How to Avoid AML And KYC Penalties and Fines

Financing criminal operations and laundering their proceeds are events that take place often despite legislation present to prevent their occurrences. Criminals are finding gaps left while securing financial systems, using them to move illegal funds through. The flow of such funds ultimately ruins the integrity of the systems and institutions they touch.

As a result, regulators across jurisdictions are strengthening legislation to prevent such issues. These legislations, collectively called Anti-Money Laundering (AML) legislations, dictate practices that financial institutions and businesses need to adopt to curb the entry and movement of crime-associated funds.

The ensuing structures financial entities adopt to keep criminal funds away from their doorsteps responsibly are their AML frameworks. KYC is an element of all AML frameworks that looks at deriving all relevant information about customers and their ongoing financial practices. Businesses and institutions can understand their inclination towards risky behaviors through KYC procedures. If the customers are indulging in such behaviors, KYC allows for easy detection and reporting to end them.

Virtual Asset Service Providers (VASPs) must integrate relevant AML and KYC procedures into their operations per their regulator's requirements. Crypto assets face increased affinity towards illegal transactions. The senders and receivers of crypto transactions are revealed as wallet addresses on blockchains, allowing criminals to hide their identities behind alphanumeric characters that are the wallet addresses.

Consequently, there is increased attention from regulators toward the operations of VASPs. Failure to prevent criminal activities or turning a blind eye to them can land VASPs in the crosshairs of regulatory action. Fines, jail time, and even sanctions and closures of platforms can be the outcomes. VASPs can also lose user trust and witness a decline in their reputations from not complying with AML and KYC mandates.

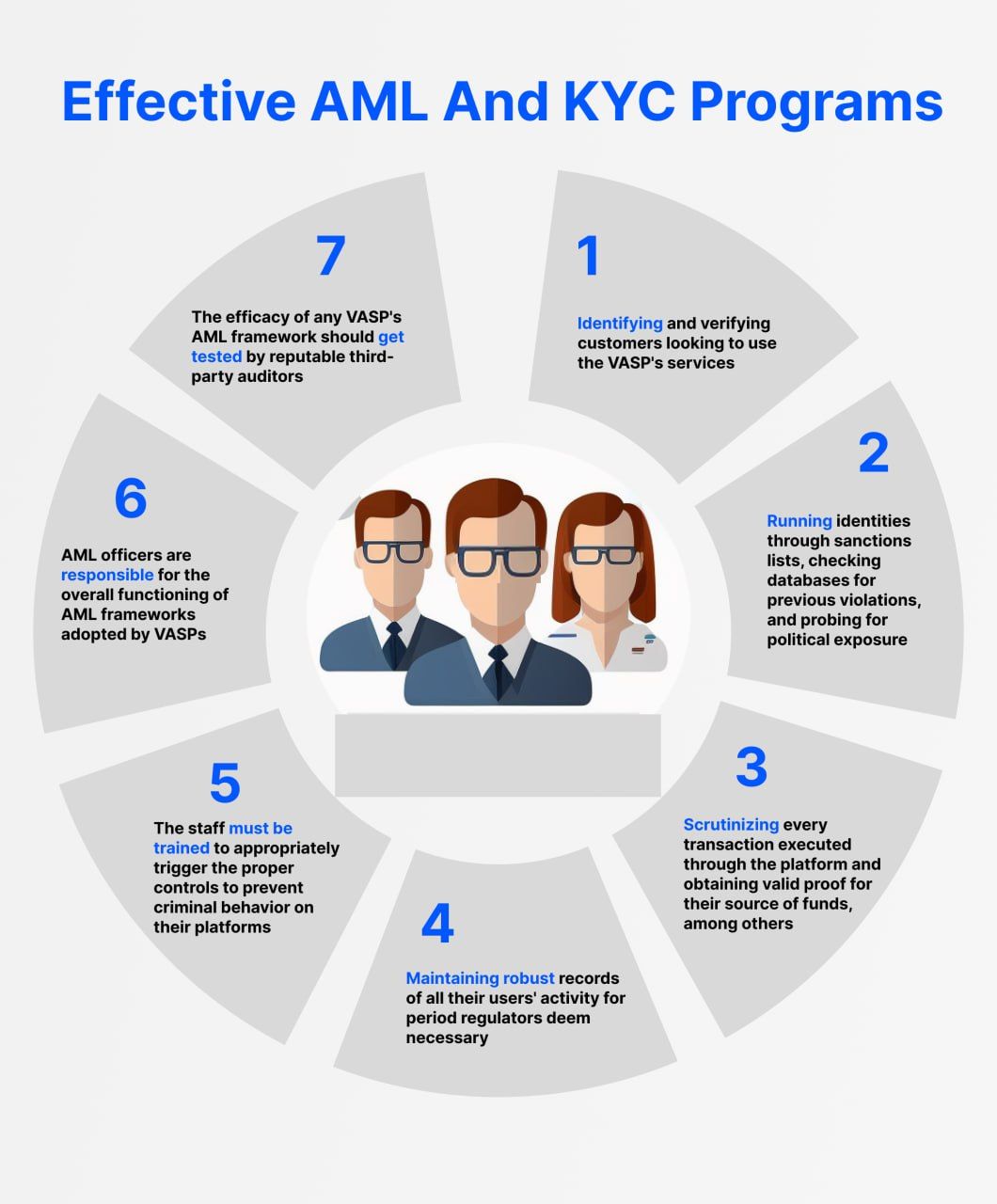

Effective AML And KYC Programs

VASPs are recommended to design and operate AML and KYC programs effectively enough to prevent criminal financial activity. A well-implemented AML and KYC program should include several components that keep VASPs ahead of criminals.

It begins with identifying and verifying customers looking to use the VASP's services. For identification purposes, government-issued IDs are the norm. Following that measures like video submissions and biometrics can be utilized to verify if users are truly who they say they are.

Knowing customer identities allows VASPs to assess the complete scope of risks they bring to the platforms. Running identities through sanctions lists, checking databases for previous violations, and probing for political exposure are ways of creating risk profiles for every customer.

Based on the risk customers bring, VASPs can monitor their activity accordingly. Those leaning toward the risky end of the spectrum need to be closely observed. That includes scrutinizing every transaction executed through the platform and obtaining valid proof for their source of funds, among others. Low-risk customers can be spared some of the stricter measures to save time and resources. However, ongoing monitoring is needed for all customers.

VASPs must maintain robust records of all their users' activity for period regulators deem necessary. This comes in handy during times of investigation of alleged bad actors. Moreover, it allows VASPs to identify shady patterns exhibited by their users, which must be informed to relevant authorities.

Pulling off such intricate measures always requires VASPs to maintain highly capable compliance teams headed by compliance officers. The staff must be trained to appropriately trigger the proper controls to prevent criminal behavior on their platforms. In addition, AML officers are responsible for the overall functioning of AML frameworks adopted by VASPs and adapting the frameworks to evolving regulations.

Furthermore, the efficacy of any VASP's AML framework should get tested by reputable third-party auditors. Identifying gaps that can lead to compliance issues must be plugged in immediately.

Common Compliance Challenges

VASPs can find themselves fighting battles to remain compliant because of factors like how cryptocurrency works, legislation trying to catch up with the asset class, and criminals being miles ahead with its usage.

A leading reason why certain VASPs need to catch up with compliance stems from the resources needed to create and maintain effective compliance programs.

Integrating the needed measures, conducting frequent audits, and finding and training staff can be time and money intensive. Crypto businesses just starting may need more resources to implement the needed regulatory measures.

Moreover, regulatory requirements can be intricate and nearly impossible to execute in practice fully. Couple that with their ever-evolving nature, and VASPs struggle to maintain continuous compliance. Furthermore, criminals looking to exploit the cryptocurrency system develop innovative strategies that VASPs and their frameworks remain oblivious to. Sometimes, the factors allowing criminals to move their funds on platforms remain outside the immediate control of the platform.

Overcoming Compliance Challenges

However, VASPs can invoke certain measures to keep themselves adequately shielded from criminals and remain compliant.

For instance, automated AML and KYC technology are taking over the compliance landscape. They can detect risky behavior and alert businesses faster than the human eye. Therefore, implementing software and scripts that benefit compliance frameworks can secure platforms from criminal funds.

Nevertheless, technology integration may need to be more resource effective for certain VASPs. Neither does getting involved with all the intricacies associated with AML requirements. In such instances, they can outsource their AML and KYC processes to vetted third-party firms specializing in the field. These firms are well-equipped to keep VASPs within compliance constraints and maneuver their frameworks with changing regulatory requirements.

The dynamic nature of AML regulations should be respected. The difficulties in staying compliant can be overcome by maintaining dialogue with other operators in the industry. Collective and collaborative knowledge can help VASPs take the right measures to remain within the bounds of compliance.

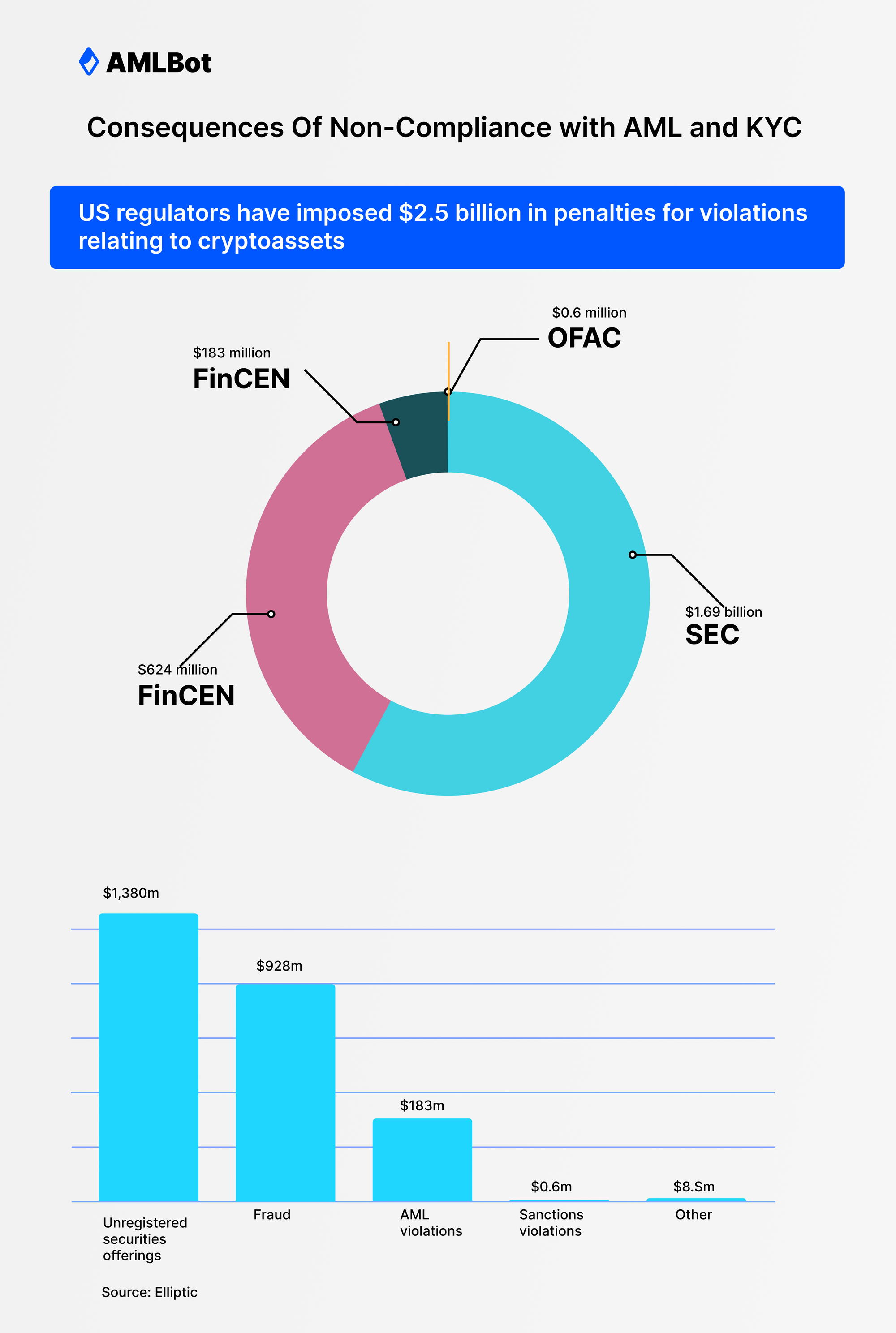

Consequences Of Non-Compliance

Compliance with AML legislation is very strict, as regulators always try to safeguard their financial systems from criminal activity. However, non-compliance is not taken lightly and can lead to legal and reputational damages for VASPs without effective AML programs.

For one, VASPs can get fined hefty amounts by regulators for failure to prevent money laundering or criminal financing. The consequences can go even further depending on the violation. VASPs blatantly allowing criminal funds to flow through can even get forced to shut down and the individuals responsible arrested.

Regulators in jurisdictions like the US are becoming the first to formulate some of crypto's most sturdy legislation. Its enforcement is especially stark as regulators are making examples of VASPs facilitating money laundering.

Helix

Not too long ago, FinCEN (Financial Crimes Enforcement, US Treasury), a US regulator, brought a massive civil lawsuit to the Helix platform. Helix was a cryptocurrency mixer that admittedly allowed the obfuscation of Bitcoin from darknet marketplaces. The regulator succeeded in suing the mixer for a tremendous $60 million in 2020. In a parallel case responsible for bringing the platform down, the US Department of Justice (DoJ) got Helix's founder, Larry Dean Harmon, to plead guilty to money laundering charges.

Tornado Cash

Tornado Cash, another crypto mixer, was sanctioned by a different US agency, OFAC (Office of Foreign Assets Control), in 2022 for being involved in illegal activities resembling Helix's. As a result, the use of the platform was made illegal despite it being decentralized and having no known owner.

The move comes when increased technological developments allow criminals to route illegal funds through the global financial system. Decentralized mixing and tumbling services use smart contract technology for their operations and need no centralized entity to facilitate their functioning – other than its creation. Moreover, the creators can remain unknown and avoid authorities' clutches while the service remains functional thanks to decentralization.

So, regulators are looking to curb every possible avenue that crypto can be used for criminal purposes. Jurisdictions like the UK and the EU also develop and enforce legislation around bleeding-edge blockchain developments like DeFi protocols and even stablecoin issuers. Conversely, the more traditional parts of the crypto world are fairly acquainted with the enforcement angle.

Bittrex

Bittrex, a centralized exchange, was the subject of regulatory enforcement by FinCEN and OFAC in late 2022. The exchange shelled out $24 million and $29 million to the agencies. It landed in hot waters with them because of negligent and purposeful violations of AML requirements. These instances caused it to violate the US Bank Secrecy Act.

With the heightened focus of regulators on the crypto industry, it is recommended that VASPs prioritize the effectiveness of their AML and KYC procedures. In situations where VASPs do commit misdemeanors and get a slap on the wrist, their reputations invariably get tarnished regardless. In addition, the trust levels of their users plummet when breaches in their AML and KYC procedures come to light.

Conclusion

Crypto AML and KYC legislation are becoming increasingly robust across jurisdictions. The moves align with increased criminal activity associated with the crypto asset class. Consequently, VASPs failing to adhere to national and international laws are witnessing drastic legal punitive action.

It is of utmost importance for VASPs to inculcate highly effective AML and KYC procedures into their compliance programs. By observing compliance, they can make the cryptocurrency landscape safer for everyone to use beyond avoiding regulatory action for themselves.

Despite the challenges faced with complying, VASPs can prevent facilitating the flow of criminal funds by adopting best practices, engaging the services of AML experts and firms, and tapping into other feasible resources. In addition, operating functional AML and KYC programs are now industry-wide norms being assisted by several reputational players and cutting-edge technology. Therefore, staying compliant is becoming achievable and not as nerve-racking as it seems.