How To Identify Whether A Crypto Project Is A Ponzi Scheme

Cryptocurrency is now a popular investment class, and every investor wants a piece of the action. Their ability to net large profits in short intervals makes them a good proposition for investing funds. However, such profits come with high risks. Therefore, investors with large risk appetites and money to spare should indulge in crypto acquisition. Another requirement for crypto investors is understanding cryptocurrency and blockchain fundamentals.

Investors are attracted to the high profit-making potential of cryptocurrency and invest in the markets without proper due diligence. Here is where the issues begin. Investors can end up with locked funds or end up giving away money to scammers and thieves. Like with fiat money, people are scammed out of their cryptocurrency too. These issues are more prominent, in fact, in the crypto world. Ponzi schemes have always been a prominent grifting technique, and now the crypto world is witnessing them in abundance.

The Rise Of Crypto Ponzi Schemes

To those unaware, Ponzi schemes are scams run by snake oil salespeople luring investors to give them their money in exchange for their solutions offering severely high returns. Unfortunately, the returns promised are too good to be true, and the scammer exits with all the investments, leaving the investors holding the bag.

The number of Ponzi schemes associated with cryptocurrency has risen since crypto investments became a lucrative opportunity. A primary advantage of cryptocurrency acquisition is its permissionless nature. Anyone with an internet connection can invest in crypto without approval from authorities or centralized bodies. The lax nature and the lack of regulations over what you can buy and from where makes the space chaotic. Because of this, the analogy of crypto with the wild west holds true. Thus, scammers running Ponzi schemes are all over the place waiting to get their hands on user funds by pretending to offer legitimate services.

Moreover, the novelty behind crypto is a barrier to identifying money-fleecing schemes – people cannot differentiate between genuine investment opportunities and fraud. To top all that, crypto is very volatile, and insane price hikes are not unheard of. So, it is all the easier for Ponzi schemes to promise unrealistic returns and camouflage them as the next big opportunity.

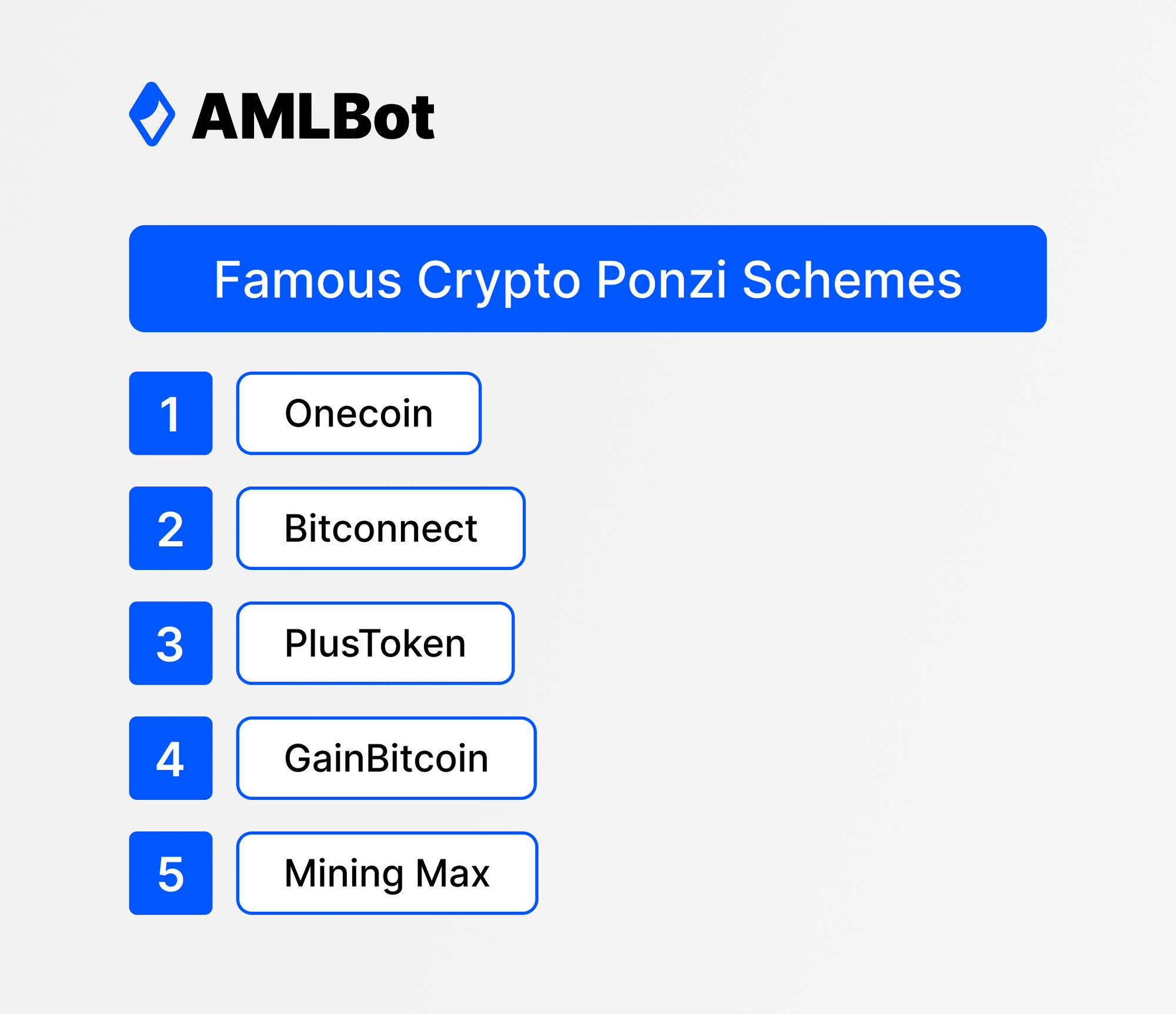

Famous Crypto Ponzi Schemes

The sad reality is that investors still fall for Ponzi schemes despite many being outed as such. From blockchain-less 'token' offerings to fake mining farms, the list is endless. But we hope to cover the exposés of the largest crypto Ponzi schemes.

Bitconnect

As the Bitconnect scheme lives on in infamy through the meme-worthy content it produced from its investor event back in the day, its financial implication on unwary investors has a darker side to it. The platform was launched in 2016 and encouraged users to exchange Bitcoin for its BCC token. The upside to locking value into BCC tokens was a monthly profit of 40%. The abnormally high returns incited warnings from Vitalik Buterin, who said that the platform was most likely a Ponzi scheme. However, the fraudulent platform credited its ability to generate high returns to its sophisticated trading bot that we now know never existed.

The sketchy returns provided to investors eventually caught the attention of governments all over. The United Kingdom asked Bitconnect to prove the legitimacy of its returns, and the Texas State Securities Board served a cease and desist, calling it a straight-up Ponzi scheme.Bitconnect shut down its operations shortly after the cease and desist, leading the value of the BCC token to plunge downward by 90%. In addition, it was reported that the Ponzi scheme led to about $3.5 billion in investments being pocketed by the founders and others involved.

PlusToken

Another crypto Ponzi scheme that reportedly saw a massive amount of funds being fleeced is PlusToken. Authorities stated that the founders of the PlusToken wallet platform ran away with around $3 billion worth of cryptocurrency – putting the scam in a similar ballpark to Bitconnect. The Ponzi scheme targeted customers worldwide but was prominent in Asia, mainly China and Korea.

PlusToken was branded and advertised all over China on billboards, malls, and digital spaces like WeChat. Advertised as a wallet service and exchange, customers were prompted to exchange their funds for the platform's token, its namesake, the PlusToken. Investors were returned profits of up to 30% on the regular for simply using the wallet and an additional yield if they bought the PlusToken. However, in January 2019, investors found it fishy when they could not cash out on their profits. The team behind PlusToken subsequently revealed the platform as a Ponzi scheme when they posted a message reading "we have run" on their application. The scammers behind the fraud have since been found and sentenced for their role in defrauding investors.

OneCoin

One of the largest cryptocurrency scams, OneCoin defrauded investors of a whopping $6 billion over five long years. Ruja Ignatova orchestrated the Ponzi scheme, also called the Cryptoqueen. OneCoin was touted as the next big innovation in the blockchain space. However, the claim ended up being highly ironic because the "cryptocurrency" had no blockchain backing it. OneCoin was sold only on the OneCoin exchange, where users would deposit funds to receive the coins.

The OneCoin Ponzi scheme was also a pyramid scheme offering existing investors incentives for bringing in more investors to the platform. It also offered educational material to lure new investors into giving their money. While the US government shut down the racket, the founder fled and remains on the run. She is labeled as a most wanted fugitive by several agencies, including the FBI.

Mining Max

Another crypto Ponzi scheme, Mining Max, was a US-based firm that allured investors with a crypto mining front. Mining Max was more creative than your average crypto Ponzi scheme and advertised itself as a mining rig distributor and a cloud mining service for the Ethereum network. Unsuspecting victims adding up to 18,000 individuals from 54 countries were duped out of their investments. The fraudsters behind the mining front were able to secure about $250 million from unsuspecting investors and used less than a third of the investments on mining devices. The rest of the amount was used to fuel the extravagant lifestyles of those behind the fraud.

A majority of the victims – around 14,000 – were from South Korea. The scheme crashed when South Korean authorities filed a suit against it, leading to investigations. Most of the individuals who orchestrated the fraud have since been arrested.

GainBitcoin

Like Mining Max, GainBitcoin was a crypto mining front that lured Indian investors into investing in its non-existent cloud mining services. Unfortunately, the Ponzi scheme guaranteed investors 10% returns for 18 months and managed to scam around 8,000 investors with attractive but false claims.

While the Mining Max scheme did involve some amount of mining rigs purchased from investor funds, GainBitcoin had nothing to show for the investments it received. What's crazy is that investigations related to the scheme lead authorities to believe that the orchestrator of GainBitcoin, Amit Bharadwaj, scammed anywhere between 300,000 to 650,000 Bitcoins. Those numbers are significantly higher than initially reported when the man behind the front was arrested in 2018.

Looking at Ponzi schemes in the crypto industry, it is safe to say that investors were defrauded by the promise of insanely high returns every time. It remains a trope with all kinds of Ponzi schemes, not just the ones associated with crypto. Understanding how large volumes of funds get scammed repeatedly needs an explainer of how Ponzi schemes work.

How Ponzi Schemes Work

Ponzi schemes are an age-old technique of conning people out of their money by promising highly lucrative returns compared to traditional investments. The investments get marketed as having no potential downside. Guarantees like this often raise red flags, but Ponzi schemes get people by doing what they promise – at least initially. Investors already on board are paid the advertised returns with the funds collected from new investors. There is no profit-making mechanism like the schemes claim. However, the regular pay-outs elude investors into thinking that the returns are genuine. The constant returns attract more investors who do not doubt the means through which the profits rake in. It is precisely how Ponzi schemes can operate for years before being busted – they execute in delivering the profits they promise. That is until the fraudsters decide to make away with the investors' funds, or the funds dry up due to the lack of new investors, and the scheme gets exposed.

In an investment class like crypto that offers users myriads of ways to earn large sums, identifying Ponzi schemes may be difficult until it is too late. Regardless, getting your money trapped in Ponzi schemes can be avoided if you know how crypto Ponzi schemes operate.

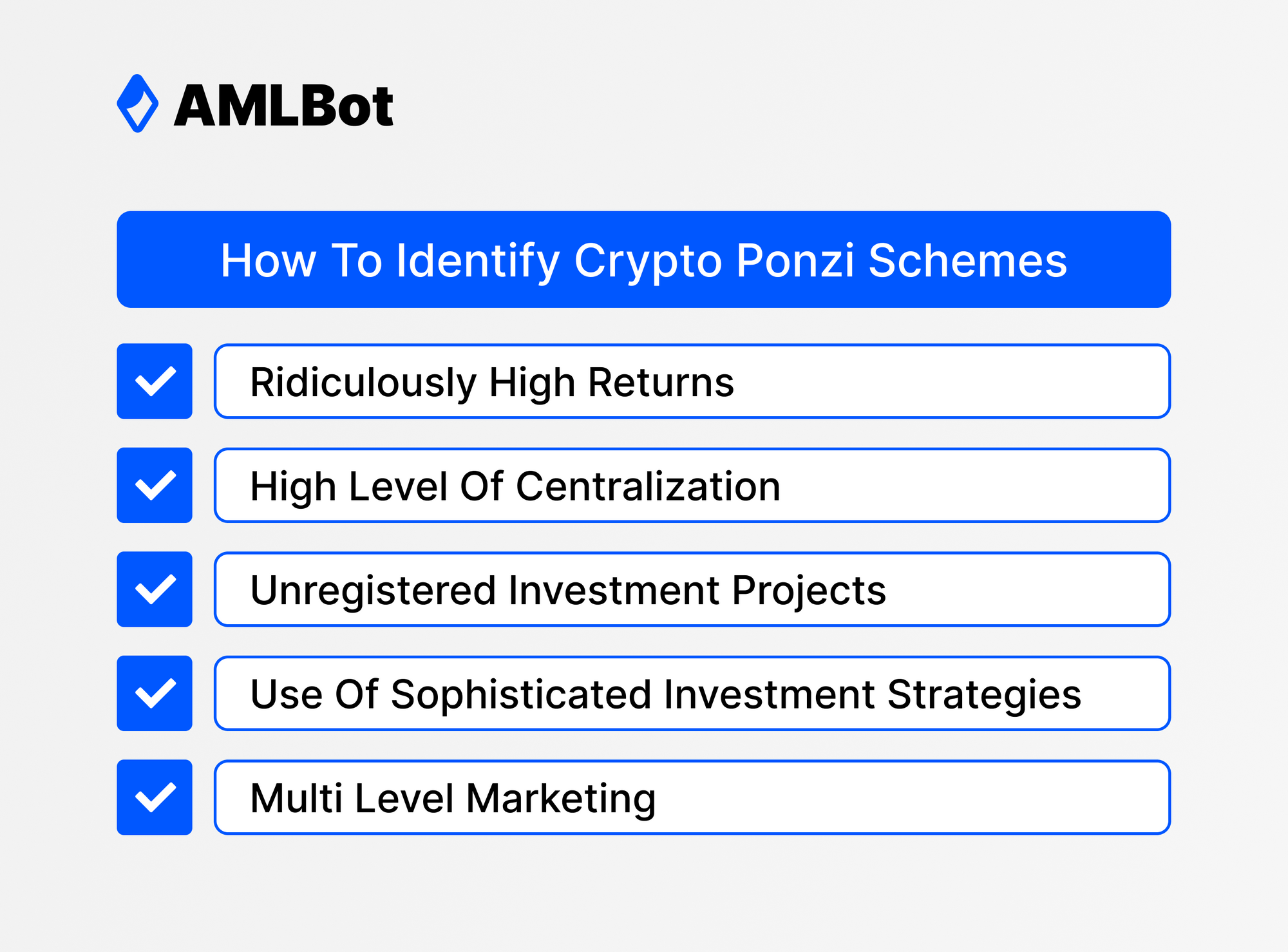

How To Identify Crypto Ponzi Schemes

Ponzi schemes come in different shapes and sizes, pitching innovative solutions to trick users into believing their legitimacy. However, despite their creative efforts to defraud investors, one can identify a Ponzi scheme off the bat by being aware of the common traits they possess.

Ridiculously High Returns

The most obvious first – every Ponzi scheme promises insanely high returns and initially delivers them. The rule of thumb is to be cautious of all investment tools which offer returns that seem too good to be true. Most often, the returns are too good to be true, especially when the project guarantees low risk. However, this can be tricky in a volatile market like crypto. Therefore, understanding how crypto works to differentiate genuine yield-offering mechanisms like those of decentralized finance from Ponzi schemes is of great priority. It is to be noted that crypto is a very high-risk space, and projects claiming the contrary are probably Ponzi schemes.

High Level Of Centralization

The essence of cryptocurrency is decentralization. It works on peer-to-peer networks allowing transactions to occur without permission and restriction. While centralized platforms offering genuine services exist, Ponzi schemes control more aspects of investor funds than required. Limits on crypto withdrawals, how the platform native token is acquired, and other peculiar terms can be giveaways of Ponzi schemes.

For instance, OneCoin prevented investors from withdrawing large sums of their deposits to stop funds from leaving their scheme. Moreover, OneCoin could only be acquired from its platform because it did not use decentralized blockchain technology. Most cryptocurrencies are available on a wide range of exchanges. Decentralization allows anyone to own and list them.

Unregistered Investment Projects

Due to the rising popularity of cryptocurrencies as investment vehicles, governments around the globe are setting regulations abided by platforms. Registered platforms are safe to use as they get vetted by regulators and follow best practices to safeguard investor funds. Naturally, Ponzi schemes are unregulated and operate in the shadows to prevent being busted by the authorities. Promises of unusually large profits and shady and secretive business and investment strategies set off alarms with regulators, forcing them to work in the shadows. Therefore, it is always recommended to choose platforms that are registered with the appropriate regulators.

Use Of Sophisticated Investment Strategies

The lack of a functioning profit-incurring service or product makes Ponzi schemes reluctant to reveal investment strategies or business plans. Instead, strawman rationales like complex algorithms and strategies get thrown around to explain how they rake in abnormally large sums when they siphon funds from new investors to existing ones.The massive lack of transparency in operations coupled with a sketchy amount of profits makes it highly probable that the project you are looking at is a Ponzi scheme. Look at Bitconnect's infamous trading bot that got attributed to its ability to generate 40% returns with no risks or downside. Unfortunately, there was no trading bot, and all returns got routed from new investors.

Multi Level Marketing

While multilevel marketing and pyramid schemes are in a league of their own, Ponzi schemes are known to apply MLM techniques to recruit more investors. Investors earn a commission for recruiting others. The commissions travel upwards from lower levels consisting of recruits to the founder at the top. Ponzi schemes adopting MLM tactics can be dangerous as they introduce an illusion of earning extra incentives on top of the high returns. The investors joining at the end of the MLM network lose out the most as no new members are left to recruit. As a result, they do not earn any returns on their investment and lose their investment. Staying away from projects incentivizing existing investors to recruit new ones is recommended because they are mostly scams.

Conclusion

Ponzi schemes have existed for some time and have caused many investors to lose their funds. It is not limited to traditional finance, and fraudsters are capitalizing on cryptocurrency too. The novelty of cryptocurrency makes it well-suited for such scams, leading to the rise of Ponzi schemes in the crypto sphere. Therefore, crypto users need to research every platform they invest their funds in and remain far away from those that look shady. The main principles of investment apply to crypto also – do your research and only invest what you are willing to lose. Also, if you become a witness of such scams, the AMLBot team can help you perform a thorough investigation.