MiCA Compliance Framework Overview for Crypto Businesses in 2026

In 2026, the EU’s MiCA (Markets in Crypto-Assets) Regulation will be fully applied across all member states. Crypto businesses operate under the complete set of MiCA requirements, supported by the final standards issued by ESMA (European Securities and Markets Authority) and the EBA (European Banking Authority).

This regulation establishes a unified compliance framework for crypto businesses, setting consistent MiCA requirements for legal, operational, governance, and disclosure obligations.

This article provides an overview of the key MiCA requirements, including issuer guidelines, operational expectations for service providers, alignment with AML (Anti-Money Laundering) and KYC (Know Your Customer), IT resilience, and user protection standards.

It does not cover market-entry topics or stablecoin-specific obligations, which are addressed in separate materials.

Note: None of this information should be considered as legal, tax, or investment advice. While we’ve done our best to ensure this information is accurate at the time of publication, laws and practices may change, so please double-check it.

What MiCA Regulates: Scope and Core Principles

The MiCA Regulation sets a single EU rulebook for crypto-assets and the crypto businesses that issue them or provide related services. Its scope focuses on crypto-assets that are not already regulated as financial instruments under other EU financial-services laws, so similar activities are treated consistently across member states.

At a high level, MiCA aligns the market around three outcomes: clearer disclosures, stronger operational and governance expectations, and stronger user protection. The full legal text is published on EUR-Lex and should be treated as the primary reference point for scope and definitions.

What the MiCA Regulation Changes in the EU Crypto Market

The MiCA Regulation replaces inconsistent national approaches with a unified compliance framework that standardizes baseline expectations for crypto-asset issuance and crypto-asset services.

In practical terms, crypto businesses can no longer rely on local interpretations of disclosure, conduct, and control requirements that differ by jurisdiction. Instead, MiCA requirements anchor how firms describe products, manage operational risk, organize governance, and protect users.

The result is a more comparable market where similar crypto activities are expected to meet similar compliance standards across the EU.

Who Is Covered Under the MiCA Regulation

MiCA applies to businesses that issue crypto-assets to the public, seek admission of crypto-assets to trading, or provide crypto-asset services in the EU. This includes crypto-asset issuers and CASPs (Crypto-Asset Service Providers) operating on a professional basis, such as platforms that facilitate trading, custody, exchange, or execution-related services.

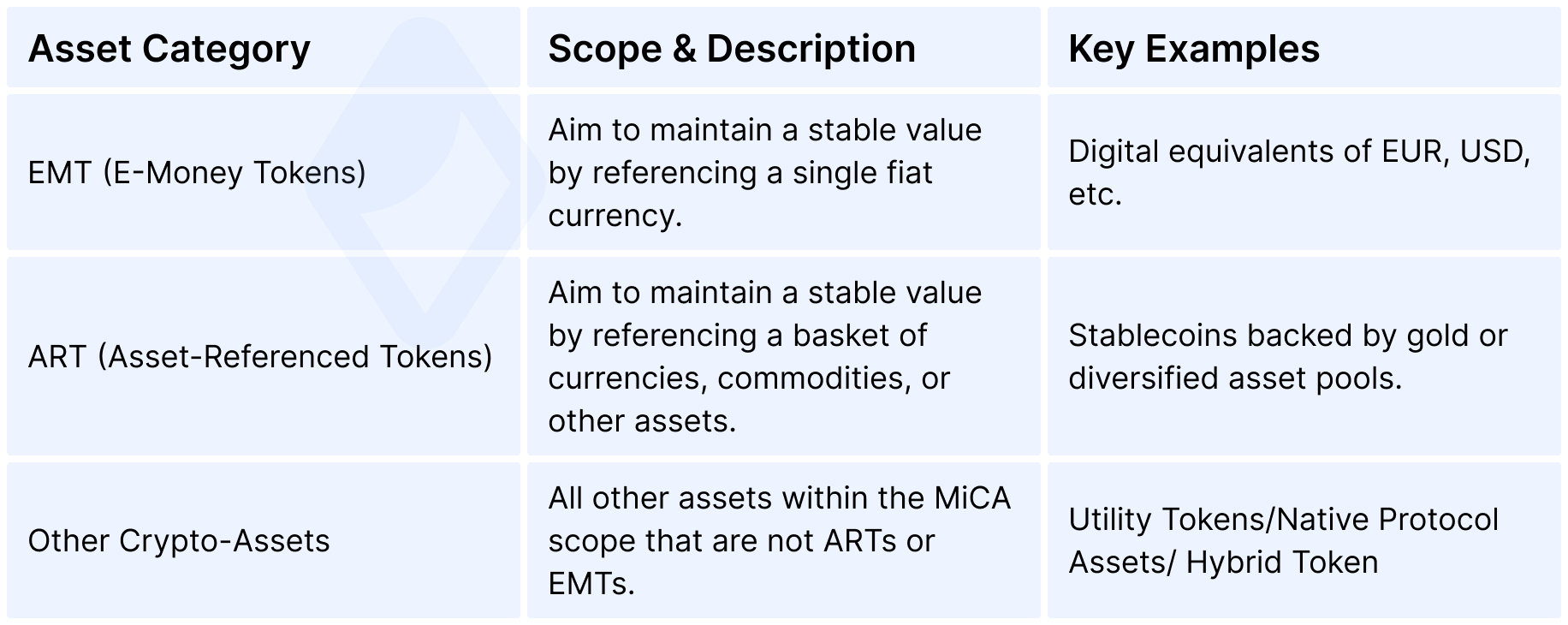

Types of Crypto-Assets Regulated by MiCA

MiCA distinguishes categories so MiCA requirements can be applied proportionately across different crypto assets.

The main groupings are EMT (E-Money Token), ART (Asset-Referenced Token), and a broader “other crypto-assets” category that commonly includes utility-style tokens and many non-stablecoin crypto-assets.

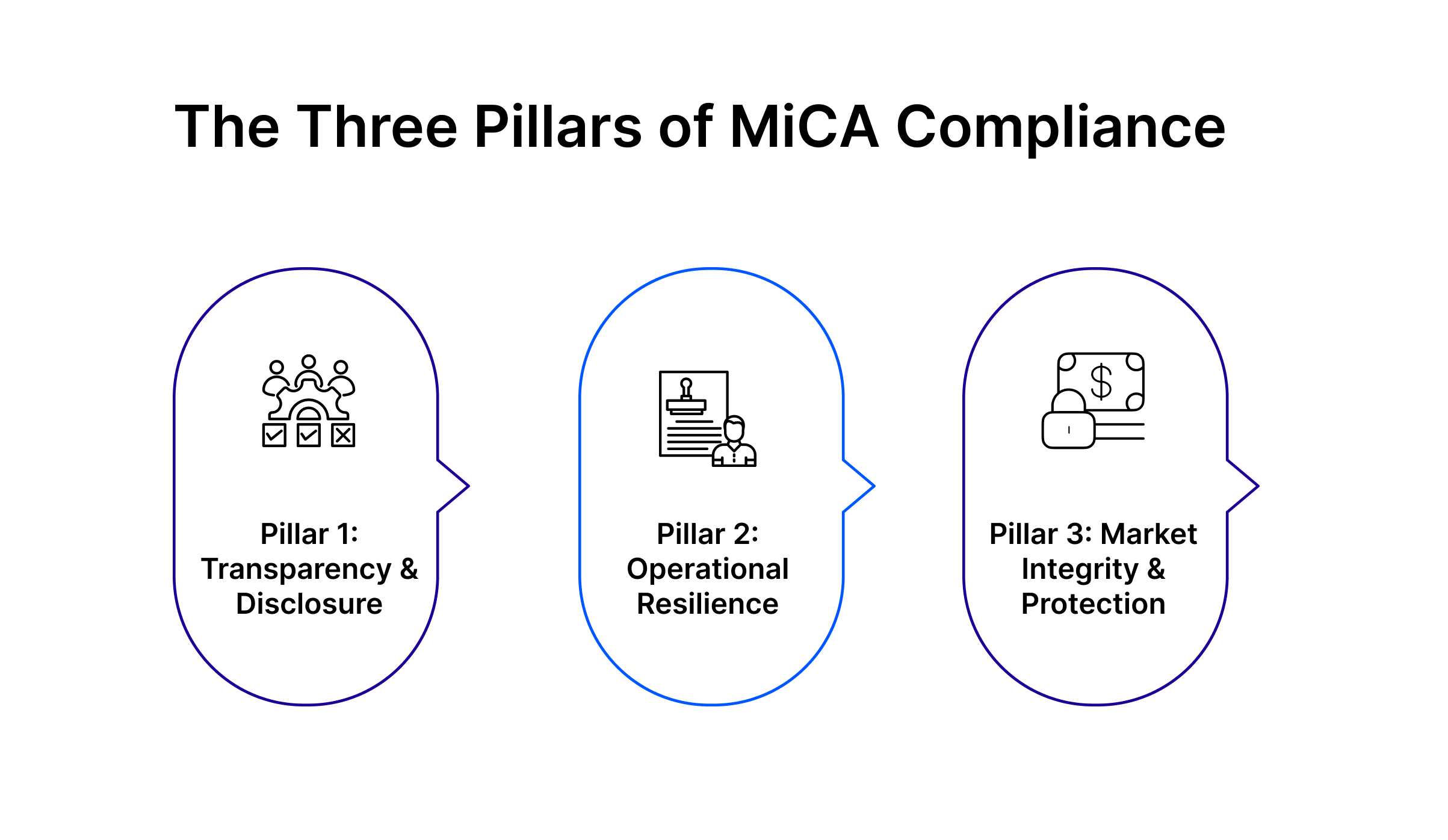

Core Principles of the MiCA Regulation (Transparency, Stability, User Protection)

The MiCA Regulation is anchored by three fundamental pillars that redefine the legal landscape for crypto-assets in the European Union.

- The first pillar, Transparency and Market Integrity, mandates a shift from opaque operations to a standardized disclosure regime. It requires issuers and service providers to maintain absolute clarity through comprehensive White Papers and communications that are fair, clear, and not misleading.

- Complementing this is the principle of Operational Stability and Resilience, which integrates crypto-asset services into the broader framework of EU financial security. Beyond simple internal policies, this principle demands robust governance structures and strict alignment with the Digital Operational Resilience Act (DORA). By enforcing rigorous ICT risk management and capital adequacy requirements, MiCA ensures that businesses are legally and operationally equipped to withstand market volatility and technical disruptions.

- Finally, Comprehensive User Protection serves as the framework’s ethical and legal compass. This principle goes beyond basic consumer rights, enforcing strict conduct-of-business rules that mandate the legal segregation of client assets and the implementation of transparent complaint-handling mechanisms. By enshrining these safeguards into law, MiCA transitions user protection from a discretionary practice to a mandatory legal standard, ensuring that crypto-asset service providers operate with the same level of accountability as traditional financial institutions.

Legal Requirements Under the MiCA Regulation

The MiCA Regulation is directly applicable EU law, so in-scope crypto businesses must meet binding legal obligations once their activities fall within MiCA’s perimeter.

The regulation sets enforceable compliance standards for disclosures, conduct of business, governance, safeguarding of client assets, and operational risk controls, with additional detail specified through ESMA and EBA technical standards.

Mandatory Legal Obligations for All Crypto Businesses

MiCA requirements establish baseline legal obligations that apply broadly across crypto businesses in scope, including issuers and CASPs.

In practice, MiCA legal requirements for cryptocurrency activities include:

- Maintaining a clear legal and organizational structure that supports accountability;

- Аcting honestly, fairly, and professionally in all client interactions;

- Ensuring communications are fair, clear, and not misleading;

- Maintaining documented controls for conflicts of interest, complaint handling, and outsourcing risk.

Where a business safeguards client funds or crypto-assets, MiCA's legal requirements for cryptocurrency emphasize segregation, safeguarding, and operational discipline to prevent misuse and reduce the risk of loss.

The standard compliance theme is that firms must demonstrate, through policies, records, and controls, that obligations are implemented in day-to-day operations, not merely described on paper.

Key Articles of the MiCA Regulation That Define Compliance Standards

MiCA’s compliance framework is anchored in specific articles that define “hard” legal standards for crypto services and issuer-facing obligations.

For example, Article 66 sets general conduct expectations for CASPs, including fairness, clarity of information, and client-first service delivery, while Article 67 covers prudential safeguards, and Articles 68–73 cover governance, safeguarding, complaints, conflicts of interest, and outsourcing controls.

MiCA also defines service-specific standards through dedicated provisions for different types of crypto-asset services.

When mapping compliance obligations internally, tie each control to the relevant MiCA article in the legal text on EUR-Lex, for example, the conduct baseline in Article 66 and the prudential safeguards in Article 67.

Risk Management and Reporting Requirements

MiCA requirements expect crypto businesses to run an active risk framework that covers operational risk, governance risk, and service delivery risk, supported by evidence-quality recordkeeping.

This includes maintaining documented procedures for identifying and managing conflicts of interest, handling complaints consistently, and controlling third-party and outsourcing risk so that external dependencies do not weaken compliance.

Reporting under the MiCA Regulation is best understood as a “show your work” expectation: firms must be able to produce traceable records that support disclosures made to users and demonstrate that internal controls are operating as designed.

Where technical standards specify data fields, templates, or formats, crypto businesses should align internal reporting and retention practices to those standards so compliance can be demonstrated consistently over time.

MiCA Guidelines for Crypto-Asset Issuers (Non-ART/EMT)

MiCA guidelines apply not only to service providers but also to issuer teams that offer crypto-assets to the public.

In this section, “issuer” refers to the legal entity responsible for the offer and the related disclosures for crypto-assets that are not ART or EMT.

For non-ART/EMT launches, the MiCA requirements focus on disclosure quality, governance accountability, and communication discipline so users can make informed decisions based on complete and consistent information.

The goal is a predictable compliance framework for issuer-facing obligations without turning token documentation into marketing.

MiCA Guidelines on White Papers and Disclosures

A core MiCA requirement for issuer activity is preparing and publishing a crypto-asset white paper before an offer to the public, with disclosures that are accurate, clear, and complete.

The white paper should describe the issuer, the crypto asset, the project, and the intended use of proceeds (where relevant), key risks, and any features that could materially affect a purchaser’s decision.

MiCA guidelines also imply strong internal controls over disclosure drafting and review, because misleading statements or omitted material facts can create legal exposure.

Issuers should treat the white paper as a compliance document: claims must be supportable, risk factors must be specific, and technical statements should match what is actually implemented or credibly planned.

If material information changes during an offer or shortly after publication, the disclosure set should be updated so that public information remains consistent and not misleading.

Governance Guidelines for Issuers Under MiCA

Issuer governance under MiCA is primarily about accountability for disclosures and fair treatment of users. The issuer should have defined decision-making responsibilities, documented controls for conflicts of interest, and a clear process for approving disclosures and public statements. Where insiders hold significant allocations, have special rights, or can influence outcomes, MiCA requirements push issuers toward transparent disclosure and consistent handling of conflicts so purchasers are not misled about incentives. Governance should also include recordkeeping that supports the disclosure narrative of what was known, when it was known, and how decisions affecting public statements were made. A practical approach is to assign a responsible owner for compliance oversight of disclosures and communications, even in smaller teams, so updates and corrections are handled consistently within the compliance framework.

Transparency and Communication Guidelines

MiCA guidelines require issuer communications to be fair, clear, and not misleading, and to remain consistent with the white paper and related disclosures. This applies across channels, including websites, social media, announcements, and promotional materials, so issuers should use a single source-of-truth disclosure baseline and review communications for consistency before publication. If the project timeline, token functionality, or risk profile changes in a way that would matter to a reasonable purchaser, transparency requires updating public information rather than allowing outdated claims to circulate. Issuers should avoid statements that imply guarantees, minimize risks, or suggest regulatory endorsement, because these can undermine transparency and create compliance issues. In practice, the cleanest standard is simple: if a statement could influence a purchase decision, it should be accurate, supportable, and aligned with the current disclosure set.

Operational Guidelines and Requirements for CASPs

CASPs operate on the front line of user-facing crypto services, so MiCA requirements place strong emphasis on how these businesses function in day-to-day operations. The focus is practical: clear client information, fair service delivery, and reliable operational handling of crypto assets and client funds.

This section summarizes operational MiCA guidelines for CASPs across three core areas:

- Сlient interactions and disclosures;

- Сonduct of business standards;

- Аsset protection and operational safeguards.

These operational requirements support a working MiCA compliance framework and are intentionally limited to service delivery and internal controls. Market-entry topics and stablecoin-specific obligations are addressed separately.

MiCA Guidelines on Client Interactions and Disclosures

MiCA guidelines require CASPs to provide information that is fair, clear, and not misleading across onboarding, product presentation, and ongoing client communications. Clients should be able to understand fees, service terms, key risks, and how a service works before they commit funds or crypto assets. Risk warnings should be presented in a way that is visible and usable, especially for retail users, and client-facing documents should be consistent with how the service actually operates. MiCA requirements also imply disciplined complaint handling as part of client interactions: users need a clear channel to raise issues, and the business should track complaints, outcomes, and recurring patterns as part of operational controls. The operational standard is simple: client disclosures must reduce surprises, not create them.

Conduct of Business: MiCA Guidelines for Service Providers

Conduct expectations under MiCA center on fair treatment, conflict management, and consistent execution of service terms. CASPs should identify conflicts of interest that could affect clients, implement controls to prevent conflicts from distorting outcomes, and disclose residual conflicts where they cannot be eliminated. Where a CASP executes or transmits orders, operational procedures should support fair order handling and execution quality that aligns with the client’s interests, with clear internal rules for how orders are prioritized and processed. MiCA requirements also extend to marketing and public statements: claims about pricing, service capabilities, and risk controls must be accurate and supportable. In practice, conduct of business compliance depends on repeatable processes, training, review workflows, and monitoring that prevent unfair treatment and reduce operational errors.

Asset Protection and Operational Standards Under MiCA

MiCA requirements place asset protection at the core of operational compliance for CASPs, especially where client crypto assets or client funds are held or controlled. Operational standards should ensure segregation and safeguarding so client assets are not treated as the firm’s own property and are protected from misuse, loss, or operational failure. CASPs should maintain controlled access to wallets and operational systems, implement reconciliations and audit-ready records, and ensure that internal ledgers and user balances can be verified and explained. Outsourcing does not reduce responsibility: MiCA guidelines expect CASPs to manage third-party risk through vendor due diligence, contractual controls, and contingency planning so critical functions remain reliable. The operational goal is consistent protection of client assets and service continuity through documented procedures, traceable records, and measurable controls.

Governance and Internal Control Requirements Under MiCA

MiCA requirements assume that compliance is sustained through governance, not ad-hoc decisions. For crypto businesses in scope, the MiCA compliance framework expects clear accountability, documented decision-making, and internal controls that prevent conflicts, operational failures, and misleading disclosures. Governance should make it obvious who owns key obligations, how issues are escalated, and how controls are reviewed over time. Internal controls, in turn, should translate those governance expectations into repeatable policies, oversight routines, and evidence-quality records.

Governance Guidelines for CASPs and Issuers

Under MiCA guidelines, governance starts with defined responsibilities. Crypto businesses are expected to maintain a management structure that assigns ownership for compliance, risk management, disclosures, client outcomes, and outsourcing oversight.

A practical governance baseline under MiCA typically includes:

- А conflict-of-interest framework covering identification, mitigation, and disclosure where unavoidable;

- Сlear segregation of duties for sensitive or high-risk activities;

- Documented approval processes for changes that affect users or public disclosures.

Internal controls should support these governance expectations through policy maintenance, periodic reviews, incident and complaint escalation, and recordkeeping that demonstrates how the business meets MiCA requirements in practice. Where critical functions are outsourced, governance should ensure vendor accountability through due diligence, contractual controls, monitoring, and contingency planning because outsourcing does not remove obligations.

For governance-related expectations and standardization work referenced by market participants, ESMA’s MiCA governance guidance is a useful reference point for how governance and control standards are operationalized in practice.

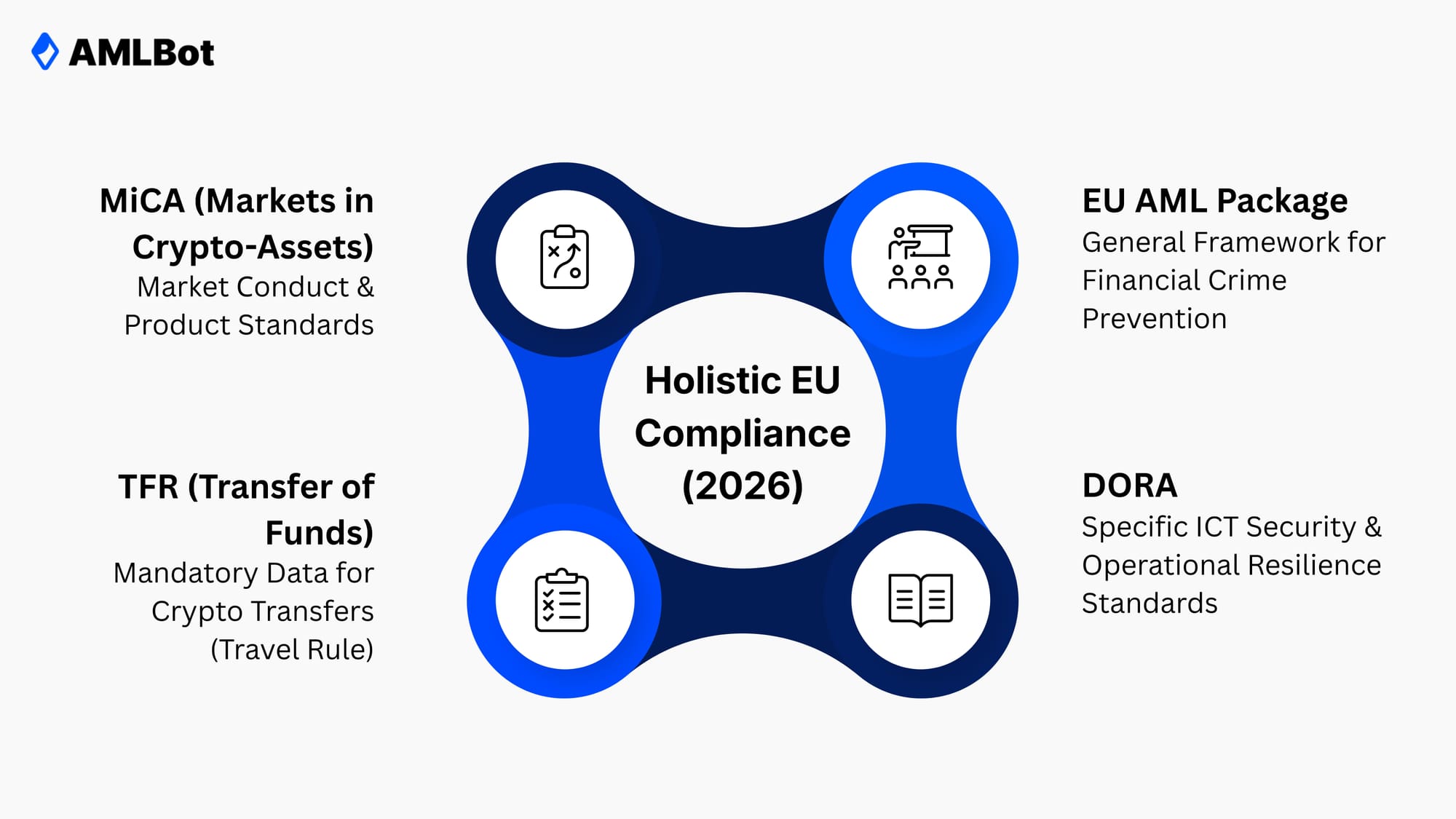

AML, KYC, and TFR Alignment Under MiCA Regulation

MiCA operates alongside EU financial crime rules rather than creating a standalone AML regime for crypto. For crypto businesses in scope, MiCA requirements should be implemented in a way that remains consistent with the EU AML Package and the TFR (Transfer of Funds Regulation), especially where crypto-asset transfers and user-facing services increase financial crime exposure. This alignment matters operationally because MiCA compliance frameworks are expected to include risk-aware controls for customer onboarding, ongoing risk review, and traceable handling of suspicious activity without turning AML into a separate, disconnected program. MiCA works alongside the EU AML Package and the TFR Regulation. For a broader view of AML rules that apply to crypto businesses, see our AML compliance guide.For companies preparing MiCA-aligned AML processes, AML automation tools (like KYT solutions) can help streamline transaction monitoring obligations.

AML Guidelines Under MiCA (Aligned With EU AML Package)

As of 2026, the European crypto-asset sector operates within a multi-layered regulatory environment where the MiCA Regulation does not function in isolation but serves as a primary pillar alongside the EU AML Package and the Transfer of Funds Regulation (TFR). This integrated approach ensures that market conduct standards are inextricably linked to financial crime prevention, creating a "holistic compliance" ecosystem.

Under this regime, crypto businesses are held to evidentiary standard. Compliance is no longer a matter of periodic review but a continuous operational requirement rooted in three critical areas of alignment:

- Proportionate Risk Management: In practice, MiCA-aligned expectations require firms to deploy risk-based KYC (Know Your Customer) protocols that are strictly proportionate to the specific risk profiles of their customers and product offerings.

- The Travel Rule (TFR) Integration: To meet legal transparency obligations, every crypto-asset transfer must be accompanied by accurate and traceable originator and beneficiary information, ensuring that "unhosted" and cross-border transactions do not circumvent EU financial safeguards.

- Active Surveillance and KYT: Beyond onboarding, the framework mandates ongoing transaction monitoring and Know Your Transaction (KYT) controls. These automated tools are essential for the real-time identification, investigation, and escalation of suspicious patterns, moving compliance from a reactive to a proactive posture.

The ultimate objective of this alignment is the generation of evidence-quality records. A crypto business must be able to demonstrate to regulators that its AML and KYC controls are not merely theoretical policies but are actively integrated into the broader MiCA compliance framework to mitigate systemic financial risk.

IT Security, Operational Resilience and Incident Management

MiCA requirements assume that crypto businesses operating in scope can protect critical systems, maintain service continuity, and respond to incidents in a controlled way. In practice, IT security and operational resilience are treated as ongoing compliance obligations: firms should have an ICT (Information and Communication Technology) risk framework, documented controls for access and asset security, and repeatable processes for business continuity and recovery. These expectations are reinforced by DORA (Digital Operational Resilience Act), which provides a common EU standard for ICT risk management, operational resilience, and incident handling across regulated financial entities, including in-scope crypto service providers.

A MiCA-aligned compliance framework for this area should include defined accountability for ICT risk, continuous monitoring for security and availability issues, and an incident management process that supports timely detection, escalation, containment, and post-incident remediation. Operational resilience should be demonstrated through tested continuity and recovery arrangements (for critical services and data), as well as governance-level oversight of third-party and outsourcing dependencies that could create single points of failure. The key standard is evidence: policies must be operationalized, incidents must be recorded and reviewed, and resilience controls should be maintained as part of normal risk management rather than treated as one-off projects.

User Protection and Transparency Obligations Under the MiCA Regulation

MiCA requirements place user protection and transparency at the center of the compliance framework for in-scope crypto businesses. Providers and issuers are expected to reduce information asymmetry through clear disclosures, fair communications, and consistent presentation of risks, fees, and service terms so users can make informed decisions. Transparency obligations also include maintaining evidence-quality records that support what is communicated publicly, especially where disclosures could influence user behavior or purchasing decisions. The practical standard is that user-facing information should be complete, understandable, and aligned with how the crypto service or crypto asset actually works.

User protection under MiCA also relies on safeguards that reduce avoidable harm:

- Complaint handling channels that provide users with a clear path to raise issues;

- Restrictions and controls around the handling of client assets to prevent misuse;

- Conduct expectations that limit unfair practices and misleading claims.

Where client crypto assets or client funds are held or controlled, MiCA requirements emphasize safekeeping principles and operational discipline so client assets are treated as client property and handled with appropriate controls. Taken together, these obligations aim to make crypto services more predictable for users while requiring crypto businesses to maintain transparency and fair treatment as ongoing compliance responsibilities.

MiCA Compliance Checklist for Crypto Businesses

The checklist below brings together the key elements crypto businesses should have in place to support ongoing compliance with the MiCA framework, based on the requirements discussed above:

- Confirm whether your activities are in scope and map which issuer and/or CASP obligations apply.

- Maintain a documented compliance framework that assigns ownership for MiCA requirements across legal, operational, and user-facing areas.

- Ensure issuer disclosures are complete, accurate, and consistent (including a current white paper where required).

- Apply governance standards that define responsibilities, manage conflicts of interest, and support oversight of critical functions.

- Keep client-facing disclosures clear and not misleading (fees, risks, service terms, and key limitations).

- Operate a complaints process that is accessible, tracked, and handled consistently.

- Safeguard and segregate client assets where client funds or crypto assets are held or controlled.

- Maintain operational controls that support reliable service delivery, recordkeeping, and audit-ready evidence.

- Apply risk management practices that are reviewed regularly and reflected in internal reporting.

- Maintain AML and KYC controls aligned with MiCA expectations and related EU rules.

- Use transaction monitoring and KYT controls to support ongoing detection and investigation of risk.

- Maintain IT security, operational resilience, and incident management controls that are tested and kept current.

- Review disclosures, policies, and internal controls on a defined schedule and update them when products or risks change.

Together, these points provide a practical snapshot of what day-to-day MiCA compliance looks like in operation. While the checklist does not replace detailed internal policies, it serves as a useful reference for assessing whether core MiCA obligations are consistently reflected across governance, operations, and user-facing processes.

-AMLBot Team

1. What Is The MiCA Regulation, And Why Is It Important For Crypto Businesses In 2025?

MiCA Regulation is the European Union’s unified rulebook for crypto-assets and certain crypto services. Adopted in 2023 and applied in stages through 2024–2025, it sets consistent MiCA requirements across EU member states for disclosures, governance, user protection, and operational standards. For businesses in 2025, MiCA matters because it replaces fragmented national approaches with a single compliance baseline, so operating in the EU increasingly depends on meeting MiCA's legal requirements for cryptocurrency activities under a single framework. For the official text, refer to MiCA (EU) 2023/1114 on EUR-Lex.

2. What Are The Main MiCA Requirements That Apply To Most Crypto-Asset Businesses?

Most in-scope crypto businesses must meet MiCA requirements for transparent disclosures, sound governance and controls, safe operations and client-asset safeguards (where relevant), risk management and reporting, and alignment with AML/KYC and Travel Rule obligations.

3. What Legal Obligations Do Crypto-Asset Issuers Have Under MiCA (excluding ART/EMT)?

For non-ART/EMT issuers, the core MiCA legal obligations center on disclosure and accountability: publishing a compliant crypto-asset white paper, ensuring marketing is consistent with disclosures, and maintaining accuracy (including liability exposure if information is misleading or incomplete). MiCA also includes user-facing protections around token offers, such as withdrawal rights in defined cases.

4. What Operational Requirements Does MiCA Impose On CASPs?

MiCA requires CASPs to run services with reliable operational controls and to treat clients fairly. Key operational requirements typically include: transparent client disclosures, complaint-handling processes, safeguards for client assets when custody or client funds are involved, market-integrity controls for trading-related services, and documented continuity and incident-response practices.

5. What Governance And Internal-Control Standards Are Required Under MiCA?

MiCA governance requirements emphasize clear accountability and effective internal control. In practice, this means defined roles and responsibilities, policies to manage conflicts of interest and risk, and compliance oversight, along with documentation to support auditability, and management-level responsibility for ensuring MiCA compliance is embedded in day-to-day operations.

What Disclosure And Transparency Rules Must Crypto Businesses Follow Under MiCA?

MiCA requires clear, fair, and non-misleading disclosures for both token offers (issuer-facing disclosures, such as white papers) and services (CASP-facing disclosures, such as fees, key risks, and service terms). The goal is to reduce information gaps so users can understand what they are buying or using, what it costs, and what risks apply.

7. How Does MiCA Interact With EU AML and KYC Rules?

MiCA operates alongside the EU AML framework and the TFR. For many businesses, this means AML and KYC programs are not optional: customer due diligence, sanctions screening, and transaction monitoring are expected as part of operating responsibly in the regulated EU environment. Travel Rule obligations under TFR also apply to in-scope transfers handled by service providers.

8. Does MiCA Require Specific IT-security, ICT-risk, Or Incident-Management Measures?

MiCA expects firms, especially service providers, to maintain strong IT security and operational resilience. These expectations are closely aligned with DORA, which sets out a structured approach to ICT risk management, incident handling, resilience testing, and third-party risk controls for relevant financial entities.

9. What User-Protection Rules Apply Under the MiCA Regulation?

MiCA strengthens user protection through requirements such as fair and non-misleading communications, clear fee/risk disclosures, complaint-handling processes, and safeguards for client assets when providers hold or control them. It also supports market integrity measures designed to reduce abusive practices and improve trust in crypto services.

10. What Should Crypto Businesses Do In 2026 to Prepare For Full MiCA Compliance?

In 2025-2026, preparation should focus on operationalizing MiCA requirements rather than writing policies “on paper.” Practical priorities include: validating scope and asset classification, tightening disclosure workflows, strengthening governance and internal controls, implementing risk management and reporting routines, aligning AML/KYC and Travel Rule processes, and improving ICT resilience and incident response so compliance holds up in day-to-day operations.