How to Open a Bank Account for a Crypto Company

Setting up a bank account for a crypto company sounds like a simple task, but in reality, it can be time-consuming and complex. As cryptocurrencies have become more mainstream, some banks have begun to extend their services to crypto companies. In contrast, others have steered clear of what they view as a risky venture—finding the right bank and completing the steps to establish an account for your crypto business requires careful thought and planning.

Locating a bank willing to partner with your crypto company can be challenging. Unfortunately, many traditional banks have been slow to accept cryptocurrencies as a legitimate way of conducting business. This article will help simplify the process and outline the steps you need to take to open a bank account for your crypto company.

What Is a Crypto Bank Account?

Crypto bank accounts are best described as multi-currency, meaning they are designed to hold fiat and traditional assets and cryptocurrencies. They exist so that users can exchange and use traditional currencies and crypto within the same account.

These accounts are essential for crypto companies that want to use multiple types of currencies to conduct user transactions, pay employees, and fund their operations. Depending on your country of residence and the type of bank you choose, a crypto bank may be more heavily regulated than other institutions like wallet services and crypto exchanges.

Government agencies ensure that some banks work with crypto companies. For example, Federal Deposit Insurance Corporation (FDIC) insures deposits at member banks in the United States. In certain cases, banks that offer crypto and traditional currency services fall under the FDIC's purview.

Why Is It Difficult to Open a Bank Account for Cryptocurrencies?

Unlike traditional currencies, such as the dollar or euro, cryptocurrencies are still new to the financial landscape. Institutions are discovering how crypto works, what procedures they should have to accommodate it, and what level of risk is involved in crypto accounts. Many are reluctant to make updates that allow for more engagement with any crypto-related company until stricter regulations are in place.

Some banks do not have the technology or experienced employees available to deal with cryptocurrencies. Several digital banks specifically structured and staffed to deal with cryptocurrencies have emerged to fill this gap.

Why Aren't the Majority of Banks Crypto-Friendly?

In most countries, cryptocurrencies are still highly unregulated. As a result, traditional banks, which often have more oversight from national and local governments, have been reluctant to adapt their practices to include digital currencies. Banks have to follow strict requirements, such as the Know-Your-Customer (KYC) policy, which they may struggle to reconcile with the relative anonymity of cryptocurrency.

Furthermore, while cryptocurrency can be extremely profitable for cautious and reasonable investors, it is still widely regarded as high-risk. As such, banks must do greater due diligence to screen potential customers. This creates a burden for the crypto company attempting to open an account and for the bank, which must review a greater volume of potentially unfamiliar paperwork.

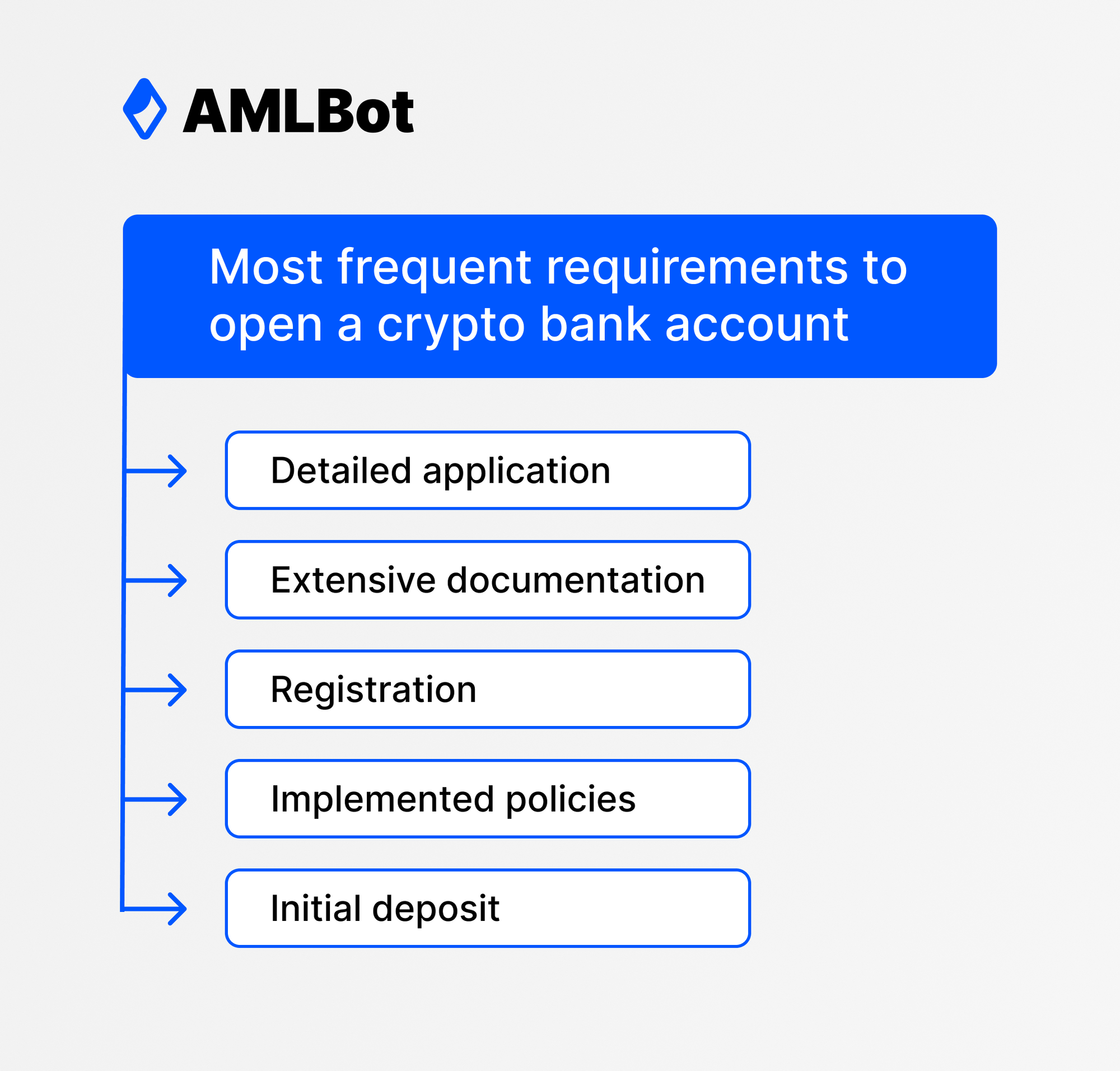

What Are the Most Frequent Requirements to Open a Crypto Bank Account?

Every financial institution has its own specific set of requirements to open a crypto bank account, so it's impossible to make a blanket statement about what process your business will undergo. However, some standard requirements apply almost universally to every legitimate financial institution. The necessary elements to open an account include the following:

- Detailed application: The first stage of opening a crypto bank account is completing an application, which will likely consist of one or more questionnaires and a narrative of your company's background. While you may be hesitant to share the full details of your business, it's crucial that you are as transparent as possible. Provide all requested information in full and give a detailed but concise description of your business model. If you leave out critical information, the bank will most likely reject your application or request that you amend it, which can significantly extend the process of opening your account.

- Extensive documentation: While the application in and of itself may seem sufficient, be prepared to compile and provide extensive documentation. Banks may ask for proof of your internal policies, due diligence reports, and other documents demonstrating that your business is viable, compliant, and above board.

- Registration: To move forward, you will need to demonstrate that you have registered your crypto company with the appropriate regulatory or overseeing agencies. A reputable bank will only advance your application if you have already obtained your business license.

- Implemented policies: In addition to proving you have registered your business, you will also need to show that you have implemented appropriate policies to prevent criminal activity and protect the interests and investments of your customers. Banks may, for example, ask you to prove that you have hired a professional compliance officer.

- Initial deposit: Many financial institutions require an initial deposit to ensure that your now-open bank account stays that way. Confirm in advance how much money you will need to deposit.

If you can meet all of these requirements and have found a bank open to working with a crypto company, the odds are good that your account opening efforts will be successful.

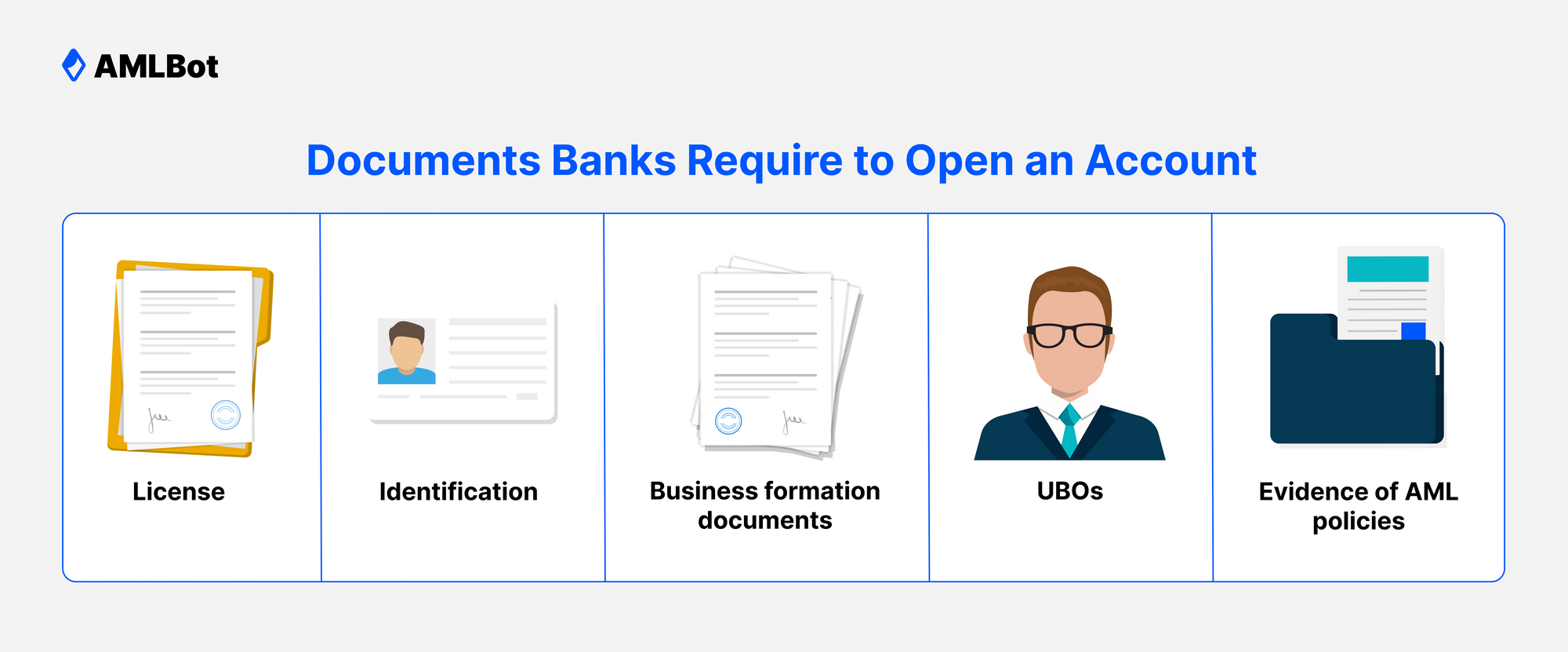

What Documents Do Banks Require to Open an Account?

The documents you will need to open a crypto bank account will depend on several factors, including the structure of your business and which jurisdiction's regulations apply to your company. In general, you can expect to be asked to provide your:

- License: If your business operates in a jurisdiction requiring a license, you must provide a copy to establish a bank account.

- Identification: As with a traditional account, you will typically need to provide identification to open a crypto bank account. Most banks accept a driver's license, passport, or another official form of identification for the owner or owners of your company.

- Business formation documents: Depending on your location and the type of business you operate, you may need to provide your company's formation documents, such as articles of organization or articles of incorporation.

- UBOs: Some regulations, such as the Anti-Money Laundering Act, require companies to provide documentation identifying their ultimate beneficial owners (UBOs). These individuals typically have controlling interests in organizations, such as owning at least 25% of a company's share capital. Banks must conduct extensive due diligence for crypto bank accounts, meaning they must fully understand the source of all funds and wealth in the company and the UBOs.

- Evidence of AML policies: Just as traditional banks hope to shield themselves from bad actors, crypto-friendly banks want to ensure that your business takes the proper steps to prevent illegal or fraudulent activity. Some banks will request documentation, such as detailed anti-money laundering (AML) policies and procedures and external audits, to prove that you comply with regulations.

It's also important to note that a bank may require that your documents appear in a particular format. More specifically, many financial institutions ask you to provide notarized, English-language versions of your documentation.

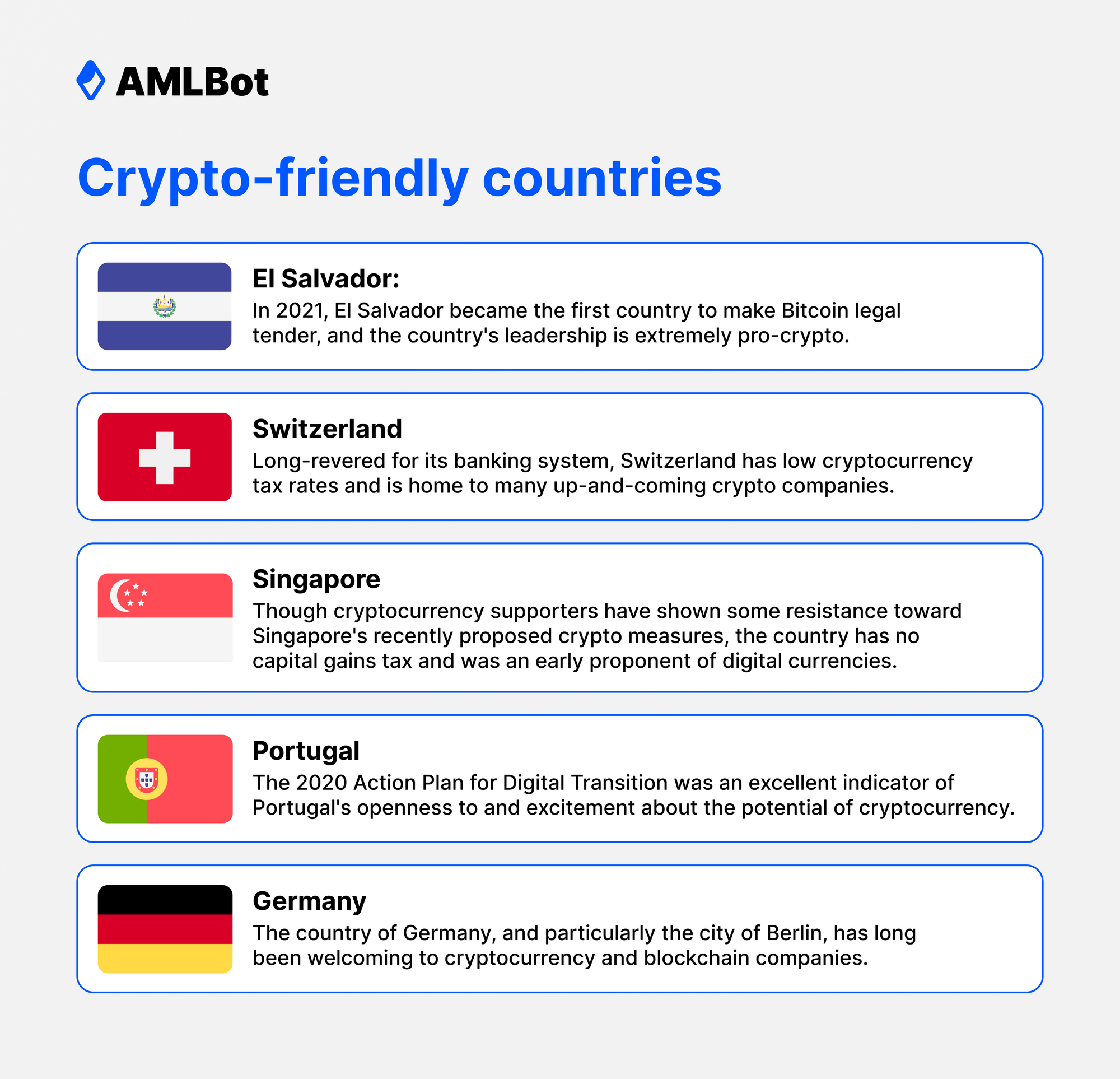

Which Countries Are the Friendliest for Crypto Companies?

Crypto regulations are still very much in flux; the status of crypto changes significantly based on where you are. Fortunately, several crypto-friendly countries have embraced these revolutionary digital currencies and their place in modern finance. They include:

Cryptocurrency rules, regulations, and tax laws are rapidly changing, and so will the environment for crypto companies in countries around the world. Closely monitoring developing legislation is key to ensuring that your company's leadership is not caught off guard.

Who Can Help with Opening a Crypto Bank Account?

From registration to gathering documents, the process of applying for a crypto bank account can quickly become overwhelming. The experts at AMLBot can help walk you through the steps and offer guidance on licensing procedures, AML policies, and appropriate documentation. Reach out to the AMLBot team to get help with your most pressing crypto-related questions.