The Role of Customer Due Diligence in AML and KYC Compliance

The financial industry is a heavily regulated with numerous laws governing its operations. Some regulations are designed to safeguard customer interests. In contrast, others are devised to keep tabs on the movement of funds to prevent illegal activities like money laundering, terror financing, and more.

As stringent Anti-Money Laundering (AML) and Know your Customer (KYC) legislation take shape globally, financial institutions and money businesses must change their existing AML frameworks. That includes virtual asset service providers (VASPS) operating in the crypto space.

A highly critical component of any AML and KYC framework is customer due diligence (CDD). It is important for crypto businesses because crypto wallets do not offer details about their owners, allowing transactions to get committed without a human identity behind them.

Therefore, CDD procedures help establish transparent customer-business relationships that help VASPs to know the customers they are dealing with, the risks the customers pose, and instances of criminal behavior during their relationship. Obviously, this is also much needed for financial entities other than VASPs.

Benefits Of Effective CDD

As CDD touches upon all factors needed to keep the relationship between businesses and their customers transparent, it is much needed for any business's AML and KYC policies and procedures. Most instances of risky behavior exhibited by customers can be eliminated immediately, thanks to it. In addition, when there is criminal activity once customers begin using the VASPs services, they can get reported instantly to regulators.

VASPs can always stay compliant with AML and KYC laws by integrating competent CDD infrastructures and, as a result, evade hefty fines or business closure by regulators. Simultaneously, effective CDD implementation breeds customer trust and helps VASPs build a good reputation in the crypto sphere. Moreover, cryptocurrency usage will witness declining rates of criminal association thanks to CDD, making it safer for individuals, businesses, and institutions across the board.

Some of the leading exchanges, custodians, and businesses within the crypto sphere implement CDD measures that are making the industry much safer. Coinbase, Kraken, and Binance are great examples of conducting effective CDD in their jurisdictions by complying with their specific AML and KYC legislation. It is also one of the reasons they are receiving the regulatory go-ahead to operate in multiple jurisdictions.

Overview Of CDD Requirements

VASPs achieve effective CDD implementation with measures like customer identification and verification, risk analysis, and ongoing monitoring of their activity and transactions. With such measures in place, VASPs can analyze the individuals and entities they need to avoid and report those that turn bad after getting accepted.

Let's look at how CDD components aim to impact customer relationships for financial institutions and businesses.

Identity Verification

Identification and subsequent verification of identities are the initial steps VASPs take while taking on new customers. First, they must collect valid identification like government IDs from individuals and owners of businesses looking to use their services.

Verifying the identifying documents may be needed depending on the risks associated with the customer and their reasons for using the service. Otherwise, VASPs are satisfied with the mere act of identification. However, newer AML legislation may enforce identity verification for all customers despite their risk profiles. This may include checking public and private databases and verifying photos and videos.

The intent is to ensure the identity provided by the entity looking to use a business's services is correct and that any attempts at impersonation are noticed. In addition, by verifying one's identity, businesses can also assess how risky the potential customer is to them and, ultimately, the financial system.

Risk Analysis

Analyzing a potential customer's risk is what comes after identity verification. High-risk customers, who are found to be so through their identifications, are promptly scrutinized through measures referred to as enhanced due diligence (EDD). In addition, previous transactions, sanction statuses, source of funds (SoF), and source of wealth (SoW) need to be investigated for them.

These include politically exposed persons (PEPs), customers in high-risk jurisdictions where AML laws are lax, and businesses operating within high-risk industries. Based on analyzing the risk their customers present, VASPs can decide to accept or reject customers looking to use their services. Furthermore, they can limit the services they can use and the number of funds they can transfer.

Ongoing Monitoring

VASPs are legally required to monitor the activities of all their customers once taken in. Most regulators mandate VASPs to store detailed reports about every customer's financial activity on their platforms. Such data must be stored securely until their regulator decides an amount of time. It should also be submitted to the regulator when prompted.

In cases where VASPs suspect a customer of financial wrongdoings, they need to turn in the suspected party's transaction history to their regulators. Questionable activity can range from transactions that imply money laundering tactics to those blatantly occurring with sanctioned entities or sanctioned regions.

Challenges Of Implementing Effective CDD

While the components of an effective CDD program may seem straightforward, their implementation is highly complex. Moreover, since different regulators worldwide suggest varying CDD measures, there needs to be more uniformity in implementing CDD frameworks worldwide.

VASPs sharing information across borders may adhere to different standards. This can cause regulatory troubles for those in jurisdictions where AML laws are highly demanding.

Moreover, smaller businesses operating or just starting in jurisdictions with highly rigid AML legislation must incur high costs to set up and operate technological and personnel resources for conducting CDD. Training personnel with the changing AML landscape to perform proper CDD procedures can cause great hassles.

Businesses, however, must remain prepared and chart out how they will remain compliant with AML and KYC requirements as they conduct their CDD practices.

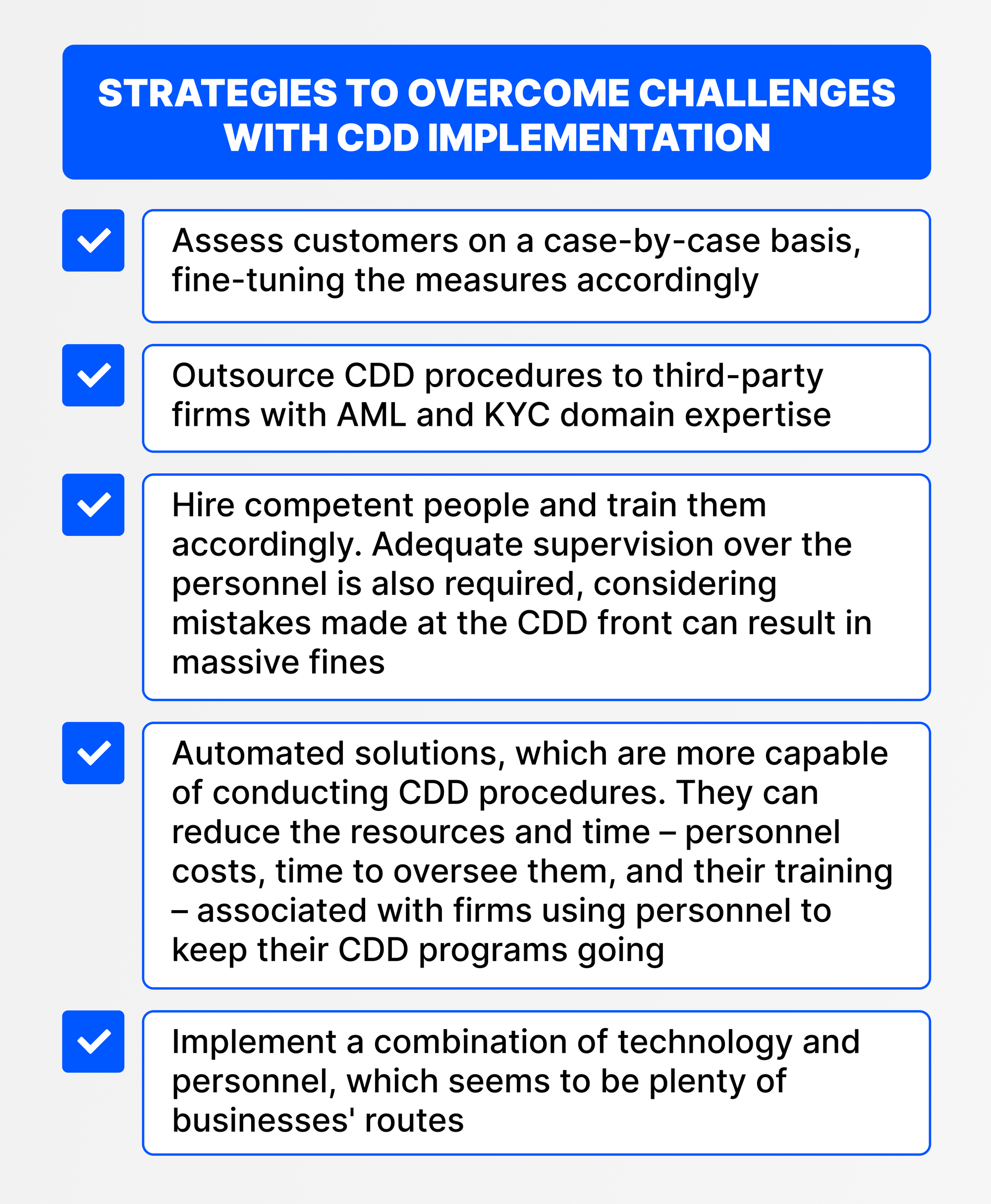

Strategies That Businesses Can Adopt to Overcome Challenges with CDD Implementation

Although businesses' cost to operate while meeting CDD requirements is high, it is in their best interest to do so, considering the benefits. Additionally, they can streamline measures to make their systems cost-effective and efficient.

Instead of implementing CDD measures to all customers similarly, businesses can assess customers on a case-by-case basis, fine-tuning the measures accordingly. So, low-risk customers need not be scrutinized deeply, saving such resources for high-risk clients and reducing costs.

VASPs can also outsource their CDD procedures to third-party firms with AML and KYC domain expertise. By outsourcing, crypto businesses can focus on other aspects of their functioning while knowing that an important aspect of their operations is being handled efficiently.

Third-party AML firms with good industry reputations must be chosen.

When VASPs decide to handle CDD procedures by themselves, they must hire competent people and train them accordingly. Adequate supervision over the personnel is also required, considering mistakes made at the CDD front can result in massive fines or, worse, the revocation of operational licenses.

An alternative to be considered here is automated solutions, which are more capable of conducting CDD procedures. They can also reduce the resources and time – like personnel costs, time to oversee them, and their training – associated with firms using personnel to keep their CDD programs going. Or, VASPs can implement a combination of technology and personnel, which seems to be plenty of businesses' routes.

Alongside all that, it is important to assess the measures other businesses take to make their CDD programs successful. Collaboration and the passage of ideas industry-wide will make cryptocurrency a safer asset class to use and the ecosystem surrounding it more attractive for potential users.

Conclusion

Customer due diligence (CDD) is integral to all AML and KYC programs. It acts as the first line of defense for VASPs and the crypto ecosystem at large from financial crimes. Furthermore, it keeps VASPs secure from regulatory fines and legal action.

Legally mandated CDD programs will protect cybercriminals, fraudsters, and other criminals from crypto platforms. Current and potential crypto users will, thus, trust VASPs, other users, and cryptocurrency more. This trust will go a long way in making cryptocurrency and its innovations a viable alternative to the traditional finance system and propel its benefits to larger populations.