The Most High-Profile Crypto Fraud Cases and What We Can Learn from Them

Cryptocurrency facilitates a novel and alternate financial system that brings several benefits, like inclusivity, integrity, and overcoming censorship. However, the same factors that breed such benefits can be responsible for the shortcomings of this industry. The pseudo-anonymity and the lack of familiarity with cryptocurrency usage make it a hotbed for fraudulent activity and scams. Some of the most memorable financial scams in the recent past can get traced to the asset class.

The infamous cases of Bitconnect, OneCoin, and QuadrigaCX are the best-documented scams in the industry. The elaborate scheming executed by the fraudsters behind them is shocking. Regardless, it is important to shed light on their specifics to decipher what they looked like as they unfolded, preventing users from walking into similar traps.

If anything is certain, it is that history repeats itself. Therefore, learning about the pitfalls experienced in cryptocurrency's brief history is crucial to help individuals keep their funds secure on the blockchain. Moreover, businesses can do their part to secure their users' funds, earn the needed reputation, and make the crypto ecosystem safer by adopting the needed frameworks and practices.

Overview of High-Profile Crypto Fraud Cases

The introduction of crypto-specific regulations in various jurisdictions is a very recent affair. For most of its existence, cryptocurrency was an ungoverned asset class, allowing businesses to operate as they liked. Additionally, the lack of cryptocurrency usage knowledge allowed scammers to roll with their grifts and lure many users.

Such circumstances allowed scams to snowball into mammoth proportions and cause damages in the millions if not billions.

Bitconnect

Bitconnect is one of the most extensively reported cryptocurrency scams, responsible for losing user funds amounting to $2.4 billion. The platform gained prominence for offering its users massive rewards that were too good to be true. Essentially, users needed to lend value in the form of the project's BCC tokens to the platform. In return, they could gain an interest of 1% compounded daily.

Thus, the demand for the token rose immensely as more users began acquiring and locking them for high profits. As a result, the value of each token skyrocketed to over $400, making BCC a top twenty token by value at one point. Unfortunately, less than two years after its inception, the platform stopped operating in 2018 when it ran into legal issues with US-based regulators. Consequently, the value of its token came crashing down, reducing its market capitalization by 92% and leaving its users holding the bag.

Behind the scenes, the founder of the scam, Satish Kumbhani, managed to siphon away user Bitcoin deposits – Users used Bitcoin to purchase BCC – in the billions through various exchanges, obscuring his tracks. In reality, his endeavor with Bitconnect was a massive Ponzi scheme. It relied on moving investor funds around to create the illusion of profits. It also employed multilevel marketing gimmicks to onboard as many users as possible.

OneCoin

OneCoin can be described as one of the biggest crypto heists to date, raising and defrauding users of over $4 billion. Certain estimates suggest that the number goes up to $6 billion. Like Bitconnect, OneCoin relied on Ponzi scheme tactics and multilevel marketing strategies to draw in large numbers of users and keep them engrossed.

What's astounding is that OneCoin called itself a blockchain project and included various blockchain-related talking points to attract victims while not incorporating any blockchain infrastructure. So, the namesake cryptocurrency, OneCoin, was not even a cryptocurrency.

The scheme included selling plagiarized cryptocurrency courses that could cost over 100,000 Euros. In exchange, users could receive freshly mined OneCoin tokens. However, despite the project claiming it had mining facilities in various countries, no actual mining was involved. Additionally, OneCoin was not listed on any exchange because it was not a real cryptocurrency. Instead, it was available solely on the project's platform, continuously thwarting users from withdrawing their funds.

Regulators and authorities from several jurisdictions caught on and set off alarm bells, warning investors to stay away from the project. The FBI issued a secret warrant to arrest the orchestrator of the massive scam, Ruja Ignatova. Unfortunately, she fled before they got to her and remained absconding.

QuadrigaCX

QuadrigaCX functioned as one of the more popular centralized exchanges of its time until it went bust. The Canadian platform rose to massive prominence when Bitcoin's price began soaring to $20,000 in 2017 and witnessed large trade volumes. However, as the trading frenzy stopped due to falling cryptocurrency prices, the platform's users began noticing red flags. Their withdrawal requests were not being honored.

In January 2019, the story took a sharp turn for the worse when the exchange issued a statement saying that the founder, Gerald Cotten, had passed away. As a result, users could not retrieve their funds because the keys to the exchange's cold wallets remained stuck on their inaccessible laptops. This meant that $190 million in user funds suddenly got trapped forever.

However, financial forensics of the exchange's cold wallets show only a minuscule of the $190 million present. Moreover, a large portion of user funds was transferred away before his death and was reportedly being used to support his lifestyle. Such facts lead many to believe that Cotten faked his death to make away with all the funds.

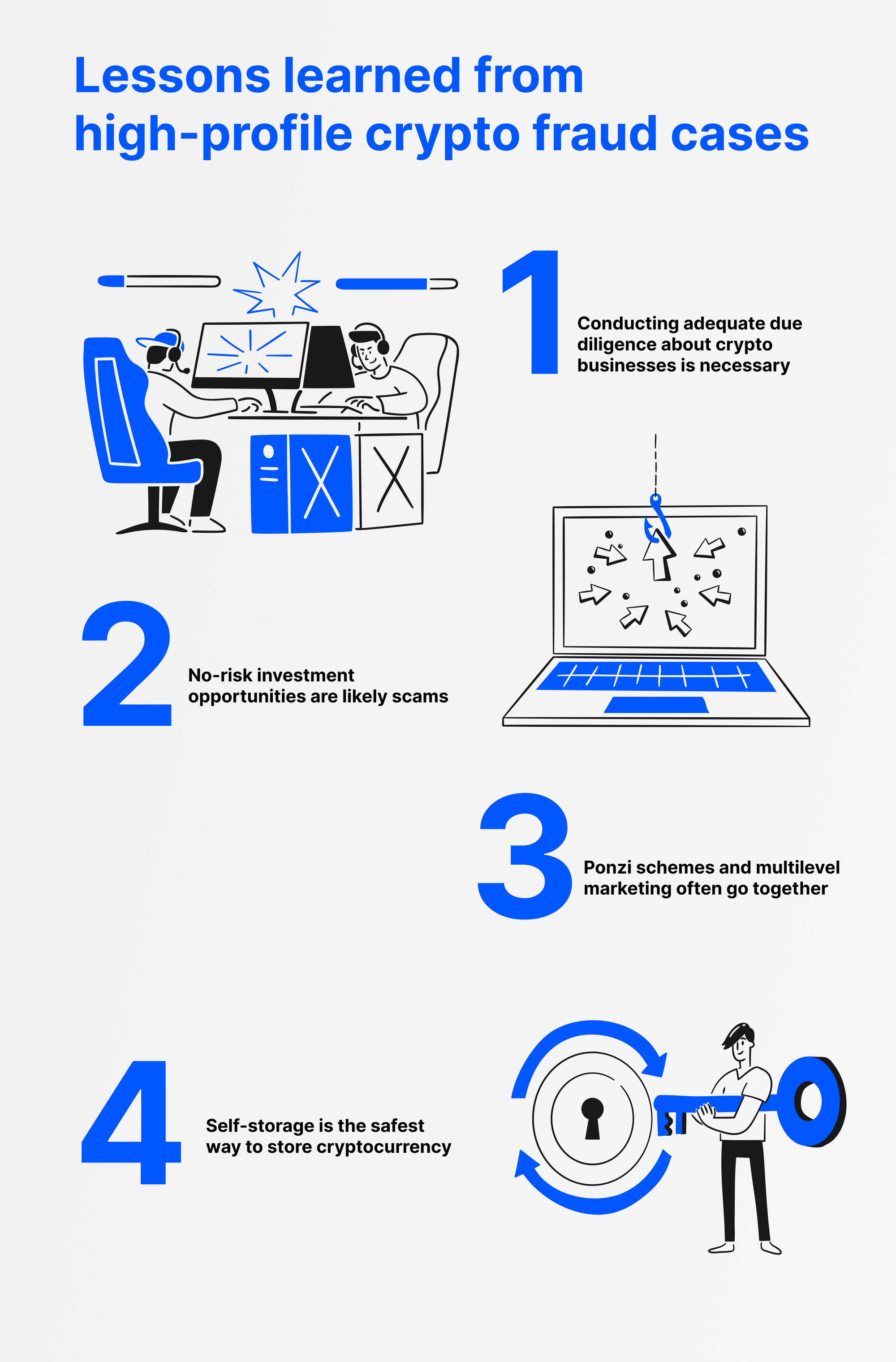

Lessons Learned from High-Profile Crypto Fraud Cases

The meticulousness with which the scams were executed can teach crypto users several things before entrusting any project with their money. Certainly, several red flags were associated with all the fraudulent platforms from the get-go.

Conducting Adequate Due Diligence About Crypto Businesses Is Necessary

Doing enough due diligence and research before getting involved could have saved users from falling prey. In addition, factors like testimonies of other users, how the community feels about the project, and the founders' history are all very important.

The founders and even certain associates of BitConnect, OneCoin, and QuadrigaCX were involved in financial crimes before pulling off their biggest heists. Knowing the founders' reputations could have been a saving grace, but most users needed to pay attention.

No-Risk Investment Opportunities Are Likely Scams

Nevertheless, the experience held by the fraudsters allowed them to execute rackets to such magnitudes. BitConnect and OneCoin appealed to investors by promising them unrealistic returns with no downsides. So, these opportunities were presented as too good to pass. However, genuine investment opportunities come with risks that only go up with increasing rewards. Keeping that in mind helped the affected users steer clear of the scams.

Ponzi Schemes and Multilevel Marketing Often Go Together

At times, it can get hard to look away from possible scams because of the constant hype around them, often propagated by investors profiting as advertised. Regardless, that is how Ponzi schemes like BitConnect and OneCoin drive up legitimacy until the investor funds used falsely to represent profits dry up. Moreover, crypto Ponzi schemes also resort to multilevel marketing strategies that pay existing users to recruit more. This strategy is a tell-tale sign that the projects have an insidious side.

Self-Storage Is the Safest Way to Store Cryptocurrency

QuadrigaCX, although skipping the multilevel marketing, was a Ponzi scheme wrapped in the guise of a crypto exchange. The deceased, yet believed to be alive, founder funneled funds from new users to satisfy the withdrawals of other users.

This was mostly possible because users left their cryptocurrency on the fraudulent centralized exchange. It is always wise to self-store cryptocurrency instead of relying on exchanges and custodians to hold them. Incidents with third parties, like fraud, cyberattacks, and insolvency, can push users away from their funds.

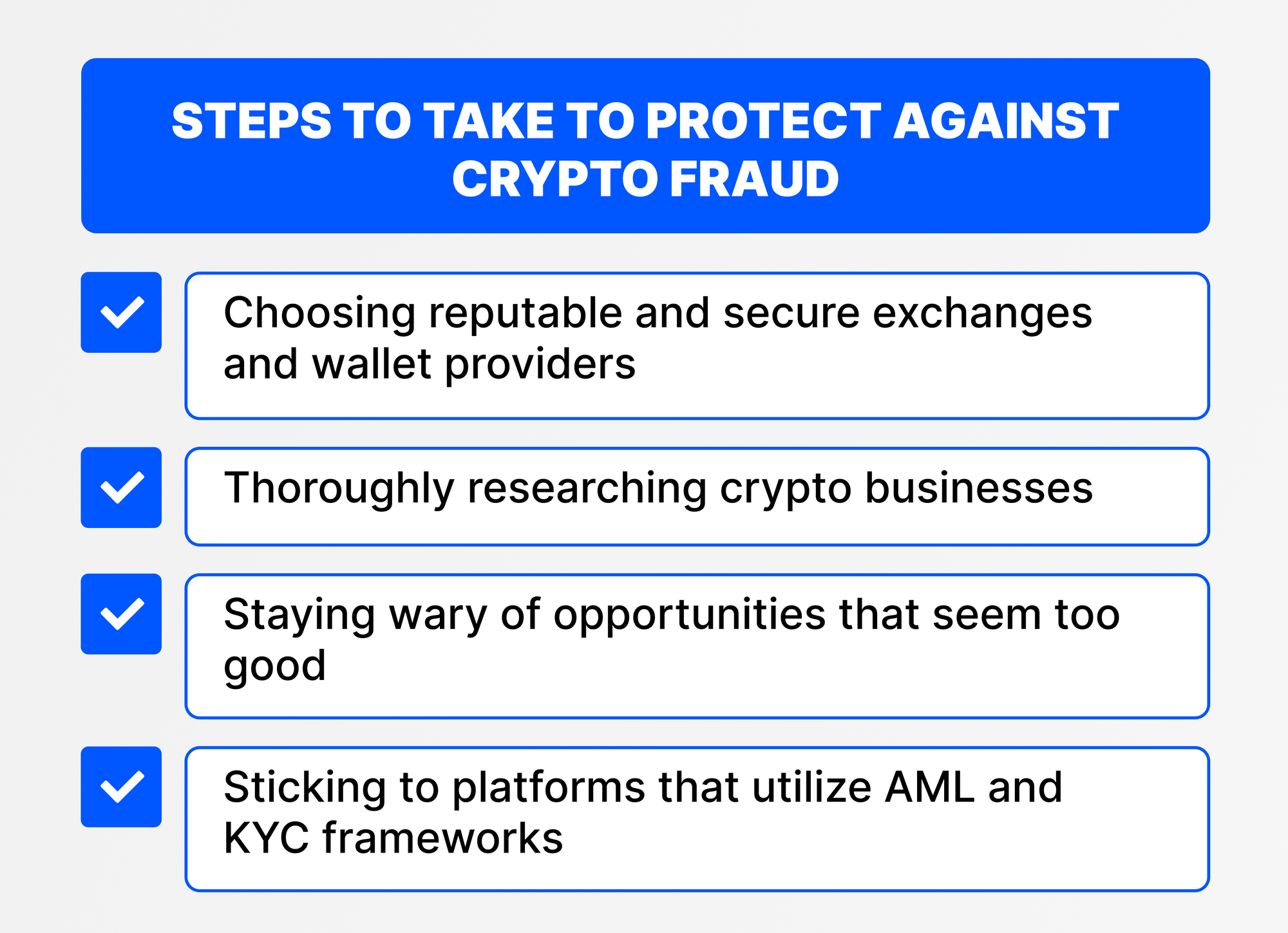

Steps to Take to Protect Against Crypto Fraud

Using cryptocurrency can seem problematic, considering the number of ways users can get parted from their assets. However, taking certain measures before investing or giving access to funds can go a long way in keeping them safe from those plotting to grab them.

Choosing Reputable and Secure Exchanges and Wallet Providers

As defined crypto regulations are set in several jurisdictions, it is getting easier to spot legitimate projects despite the swarm of fraudulent and irresponsible ones. Users should stick to licensed and regulated ones and thus follow all protective measures.

Users who still want third parties to manage their private keys and cryptocurrency must look for exchanges and custodian services that are known for their security. It is the same for those taking the self-custody route when choosing wallet providers.

Thoroughly Researching Crypto Businesses

Of course, there is repeated insistence that research is vital while indulging with any crypto business – regulatory status, roadmap, leadership, user satisfaction, and business practices must be investigated. Any identifiers of unusualness will help determine if the business is out to pull a fast one over users. For instance, practices resembling multilevel marketing often become full-blown pyramid schemes in this industry.

Staying Wary of Opportunities That Seem Too Good

Similarly, anything with unbelievable returns must be scrutinized heavily before usage. Often, such returns can only get offered by Ponzi schemes. If the fundamentals of the operation do not justify the profits it generates for its users, it is a scam. So again, the idea is to be cautious of any business that offers its users more than the norm.

Sticking to Platforms That Utilize AML And KYC Frameworks

Additionally, it is always better to utilize platforms with AML (Anti-Money Laundering) and KYC (Know Your Customer) policies ingrained into their operations. Most regulated crypto businesses are required to possess these frameworks. Their implementation allows virtual asset service providers (VASPs) – like exchanges and custodians – to know the users behind every transaction on their platform. This can help determine if the funds they transact are from crime-ridden sources.

Cryptocurrency is known to get used for laundering money by the likes of the darknet and terrorist operations. The pseudo-anonymity associated with crypto transactions is a major reason. AML and KYC measures can help platforms identify high-risk wallets indulging in laundering efforts. Moreover, platforms can also pinpoint entities involved in other nefarious activities like stealing user cryptocurrency.

Platforms can then report them to authorities and prevent them from using such services, making it safer for crypto users industrywide. As a result, troubles can be avoided, like users getting scammed or landing in legal hot waters for unknowingly receiving laundered funds.

Conclusion

The crypto industry is not new to fraud. The users get scammed or lose their cryptocurrency because of various factors. Understanding how these incidents occur can help prevent them from repeating and make the industry safer.

Users should stick to best practices when storing and transacting cryptocurrency. It does not hurt for them to understand the functioning of any service or investment opportunity before dipping their toes into it.

Furthermore, AML and KYC implementation by businesses can help make the crypto industry safe for everyone to use and ready for mainstream adoption. AMLBot is working towards this future by setting up AML and KYC architectures for crypto businesses in tune with regulatory standards, thereby securing them and their users from incidents of exploits and defrauding.