FATF Crypto Travel Rule Explained: What It Is and How It Applies to Crypto

Crypto businesses often search for “crypto travel rule” and “FATF Travel Rule” because they need a single, authoritative baseline for the global standard before they begin mapping anything to a specific jurisdiction. The (FATF) explains that its Standards comprise the Recommendations, their Interpretive Notes (page 31), and the applicable Glossary Definitions (page 125), and that countries should adapt implementation to their circumstances. This article is a legal-style, definition-level foundation: it explains the Travel Rule as a FATF standard, why crypto came into scope, which business models are primarily targeted, and what information is expected to “travel” with an intermediated transfer. It intentionally avoids jurisdiction-specific rules, technical data formats, and step-by-step compliance checklists, because FATF sets the global baseline while countries implement it locally.

What Is the FATF Crypto Travel Rule?

In plain terms, the Travel Rule is FATF’s payment-transparency expectation: identifying information about the parties to a transfer should not be lost as value moves through regulated intermediaries.

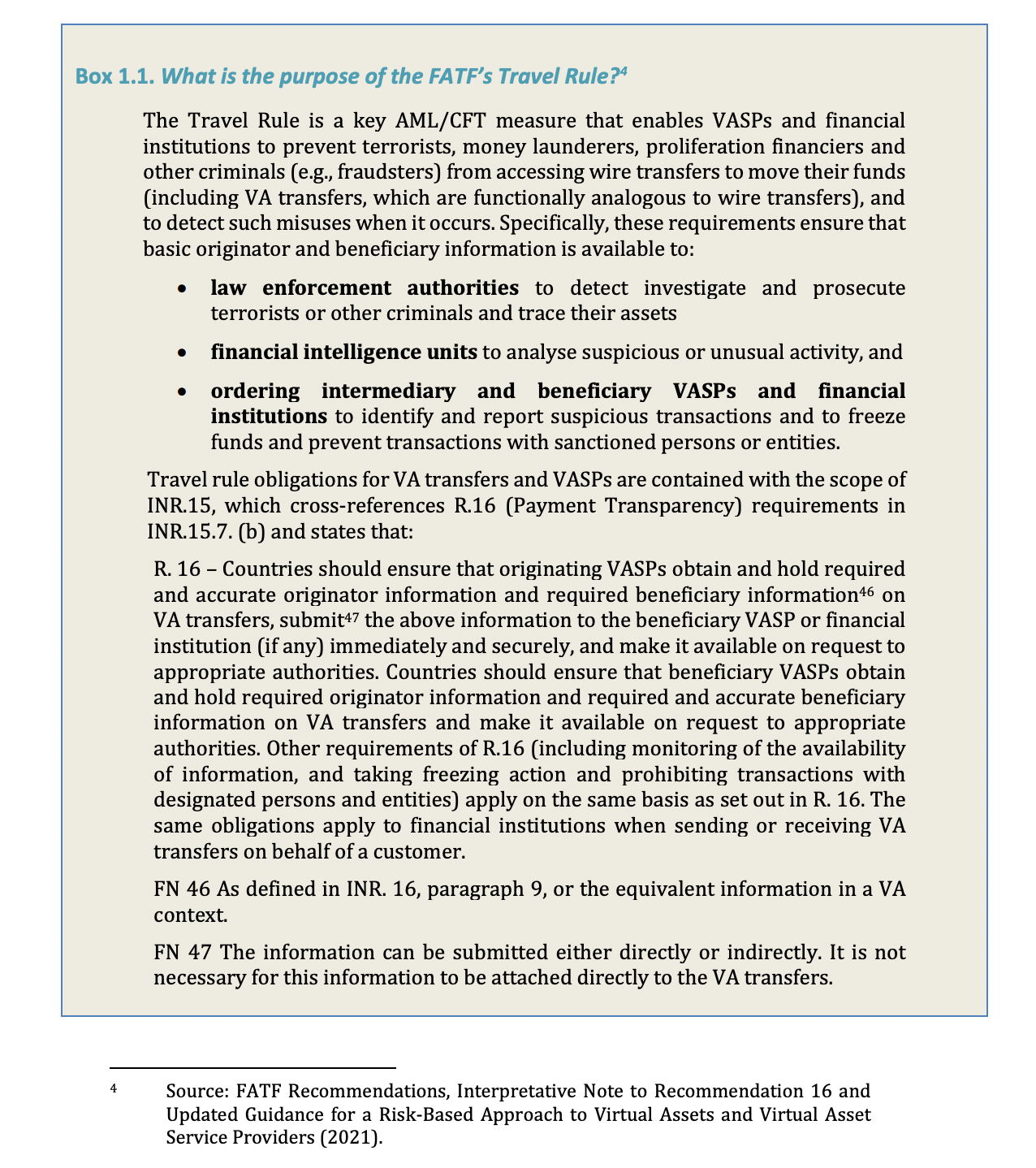

In the crypto context, the FATF Crypto Travel Rule applies that payment-transparency logic to virtual asset transfers conducted by virtual asset service providers (VASPs), primarily through Recommendation 15 (New Technologies) and its Interpretive Note, in conjunction with Recommendation 16 (Payment Transparency).

External authoritative source: FATF Recommendation 15 and the FATF Guidance on Virtual Assets.

A core duty for virtual asset transfers is stated directly in the FATF Recommendations:

“Countries should ensure that originating VASPs obtain and hold required and accurate originator information and required beneficiary information … on virtual asset transfers.”

FATF also defines the core term “Virtual Asset” in its Glossary:

“A virtual asset is a digital representation of value that can be digitally traded, or transferred, and can be used for payment or investment purposes.”

page 140-141

In simple terms: when a regulated crypto intermediary transfers virtual assets on behalf of a customer to another regulated intermediary, the sending side is expected to obtain and keep required originator (Sender) information and required beneficiary (Recipient) information and to ensure that the receiving side gets the relevant identifying information in a timely, secure way. This is the “information travels with the transaction” concept, implemented at the intermediary layer rather than “written into” a blockchain. This standard is not a single worldwide statute. FATF states that countries adapt the implementation of the Recommendations to their own circumstances, and FATF monitors implementation through its monitoring and assessment tools.

Why the FATF Introduced the Travel Rule for Cryptocurrency

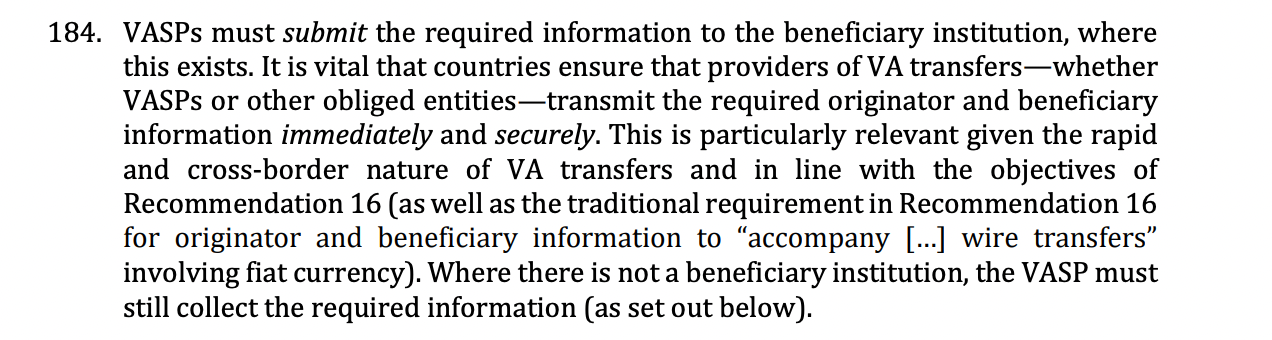

FATF’s framework is risk-based. It expects countries and obliged entities to identify and mitigate Money-Laundering and Terrorist Financing risks proportionately. FATF describes the risk-based approach as the “cornerstone” of its Recommendations. Crypto made transparency harder because virtual asset transfers can be rapid, cross-border, and executed using pseudonymous identifiers, which can reduce basic counterparty visibility if intermediaries do not share identifying information.

FATF explicitly links “immediately and securely” transmission to “the rapid and cross-border nature of VA transfers.” FATF also explains why the standards were clarified: in October 2018, FATF amended its Recommendations to clarify they apply to virtual asset activities and added definitions for “Virtual Asset” and “Virtual Asset Service Provider”; in June 2019, FATF adopted an Interpretive Note to Recommendation 15 to clarify how requirements apply to VAs and VASPs. From a market-design perspective, the FATF examines stablecoins and Peer-to-Peer (P2P) activity because they affect where intermediaries are located. FATF notes that stablecoins aim to reduce volatility and may facilitate payments and transfers, and defines P2P transactions as transfers conducted without the involvement of a VASP or other obliged entity (for example, between two unhosted wallets where users act on their own behalf).

Simply put, “FATF Travel Rule cryptocurrency” is about preserving basic identification and traceability when intermediaries are involved, even though the underlying asset layer can be borderless and fast.

Who Must Comply With the Travel Rule Under FATF Standards

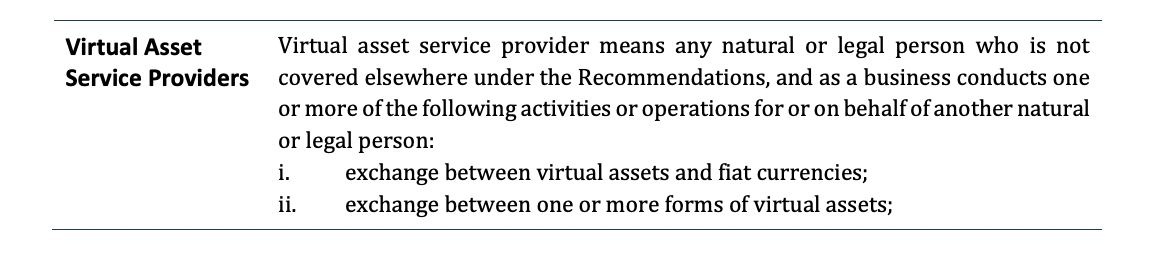

The scope question “who must comply with FATF Travel Rule” is usually answered by determining whether a business is a VASP under FATF’s functional definition.

FATF defines a VASP as a person or company that, “as a business”, conducts certain activities “for or on behalf of another” person, including exchange and transfer.

“Virtual asset service provider means any natural or legal person … and as a business conducts one or more of the following activities … for or on behalf of another … person.”

So, if your business takes custody of customers’ virtual assets, exchanges them, or transfers them as a service, FATF expects countries to regulate and supervise you for AML/CFT purposes (subject to local implementation). In practice, this typically captures custodial exchanges, custodial wallet providers and custodians, and brokers/dealers facilitating customer transfers.

The related scope question—“Who Does the Crypto Travel Rule Apply To”—is answered by FATF’s structural choice: the Standards generally place obligations on intermediaries rather than on individuals. FATF states that Peer-to-Peer transfers without involvement of a VASP or other obliged entity are not explicitly subject to AML/CFT controls under the FATF Standards for that reason.

In practice? The virtual asset service provider travel rule is primarily triggered when a regulated intermediary sends or receives a transfer on behalf of a customer. How jurisdictions treat interaction points with unhosted wallets can vary, but the baseline logic is intermediary-focused.

What Information Does the Crypto Travel Rule Require to Be Shared

Conceptually, the Travel Rule requires two categories of information to be handled by intermediaries:

- originator (Sender) information; and

- beneficiary (Recipient) information.

FATF’s standards require the originating VASP to submit relevant information to the beneficiary VASP or financial institution “immediately and securely” and make it available to competent authorities on request. A key legal clarification is that the required information does not need to be embedded in blockchain data.

FATF states:

“The information can be submitted either directly or indirectly. It is not necessary for this information to be attached directly to the VA transfers.” FATF’s Updated Guidance explains the same idea in timing terms: post-transfer submission should not be permitted, and submission “must occur before or when the VA transfer is conducted.”

In Travel Rule crypto discussions, “information travels with the transaction” means VASPs exchange the required identifying data at the time of transfer, even if the blockchain itself only records addresses and transaction metadata. FATF characterizes this approach as technology-neutral, so it does not mandate publishing personal data on-chain.

How the FATF Travel Rule Applies to Cryptocurrency Transactions

FATF applies obligations based on function (transfer/exchange/custody for customers), not on token branding. FATF explicitly notes that its standards cover both “virtual-to-virtual and virtual-to-fiat transactions.”

This is why the Travel Rule matters for mainstream crypto-assets—including Bitcoin and stablecoins—when a VASP transfers them on a customer's behalf to or from another intermediary.

A practical way to think about the Bitcoin Travel Rule is not “writing identities onto the Bitcoin blockchain,” but understanding what regulated intermediaries must know and transmit when they move Bitcoin for customers. FATF states that required information “need not be communicated as part of (or incorporated into) the transfer on the blockchain or other DLT platform itself.”

The Travel Rule is an off-chain transparency expectation between regulated service providers, intended to keep counterparties identifiable even when transfers are global and fast.

Travel Rule and AML Compliance for Crypto Companies

The Travel Rule is part of a broader AML/CFT control framework. FATF’s virtual asset materials state that VASPs should implement preventive measures similar to those in traditional finance (such as due diligence, recordkeeping, and suspicious transaction reporting) and should “obtain, hold and securely transmit originator and beneficiary information when making transfers.”

Travel Rule AML supports other AML controls by ensuring the receiving intermediary is not “blind” to who initiated the transfer and to whom it should be sent. FATF’s Best Practices in Travel Rule Supervision frames Travel Rule obligations and supervisory expectations as part of how jurisdictions ensure that VASPs can meet their standards-based duties.

In semantic terms, “crypto travel rule AML” is where teams usually move from “definition” to “operational reality.” This page stays foundational, but a deeper discussion of non-technical hurdles is available in Travel Rule Implementation Challenges.

How the FATF Travel Rule Is Implemented Across Different Jurisdictions

FATF sets the global standard. Countries implement it locally. FATF states that countries adapt implementation to their legal and operational circumstances, which is why the same global Travel Rule concept can translate into different legal rules, supervisory expectations, and compliance testing approaches across markets.

FATF also tracks implementation progress and challenges through its targeted updates on virtual assets and VASPs. Its 2025 Targeted Update states that it covers “global implementation of R.15, including the Travel Rule,” assesses technical compliance, outlines challenges, and highlights best practices.

The FATF crypto travel rule is globally recognizable, but practical rollout and supervisory expectations differ across jurisdictions—so crypto firms should treat “one-size-fits-all” assumptions as risky.

Global Standard, Local Implementation (High-Level Only)

As noted earlier, FATF serves as a global standard setter rather than a law-making authority. Its Recommendations establish a common international framework for combating money laundering and terrorist financing, including how transparency obligations apply to virtual asset transfers.

However, FATF does not directly regulate crypto companies. Instead, individual countries and regions translate FATF standards into domestic laws, supervisory expectations, and enforcement practices according to their own legal systems and risk environments.

In practice, the FATF Crypto Travel Rule provides a globally recognized foundation, but how companies must operate under it ultimately depends on how local regulators implement those standards. As a result, compliance expectations may appear similar in principle across markets, while differing in legal structures, reporting mechanisms, or supervisory approaches.

Regional Examples (High-Level Only)

Across Europe, regional legislation and supervisory frameworks determine how Travel Rule obligations are implemented for regulated crypto intermediaries. While the FATF standard forms the foundation, practical requirements are shaped at the regional and national levels.

In the United States, domestic financial crime and money-transmission regulations similarly adapt FATF standards into enforceable requirements for relevant service providers. Implementation details differ from other jurisdictions, but the underlying objective remains consistent with the FATF framework.

Key Challenges Crypto Companies Face With the Travel Rule

FATF highlights recurring practical issues: interoperability between counterparties, fragmented tooling, and secure exchange of sensitive data across firms at different stages of implementation.

So, Travel Rule is a multi-party problem—your ability to meet obligations depends on whether counterparties can reliably exchange the required information. For more context, see Travel Rule Implementation Challenges.

Conclusion: From FATF Standards to Practical Compliance

The FATF Crypto Travel Rule is FATF’s application of payment transparency to intermediated virtual asset transfers: originator and beneficiary information is expected to travel between regulated service providers when crypto is transferred on behalf of customers.

Because FATF standards are implemented locally, obligations in practice differ across jurisdictions—and compliance should be treated as an ongoing process rather than a one-time project.

Finally, Travel Rule AML controls typically sit alongside broader monitoring and risk management, such as KYT/AML Monitoring.

-AMLBot Team

Follow AMLBot:

🔗 Website

🔗 Telegram

🔗 Support Team

🔗 LinkedIn

What Is the FATF Crypto Travel Rule?

The FATF Crypto Travel Rule is a global Anti-Money Laundering standard requiring identifying information about both the originator and beneficiary to accompany certain virtual asset transfers between regulated service providers. In practice, this means identifying data must “travel” together with qualifying crypto transfers conducted through intermediaries.

Who Introduced the Crypto Travel Rule for Cryptocurrency Transactions?

The Crypto Travel Rule for virtual asset transfers was introduced by the Financial Action Task Force (FATF) as part of its global standards for virtual asset service providers. FATF clarified that payment transparency principles used in traditional finance should also apply to regulated crypto transfers.

Is the FATF Crypto Travel Rule a Law or a Regulation?

The FATF Crypto Travel Rule itself is not a law. It is an international standard that becomes legally binding only after individual jurisdictions implement FATF recommendations through domestic legislation or regulation.

Which Crypto Businesses Must Comply With the FATF Travel Rule?

Under the FATF Travel Rule, compliance obligations primarily apply to Virtual Asset Service Providers (VASPs), including crypto exchanges, custodial wallet providers, brokers, and other intermediaries conducting transfers on behalf of customers.

Does the FATF's Travel Rule Apply to All Crypto Transactions?

The FATF Travel Rule does not apply to all crypto transactions. It mainly covers transfers conducted through regulated intermediaries, while peer-to-peer transfers between private wallets without service providers generally fall outside the core intermediary model.

What Information Must Be Shared Under the Crypto Travel Rule?

Under the Crypto Travel Rule, basic identifying information about both the transaction originator and the beneficiary must accompany qualifying virtual asset transfers between intermediaries to support transparency and traceability.

How Does the FATF's Travel Rule Relate to AML Compliance?

The FATF Travel Rule forms part of broader anti-money laundering and counter-terrorist financing (AML/CFT) frameworks by improving transaction transparency and helping compliance teams identify parties involved in cross-border crypto transfers.

Does the FATF Crypto Travel Rule Apply to Non-Custodial Wallets?

The FATF Crypto Travel Rule primarily targets regulated intermediaries rather than private wallets, although how transfers involving non-custodial or unhosted wallets are handled depends on how jurisdictions interpret and implement FATF standards.

Is the FATF's Travel Rule Implemented the Same Way in Every Country?

The FATF Travel Rule establishes a global standard, but implementation differs across jurisdictions because each country adapts FATF recommendations into its own regulatory and supervisory framework.

Why Is the FATF's Travel Rule Important for Cross-Border Crypto Transfers?

The FATF Travel Rule is particularly relevant for cross-border crypto transfers because virtual asset transactions can move rapidly between jurisdictions, and transmitting originator and beneficiary information helps regulators and compliance teams track financial flows across borders.