Crypto Compliance 2025: Complete AML Regulation Guide for Crypto Businesses

Today, cryptocurrency may feel borderless and free from traditional rules, but in reality, it’s one of the most closely watched industries in the world. The same tools that make digital assets fast and global also make them attractive to criminals. To prevent money laundering, fraud, and terrorist financing, regulators worldwide now require crypto businesses to adhere to strict Anti-Money Laundering (AML) Standards.

For founders and operators, compliance is necessary to safeguard the company’s operations and longevity. Without the proper license or controls in place, a company could face frozen bank accounts, massive fines, or even be shut down overnight. One of the most high-profile examples is BitMEX, a crypto derivatives exchange. In January 2025, BitMEX pleaded guilty to willfully violating the Bank Secrecy Act by failing to implement and maintain an adequate AML Program, including its customer identification requirements. The U.S. Attorney’s Office imposed a $100 million criminal penalty on BitMEX following its guilty plea, in addition to an earlier $130 million in civil penalties assessed by the U.S. Commodity Futures Trading Commission (CFTC), bringing its total AML-related sanctions to over $230 million.

The main challenge for crypto businesses? There is no “one-size-fits-all” crypto law. The rules differ from country to country: what’s allowed in Switzerland may be restricted in Spain, and what works in Singapore may not work in the U.S. This guide breaks down global AML regulations into clear, practical terms, helping you understand what authorities expect, where the main risks are, and how to choose the proper jurisdiction for your crypto business.

Note: None of this information should be considered as legal, tax, or investment advice. While we’ve done our best to ensure this information is accurate at the time of publication, laws and practices may change, so please double-check it.

Global AML Framework: FATF and the Travel Rule Explained

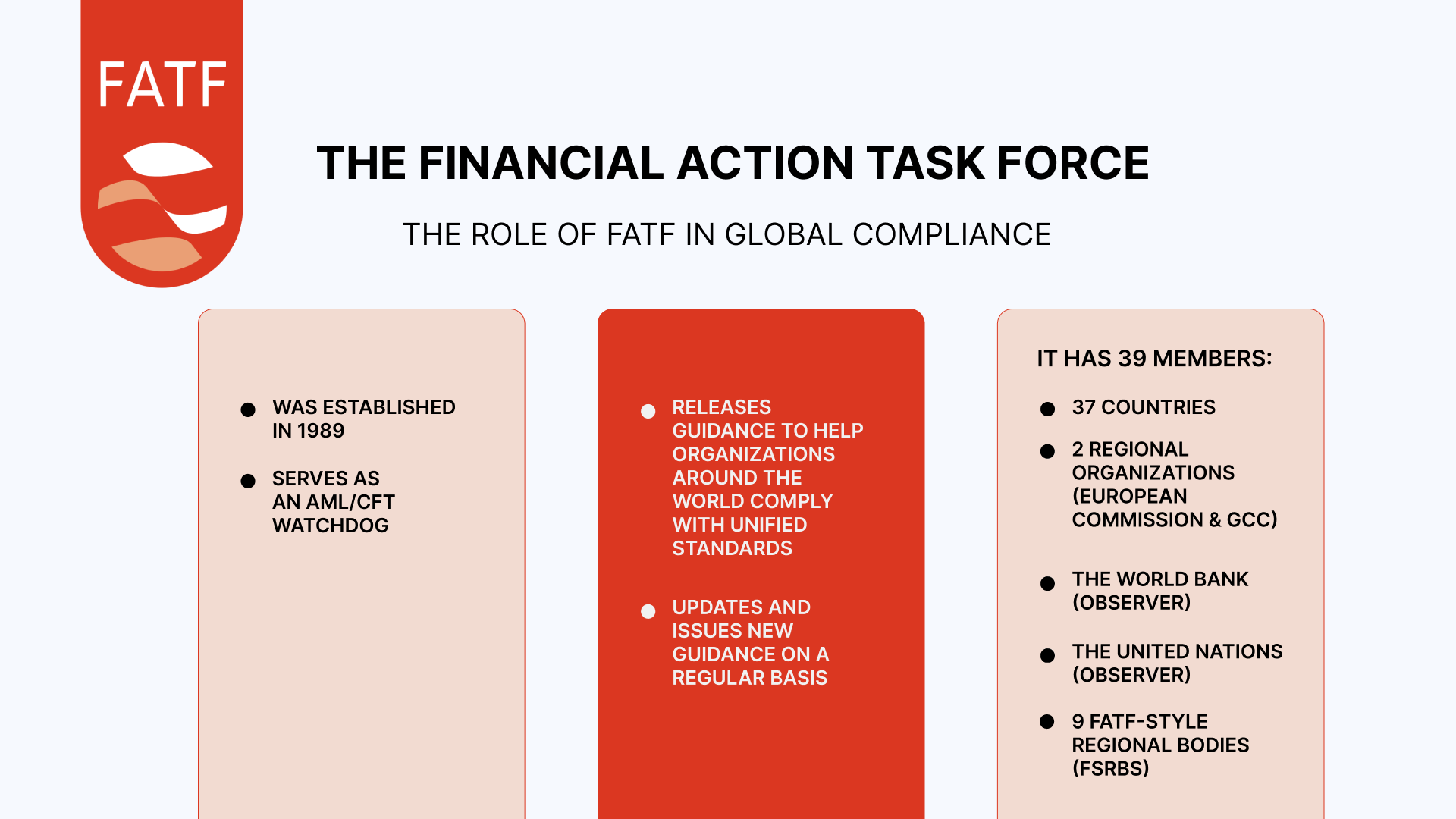

The Financial Action Task Force (FATF) serves as the premier intergovernmental organization for combating money laundering and terrorist financing worldwide. Established in July 1989 during the G-7 Summit in Paris , FATF originally focused on addressing the growing threat of drug money laundering. Following the September 11, 2001 attacks, its mandate expanded significantly to include counter-terrorism financing (CTF). FATF operates as a policy-making body with 39 member countries and works alongside nine FATF-Style Regional Bodies (FSRBs), collectively covering almost every country in the world.

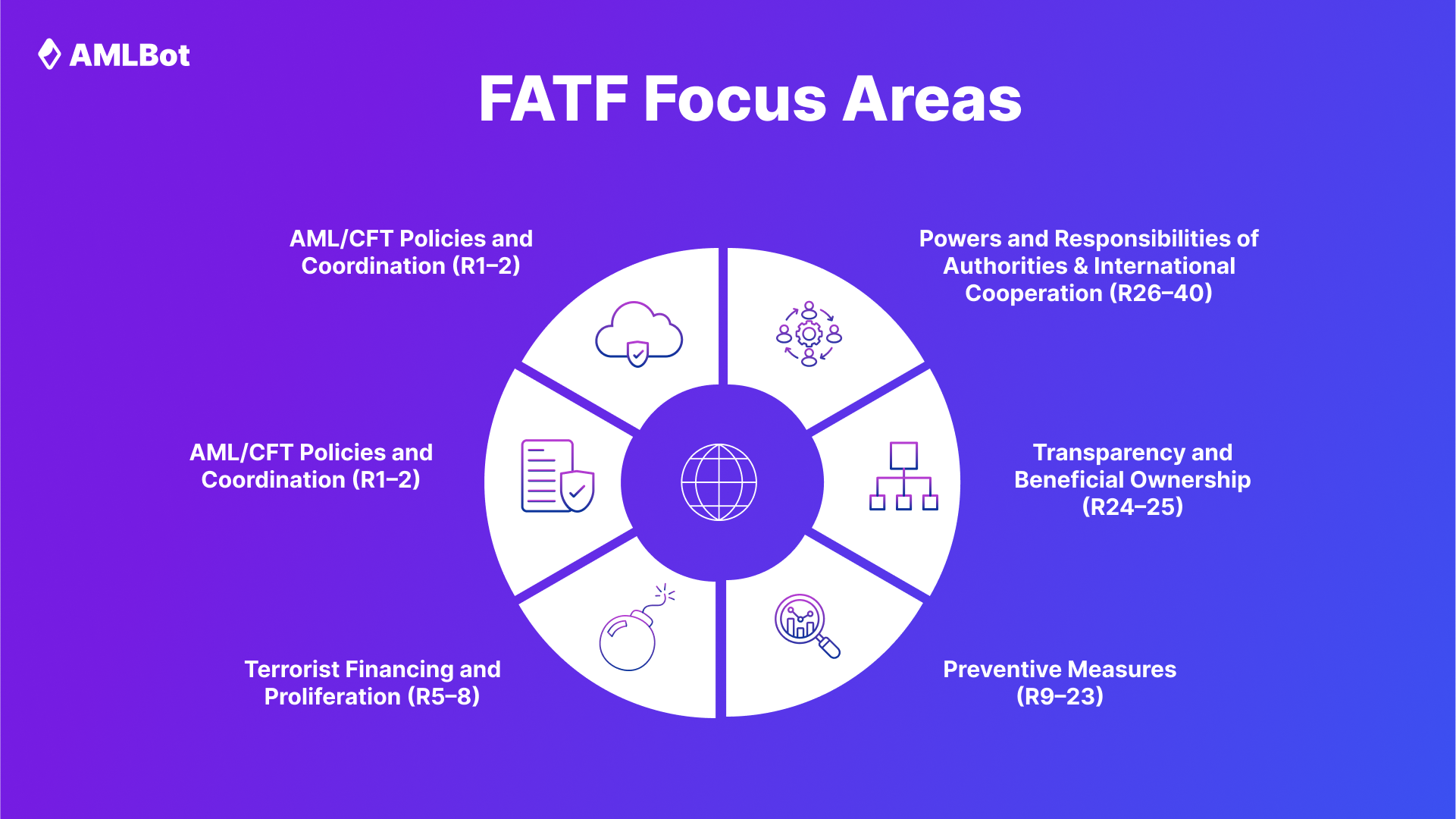

The FATF Recommendations* form the backbone of crypto regulations worldwide, influencing how individual countries develop their regulatory frameworks for digital assets and cryptocurrency businesses. These recommendations together establish national risk assessments, legal definitions, criminalization measures, preventive controls such as customer due diligence and transaction monitoring, transparency through beneficial ownership rules, enforcement powers for regulators and law enforcement, and mechanisms for international cooperation.

Note: The FATF 40 Recommendations are universal standards for all financial institutions, DNFBPs (Designated Non-Financial Businesses and Professions), and now VASPs* (Virtual Asset Service Providers). In 2019, FATF introduced the Interpretive Note to Recommendation 15, which explicitly extended AML/CFT rules to cryptocurrencies and VASPs. There is no separate “crypto block” among the six groups. Instead, crypto businesses are integrated into the same framework, with specific clarifications for KYC (R10), new technologies (R15), and the Travel Rule (R16).

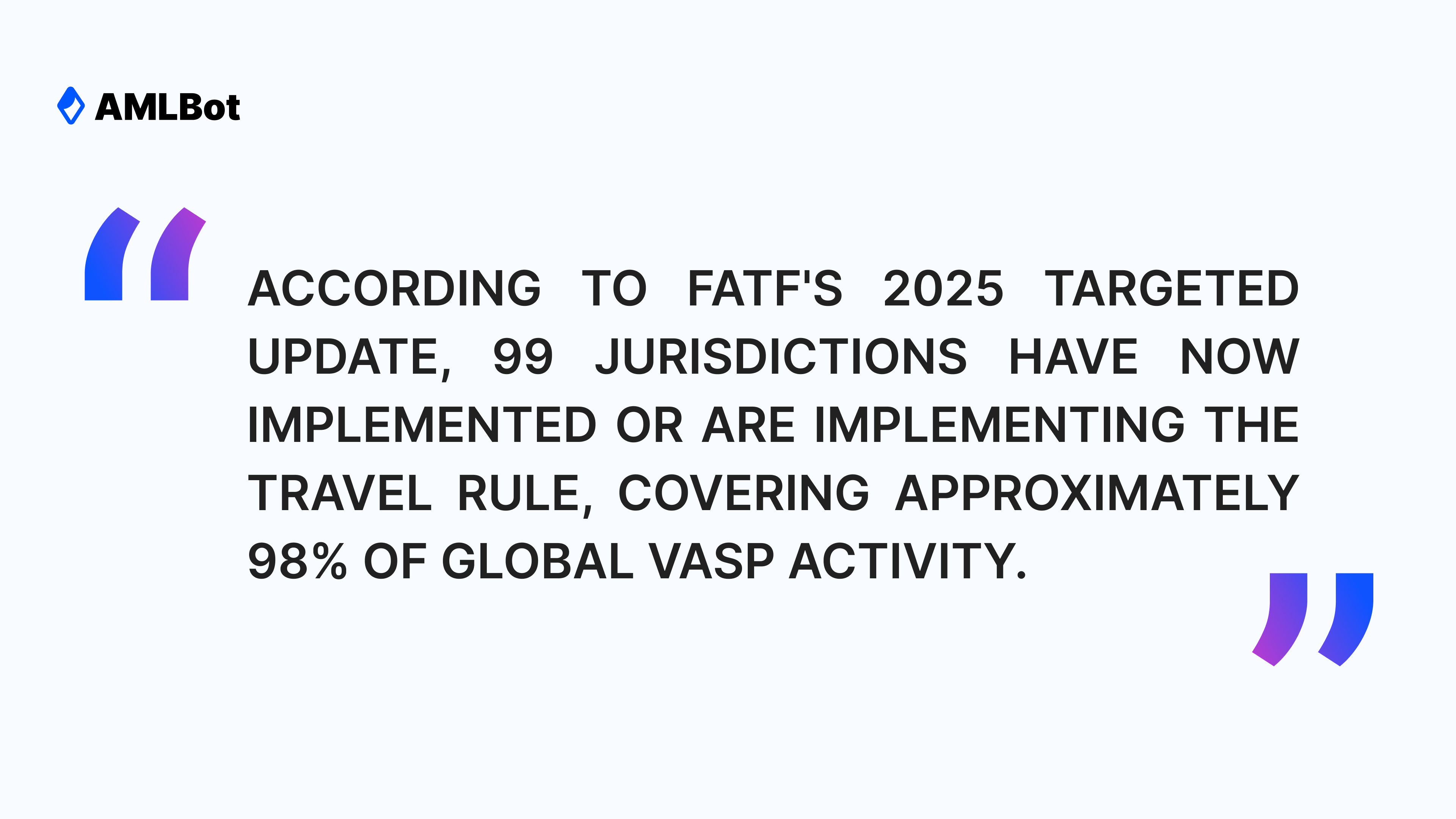

Recommendations 10 (Customer Due Diligence), 15 (New Technologies/VASPs) and 16 (Wire Transfers/Travel Rule) are the core FATF standards most directly tailored to the crypto sector. The Travel Rule, enshrined in FATF Recommendation 16, stands out as one of the most consequential requirements for VASPs. This regulation mandates that cryptocurrency businesses collect and share customer information for transactions exceeding specific thresholds. While FATF recommends a de minimis threshold of USD/EUR 1,000, individual jurisdictions set their own thresholds – ranging from €0 in the EU under MiCA regulation to $3,000 in the United States, with variations like CAD 1,000 in Canada and SGD 1,500 in Singapore.

Building on this, FATF Recommendation 10 establishes the core Customer Due Diligence standards (CDD) that all financial institutions must follow, while Recommendation 15 extends those AML/CFT obligations specifically to VASPs by requiring licensing or registration, enhanced due diligence, ongoing transaction monitoring, and timely suspicious activity reporting.

Other parts of the FATF 40, most notably Recommendation 1 (Risk-Based Approach), Recommendation 2 (National Coordination), Recommendation 11 (Record-Keeping) and the special asset-freezing sanctions under Recommendations 5–7, also play important supporting roles, but R10, R15 and R16 are the standout requirements for VASPs. These international standards directly influence how local regulators craft their crypto regulations, creating a harmonized approach to cryptocurrency compliance across different markets.

FATF also enforces its standards through Mutual Evaluations (Peer Reviews) and by placing non-compliant jurisdictions on its ‘grey’ or ‘black’ lists, creating reputational and financial incentives to strengthen AML/CFT regimes.

*The FATF Recommendations represent the current international standard, originally adopted February 15, 2012, and regularly updated since with the most recent amendments published June 2025. Beyond the core 40 standards, FATF continuously issues targeted guidance on emerging risks including virtual assets, proliferation financing, and financial inclusion, plus a separate "Methodology for Assessing Technical Compliance" that explains how countries are evaluated for compliance with these Recommendations. For the most current version and complete update history, see the official FATF Recommendations page.

**Virtual Asset Service Provider (VASP) is any individual or company that, as a business, carries out one or more of the following on behalf of others: swaps between cryptocurrencies and fiat money; exchanges one type of cryptocurrency for another; sends or receives crypto assets (i.e., executes transfers); holds or safeguards crypto assets (including wallets or custody services); offers financial services tied to issuing or selling crypto tokens.

AML Regulations by Region (US, EU, UK, Asia, UAE)

As the information above makes clear, the goal of mitigating illicit finance risks is shared by jurisdictions worldwide in 2025. Yet regional regulators continue to shape their crypto frameworks to reflect local economic priorities, risk assessments and regulatory philosophies, while broadly aligning with FATF standards. Below, we examine the main approaches taken by the United States, the European Union, and the United Kingdom.

USA Crypto Regulations

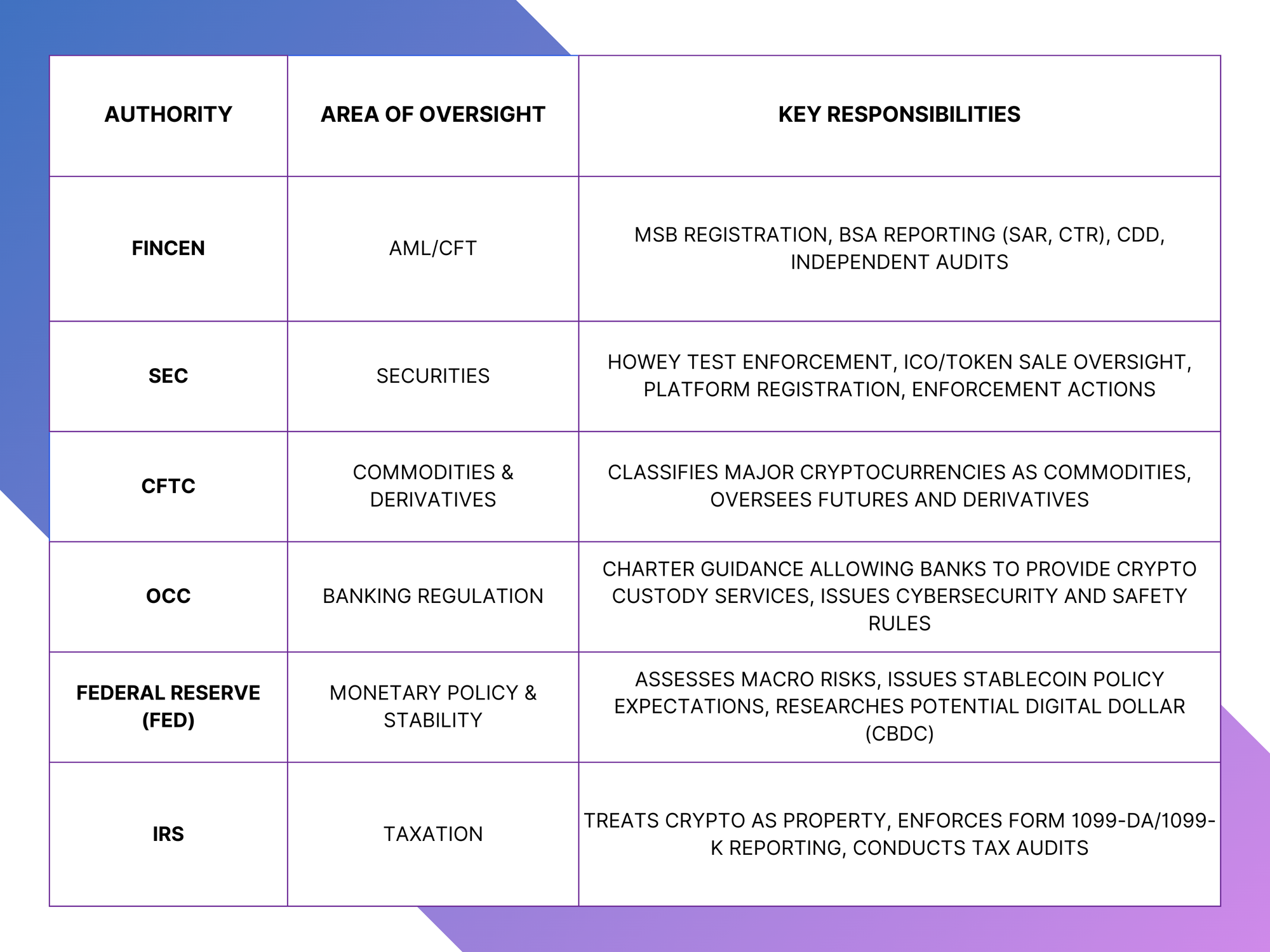

The United States relies on a layered, multi-agency model to oversee cryptocurrency activities, with each regulator focusing on a distinct slice of the market yet coordinating to form a cohesive compliance landscape. For founders, this means there is no single “crypto regulator”. Instead, different agencies handle AML, securities, commodities, banking, taxation, and state-level licensing. Сrypto firms must comply with at least six layers of oversight: AML (FinCEN), securities (SEC), commodities (CFTC), banking (OCC & Fed), taxation (IRS), sanctions (OFAC), and state licensing (e.g., BitLicense).

At the heart of Anti-Money-Laundering controls sits the Financial Crimes Enforcement Network (FinCEN), which treats most crypto firms as Money Services Businesses (MSBs. Every exchange, wallet provider, or transmitter must file FinCEN Form 107 within 180 days of starting operations, renew every two years, and implement a full AML program under the Bank Secrecy Act (BSA). This includes appointing a compliance officer, maintaining customer due diligence, and filing Suspicious Activity Reports (SARs), and conduct independent reviews. FinCEN also expects ongoing monitoring and record-keeping comparable to traditional financial institutions.

While FinCEN governs how crypto businesses must operate to prevent money laundering, another major question for U.S. regulators is what the underlying assets themselves actually are.

A major complexity is deciding whether a token is a security or a commodity. If a token meets the Howey Test (investment in a common enterprise with expectation of profit from others’ efforts), it falls under the Securities and Exchange Commission (SEC). The SEC oversees ICOs, token sales, and platforms trading security tokens. If not a security, but used in derivatives or futures, it likely falls under the Commodity Futures Trading Commission (CFTC), which treats major tokens like Bitcoin and Ethereum as commodities. This split has caused regulatory uncertainty, but both agencies are tightening cooperation. In September 2025, the SEC and CFTC issued a joint statement clarifying how spot crypto trading on registered exchanges fits their mandates, marking progress toward a more consistent approach.

For example, the long-running Ripple vs. SEC case shows how difficult these classifications can be in practice. The SEC argued that Ripple’s XRP token was a security when sold to institutional investors, while Ripple maintained it was simply a digital asset. In July 2023, Judge Analisa Torres ruled that institutional sales of XRP did indeed qualify as securities, but sales on public exchanges did not, splitting the outcome down the middle. This landmark decision not only reshaped how the Howey Test is applied to tokens, but also underscored the broader uncertainty businesses face when offering or trading digital assets in the U.S.

Beyond token classification, the U.S. also regulates how traditional financial institutions interact with crypto. Banking regulators set the rules for custody, payments, and the broader stability of the financial system, extending oversight from exchanges and token issuers to the heart of the banking sector. The Office of the Comptroller of the Currency (OCC) regulates federally chartered banks and issued key guidance (since 2020) allowing them to provide custody services for crypto assets.This legitimized crypto custody within the traditional banking system. Meanwhile, the Federal Reserve (Fed) monitors macro-level risks: it sets policy expectations for stablecoins and explores frameworks for a potential U.S. CBDC (Digital Dollar). Although still in research, Fed commentary strongly shapes how stablecoin issuers structure reserves and operations.

Alongside institutional oversight, the U.S. tax authority plays a critical role in regulating how both companies and individuals account for their crypto activity. The Internal Revenue Service (IRS) enforces tax reporting for digital assets. Crypto is treated as property, meaning gains are taxable. For businesses, crypto transactions are regular income subject to corporate tax (19–25%). For individuals, crypto disposals fall under capital gains tax. Since 2024, exchanges and brokers must issue Form 1099-DA (a digital asset-specific version of 1099) in addition to 1099-K, giving the IRS greater visibility into crypto transactions. IRS scrutiny is high, and failures in reporting can trigger audits or penalties.

On top of federal rules, state regulators impose additional requirements. The most famous is New York’s BitLicense (23 NYCRR Part 200), which demands strong capital reserves, cybersecurity controls, and consumer-protection standards. Beyond New York, over 40 states require Money Transmitter Licenses (MTLs), creating a patchwork. Many national operators must therefore secure multiple state licenses unless Congress harmonizes the system.

Sanctions Сompliance adds yet another layer. The Office of Foreign Assets Control (OFAC), part of the U.S. Treasury, enforces America’s economic and trade sanctions. For cryptocurrency businesses, this means every customer and every transaction must be screened against OFAC’s Specially Designated Nationals (SDN) List, as well as other restricted lists that cover sanctioned countries, organizations, and individuals. If a potential match is found, companies are obligated not just to block the transaction, but also to file a report with OFAC. OFAC has already designated specific wallet addresses linked to illicit actors, such as the North Korean hacking group Lazarus, and has sanctioned mixers like Tornado Cash for facilitating money laundering. That means crypto exchanges, custodians, and payment processors must integrate real-time sanctions screening tools that continuously update as OFAC lists evolve.

In practice, most businesses rely on specialized API providers, such as AMLBot, that automatically refresh their databases with the latest OFAC updates and screen every transaction before it settles.

In conclusion, the U.S. system is complex and sometimes fragmented, but being regulated in the U.S. carries reputation benefits for global partners, banks, and investors. Congress continues to consider comprehensive legislation to harmonize rules and frameworks. However, as of late 2025, no single statute exists. Crypto compliance remains a multi-layered effort across agencies and states.

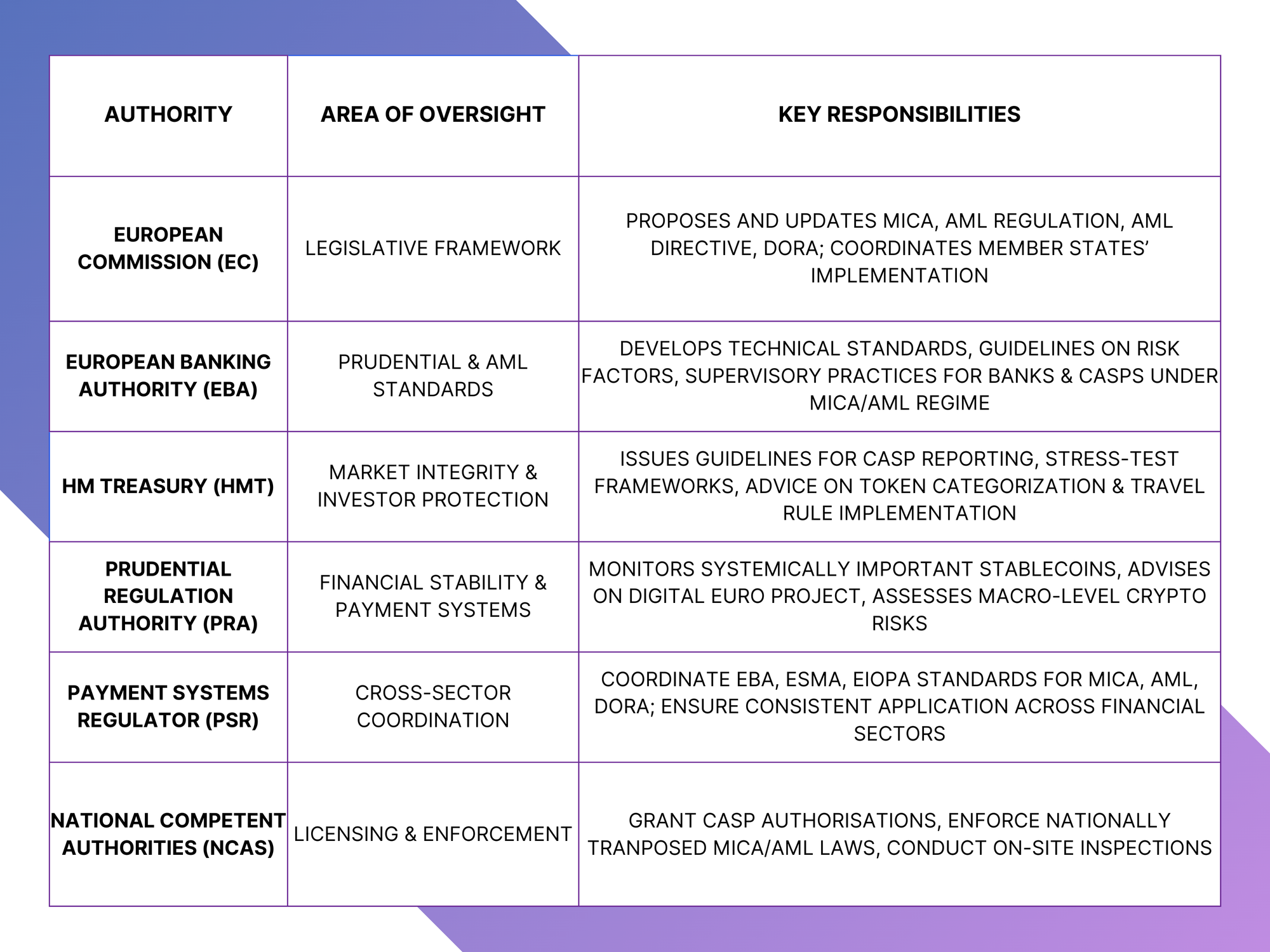

EU Crypto Regulations

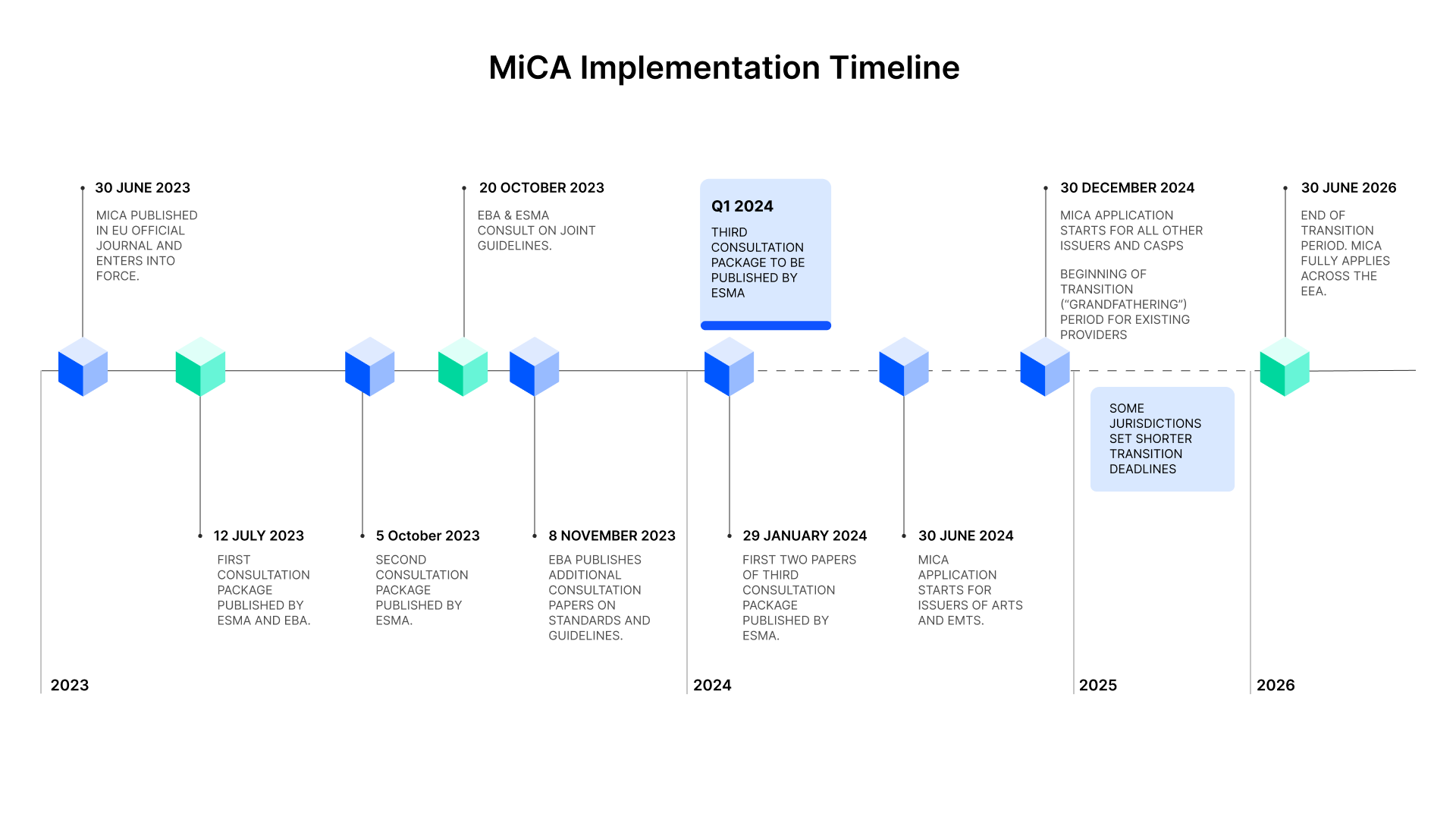

The European Union has implemented the Markets in Crypto-Assets (MiCA) Regulation, creating a comprehensive framework for cryptocurrency oversight across member states.

MiCA (Regulation (EU) 2023/1114) sets uniform EU-wide rules for issuing and trading crypto-assets. It covers:

MiCA officially began applying on December 30, 2024, with a transitional period extending until July 2026 for companies that were already operating under national laws.

Under EU crypto regulations, Virtual Asset Service Providers must also comply with the Fifth Anti-Money Laundering Directive (5AMLD), which extends traditional AML requirements to cryptocurrency businesses. This includes customer identification procedures, transaction monitoring, and suspicious activity reporting to national Financial Intelligence Units. The subsequent Sixth Anti-Money Laundering Directive (6AMLD) further strengthened enforcement by expanding the list of predicate offences and increasing sanctions for financial crimes.

At the same time, the Transfer of Funds Regulation introduced the so-called Travel Rule for crypto transfers, mandating that every transaction includes detailed information about the originator and beneficiary. Unlike the United States, which sets a $3,000 threshold, the EU applies the rule to all crypto transfers with no minimum, and requires service providers to verify self-hosted wallets once transfers exceed €1,000.

Operational resilience is also addressed through the Digital Operational Resilience Act (DORA), which came into effect in January 2025 and obliges financial institutions, including crypto businesses, to ensure their ICT systems can withstand cyberattacks and severe disruptions. Oversight is coordinated across several EU bodies. The European Banking Authority (EBA) and ESMA collaborate on technical standards, guidelines for reporting, and stress-testing frameworks to ensure consistent implementation of MiCA and DORA across member states. Meanwhile, the European Central Bank monitors systemically important stablecoins and continues its investigations into a digital euro, providing consultative advice on systemic risk and monetary implications.

In practice, the EU is now the first region in the world to offer a fully harmonized and comprehensive crypto regulatory framework. Firms that meet the higher standards gain not just an EU license, but also credibility in the eyes of banks, investors, and global partners. At the same time, businesses must adapt to strict compliance, as Europe makes clear that digital assets will only be integrated into its financial system under the same rules that govern traditional finance.

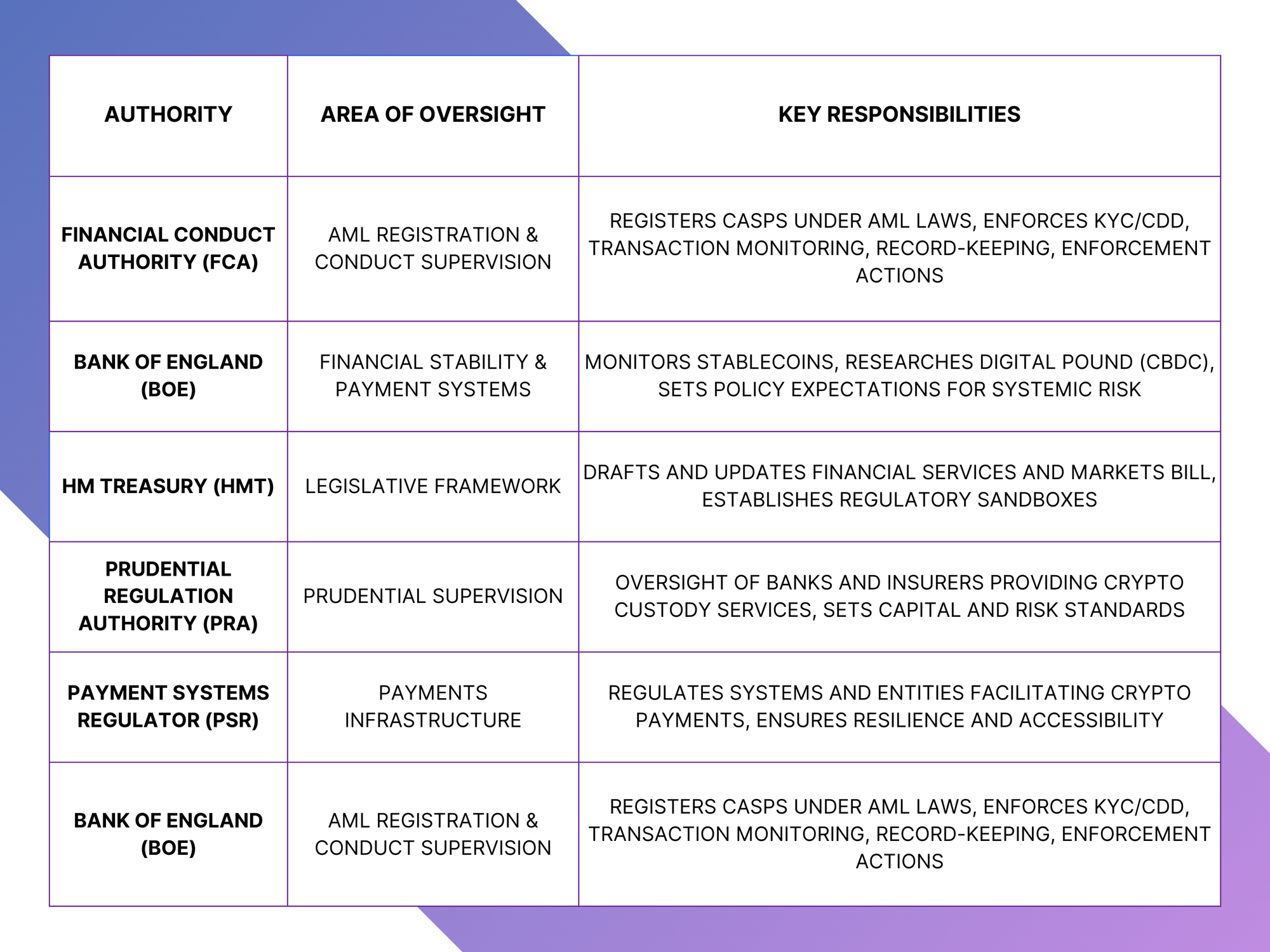

UK Crypto Regulations

In the UK, crypto regulation is woven into the existing financial framework rather than standing alone under a single “crypto regulator.” At the core sits the The Financial Conduct Authority (FCA), which requires any firm that exchanges, holds, or transfers crypto on behalf of customers to register under the UK’s AML regime. These FCA-registered firms must implement KYC/CDD procedures, monitor transactions for suspicious activity, maintain detailed records, and submit Suspicious Activity Reports as needed. Complementing the FCA’s role, Her Majesty’s Revenue & Customs (HMRC) sets the tax treatment for crypto-asset transactions, treating gains and losses as taxable events and requiring businesses to maintain accurate profit-and-loss records for digital assets.

On the banking side, the Bank of England (BoE) oversees the stability of payment systems and monitors systemic risks posed by stablecoins, while also exploring the potential issuance of a digital pound (CBDC). Meanwhile, stablecoins that provide payment services fall under the Payment Services Regulations 2017, triggering additional licensing requirements and oversight for providers handling e-money and payment operations.

Looking ahead, the Financial Services and Markets Bill promises to strengthen the FCA’s powers over stablecoins, enhance consumer protections for crypto users, and create dedicated regulatory sandboxes to facilitate innovation. Taken together, this multi-layered approach creates a comprehensive and coherent UK regime that balances crime prevention with a supportive environment for legitimate crypto businesses.

Core Compliance Requirements for Crypto Companies : KYT, СDD, KYC, Sanctions Screening and Activity Reporting

Transaction Monitoring (KYT)

Know-Your-Transaction (KYT) is the crypto-native evolution of traditional transaction monitoring. An effective KYT system must integrate both on-chain and off-chain data to detect suspicious behavior in real-time. This process involves using blockchain analytics tools to assess wallet risk by screening against databases of illicit entities, tracing the flow of funds to identify laundering techniques such as "chain-hopping," and detecting behavioral patterns like structuring or mixer usage. The system's rules must be specifically tuned to flag modern typologies.

For example, AMLBot Transaction Monitoring Solution analyzes transaction flows in real-time, checking against sanctions lists, known criminal addresses, and behavioral patterns that may indicate illicit activity.

Customer Due Diligence (CDD) and Know Your Customer (KYC)

Know Your Customer (KYC) and Customer Due Diligence (CDD) are a VASP's first line of defense. A strong Customer Identification Program (CIP) is non-negotiable, requiring the collection and verification of identity for all users. For corporate clients, procedures must be in place to identify and verify the Ultimate Beneficial Owners (UBOs). For higher-risk customers, such as Politically Exposed Persons (PEPs), Enhanced Due Diligence (EDD) is required, including the collection of information on the source of funds and wealth.

Sanctions Screening and Compliance

Cryptocurrency businesses are required to screen customers, transactions, and blockchain addresses against international and national sanctions lists (including OFAC, EU, UN, and others). This screening must be ongoing and updated frequently, as sanctions lists change regularly. Firms must maintain detailed records of all screening activity and implement clear procedures for investigating, escalating, and reporting potential matches. When a positive match is identified, companies may be obliged to freeze assets and file a report with their national Financial Intelligence Unit (FIU) or relevant authority.

Suspicious Activity Reporting

Timely and accurate reporting of suspicious activity is a cornerstone of AML compliance. Firms must have clear procedures for investigating alerts and filing Suspicious Activity Reports (SARs) or Suspicious Transaction Reports (STRs) with their national Financial Intelligence Unit (FIU).

In the U.S., SARs must be filed for suspicious transactions involving at least $2,000. All AML-related records, including CDD data, transaction details, and SAR filings, must be retained for a minimum of five years and be readily accessible for regulatory audits and inspections. These reports must be submitted without delay. In some jurisdictions immediately, in others within a defined maximum timeframe (for example, 30 days in the US). The exact deadline depends on the jurisdiction, but the expectation everywhere is timely reporting as soon as suspicion is formed.

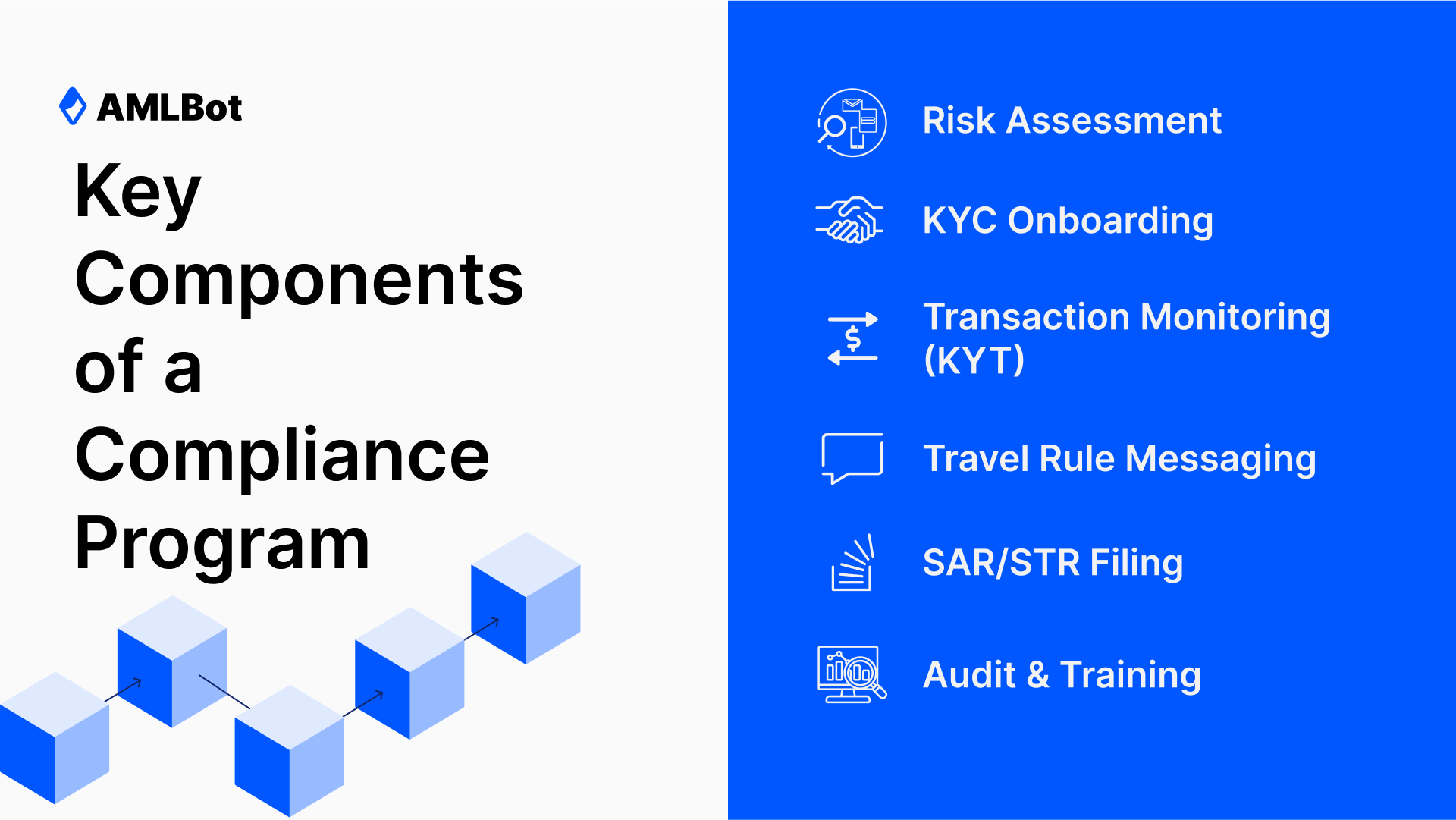

How to Implement Crypto Compliance in Practice

Successful implementation of AML compliance requires integrating regulatory requirements into daily business operations through automated systems and well-defined procedures.

For organizations seeking comprehensive crypto compliance solutions, automated platforms offer advantages in managing complex regulatory requirements across multiple jurisdictions.

AMLBot provides a true all-in-one compliance solution designed specifically for the needs of crypto businesses. Instead of piecing together multiple vendors, you can rely on one platform that covers every critical layer of compliance.

Through its Transaction Monitoring, AMLBot delivers real-time transaction screening and automated risk scoring with accuracy, helping you detect suspicious activity before it becomes a liability. Integrated KYC/KYB verification ensures that users and business partners are properly vetted before onboarding, reducing fraud and building long-term trust. When risks escalate, AMLBot’s Blockchain Investigation tool (Tracer) makes it possible to trace fund flows, uncover money-laundering patterns, and generate detailed investigative reports. For urgent cases such as asset theft, AMLBot’s in-house blockchain analytics team team supports businesses directly, preparing documented claims for exchanges or legal processes. Taken together, this ecosystem gives businesses a centralized, regulator-ready solution that makes compliance not just achievable, but scalable.

AMLBot also offers training modules for compliance teams and investigators: AML Fundamentals for Crypto Business Training & Certification and Blockchain Analytics Mastery Training & Certification. Our programs go beyond theory by combining expert-led content with real-world case studies, practical tools, and compliance checklists that can be applied immediately in business operations. All the participants gain an industry-recognized certification, up-to-date knowledge aligned with global regulations (FATF, MiCA, FinCEN, SEC), and insights into current trends in crypto crime.

Conclusion: Staying Ahead of AML Enforcement in 2025

The regulatory landscape for cryptocurrency continues to evolve, with authorities worldwide implementing sophisticated mechanisms. Businesses must stay ahead of these changes by implementing AML compliance programs and maintaining awareness of regulatory developments across relevant jurisdictions.

As crypto regulations become more stringent, proactive compliance measures are no longer optional but essential for business sustainability. Companies that invest in comprehensive compliance frameworks today will be better positioned to navigate future regulatory challenges and maintain competitive advantages in the evolving digital asset market. Organizations ready to enhance their compliance capabilities should consider implementing professional AML solutions tailored to the unique challenges of cryptocurrency operations.

Ready To Strengthen Your Crypto Compliance Program? Contact Our Team To Discuss Customized AML Solutions For Your Business Needs

Key Takeaways

- FATF’s Travel Rule is now enforced in 99+ countries, shaping the foundation for cross-border crypto compliance.

- MiCA and AMLR have created the first unified regulatory framework for the EU’s crypto market.

- U.S. firms must comply with FinCEN (BSA), SEC/CFTC, OFAC, and IRS requirements across federal and state levels.

- Compliance Automation, from KYC/KYB to KYT, is essential for scalability and risk control.

- AMLBot delivers full-stack AML/KYC/KYT coverage across jurisdictions, helping crypto businesses stay audit-ready and regulator-compliant.