need combined help from exchanges, forensic services, and legal authorities to maximize the chance of recovery. Coordination ensures that frozen funds, investigative leads, and court‑ready evidence are aligned into one strategy that addresses the theft as a whole.

Why Coordination Is Key in Crypto Recovery

The final step in how to recover stolen cryptocurrency is COLLABORATION. Rarely can one party solve the case alone.

Recovery typically requires: exchanges freezing suspicious funds, law enforcement pursuing the criminals, legal services protecting the victim’s rights and handling tax or restitution issues, forensics providers supplying data and evidence. By aligning all sides, you move from being a passive victim to actively increasing your chances to recover.

Start Your Recovery Today

Recovering stolen digital assets is never easy, but there is a roadmap. From spotting the first signs of theft to working with forensic experts and legal services, you now know how to recover stolen cryptocurrency in 5 practical steps. Recovery is not guaranteed, but in 2025, more cases are being solved thanks to global cooperation and stronger forensic tools. The key is speed, persistence, and involving the right help.

If you have fallen victim to cryptocurrency theft, fraud, or a scam, taking immediate action significantly improves your chances to recover. AMLBot’s Crypto Recovery Service provides the expertise, legal support, and forensic resources necessary to trace stolen assets, engage with exchanges, and coordinate with authorities for a potential return of your funds.