The High Cost of Non-Compliance: AML and KYC Explained

AML and KYC failures in the crypto industry no longer result in warnings or minor corrective actions. Today, non-compliance leads to regulatory investigations, financial penalties, license restrictions, and long-term reputational damage. This article does not explain how to complete KYC or what specific platforms require. Instead, it examines the real cost of AML and KYC non-compliance for crypto businesses, using enforcement actions and penalties as practical examples.

Regulators worldwide have moved away from providing mere guidance and are now taking aggressive regulatory enforcement action. Crypto exchanges and service providers that fail to meet AML/KYC compliance standards now face outcomes that can threaten their very existence. From multi-million dollar financial penalties to frozen licenses and bank account closures, the consequences underscore that compliance failures are a strategic business risk – not just a basic formality.

What AML and KYC Non-Compliance Means in the Crypto Industry

In the cryptocurrency industry, AML/KYC non-compliance refers to failing to implement the Anti-Money Laundering and Know-Your-Customer measures that regulators require. Importantly, regulators judge non-compliance not just by absence of policies, but by the effectiveness of those measures in practice. Many crypto businesses have fallen into “check-the-box” compliance – doing minimal KYC paperwork without genuine risk controls – and regulators view this as non-compliance.

For example, one exchange was found to have “violated not only formal, but also substantive requirements” by deliberately not verifying customer identities properly to avoid losing revenue. In regulators’ eyes, formal KYC without real risk assessment, no ongoing monitoring of transactions, weak AML controls, and governance failures (such as lack of compliance leadership) all constitute non-compliance.

Rather than asking whether a crypto business has a KYC program on paper, regulators now scrutinize if that program actually WORKS. Non-compliance means the business’s AML/KYC measures are inadequate to detect and prevent illicit finance. Common red flags include onboarding customers with only perfunctory ID checks, not screening customers against sanctions lists, failing to monitor for suspicious transactions, and lacking trained compliance staff to oversee these processes.

A crypto exchange that, for instance, lets users trade anonymously with just an email address – with no risk profiling or ongoing surveillance – would be deemed non-compliant even if it technically “performed KYC” at signup. In short, if AML and KYC controls exist only in name but not in effect, regulators treat it as non-compliance.

How AML and KYC Enforcement Works in Crypto

Enforcement is a systematic process. Regulators have developed methods to identify and punish AML/KYC failures in the crypto sector, similar to how they police traditional banks. Enforcement of AML/KYC in the crypto sector involves continuous oversight of businesses, formal investigations into potential violations and subsequent corrective action or penalties. It’s important to understand that “enforcement” is more than just headline-grabbing fines – it encompasses the entire journey from supervision and reviews to sanctions and remediation.

Supervisory Reviews and Regulatory Investigations

Crypto businesses operate under the watch of financial regulators who exercise supervisory powers to assess compliance on an ongoing basis. This starts with periodic audits, inspections, and information requests. Regulators can conduct on-site examinations of a crypto exchange’s controls, demand data on its customers and transactions, and evaluate whether the firm’s AML Program meets required standards. These supervisory reviews are often routine, but if they uncover red flags, they escalate into deeper regulatory investigations.

During an investigation, authorities scrutinize a firm’s records and procedures in detail. They might analyze suspicious transaction reports (or the lack thereof), review customer onboarding files, and interview compliance officers. Investigations can be intensive and span months.

For example, in the EU or UK, supervisors have broad authority to request information and conduct inspections to test a firm’s AML defenses. The goal is to identify systemic weaknesses (such as unreported large transfers, customers with fake identities, or management override of compliance rules).

Importantly, supervision is continuous. Crypto businesses face ongoing monitoring by regulators (and sometimes self-regulatory bodies), not just one-time license approval. If a business is found lacking, regulators may first issue remediation orders – requiring fixes in policy, extra training, or independent audits. This is often a warning stage. Should the firm fail to improve or if the violations are severe, regulators move to formal enforcement.

In summary, enforcement actions are typically the culmination of oversight and investigations: regulators identify issues through supervision, gather evidence in investigations, then decide on penalties.

Financial Penalties and Sanctions

When serious AML/KYC violations are confirmed, regulators impose financial penalties and other sanctions to penalize the offending crypto business. In recent years, these AML/KYC penalties have grown from negligible amounts to record-breaking fines. Notably, regulators levy such fines for systemic compliance failures – not isolated mistakes. A one-time error (like a single suspicious transaction missed) might result in a warning or small fine, but repeated or egregious failures (like having no effective AML Program at all) trigger penalties.

For example, at the end of 2025 the U.S. Financial Crimes Enforcement Network (FinCEN) fined the Paxful crypto platform $3.5 million after finding it willfully violated the Bank Secrecy Act by operating for years without an AML Program or reporting suspicious activity. FinCEN determined Paxful had facilitated over $500 million in illicit transactions due to these lapses.

In Europe, regulators have been equally aggressive – Lithuania’s Financial Crime Investigation Service imposed a record €9.3 million fine on Payeer in 2024 for “serious” AML breaches after the exchange allowed sanctioned Russian funds to flow through unchecked.

These cases illustrate that financial penalties now reach into the millions (or even billions) when a crypto business’s compliance program is found fundamentally lacking.

In addition to fines, regulators can apply other sanctions or corrective measures. They may issue public censure, impose business restrictions, or mandate the removal of executives responsible for the failures. In extreme cases, authorities pursue criminal sanctions against individuals if they knowingly facilitated money laundering.

The key point is that financial fines are often accompanied by enforceable undertakings: the company might be required to overhaul its compliance program under regulator supervision, submit to periodic third-party reviews, or even suspend operations in certain markets. Enforcement today is about driving change in behavior, not just punishing past actions.

Real-World AML and KYC Non-Compliance Cases in Crypto

In the past few years, numerous crypto companies have been hit with penalties and sanctions due to AML/KYC failures. Below, we examine two notable cases – Payeer and Paxful – to see what went wrong and what consequences followed. These examples show regulators’ rationale in action: each company was penalized for systemic, prolonged compliance breakdowns that allowed illicit finance to pass through unchecked.

Note: The companies are discussed solely in the context of regulatory actions and penalties, not as endorsements or critiques of their services.

Payeer – AML and KYC Non-Compliance and Regulatory Penalties

Payeer, a cryptocurrency payment and exchange platform, became an example of AML/KYC non-compliance in 2024 when it faced one of the largest crypto-related fines in EU history. Lithuania’s Financial Crime Investigation Service (FCIS) fined Payeer a total of €9.3 million for severe Anti-Money Laundering violations and for enabling transactions with sanctioned entities. The enforcement action followed an in-depth investigation that revealed Payeer’s compliance program was effectively non-functional, allowing high-risk transactions to go undetected.

Regulatory auditors found that Payeer had been servicing mainly Russian clients and permitting transfers in Russian rubles to and from Russian banks under EU sanctions. Despite EU laws prohibiting transactions involving sanctioned Russian banks and persons, Payeer did not implement controls to stop such activities. Under the law, the company should have been conducting thorough customer identification (KYC) and screening out any sanctioned individuals or institutions. Instead, for over 1.5 years, Payeer continued business as usual, accumulating at least 213,000 customers and €164 million in revenue while ignoring sanctions rules. Regulators concluded that Payeer intentionally chose not to properly verify customer identities or assess their risk, because doing so would have cut off a large portion of its revenue. In other words, it treated compliance as optional – a calculated trade-off against profit.

When FCIS inspectors delved into Payeer’s operations, they uncovered multiple compliance failures. Payeer failed to report large transactions (over €15,000 in crypto) to authorities as required, had deficiencies in its internal AML policies, and lacked ongoing transaction monitoring. These gaps meant suspicious activities were neither detected nor flagged. Compounding the issue, Payeer’s management allegedly did not cooperate fully with investigators, further aggravating the regulator. The outcome was a two-part fine: €8.236 million for sanctions violations and €1.06 million for breaches of Lithuania’s AML/CFT law. For Payeer, beyond the immediate financial hit, the penalties carried other costs: the company’s reputation in the EU was damaged, and its previous attempt to simply relocate proved futile as regulators followed its trail. The Payeer case shows that systematically bypassing KYC/AML obligations – whether by neglect or design – will invite a harsh, multi-pronged enforcement response.

Paxful – Enforcement Action and the Cost of AML and KYC Failures

Paxful, a peer-to-peer crypto marketplace, offers a stark lesson in the long-term cost of AML/KYC non-compliance. For years, Paxful operated with an extremely lax approach to compliance – and it eventually caught up with them. In 2023, Paxful’s co-founder abruptly announced a shutdown of the platform, citing regulatory pressures and compliance challenges. By late 2025, U.S. authorities brought the hammer down: Paxful pleaded guilty to criminal charges and agreed to pay fines as part of concurrent Department of Justice and FinCEN enforcement actions.

What exactly had Paxful done (or failed to do)? Government documents revealed that Paxful operated for years without a compliance officer, without AML training for staff, and without transaction monitoring controls. In fact, Paxful did not file a single Suspicious Activity Report (SAR) until November 2019, despite clear signs of illicit transactions on its platform. The company even marketed itself to users as a platform that “did not require KYC” – actively promoting the ability to trade crypto anonymously as a feature. This stance attracted a criminal clientele.

According to the DOJ, Paxful “knowingly moved cryptocurrency for the benefit of fraudsters, extortionists, money launderers and purveyors of prostitution,” and it “attracted its criminal customers by promoting its lack of anti-money laundering controls”. In other words, Paxful’s compliance failures were not accidental oversights but part of its business model.

The consequences were severe. U.S. prosecutors charged Paxful with conspiring to violate the Bank Secrecy Act (by willfully failing to implement an AML program and register as an MSB), among other charges. The theoretical criminal fine for Paxful’s offenses was calculated at $112.5 million, reflecting the seriousness of its violations. Paxful ultimately paid a reduced criminal penalty of $4 million due to an inability to pay (having ceased U.S. operations). Separately, FinCEN imposed a $3.5 million civil penalty for willful BSA violations, which Paxful admitted to. As part of the resolutions, Paxful’s leadership saw upheaval – the CEO departed earlier, and another co-founder pled guilty to related charges. The platform had already effectively been dismantled by the time fines were paid.

For Paxful, the long-term damage far exceeded the fines. The company’s reputation is irreparably tarnished. It went from being a popular P2P exchange to a cautionary tale of what happens when you ignore compliance. It lost its business, and its founders faced personal legal consequences. The enforcement actions also sent a wider signal: even mid-sized crypto companies will be aggressively pursued if they flout AML/KYC laws. Paxful’s case underscores that AML and KYC non-compliance isn’t just about paying a fine – it can mean the collapse of your business and potential criminal liability.

Beyond Fines – The Broader Cost of Non-Compliance

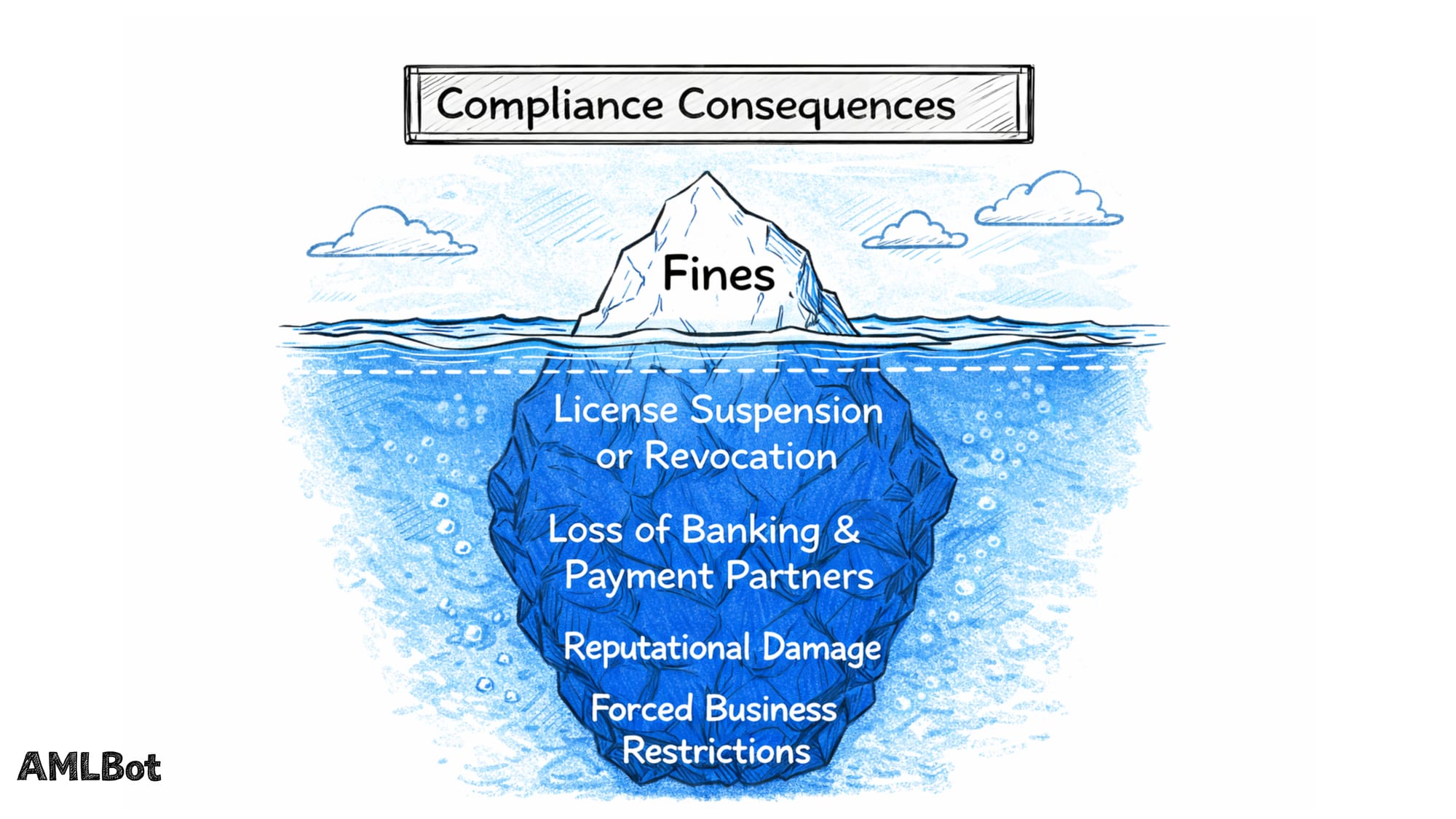

Financial penalties are often described as the “cost of non-compliance,” but in truth they are only the most visible tip of the iceberg. Beyond fines, crypto businesses that fail to comply with AML and KYC requirements face a range of other consequences that can be even more damaging in the long run. These include loss of operating licenses or inability to obtain new ones, severed banking and payment relationships (“de-banking”), reputational harm, and the opportunity costs of lost business. In many cases, a fine is just the beginning: the ripple effects of an enforcement action can jeopardize a company’s very ability to operate.

Licensing and Market Access Risks

One major “below the waterline” consequence is the risk to a company’s license and market access. Crypto businesses are typically required to obtain licenses or registrations in the jurisdictions where they operate (for example, as a Money Service Business, crypto exchange, or virtual asset service provider). Regulators can suspend or outright revoke licenses for serious AML/KYC violations, which can instantly cut off a company from its market.

We’ve already seen this with Payeer’s saga – the company’s license in Estonia was revoked when that country tightened its AML rules, forcing Payeer to relocate operations. More broadly, entire markets have been swept clean of non-compliant firms. In Estonia, for instance, enforcement of new AML regulations in 2022–2023 led to the withdrawal or revocation of nearly 80% of crypto service provider licenses – dropping from 489 licensed firms to only about 100 by May 2023. The Estonian Financial Intelligence Unit found widespread “suspicious circumstances” in firms’ applications and ongoing operations, and did not hesitate to purge those deemed non-compliant. This example shows that regulators are willing to deny entry or push out businesses that don’t meet AML standards.

Losing a license means a business must cease operations in that jurisdiction (if not globally). Even the threat of license suspension can be enough to drive away customers and partners. Additionally, a firm labeled as non-compliant may find its applications for new licenses denied in other regions. Market access can quickly shrink. For example, a crypto exchange penalized in the EU might struggle to pass rigorous licensing in, say, Singapore or the UK afterward due to its track record. License restrictions can range from conditions imposed on a license (e.g. “you can operate, but cannot onboard new high-risk customers until fixes are verified”) to an outright ban.

In all cases, the business growth is stunted. Essentially, non-compliance puts a crypto company’s regulatory permission to operate at risk – a cost that can far exceed any fine.

Banking, Payments, and Partner De-Risking

Another broad consequence of AML/KYC non-compliance is the impact on banking and payment relationships, as well as other key partners. Crypto companies rely on banks for fiat on/off-ramps and on payment processors to serve customers – but these partners have their own compliance obligations and risk appetites. If a crypto business gains a reputation for weak AML controls (for example, being fined or publicly called out by regulators), banks and payment providers may respond by “de-risking”, i.e. terminating the relationship to protect themselves.

The crypto industry has seen this dynamic play out repeatedly. A high-profile recent example is Binance, the world’s largest exchange. In 2023, following increased regulatory scrutiny and enforcement actions against Binance, major payment processors like Checkout.com and Paysafe abruptly cut ties with the exchange. Checkout.com’s CEO explicitly cited concerns over Binance’s anti-money laundering compliance and reports of regulators’ actions as the reason for the termination. This kind of partner exodus can be devastating – without payment processors, customers have trouble moving money in and out, and without banking, an exchange cannot easily manage customer funds or business expenses.

Smaller crypto businesses face an even greater de-risking risk. Many have struggled to maintain basic bank accounts if banks perceive them as high-risk. Often, after an enforcement action, a crypto company will find that mainstream banks refuse to service them, forcing the company to resort to less reliable banking channels or complex arrangements. Payment gateways might also stop integrations, fearing regulatory backlash.

In short, non-compliance can lead to a firm being isolated from the traditional financial system. Even beyond banking, other partners – such as institutional investors, liquidity providers, or other exchanges – might sever partnerships to avoid guilt by association. The loss of these relationships constrains a crypto business’s ability to operate normally and can scare away clients. Crucially, once a firm is de-banked or de-risked by major providers, it is very hard to regain that trust; this impact often outlasts the immediate regulatory penalties.

Why Weak KYC and AML Controls Lead to Enforcement

Regulators do not impose penalties arbitrarily – enforcement actions usually trace back to specific compliance failures within a crypto business. Understanding why weak KYC/AML controls trigger enforcement is important for prevention. In almost every case, large penalties are linked to systemic shortcomings in a firm’s compliance program. Here are the common failures that draw regulators’ ire:

- (a) Inadequate Customer Identification and Due Diligence: The business collects insufficient info or fails to verify it, resulting in fake or anonymous customers on the platform. For example, allowing users to trade by providing only an email (no ID) was a failure cited in the Binance case:contentReference[oaicite:32]{index=32} and Paxful’s case:contentReference[oaicite:33]{index=33}, enabling criminals to exploit the platform.

- (b) Absence of Risk-Based Controls: Treating all customers and transactions the same, without enhanced checks for higher-risk cases. Regulators expect a risk-based approach – e.g., extra scrutiny for large transactions, users from high-risk jurisdictions, or politically exposed persons. If a firm’s KYC process doesn’t differentiate risk (or ignores obvious red flags), it’s a recipe for undetected illicit activity.

- (c) Lack of Ongoing Monitoring and Screening: Failing to continuously monitor customer transactions and to screen customers against sanctions or watchlists. Ongoing monitoring is crucial because risks evolve after onboarding. Many enforcement actions (like Payeer’s) noted the failure to monitor and report suspicious transactions in real time:contentReference[oaicite:34]{index=34}, which allowed prohibited transactions to continue for months or years.

- (d) Governance and Staff Failures: Weak compliance governance – e.g., no appointed compliance officer, untrained staff, or a culture where compliance is undermined by business goals. Paxful operated years without a compliance officer or AML training:contentReference[oaicite:35]{index=35}, and BitMEX infamously had executives instruct staff to ignore KYC. Regulators view such management failings as willful neglect, and they often form the basis for hefty penalties or even personal liability for leaders.

- (e) Failure to File Reports and Escalate Issues: Not filing Suspicious Activity Reports (SARs) or other required reports to regulators is a serious breach. If a crypto exchange detects suspicious activity but does nothing, or fails to implement systems to detect it at all, regulators see it as a fundamental AML program failure. For instance, U.S. authorities penalized Paxful and others heavily for not filing SARs on obvious illicit transactions. Not reporting means law enforcement is kept in the dark – something regulators will not tolerate.

When these weaknesses exist, compliance risk soars – and regulators almost inevitably find out. Crypto companies are subject to regulatory investigations via audits, whistleblowers, or even blockchain analytics that flag suspicious patterns. Once regulators uncover such systemic issues, enforcement follows. It’s worth noting that today’s regulators expect crypto businesses to adhere to the same standards as banks. Any gap – be it missing identity documentation, lack of a risk-scoring system, or ignorance of obviously shady transactions – is seen as a violation of crypto KYC requirements and AML laws, not a minor oversight.

In summary, weak KYC/AML controls lead to enforcement because they create conditions where money laundering and terrorist financing can occur undetected. Regulators’ core mission is to prevent that illicit abuse of the financial system. If a crypto firm’s controls are so weak that criminals can easily move funds, the firm essentially becomes a conduit for crime – and regulators will step in forcefully. The Paxful case is a prime example: by neglecting every basic AML control, Paxful enabled massive illicit flows, directly provoking the joint DOJ/FinCEN action. The lesson for all crypto businesses is that robust AML and KYC controls aren’t just about meeting technical rules – they are what stand between your platform and potential misuse by bad actors, which in turn stands between your business and a regulator’s penalty.

Regulatory Frameworks and the Rising Cost of Non-Compliance

The escalating enforcement we see in crypto is part of a global trend of tougher AML regulations and penalties. Around the world, governments are raising the stakes for non-compliance, ensuring that crypto businesses face equally high expectations (and punishments) as traditional finance. From the United States to the European Union and Asia, regulatory frameworks are being tightened, and the cost of non-compliance is rising in tandem.

One clear indicator is the sheer growth in fines. In 2023, crypto companies globally saw record penalties – by one analysis, the cryptocurrency sector racked up around $5.8 billion in AML-related fines in 2023, the highest of any industry, even exceeding banking that year. The most dramatic example was Binance’s $4.3 billion settlement with U.S. authorities in 2023, resolving charges that it had grievously weak AML controls. Regulators asserted that Binance’s poor controls allowed terrorists, cybercriminals, and sanctioned parties to launder money through the platform for years. The founder of Binance resigned and even personally paid $50 million as part of the resolution. This case underscores that regulators are not hesitating to impose fines in the billions (a scale previously unheard of in crypto) when major compliance failures are found. It also shows how global enforcement is converging – U.S. actions had worldwide impact on a Cayman/Virgin Islands-based exchange operating globally.

Regulatory enforcement expectations are climbing across jurisdictions. In the United States, agencies like FinCEN, OFAC, the SEC, and DOJ have all stepped up oversight of crypto – with high-profile actions not only against exchanges (Coinbase, Kraken, Bittrex) but also mixers, NFT platforms, and others. Many countries in APAC and the Middle East are introducing stricter licensing and examination regimes for crypto service providers as well.

The message is consistent: crypto businesses must implement governance, risk assessment, KYC, transaction monitoring, and sanctions compliance at a standard comparable to banks, or face penalties.

A prime illustration of this trend is the European Union’s new Anti-Money Laundering Regulation (AMLR). The EU is replacing its older AML directives with this single regulation to unify and toughen AML rules across Europe. AMLR exemplifies stronger enforcement expectations – it creates a common rulebook and gives authorities more power to enforce it uniformly. Notably, AMLR establishes a new EU AML Authority with direct oversight powers, signaling that inconsistent enforcement by individual countries will be a thing of the past. As a result, crypto businesses in the EU will be subject to more consistent and rigorous supervision. The AMLR shifts KYC compliance from a one-time checkbox to a continuous, risk-based duty tied to ongoing monitoring and reporting. In other words, it formalizes what regulators have been informally pushing: that compliance must be an ongoing, proactive process.

EU AMLR as an Example of Stronger Enforcement Expectations

To understand the new bar being set, consider the EU AMLR (Anti-Money Laundering Regulation) more closely. Adopted in 2024 and coming into force through 2025–2026, AMLR represents a sweeping overhaul of AML laws in Europe. Unlike previous EU directives, which each member state implemented with some variation, AMLR is a regulation with direct effect – it applies uniformly across all EU member states, creating a truly single standard for AML/KYC. For crypto businesses, this is highly significant: AMLR explicitly brings crypto-asset service providers (CASPs) into the core of EU AML regulation (whereas before, coverage of crypto under EU law was slightly patchy or inconsistent). Under AMLR, CASPs are defined as “obliged entities” just like banks or insurers, meaning they must adhere to the full spectrum of customer due diligence, record-keeping, and reporting obligations.

AMLR’s impact on KYC obligations for crypto businesses is profound. It reorganizes existing EU AML requirements into a single, stricter framework, and it shifts KYC from a standalone onboarding step to an ongoing process. For example, AMLR mandates continuous monitoring of customer transactions and regular risk reviews, not just initial identity verification. It also ties in the Travel Rule (for tracing crypto transactions) as a standard obligation. Perhaps most importantly, AMLR introduces the prospect of consistent enforcement across Europe. Instead of 27 countries each doing varying levels of enforcement, the new EU AML Authority (AMLA) will ensure high-risk crypto firms can be directly supervised at the EU level. The EU Council has noted that the regulation will be applied more consistently and better enforced across the Union.

In practical terms, a European crypto exchange can expect more frequent inspections and less leniency if it falls short. Penalties under AMLR can be substantial – up to double the profit gained or a set monetary cap (whichever is higher), with the ability to ban individuals from management. The “rising cost of non-compliance” is built into the regulation: it demands that member states implement effective, proportionate, and dissuasive penalties for breaches. Given that many EU countries historically had relatively low fines for AML in crypto, AMLR is likely to ratchet those up. The unified approach also means a firm cannot “forum shop” for a lax EU jurisdiction – a weakness in the old directive system that allowed some crypto firms to base in countries with light enforcement. Now, a failure to comply in one EU country can quickly result in EU-wide action.

AMLR is just one regional example. Its introduction reflects a global mood: lawmakers and regulators are closing loopholes and arming themselves with stronger tools to ensure crypto compliance. For crypto businesses, this means the era of light-touch oversight is ending. The cost of non-compliance – whether measured in fines, business disruption, or lost opportunity – will continue to climb as new laws like AMLR come into effect.

Reducing Enforcement Risk Through Effective AML and KYC Programs

Given the formidable consequences detailed above, crypto businesses have a clear incentive to reduce their enforcement risk by strengthening AML and KYC programs. An effective compliance program is essentially an insurance policy against regulatory action – it addresses the root causes that lead to enforcement, thereby keeping the business out of regulators’ crosshairs. While there is no one-size-fits-all checklist (and this article isn’t about providing a compliance manual), there are high-level principles observed in companies that successfully avoid penalties.

(a) First and foremost is cultivating a “Culture of Compliance” from the top down. This means leadership (founders, CEOs) treat AML/KYC not as a perfunctory cost center but as a core part of the business’s strategy and risk management. In practice, that involves appointing qualified compliance officers with real authority, providing ongoing training to employees, and incentivizing adherence to compliance over pure growth metrics. Regulators often cite “Tone at the Top” as a factor in enforcement – a strong compliance culture can even mitigate penalties if an issue is found, whereas a negligent culture will aggravate them.

(b) Secondly, crypto businesses should implement KYC and Transaction Monitoring systems that are commensurate with their risk exposure. This often means investing in technology and third-party solutions: for example, using specialized providers for identity verification, blockchain analytics tools for tracing transactions, and automated alerts for suspicious patterns. Many exchanges now use real-time monitoring to flag risky wallets or unusual trade behavior, helping them intercept problems early. Effective programs also have ongoing Customer Due Diligence – periodically refreshing KYC information, especially for high-value accounts or if a customer’s behavior changes. By catching issues internally and early, a company can often self-report or correct them before regulators even notice, which tends to lead to more lenient outcomes.

(c) Another pillar is comprehensive internal controls and independent review. This includes having clear AML/KYC policies that outline procedures for customer onboarding, risk scoring, sanction screening, reporting, etc., and then auditing those procedures regularly. Many regulators require independent audits of AML programs – but even if not mandated, it’s a best practice. An audit might reveal, for instance, that a certain high-risk customer segment was not being screened properly, allowing the company to fix it proactively. Such diligence can significantly reduce enforcement risk. In fact, in enforcement cases, regulators often credit firms that identify and remediate issues proactively. For example, FinCEN noted that Paxful conducted a review to identify previously unreported suspicious activity and filed those SARs as part of its remediation, which was considered a mitigating factor. The takeaway is that regulators are more forgiving when a firm can show it takes compliance seriously and corrects missteps on its own.

(d) Finally, staying ahead of regulatory changes is key. Compliance is a moving target – new laws (like AMLR, updated FATF Guidance, or U.S. Infrastructure Bill requirements) can alter standards. Businesses that keep abreast of these changes and update their programs accordingly will always fare better than those playing catch-up after an enforcement action. Compliance officers should maintain open dialogue with regulators and even participate in industry groups to learn best practices. By doing so, a crypto business can often anticipate what regulators will focus on in the next round of exams (be it DeFi risks, privacy coins, or NFT markets) and adjust controls preemptively.

In essence, reducing enforcement risk comes down to this simple idea: make AML and KYC a foundational part of the business, not an afterthought. Companies that do so tend not only to avoid penalties but also to gain trust from banking partners, users, and regulators, which in turn is good for business. In contrast, those that treat compliance as a box-ticking exercise or, worse, flaunt lax controls to attract users eventually pay a steep price. The current regulatory environment is unforgiving to non-compliance, but it rewards (or at least spares) those who demonstrate effective governance, risk management, and a commitment to preventing financial crime.

Conclusion

The high cost of AML and KYC non-compliance for crypto businesses is now unmistakable. In today’s regulatory climate, ignoring compliance is an existential gamble – one that can result in multi-million dollar fines, criminal investigations, the loss of operating licenses, and irreversible reputational harm. The cases of Paxful, Payeer, Binance, and others underscore that regulators around the world are treating crypto just like any other part of the financial system: if you operate without proper AML/KYC controls, you will be held accountable and penalized accordingly.

For crypto founders, compliance officers, and investors, the takeaway is clear. AML and KYC compliance is not just a legal checkbox – it is a strategic business imperative. The firms that treat it as such are increasingly distancing themselves from those that don’t, not only avoiding enforcement actions but also gaining a competitive edge in credibility and access to markets. Conversely, firms that remain complacent or view compliance as a hurdle find themselves facing enforcement penalties and possibly being pushed out of the regulated ecosystem altogether.

In summary, as the crypto industry matures and integrates with mainstream finance, strong AML and KYC governance is the price of admission. Non-compliance is no longer met with a gentle slap on the wrist. It’s met with the full force of regulatory enforcement actions – from hefty financial penalties to operations-crippling sanctions. Crypto businesses must recognize AML/KYC compliance as a core responsibility and investment. The cost of doing so is far outweighed by the cost of not doing so. In an environment of rising enforcement, compliance isn’t just about avoiding fines – it’s about ensuring the longevity and legitimacy of your business in the cryptocurrency market.

Follow AMLBot:

🔗 Website

🔗 Telegram

🔗 Support Team

🔗 LinkedIn

What Is Considered AML and KYC Non-Compliance in the Crypto Industry?

It refers to failing to meet the anti-money laundering and Know Your Customer requirements expected of crypto businesses. This could mean not having an effective AML program, doing only superficial KYC checks, ignoring ongoing monitoring duties, or otherwise leaving gaps that allow illicit transactions. In practice, if a crypto exchange’s controls are so weak that they don’t identify customers properly or detect suspicious activity, regulators deem it non-compliant with AML/KYC laws.

What Types of Penalties Can Crypto Businesses Face for AML and KYC Violations?

They can face financial penalties (fines) ranging from tens of thousands to millions (even billions) of dollars, depending on severity. Beyond fines, regulators may impose sanctions like license suspensions or revocations, cease-and-desist orders limiting certain activities, mandatory compliance overhauls, and in some cases criminal charges against the company or responsible individuals. Enforcement often comes with public enforcement notices that name and shame the business as well.

How Do Regulators Detect AML and KYC Non-Compliance in Crypto Companies?

Regulators detect non-compliance through supervisory reviews and investigations. They conduct routine audits, request reports (like suspicious activity reports filings), and perform on-site inspections of crypto companies. They also use blockchain analytics to spot illicit flows linked to a platform. Whistleblowers and customer complaints can trigger investigations. If a crypto business isn’t filing required reports or has glaring lapses, it will raise red flags. International cooperation between regulators is common, so a problem spotted in one jurisdiction can lead to action in another.

Are AML and KYC Penalties Limited to Financial Fines?

No. While fines get the most attention, penalties are not limited to money. Regulators can suspend or revoke a company’s operating license, issue orders that restrict business activities (for example, barring onboarding of new clients until fixes are made), or require the removal of directors and executives. They can also mandate independent monitors to oversee the company’s compliance for a period of time (at the company’s expense). In extreme cases, especially when willful misconduct is involved, individuals can face criminal prosecution, which can lead to jail time or personal fines.

Can AML and KYC Non-Compliance Lead to License Suspension or Loss of Market Access?

Yes, absolutely. This is one of the most severe consequences of non-compliance. If a regulator believes a crypto business’s AML failures pose a danger, they can suspend the business’s license or registration – effectively shutting down its operations in that jurisdiction. We’ve seen countries revoke hundreds of crypto licenses when companies didn’t meet new AML standards. Losing a license in one region can also have a domino effect, as other regulators may refuse to license that business afterward. It can amount to losing access to an entire market or even multiple markets.

Why Do Regulators Impose Large Penalties for Weak AML and KYC Controls?

Regulators impose large penalties to punish and deter what they view as serious misconduct. Weak AML/KYC controls in a crypto business can enable money laundering, terrorism financing, fraud, or sanctions evasion on a significant scale. For example, if an exchange’s lax controls let illicit funds flow through freely, that undermines financial integrity. Large penalties send a message that such lapses are unacceptable. They also aim to strip away any profits a company made by avoiding compliance costs. Essentially, regulators want non-compliance to be much costlier than compliance, creating a strong incentive for all companies to invest in proper controls.

How Does AML and KYC Non-Compliance Affect Banking and Payment Relationships?

If a crypto company is known for compliance issues, banks and payment processors may label it high-risk and terminate their relationships. This is often called “de-risking.” Banks have their own regulators and do not want to be associated with facilitating money laundering. So a crypto exchange that just got fined for AML failures might find its bank accounts closed or its payment partners (credit card processors, etc.) cutting off service. This greatly hampers the business – without banking, it’s hard to handle customer funds, and without payment channels, customers can’t easily move money in or out. So non-compliance can effectively isolate a company from the traditional financial network, making it difficult to operate.

Do Enforcement Actions Target Isolated Failures or Systemic Compliance Issues?

Enforcement actions primarily target systemic or serious compliance issues. Regulators understand that minor isolated mistakes can happen, and those are usually dealt with via warnings or minor remedial actions. When you see a major enforcement action (big fine, etc.), it’s almost always because the regulator found broad, persistent failures: for example, an exchange not having any effective transaction monitoring for years, or management willfully ignoring the law. If a problem is isolated – say one rogue employee or one time a report was filed late – it typically wouldn’t draw a huge penalty on its own (unless that lapse led to big consequences). It’s the patterns of negligence or intent to evade compliance that bring out the heavy enforcement.

How Does Regulatory Enforcement for AML and KYC Differ Across Jurisdictions?

Enforcement intensity and styles do vary globally, but the gap is closing. In the US, enforcement tends to be very public and punitive – multiple agencies may pile on (e.g., SEC, FinCEN, OFAC, DOJ) and fines can be very high, even criminal charges are used. In the EU, historically enforcement varied by country; some regulators were strict, others were more lenient. With new regulations like AMLR, the EU is moving toward more unified and tougher enforcement EU-wide. Other jurisdictions like Singapore, Hong Kong, and Australia also have strong enforcement records, often emphasizing internal compliance reviews and license conditions. One difference can be who enforces – some countries use financial regulators, others use law enforcement or specialized financial intelligence units. But generally, the trend is that most major jurisdictions are adopting a more aggressive stance, so while specifics differ (like fine sizes or negotiation processes), the risk of enforcement exists almost everywhere now. Crypto companies need to be aware of local compliance laws in each market they operate, as enforcement will be based on those local laws.