How to Get a Crypto License for Your Business: A Complete Guide

Intro

In 2025, amid evolving regulations and stricter oversight, obtaining a crypto license may seem daunting for many businesses. However, securing the proper license is a vital step to ensure your crypto exchange or wallet service complies with all legal requirements, operates legally in your jurisdiction, and maintains customer trust.

In this complete guide, we explain what crypto licenses cover, what regulators require, and how exchanges and wallet providers can apply for authorization through a clear step-by-step process.

Keep reading to learn more about crypto licenses and how to successfully submit an application for your business. This guide focuses on global and national crypto licensing standards used across different jurisdictions.

What Is a Crypto License?

A cryptocurrency license (often called a Virtual Asset Service Provider, or VASP, license) is an official authorization that allows companies to legally facilitate cryptocurrency transactions, including exchanges, transfers, trading, and the custody of digital assets. The concept aligns with the international virtual asset guidelines issued by the Financial Action Task Force (FATF). Similar to a general business license that allows a company to operate in a region, a crypto license is focused on activities involving virtual assets such as Bitcoin, Ethereum, and other cryptocurrencies. Depending on the jurisdiction, a crypto license may cover custody, brokerage, exchange operations, ICO/ITO facilitation, or payment services involving digital assets. Having a crypto license means a business has met the regulatory requirements to operate in the crypto sector. Understanding how crypto licenses work is essential for all crypto businesses that want to avoid regulatory penalties or, in the worst case, forced shutdowns. As global regulatory standards continue to tighten in 2025, the definition and scope of crypto licenses have become more formalized and strictly enforced across multiple jurisdictions.

Who Oversees Crypto Licenses?

Regulation of the cryptocurrency industry is now well-established in many countries, but the responsible regulatory bodies and rules can vary widely by jurisdiction. In most cases, government financial regulators or financial intelligence units oversee crypto licensing. Some countries have national policies, while others defer to state or provincial authorities for certain approvals.

For example, in the United States, both federal and state regulators play a role. The U.S. Securities and Exchange Commission (SEC) oversees crypto assets that qualify as securities, requiring issuers and exchanges of such tokens to register with the SEC. Meanwhile, the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) treats crypto exchanges and payment providers as Money Service Businesses (MSBs) that must register at the federal level and implement strict AML programs. Individual U.S. states also have licensing requirements (for instance, the New York BitLicense) for crypto companies. Recent enforcement actions and public statements by regulators indicate a clear shift toward tighter control and unified oversight of crypto platforms in the U.S.

In the European Union, historically, each member state issued its own crypto licenses or registrations. However, the new Markets in Crypto-Assets (MiCA) regulation, approved in 2023 and set to come into effect by late 2024, introduces a harmonized EU-wide licensing framework. Under MiCA, crypto companies will be able to obtain a single CASP authorization (often dubbed the "MiCA license") valid across all 27 EU countries, replacing the patchwork of national regulations. This means exchanges and wallet providers can operate across the EU with a single license, greatly simplifying compliance.

On the global stage, international bodies also influence crypto licensing standards. The Financial Action Task Force (FATF) issues recommendations that many countries use as the basis for their crypto regulations. FATF Guidance encourages countries to license or register all crypto Virtual Asset Service Providers and to enforce AML/CFT controls on them. As a result, whether you’re in North America, Europe, or elsewhere, if you operate a crypto business, you will likely need to be authorized by a relevant regulator to legally offer services.

What Are the Requirements for a Crypto License?

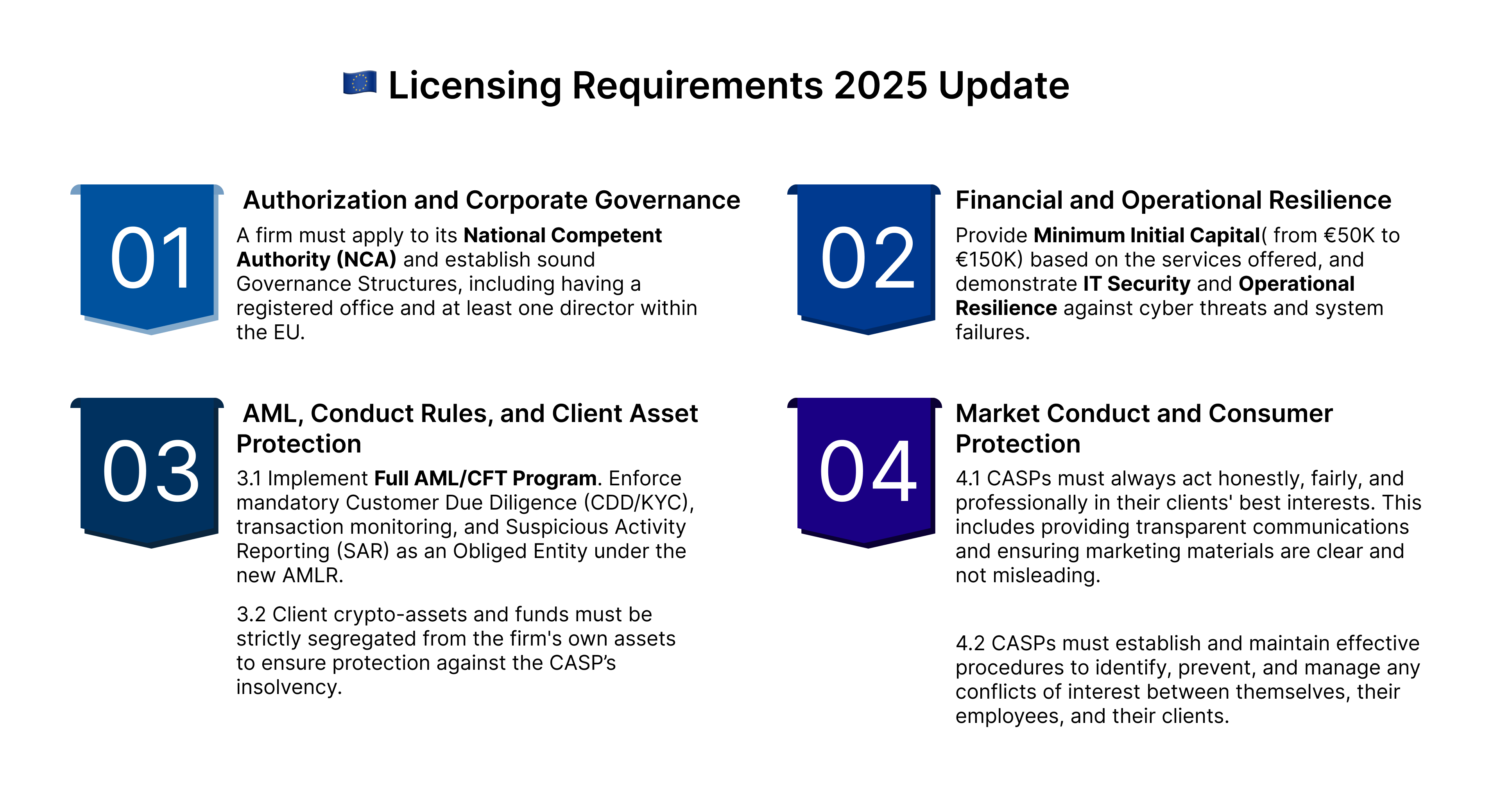

While specific requirements vary globally, the EU's implementation sets a high, harmonized standard for licensing. Each jurisdiction sets its own specific criteria for obtaining a crypto license, but there are shared foundational elements most regulators require.

In general, to qualify for a crypto license, your business must:

- Legal Entity & Governance. Establish A Legal Entity and apply for authorization to the National Competent Authority (NCA) of the home member state. Appoint qualified personnel who meet "fit and proper" criteria, including management and directors. MiCA specifically requires having at least one director and a registered office in the EU.

- Financial Integrity & Capital. Meet Minimum Capital Requirements. CASPs must maintain a minimum level of initial capital (€50k to €150k, depending on services) and satisfy ongoing prudential requirements to ensure financial stability. Client crypto-assets and funds must be strictly segregated from the CASP’s proprietary assets to protect users in the event of firm insolvency.

- AML/KYC Compliance. As "obliged entities", CASPs must implement comprehensive Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) programs, including mandatory Know Your Customer (KYC) procedures, enhanced Due Diligence, transaction monitoring, and Suspicious Activity Reporting (SAR).

- Operational and IT Resilience. Implement strong internal control mechanisms, audit procedures, and risk management measures. CASPs must ensure a high level of IT security and operational resilience to prevent cyberattacks, maintain service continuity, and securely protect customer data and assets.

- EU Passporting. Once authorized in one EU member state, the license can be "passported" to offer services across all 27 EU countries, creating a single market access model.

Important Business Consideration (Non-Regulatory):

- Secure Banking Partnerships. Though not a direct licensing requirement, securing partnerships with a bank or a licensed financial institution remains essential for processing fiat on- and off-ramps (the exchange between traditional currency and crypto-assets).

Because crypto regulations continue to evolve, it’s essential for any crypto exchange or wallet provider to stay updated on the latest laws in the relevant jurisdiction. Missing a requirement can delay your licensing or lead to penalties. Before applying, carefully review the regulator's official checklist to ensure your company meets all criteria. Specific requirements vary significantly across jurisdictions, depending on the regulatory model and the type of services a business provides.

[2025 Update] This need for vigilance is now more critical than ever. The regulation is undergoing a transformation. What was once a patchwork of national rules is becoming a harmonized, high-standard framework. For firms operating or planning to operate in the EU, it is essential to move beyond generic compliance and master the specifics of these laws. Especially regarding capital requirements, consumer protection duties, and the stringent AML/CFT obligations set by the new regime. Before applying, companies must diligently review the regulator's official checklist to ensure full compliance with the new, unified criteria for the single European market.

Why Do Crypto Companies Need to Get a License?

A crypto license is not just a regulatory formality. It is a CORE component of building a sustainable, trustworthy, and scalable crypto business. It protects not only the company, but also its customers, partners, and the broader financial ecosystem. Licensing helps businesses operate legally, reduce the risk of enforcement actions, and gain access to banking, payment networks, and institutional partnerships. It also allows companies to expand their services, build credibility, and establish long-term resilience. In many cases, obtaining a license becomes an investment in business continuity, reputation, and strategic growth.

Oversight and Legal Protection

Before formal regulation, crypto platforms operated with little accountability, often leading to market instability, fraud, and sudden collapses. Licensing introduced structured oversight, helping regulators ensure that only financially sound, well-governed, and compliant companies enter the market. Through inspections, reporting obligations, AML/KYC procedures, and operational audits, regulators can continuously monitor licensed entities.

This acts as a filter against unqualified or high-risk operators, reducing systemic vulnerabilities. Strong governance, risk management, and internal controls, required as part of licensing, help lower the likelihood of operational failures, security breaches, or irresponsible asset handling.

Customer Trust and Business Reputation

Customers feel more secure when dealing with licensed providers because licensing implies accountability, transparency, and adherence to required safeguards. Licensed businesses must protect client assets, maintain records, and follow defined security, custody, and audit standards. If a dispute occurs, customers have mechanisms for escalation and investigation, which strengthens confidence. Institutional partners, including payment processors, liquidity providers, and financial institutions, typically engage only with licensed crypto companies, which further elevates trust and stability. Licensing also reduces the risk of abrupt business shutdowns, giving customers and partners confidence that operations are built on a foundation of compliance and responsibility.

Types of Cryptocurrency Licenses

Underlying Principles of Crypto Authorization

Not all crypto licenses are the same. The type of authorization a company needs depends on its business model, the level of control it has over customer funds, and the nature of services it provides. In many jurisdictions, licenses are designed to regulate specific types of crypto activities — such as custody, exchange, brokerage, or payment services. Although license names may differ across countries, the underlying principles remain largely consistent.

- A Cryptocurrency Exchange License authorizes a company to legally operate a platform where users can buy, sell, swap, or trade digital assets. This includes centralized exchanges (CEX), brokerage platforms, OTC desks, and automated trading platforms that match buyers and sellers. This type of license typically comes with HIGH REGULATORY EXPECTATIONS. Since exchanges directly handle customer onboarding, transaction execution, and potentially user funds, companies must demonstrate strong AML and KYC procedures, transaction monitoring capabilities, secure custody arrangements, and transparent pricing structures. Regulators also assess the firm’s governance standards, internal controls, technological security, and ability to prevent misuse of the platform, such as market manipulation or fraudulent activity. Licensed exchanges are often required to maintain minimum reserves, submit to system audits, and report trading volumes, suspicious activities, or fraud attempts.

- A Cryptocurrency Wallet (Custody) License applies to businesses that store digital assets on behalf of clients or manage private keys linked to those assets. It covers hosted wallet solutions, institutional-grade custody services, digital asset vaults, and infrastructure providers that administer customer funds. To qualify for this type of license, companies must demonstrate measures to protect client funds, which typically include segregated account management, secure private key storage, encryption protocols, backup procedures, and risk management frameworks. Regulators also focus on cybersecurity readiness and expect companies to demonstrate their ability to detect breaches, respond to incidents, and continuously maintain the integrity of stored assets. They may also be required to purchase insurance, undergo external system audits, implement robust transaction monitoring, and establish compliance manuals that describe how assets are safeguarded and accessed. Custody-licensed entities must also establish clear procedures for withdrawal authorization, outline how assets would be recovered in the event of operational failure, and maintain detailed transaction records. In many jurisdictions, regulators examine not only the security of the infrastructure but also how effectively the company manages access rights, identity verification, governance, and operational resilience.

[2025 Update] In the European Union, the new regulation simplifies this. It introduces a single CASP (Crypto-Asset Service Provider) license. A CASP's authorization specifies which of the 8 regulated activities (including Exchange and Custody services described below) the firm is permitted to carry out. The high expectations regarding governance, capital, AML/KYC, and asset segregation remain mandatory across all relevant service types under a single framework.

A Step-by-Step Guide to Getting a Crypto License

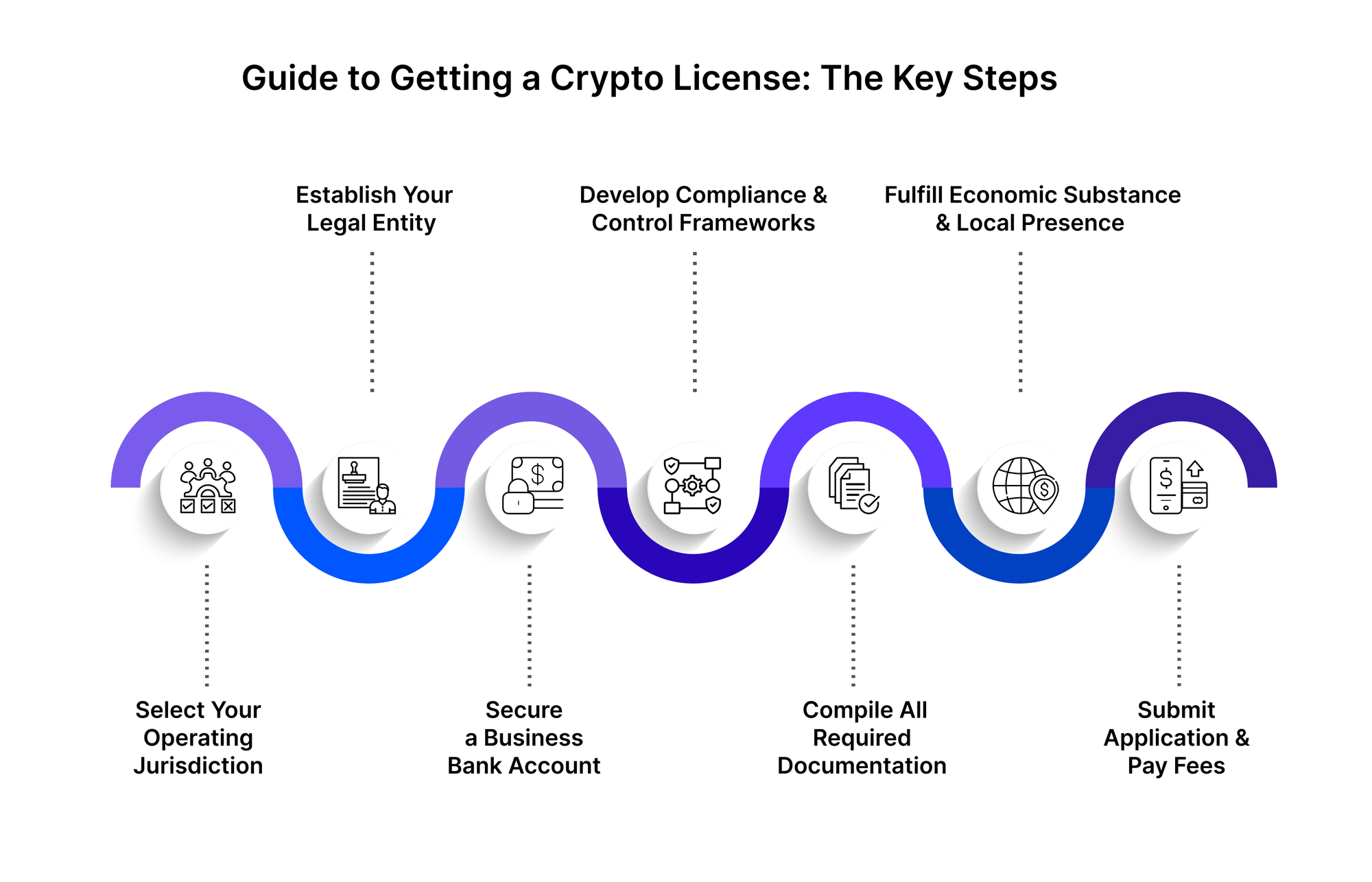

Applying for any financial license can feel overwhelming, especially in the crypto where regulations may be new or evolving. While the core steps are similar, the exact process can vary significantly by jurisdiction, as each regulator sets its own requirements for minimum capital, AML/KYC standards, governance, documentation format, and management structure.

- Select Your Jurisdiction. The choice of jurisdiction directly defines the licensing requirements, costs, review timelines, and expectations for economic substance. Some regulators expect companies to appoint local directors, maintain an office, or demonstrate real operational presence from the beginning. Evaluating the regulatory complexity, licensing fees, supervisory reputation, and expectations for physical presence is an essential first step before submitting any documentation.

- Register Your Company As A Legal Entity. If you haven’t already, incorporate a legal entity in the target jurisdiction. The type of entity you choose can influence taxation, reporting obligations, and governance structure. In some jurisdictions, businesses must assign a resident director or deposit initial share capital as part of incorporation. It is important to confirm that the company structure meets all legal and ownership criteria BEFORE moving to the licensing stage.

- Open A Business Bank Account. Banks often conduct a full AML Due Diligence review before accepting a crypto company as a client. You may need to demonstrate the legitimacy of your funding sources, provide details of your business model, and prove that client funds will be handled safely. In some cases, opening a business account is required before submitting the license application, as proof of minimum capital is required.

- Establish Compliance Policies and Internal Controls. Before filing the application, businesses must prepare and formalize their compliance framework. This includes AML, KYC, and Enhanced Due Diligence procedures, transaction monitoring workflows, risk assessment manuals, and security policies. A designated compliance officer must be appointed, and the company’s internal control system and governance structure should be clearly documented and audit-ready.

- Prepare And Gather All Required Documents. Regulators typically expect a structured documentation package that includes, at a minimum: a business plan, financial projections, corporate documents, shareholder information, AML/KYC manuals, governance and security frameworks, and organizational charts. In some cases, companies must also explain the origin of their initial capital and describe their IT infrastructure and data security controls. All documents must be submitted in standardized formats required by the regulator.

- Meet “Economic Substance” And Local Presence Requirements. Regulators now demand proof that the crypto company has a real operational presence. Not just a registered address. Substance typically includes having local personnel, physical office space, and sufficient capital allocated to the business. These requirements are among the most common reasons for license rejections, as regulators aim to filter out shell companies without genuine operations.

- Submit Your Application And Pay The Fees. After completing the application forms and assembling all documents, the business can submit the package and pay the official licensing fees. Regulators may request additional clarifications or supplementary documents during the review process. Interviews with founders or compliance officers are a standard part of many licensing procedures, allowing regulators to verify governance readiness and understanding of compliance.

Once submitted, the review period can extend to several months, depending on the regulator’s workload and the complexity of the application. Maintaining responsiveness and being prepared for follow-up requests is crucial. Licensing is only the beginning! After approval, the company must continuously meet compliance and reporting obligations to retain its authorization.

Countries that Allow Licensing of Crypto Businesses

Not all countries have the same approach to crypto licensing. Some still lack clear regulations or prohibit most crypto activities, making it impractical or impossible to obtain a license there.

On the other hand, a number of crypto-friendly countries have established well-defined licensing regimes that welcome exchanges and wallet providers. Below, we highlight a few notable jurisdictions as of 2025 and how they handle crypto licenses:

Note: Within the European Union, the MiCA regulation is standardizing crypto licensing across all member states. By 2025–2026, any crypto business operating in an EU country will need a MiCA license (CASP authorization), which then passports to all EU markets. The country-specific frameworks in the EU (like those in Estonia, Lithuania, Malta, etc., described below) are undergoing changes to align with MiCA’s unified requirements.

Canada

Canada has a registration-based approach to crypto oversight. Crypto exchanges and payment processors in Canada are considered Money Services Businesses (MSBs) and are subject to federal AML laws. The primary regulator is the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), which oversees AML compliance. To operate legally, a crypto exchange must register with FINTRAC as an MSB and implement the full set of FINTRAC requirements. Exchanges also need to renew this registration periodically and are subject to examinations.

In addition to federal MSB registration, Canadian crypto platforms may fall under provincial securities regulations if they deal in crypto assets that are deemed securities or derivatives. For example, the Ontario Securities Commission and other provincial regulators require crypto trading platforms serving Canadians to comply with investor protection rules and, in many cases, to pre-register or obtain restricted dealer licenses. This has led some uncompliant exchanges to exit the Canadian market.

Overall, Canada welcomes crypto businesses that play by the rules: obtaining the MSB license, adhering to tax and reporting obligations, and, if applicable, cooperating with securities regulators.

Estonia

Estonia was once known as a go-to jurisdiction for crypto licenses, but in 2022, it tightened its crypto licensing regulations. The Estonian Financial Intelligence Unit issues special licenses (formerly known as Virtual Currency Service Provider licenses) for companies that deal in digital assets.

Under new laws, the requirements for obtaining and maintaining an Estonian crypto license have become stricter. Applicants must now have a minimum share capital of at least €100,000 (or €250,000, depending on the services) fully paid up and continuously maintained. Companies also need to have a real office in Estonia and employ at least two full-time local staff. One of these must be a dedicated AML Compliance Officer who is an Estonian resident with relevant experience. The FIU conducts background checks on all directors and shareholders. Estonia’s overhaul led to the revocation of around 500 crypto licenses in 2022, as many previously licensed firms did not meet the new standards.

Today, only well-prepared firms with resources and genuine operations in Estonia are granted a license. If you obtain an Estonian crypto license, you benefit from a clear regulatory framework and Estonia’s e-governance infrastructure, but you must comply with its AML laws and begin business operations within 6 months of licensing.

In summary, Estonia still allows crypto licensing but sets a high bar to ensure only serious, compliant businesses participate in its market.

For a detailed analysis of Estonia’s updated requirements, compliance pitfalls, and the most common reasons companies lose their authorization, see our dedicated guide on “How Not To Lose A Cryptocurrency License In Estonia”.

Lithuania

Lithuania has established itself as a crypto-friendly gateway to the European market, with comprehensive legislation governing crypto activities. The country requires crypto businesses to register on an official register of legal entities engaged in virtual asset services, under the supervision of the Lithuanian Financial Crime Investigation Service (FCIS) and the Ministry of Finance.

To qualify, you must form a Lithuanian company (usually a UAB, similar to an LLC) and appoint an exclusive AML Officer who is responsible for the company’s compliance. As of 2023, Lithuania also introduced a minimum authorized capital requirement of €125,000 for crypto companies. This capital must be paid in and is meant to ensure the firm has sufficient financial substance.

One advantage in Lithuania is that a company can pursue multiple crypto activities under a single registration. For example, if you want to run both an exchange and a custodial wallet service, you can apply for both authorizations simultaneously and operate both under one corporate entity. The licensing process in Lithuania is relatively fast, and the ongoing compliance obligations, while strict, are viewed as reasonable.

Lithuanian regulators are actively updating their laws to align with EU standards, and the country is expected to transition its registered crypto companies to the new MiCA framework by 2025–2026. For now, Lithuania remains a popular choice for its balance of AML standards and a business-friendly environment.

Malta

Malta was one of the first jurisdictions to create a bespoke regulatory framework for cryptocurrencies. Under Malta’s Virtual Financial Assets (VFA) Act, any organization that wants to offer services involving virtual assets must obtain a license from the Malta Financial Services Authority (MFSA). There are four classes of VFA licenses in Malta, ranging from a license for brokers or advisors up to a license for operating an exchange. Regardless of class, the requirements are stringent. A crypto company must establish a physical presence in Malta (at least 3 full-time employees). The firm’s management must include persons of proven experience and good repute in the financial or crypto industry. Malta also requires engaging a locally licensed VFA Agent who vets the application and serves as a point of contact between the company and the regulator.

The application process in Malta involves preparing detailed documentation and passing a fitness test by the MFSA. There are also significant capital requirements that depend on the license class. Malta has comprehensive cryptocurrency legislation covering custody, cybersecurity, and auditing, making it one of the most regulated environments. While this means the barrier to entry is high, companies that do get licensed in Malta signal to the world that they adhere to some of the highest standards in crypto. The MFSA continues to update its rules to align with European Union directives and MiCA, ensuring that license holders are well-positioned under the upcoming EU-wide regime.

Poland

Poland introduced specific regulations for cryptocurrency businesses in 2021 by amending its Act on Counteracting Money Laundering and Terrorism Financing (AML Act). Under these rules, crypto service providers in Poland must register in the official Register of Virtual Currencies maintained by the Ministry of Finance. The Polish Financial Supervision Authority (KNF) and the General Inspector of Financial Information (GIIF) oversee compliance.

In practice, obtaining a “crypto license” in Poland means submitting an application to be listed in the registry and meeting a set of conditions. These conditions include having a clean criminal record for company directors, demonstrating knowledge or experience in Cryptocurrency/AML, and establishing a local presence for the business.

Poland does not impose high minimum capital requirements for VASPs, making entry easier on that front, and the registration process can be completed in a matter of months if all documents are in order. However, once registered, crypto companies must comply with Polish AML Laws: implementing KYC for clients, maintaining transaction records, filing reports on suspicious activity with the FIU, and undergoing audits. The revised regulations also clarified that both individuals and companies providing exchange or custodian services must register. Failure to register can result in financial penalties or even criminal liability.

In summary, Poland offers a relatively accessible regulatory regime for crypto startups, but it expects diligent compliance. Notably, as an EU member, Poland will also transition to the MiCA framework soon, so new registrants should be prepared to meet those broader EU standards in the coming years.

UK

The United Kingdom requires any company providing crypto asset services (such as exchange, trading, custody, or ATM operations) to register with the Financial Conduct Authority (FCA) under the UK Money Laundering Regulations. Since January 10, 2020, it has been illegal to operate a crypto exchange or similar business in the UK without FCA registration (which in practice serves as a crypto license). To become licensed/registered, a crypto business must demonstrate robust AML/CFT measures, including U.K.-compliant KYC procedures, ongoing transaction monitoring, and an appointed MLRO. Additionally, companies need appropriate banking arrangements to handle client money and crypto transactions, and they must submit extensive documentation to the FCA. This documentation typically includes a detailed business plan, a risk assessment of the business’s products and customers, descriptions of technology systems, cybersecurity policies, and AML/KYC policies.

The FCA’s process is known to be one of the most rigorous globally. By late 2022, out of hundreds of applicants, only a few dozen firms had successfully obtained registration – many others either withdrew their applications or were refused due to not meeting the standards. Successful applicants often engage legal compliance advisors and dedicate significant resources to ensure every aspect of the business meets regulatory expectations. After registration, UK crypto companies are subject to ongoing supervision; the FCA can conduct inspections or request reports to ensure continued compliance. It’s also worth noting that the UK government has been discussing broader crypto regulatory legislation (beyond AML) to cover consumer protection and market integrity, which may come into effect in the near future.

But as of 2025, the FCA registration remains the key gateway to operating in the UK crypto sector.

If your company plans to operate anywhere in the European Union, review our MiCA Licensing Guide, which covers CASP authorization requirements, documentation, and EU passporting.

If your company plans to operate anywhere in the European Union, review our MiCA Licensing Guide, which covers CASP authorization requirements, documentation, and EU passporting.

Simplifying the Process of Getting a Crypto License

Obtaining a crypto license is only the beginning. Once a license is granted, companies must maintain ongoing compliance, conduct transaction monitoring, implement risk-based AML controls, protect customer assets, and be prepared for audits. Regulators expect licensed businesses to operate with mature governance systems, well-documented policies, continuous staff training, sanctions screening, and robust reporting mechanisms.

This is where many companies struggle…Not with collecting documents for the application, but with building a long-term compliance infrastructure that actually works. Sustaining regulatory approval requires more than just paperwork: it requires technology, processes, and dedicated oversight.

AMLBot helps crypto businesses handle this full compliance lifecycle. Before, during, and after licensing.

Do Crypto Businesses Need Physical Presence Or Local Staff To Obtain A License?

Yes, increasingly so. Regulatory trends worldwide emphasize the need for "Economic Substance." Regulators often require a physical office, local management, or personnel dedicated to compliance and operations within the licensing jurisdiction. This is done to prevent the creation of shell companies and ensure effective local supervision and accountability.

What Is The Difference Between A Registration And A Full Crypto License?

A "Registration" typically grants permission to operate under Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) laws, mainly focusing on Know Your Customer (KYC) and transaction monitoring. A Full Crypto License (e.g., MiCA CASP or similar) is a comprehensive financial authorization. It imposes higher standards on capital, governance, consumer protection, IT security, and market conduct, in addition to AML compliance. A full license provides greater regulatory legitimacy.

Why Do Regulators Sometimes Reject Crypto License Applications?

Rejections are most commonly due to: 1) Insufficient Economic Substance; 2) Weak AML/CFT Frameworks; 3) Inadequate Governance; or 4) Insufficient Capital to meet the jurisdiction’s minimum financial thresholds.

How Much Minimum Capital Do Most Jurisdictions Require For Crypto Companies?

The minimum capital requirements vary significantly depending on the jurisdiction and the type of service. For basic services, requirements can start from €10,000 to €50,000. However, for comprehensive activities such as operating a trading platform or providing custody, major jurisdictions (such as the EU under MiCA) require higher amounts, often starting at € 125,000 or more, to ensure financial resilience.

Are Custodial And Non-Custodial Wallet Providers Regulated Differently?

Yes, significantly. Custodial Wallet Providers are typically regulated as financial institutions. They face strict requirements concerning asset segregation, capital, operational resilience, and cybersecurity. Non-Custodial Providers are regulated far less strictly, focusing primarily on AML/KYC for certain interactions, or sometimes not at all, as they do not control client funds.

Can A Company Operate Internationally With A License From One Jurisdiction?

Generally, no. A license typically grants the right to operate only within the issuing jurisdiction. However, within economic blocs like the European Union, the MiCA framework introduces "Passporting," allowing a single CASP license obtained in one EU member state to be used to offer services across all 27 member states. This is a notable exception to the traditional single-jurisdiction rule.

Do Crypto Businesses Need Separate Licenses For Exchange And Wallet Services?

In many jurisdictions, yes, these activities historically required separate authorizations because they carry different risks (trading vs. safekeeping). However, modern frameworks like MiCA consolidate this into a single Crypto-Asset Service Provider (CASP) license. A company applies for the CASP status but specifies which regulated services it will provide. This tailored authorization means higher capital and compliance requirements apply based on the combination of services offered.