Essential Steps to Take When You Discover Your Crypto Assets Are Lost or Stolen

Realizing that your digital assets have vanished is a nightmare, but crypto asset recovery could put an end to your bad dream. If bad actors have taken your cryptocurrency, you're not alone. Hackers have stolen $901 million in crypto from exchanges, bridges, and DeFi protocols in the second half of 2023. Of that, $773 million was lost due to wallet access control issues. Lost passwords, phishing schemes, crypto fraud, and stolen credentials are to blame for a significant number of stolen and lost crypto cases.

Implementing a strong system of asset security is the key to mitigating risk, but even the strongest measures can fail. When that happens, it's vital that you quickly begin the process of crypto asset recovery. In this guide, we'll explain exactly what you should do when your assets are lost or stolen so that you have the best possible chance of recovering them.

1. Understand the Situation

From 2020 to 2021, the value of stolen crypto increased 9 times, with more than $725 million lost to theft and other attacks in August 2021 alone. For many of these victims, recovery was impossible because they didn't realize what had happened until it was too late. To reduce the risk of permanent loss, you'll need to have a clear picture of exactly what happened.

Signs of Stolen Cryptocurrency

There are almost always indications that someone has taken your cryptocurrency — you just have to know where to look for them. The most obvious is if you notice a substantial and unexplained decrease in your balance. If the amount of crypto in your account has suddenly dropped and you didn't authorize any transactions, there's a good chance it has been stolen.

You might also notice outgoing transactions that you didn't authorize or other unusual activity in your account, including:

- Login attempts from locations you haven't visited

- Multiple failed login attempts

- Account access on unauthorized devices

- Unexpected password changes that you didn't initiate

In addition to looking at the details of your account, it's also beneficial to keep up with news in the industry. If you learn that an exchange or platform you use has experienced a security breach or that funds have been stolen from other crypto holders, there's a good chance that your assets are at risk or already gone.

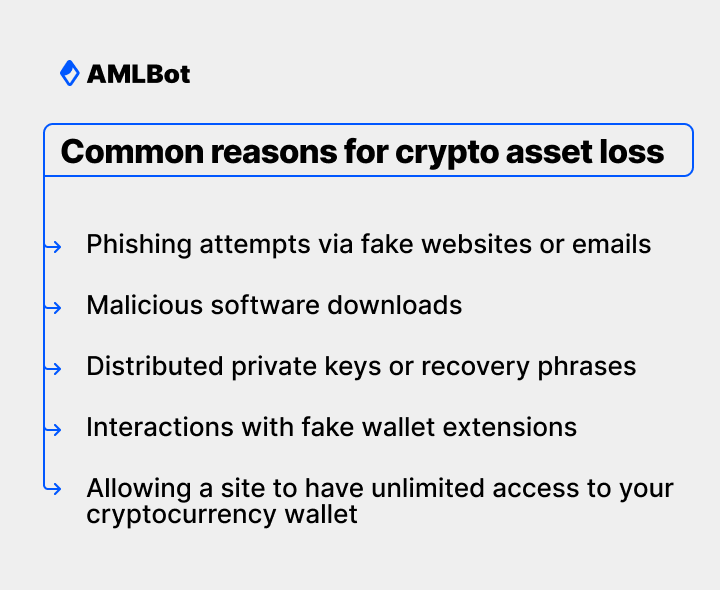

How Crypto Gets Lost

Because it's a digital form of currency, you can't lose crypto by leaving behind your wallet at the grocery store. You do, however, run the risk of losing your crypto for other reasons, including:

- Phishing attempts via fake websites or emails

- Malicious software downloads

- Distributed private keys or recovery phrases

- Interactions with fake wallet extensions

- Allowing a site to have unlimited access to your cryptocurrency wallet

If you discover that your digital assets are lost due to these or other scenarios, take a proactive stance to minimize your risk. Stop using that particular platform until investigations are complete and you can confirm that it and your assets are safe.

2. Reach Out for Support

When you realize that your cryptocurrency is gone, the clock starts ticking. The first few minutes and hours could impact your chances of lost or stolen asset recovery. If you're working with a large, trustworthy exchange or wallet provider, they may have already started their investigations and begun attempting to restore your funds. This is especially true if multiple victims are involved or at risk.

Although the cryptocurrency company may be one step ahead in searching for your lost crypto assets, you shouldn't wait for them to call. As soon as you realize your assets are gone, contact the customer support department for your wallet or exchange provider. Provide them with the full details about your lost or stolen cryptocurrency, including exactly how much crypto is missing.

Your service provider may have the power and tools to conduct an independent analysis that will aid in the recovery of your stolen funds. They might also have an insurance policy that helps recover your funds or the option to freeze them if they find out early enough.

You should reach out to the provider regardless of whether you think they'll put genuine effort into locating your funds, but their location influences how helpful they'll be. For instance, exchanges based in areas with minimal regulations might be less willing to assist in investigations, meaning recovery will probably be more difficult.

3. Report the Loss to the Authorities

The exchange or wallet provider isn't the only organization that needs to know about your lost assets. You should also file a report with any and all relevant regulatory bodies. Unfortunately, cryptocurrency platforms are different from other financial services because there are no built-in consumer protections. Unlike fiat currencies, the government doesn't cover or insure your investment in an exchange or wallet.

With that said, government agencies have begun to take cryptocurrency theft more seriously. For example, in September 2023, police in Connecticut recovered $3 million in Bitcoin that was stolen during a scam. Instances like these give hope to people who want law enforcement to help them recover assets.

That's why you should report your loss to the local authorities, particularly if you feel that a crime has occurred or you lost a significant amount of crypto. Provide as much detail as possible about the incident and cooperate fully throughout any investigations to increase the odds of recovery. Don't hold back when officers ask you questions —the information you share could lead to identifying and prosecuting the person who stole your cryptocurrency.

You can also report the crime to the Justice Department's National Cryptocurrency Enforcement Team (NCET). Under the direction of Eun Young Choi, this team identifies, investigates, and pursues cases related to digital assets. However, if you're the sole victim of a scam or your losses are comparatively small, the federal authorities might not be much help. With so many scams and hacks happening every month, they don't have the resources available to help every private citizen get their funds back.

4. Employ Blockchain Forensics

You don't have to wait powerlessly in the wings while law enforcement agencies look for evidence. Instead, hire a professional blockchain forensics recovery service to conduct their own cryptocurrency investigations, trace and analyze related transactions, and attempt to restore your funds.

One of the greatest benefits of cryptocurrency is that it leaves a trail, but many investors and owners don't know how to follow it. Professionals who specialize in blockchain forensics have training in how to track assets taken during cryptocurrency theft. They use the permanent digital record that exists on the blockchain to complete a series of steps, including:

- Gathering data related to your loss

- Analyzing the data using methods such as address clustering, network analysis, and transaction graph analysis

- Visualizing the results with charts and diagrams

- Presenting the evidence to you and, when necessary, law enforcement

Bad actors sometimes use techniques, such as mixers and chain-hopping, to try to throw off investigations. Fortunately, highly-trained recovery services are aware of these strategies and are learning how to work around them.

5. Implement Security Measures

While recovery services are completing their investigations and working toward recovery of your crypto, it's your job to protect your remaining and future funds. Lower your risk levels by implementing crypto security measures, such as:

- Switching email accounts and reformatting or replacing a device that you used to store crypto assets after your account has been compromised

- Using cold hardware wallets for as much of your crypto as possible

- Updating and strengthening your passwords and security protocols

- Monitoring activity on your crypto accounts

- Regularly reviewing other accounts connected to your cryptocurrency wallet or exchange

- Knowing the signs of phishing scams

In addition to these methods, don't ignore the importance of working with a reputable wallet or exchange service. Many cryptocurrency exchanges around the world use know-your-customer (KYC) checks to collect identifying information for crypto users. This data makes it easier for investigators to conduct crypto asset recovery if your funds are lost.

While none of these measures will make you invincible in the crypto world, they can significantly reduce the number of risks that you face. A solid security plan is your first defense against hackers, ransomware, and scammers, just to name a few.

Get Help with Your Crypto Recovery

Cryptocurrency crime saw a decline in 2023, but it's far from over. In a recent attack, hackers stole approximately $115 million in cryptocurrency from the HTX exchange and Heco Chain. That horrible, stomach-sinking feeling of losing your crypto is natural, but don't let it paralyze you. The longer you wait to start your stolen asset investigations, the higher the risk that they're lost forever.

Methods for recovering stolen funds are improving every day, and investigations can make it easier to put your cryptocurrency back in your account. AMLBot's crypto recovery and blockchain investigation support is a valuable solution that helps you discover where your lost assets are and how to get them back.