Crypto Security Guide: How to Keep Your Assets Safe

Cryptocurrency has forever changed the face of financial transactions, but crypto security is still catching up with other aspects of the industry. Criminals have capitalized on this lag and made big money, and the problem continues to grow. Hackers stole nearly $2 billion worth of cryptocurrency in only the first seven months of 2022.

With regulations for cryptocurrency remaining rather fuzzy, a greater frequency of state-backed attacks, and cyber attackers constantly finding new ways to infiltrate private and business systems, the threat of substantial losses in the crypto world is very real. It's essential for everyone involved in buying, selling, or exchanging crypto to protect themselves by implementing effective security measures.

Cryptocurrency Security Standards

The Cryptocurrency Security Standards (CCSS) are an important component of the shift toward a more secure crypto marketplace. The standards outline requirements for cryptocurrency systems, including exchanges and web applications.

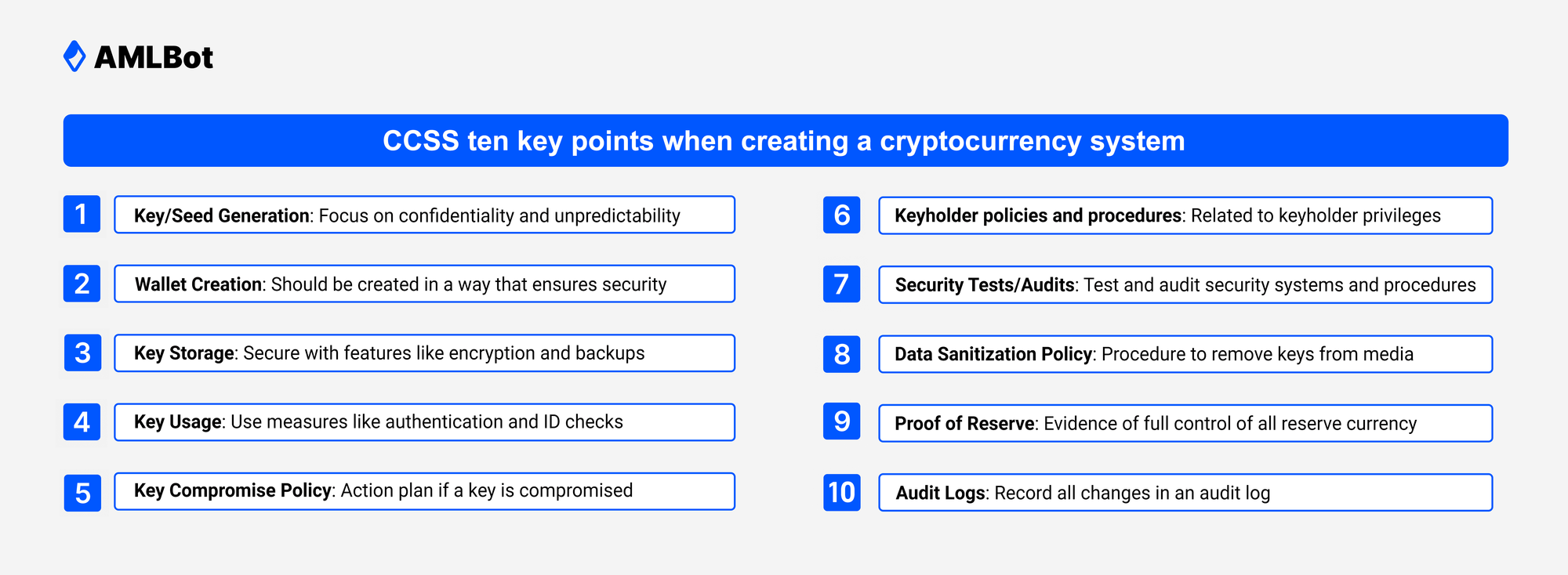

The CCSS is based on ten key points that should be covered when creating a cryptocurrency system:

- Key/seed generation: When businesses generate cryptographic keys and seeds, they should focus on confidentiality and unpredictability. In other words, the keys should not be easily read, copied, or guessed by unauthorized parties.

- Wallet creation: Wallets should be created in a way that ensures security, including features like multiple keys and geographic distribution of keys.

- Key storage: When they are not in use, keys and seeds should be securely stored with features like encryption and backups.

- Key usage: Keys should also be securely used with measures like authentication and ID checks.

- Key compromise policy: There should be a protocol in place that identifies the necessary actions to take if a key, seed, or user is compromised in some way.

- Keyholder grant/revoke policies and procedures: Organizations dealing with cryptocurrency keys should also establish policies related to giving or removing keyholder privileges.

- Security tests/audits: Even highly-skilled teams should bring in third-party reviewers to test and audit security systems and procedures.

- Data sanitization policy: Organizations should plan ahead for times when they might need to remove keys from their media.

- Proof of reserve: Cryptocurrency wallets and exchanges should have evidence that they have full control of all reserve currency.

- Audit logs: Every time there is a change to some aspect of the system, including routine maintenance, it should be recorded in an audit log.

It's important to note that the CCSS is not intended to replace pre-existing security practices. Rather, the CCSS should serve as another layer of security to help prevent data loss and breaches.

AML & KYC Solutions

The Financial Action Task Force (FATF) is one of the most important voices in cryptocurrency security because it develops standards for global anti-money laundering (AML) laws. The experts at FATF were early and outspoken advocates of protecting the cryptocurrency market from money laundering and terrorism financing, and their 2015 AML guidance was pivotal to the development of many of today's crypto regulations.

AML & Virtual Currencies

The FATF took such an active interest in cryptocurrency largely because transactions of this kind are so appealing to criminals. Because cryptocurrency is pseudonymous, meaning that individuals and businesses use alternate names, criminals feel that they can operate at a level of relative obscurity.

One of the FATF's most important AML measures is the travel rule, which requires virtual asset service providers (VASPs) to send, receive, and screen information when they facilitate crypto transactions. The FATF guidelines also direct VASPs to hire AML compliance officers. These officers help identify potential cases of fraud and money laundering, conduct and assist with audits, train staff, and report criminal activity to the authorities.

Know-Your-Customer (KYC)

Another key aspect of crypto AML is know-your-customer (KYC) checks. By following these procedures, VASPs can offer support to law enforcement in the event that criminal activity occurs.

How do KYC measures help investigators address fraud and crypto theft? To put it simply, KYC reduces the ambiguity of the cryptocurrency marketplace. One of the risks of crypto is that individuals and businesses use pseudonyms for their accounts, which can make it difficult to identify bad actors and tie them to illegal behavior. KYC helps law enforcement agencies connect the pseudonyms on crypto accounts to actual identities so that they can recover funds.

For example, in November 2022, the U.S. Attorney announced that, after more than ten years of investigating, federal officers had managed to recover $3.36 billion worth of previously stolen cryptocurrency. Following KYC protocols can help enable investigators to resolve future thefts with an equal level of success in a shorter period of time.

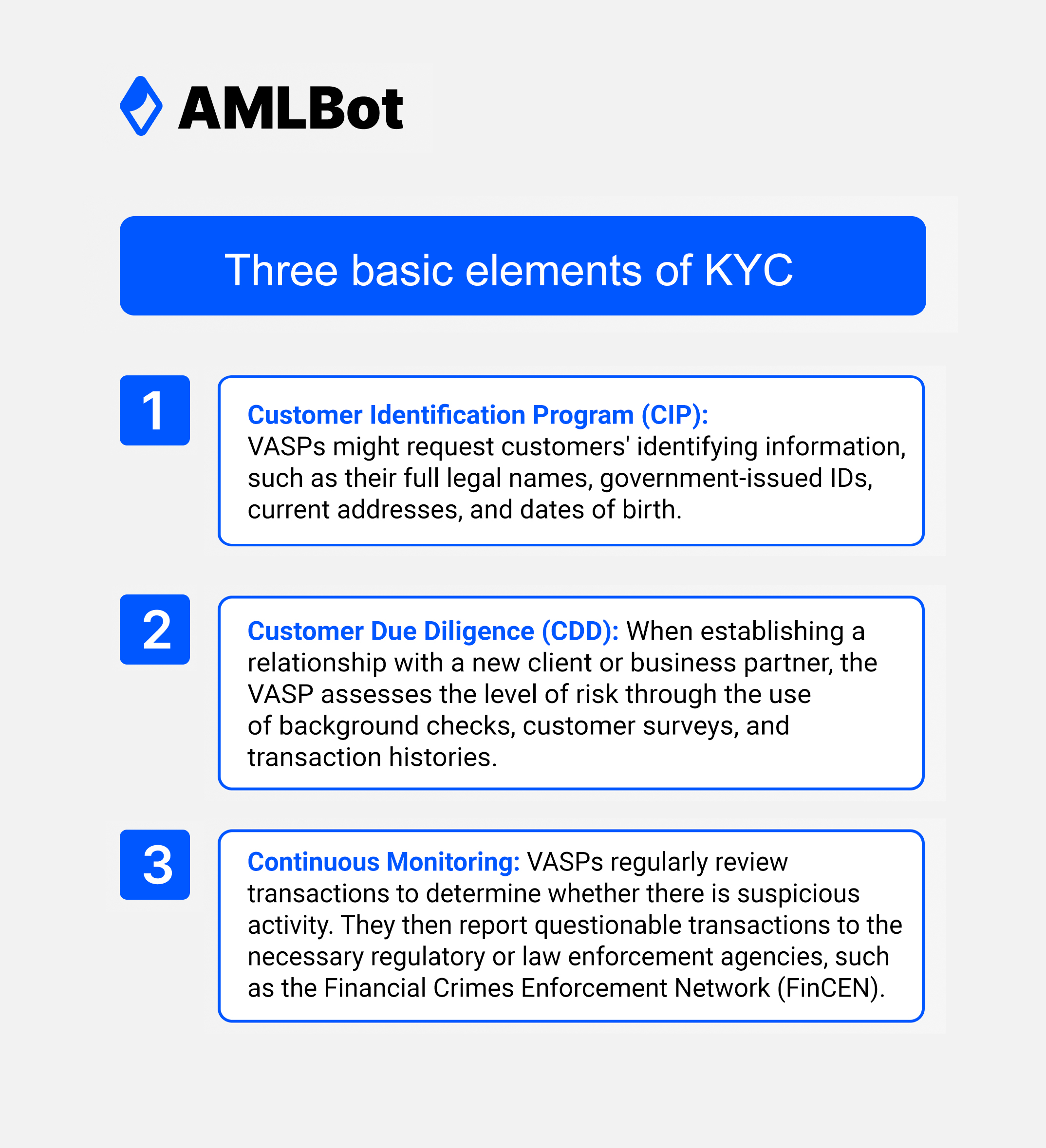

KYC requirements in the crypto industry are not as strict as in some other areas of finance. However, many crypto exchanges incorporate the three basic elements of KYC into their onboarding and security systems. These core components are:

- Customer Identification Program (CIP): VASPs might request customers' identifying information, such as their full legal names, government-issued IDs, current addresses, and dates of birth.

- Customer Due Diligence (CDD): When establishing a relationship with a new client or business partner, the VASP assesses the level of risk through the use of background checks, customer surveys, and transaction histories.

- Continuous Monitoring: VASPs regularly review transactions to determine whether there is suspicious activity. They then report questionable transactions to the necessary regulatory or law enforcement agencies, such as the Financial Crimes Enforcement Network (FinCEN).

While not every cryptocurrency exchange handles KYC in the same way, following through on these requirements helps VASPs build trust with customers and ensure that they meet the highest levels of compliance.

How to Protect Your Crypto Assets

Protecting your crypto assets takes a little work, but it's more than worthwhile to invest the time and resources necessary to lower your level of risk. Cryptocurrency can be a safe and fruitful investment if you take the proper steps.

Use Exchanges Responsibly

The Federal Bureau of Investigation (FBI) has emphasized that decentralized finance (DeFi) platforms are especially vulnerable to the work of cybercriminals. This means that investors should tread carefully when selecting and using cryptocurrency exchanges.

The Risks of Crypto Exchanges

Digital currency exchanges are a popular and potentially secure way to buy, sell, and trade cryptocurrency. However, these exchanges present risks in a few different ways:

- DeFi platforms are based on open-source code, which anyone can review. This gives attackers ample opportunity to study the code and identify vulnerabilities.

- Scammers create fake exchanges, often with only slight variations in the URLs, to defraud investors.

- The funds you store in the exchange are not insured by the Federal Deposit Insurance Corporation (FDIC). If the exchange unexpectedly goes out of business, you may have no way to recover your funds.

- If the exchange is hacked, your funds may be stolen.

As with any investment, it's important to have these risk factors in mind when you use crypto exchanges.

Ways to Mitigate Exchange Risks

The fact that exchanges involve risk doesn't mean that investors shouldn't use them. Rather, they should proceed with caution by taking two crucial steps.

First, thoroughly research an exchange to determine whether it's safe and reputable. You can evaluate the quality of exchanges by checking:

- URLs

- Certificates

- KYC protocols

- Team members

In addition to conducting research, you should also avoid storing your cryptocurrency on the exchange itself. Instead, download your funds to a secure wallet so that they are protected if hackers choose to target the exchange for an attack.

Establish a Secure Network

The network you use to access a digital exchange is equally important as the exchange itself. Avoid using public WiFi, such as at a library or coffee shop, when you buy or sell crypto. Opt for a secure internet connection and, if possible, a virtual private network (VPN).

Stay Up-to-Date

One of the difficulties of preventing cyberattacks is the constant evolution of existing threats. To best protect your investment, stay up-to-date on cyber attacks and newly developed strains of malware by monitoring the news or subscribing to a cybersecurity newsletter.

Steps to Prevent Cyber Attacks on Your Crypto Wallet

Storing your funds in a crypto wallet is far more secure than keeping them in a digital exchange. However, you will still need to make an effort to protect your wallet as much as possible.

Choose the Right Wallet

When selecting a crypto wallet, there are two basic categories available: hot and cold. Although you can store your cryptocurrency in either one, they have different benefits in terms of convenience and security.

Hot wallets come in the form of downloadable desktop applications, web wallets, and mobile wallets. They are user-friendly because they are connected to the internet, and some kinds can be accessed from anywhere. Unfortunately, this convenience comes with a higher risk of hacking and infiltration.

Cold wallets, on the other hand, have no online connection and thus can't be hacked as easily. Hardware wallets, the most popular kind of cold wallet, are separate devices that you can connect to your computer with a USB port. Safe storage of these hardware wallets is critical. If you lose the device, you also lose your cryptocurrency.

Protect Your Wallet Keys

No matter what kind of crypto wallet you use, you will need to properly manage and protect your wallet keys. Keys are generated by wallet providers and grant you access to your funds. Without the key, you cannot sign in to your wallet. If other people somehow obtain your keys, there is very little to prevent them from stealing your crypto. Take the following steps to prevent either of these scenarios from occurring:

- Do not access your wallet on a public or work computer.

- When setting up your wallet, use a personal email address.

- Never disclose your wallet information to others.

- Keep several copies of your wallet key in different places, such as a personal safe or a bank safety deposit box.

Dividing your crypto across multiple wallets is also wise. If one wallet is compromised, your entire portfolio is not lost.

Beware of Scams

Scams have become ubiquitous in the world of cryptocurrency. The Federal Trade Commission Phishing reports that from the beginning of 2021 to the middle of 2022, people lost more than $1 billion to crypto scams.

While they may seem easy to avoid, scammers are clever and make only minor changes to familiar email addresses to trick investors out of their funds. Following these standards can help protect you:

- Before you invest in cryptocurrency, do thorough research to avoid potential scams.

- Never click on strange links from emails or text messages.

- Don't trust anyone with sensitive information like passwords or wallet recovery phrases.

- Keep an eye out for fake software, wallets, and apps.

Even celebrities are susceptible to scams. Comedian and actor Seth Green lost four NFTs, totaling $268,000 in value, from his wallet due to a phishing scam.

Cryptocurrency Security Measures

It's not always possible to prevent every cyber attack, but there are ways to reduce the likelihood that one will succeed. Consider implementing these security measures:

- Use two-factor authentication, ideally with an authenticator app, for your crypto wallet.

- Regularly update software and firmware.

- Install the latest versions of anti-malware and anti-virus protection tools.

- Create a strong password with a mix of numbers, special characters, and capital and lowercase letters.

- Frequently update your passwords and don't share passwords between sites.

In general, these steps are a fast and relatively inexpensive way to protect your crypto.

Resources for Securing Your Crypto Assets

It's more important than ever to be mindful of what crypto-security measures you have in place. Protecting your investment might seem like a tall order, but there are resources and tools available that can help simplify the process.

AMLBot's transaction validation makes it possible for you to avoid issues with regulators and unintentional association with illicit funds. The experts at AMLBot can also assist you with tracking down and recovering stolen cryptocurrency. Send a message or schedule a free consultation to learn more.