KYC Service Providers in 2025: Trends, Challenges, and Key Selection Criteria

Intro

Know Your Customer (KYC) service providers have become an important part of the infrastructure for crypto and fintech companies. KYC helps businesses to check that customers are who they say they are. Their significance has grown further in 2024-2025, as the industry faces rising fraud and complex Anti-Money Laundering (AML) requirements worldwide.

Choosing the right KYC provider and understanding the latest trends and challenges in the space has become a strategic priority for any business building a trustworthy compliance framework. We’ve outlined the main crypto KYC requirements in 2025 in our detailed article.

Note: None of this information should be considered as legal, tax, or investment advice. While we’ve done our best to ensure this information is accurate at the time of publication, laws and practices may change, so please double-check it.

The Evolving Role of KYC Service Providers in the Crypto Ecosystem

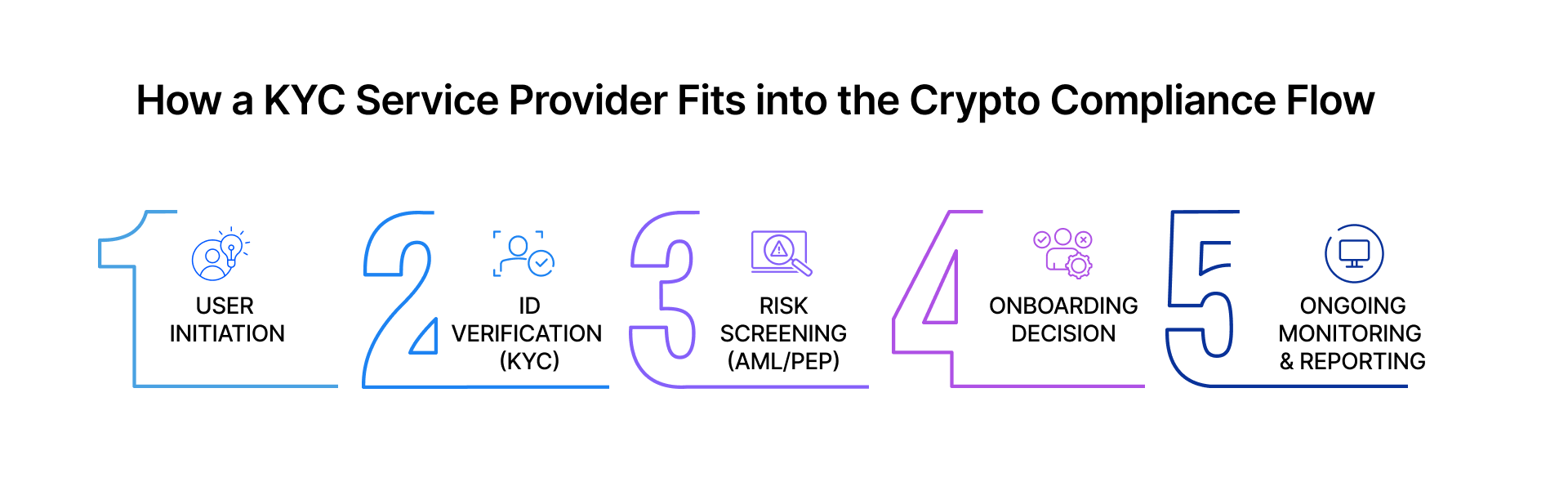

The role of KYC service providers in the crypto and fintech has expanded from a nice-to-have tool into a critical compliance asset. In 2025, they are deeply integrated into crypto exchanges, payment apps, and digital banks, serving as a bridge between regulatory requirements and customer onboarding. As crypto platforms face tighter oversight, KYC processes are effectively required. Regulators such as FinCEN in the US and the ESMA in the EU now enforce stringent KYC/AML rules on exchanges and wallet providers.

By the end of 2025, all major crypto businesses are expected to have strict customer verification and monitoring controls in place to meet these global standards.

In practice, KYC providers bring expertise in document recognition, biometric checks, and risk screening that would be costly and difficult to maintain in-house. They let crypto startups and financial institutions focus on their core business, while the provider ensures the Customer Due Diligence process is thorough and up to date with the latest rules.

Why KYC Providers Matter in 2025

Several factors have strengthened the importance of KYC providers in 2025.

First, globalization and digital growth. Even small fintech startups may serve customers across dozens of countries, something that was once the domain of big banks only a few years ago. These businesses need KYC that covers multiple jurisdictions. Leading providers now support ID Verification for users in over 190+ countries and thousands of document types, a scale that allows fintech and crypto companies to onboard a global customer base without geographic friction. The speed and user experience that automated KYC offers are also crucial. If identity checks are too slow, customers drop off during onboarding.

In fact, around 70% of financial institutions (predominantly traditional banks), according to an industry report by Fenergo, reported losing clients in the past year due to slow or inefficient onboarding processes. This specific statistic primarily relates to traditional banks. But the challenge of slow or inefficient verification is equally acute for fintech businesses. It directly impacts revenue, which is why fast, user-friendly verification is a necessity.

Secondly, accuracy and risk reduction have taken center stage.

For example, a recent industry report by Chainalysis noted that the value of stolen crypto-assets (hacks and theft) nearly doubled, rising by almost 84% year-over-year in the first half of 2024, prompting regulators to crack down on exchange compliance.

KYC service providers help businesses stay ahead of these risks by employing document forensics, biometric identity matching, and database screening. These systems are far more effective at detecting fake IDs or suspicious identities than manual reviews. Importantly, they also help avoid mistakes, such as onboarding someone on a sanctions list, which could lead to regulatory penalties.

With compliance costs and penalties, outsourcing to a KYC provider that specializes in accuracy is an attractive solution. Indeed, the use of AI and ML tools in KYC/AML compliance has skyrocketed.

By 2025, according to Accenture's Technology Vision 2025, an estimated 82% of financial institutions planned to use advanced AI for compliance, up from 42% the year prior.

This echoes broad industry recognition that automated KYC solutions are vital to compliance.

From Manual Checks to Automated KYC Solutions

The KYC process has experienced a transformation from manual, paper-based checks to automated digital solutions. Manual KYC checks, in which a human Compliance Officer reviews passport scans, Proof-of-Address documents, and so on, were once the norm but were slow, labor-intensive, and prone to human error. In contrast, automated KYC solutions leverage Machine Learning, OCR (Optical Character Recognition), and biometric recognition to validate customer identities in real time.

According to cited industry forecasts, more than 80% of customer onboarding KYC steps are projected to be automated by 2025 using digital identity verification and analytics. Instead of waiting hours or days for a manual review, customers can now be verified and approved within minutes.

For example, innovations like AI-powered ID document recognition and facial liveness checks have reduced verification times. According to an industry report by SumSub, crypto platforms using these tools have achieved onboarding success rates of over 93% and reduced verification time by an average of 46%.

In some cases, especially with emerging document-free verification methods, an identity can be verified in as little as 2 seconds. This speed would have been unthinkable with manual processes. Crucially, automation doesn’t just mean speed. It also improves scalability. An automated KYC system can handle thousands of verification requests 24/7 without exhaustion, whereas a manual team would be a bottleneck and could introduce inconsistencies.

In addition, many providers use a hybrid approach. AI handles routine verifications instantly, while any high-risk cases get flagged for human review. This human-in-the-loop model ensures that you maintain high accuracy without sacrificing the efficiency gains of automation.

The bottom line is that the industry has firmly shifted to digital KYC as the standard, with providers offering solutions that can grow with a business and maintain compliance at digital speed.

Key Industry Trends Among KYC Service Providers in 2025

In 2025, several key industry trends are shaping how KYC providers deliver their solutions. Below are some of the most significant developments across KYC automation trends and the identity verification industry.

Automation, AI, and Document Recognition

- Automation and AI continue to redefine what KYC platforms can do. Modern KYC providers are investing in artificial intelligence and machine learning to improve the accuracy and efficiency of identity verification. This ranges from AI models that detect document fraud to deep learning algorithms that match selfies to ID photos with ever-greater precision. The result is that automated KYC checks are becoming both faster and more reliable than traditional methods. In fact, automation and AI are now “helping institutions detect risks earlier and with greater accuracy,” essentially raising the bar for KYC compliance in 2025. Machine Learning models can analyze customer data and behavior patterns to catch anomalies that rule-based checks might miss, significantly reducing false positives and manual reviews.

For instance, our research “Can Machine Learning Catch Criminals Before the Blockchain Does?” highlights these systems' ability to proactively identify suspicious activity before it fully manifests on the blockchain.

- Advanced Document Recognition. It is another area of rapid improvement. KYC service providers now routinely use OCR and computer vision to read and validate identity documents from around the world. These systems can handle multiple document formats (passports, driver’s licenses, ID cards, residency permits, etc.), parse machine-readable zones (MRZ), read barcodes and security features, and even interpret documents in various languages and scripts. The use of AI means the software “learns” to better recognize documents even if images are suboptimal. Some providers also integrate NFC reading for biometric passports and ID chips, further improving accuracy.

- Biometric Verification. This one goes hand in hand with document checks. Providers use facial recognition and liveness detection to verify that the person presenting the document is its rightful owner and physically present. Liveness detection techniques, often AI-based, ask users to take a selfie or a short video and then determine whether the imagery is from a real person or a spoof.

The integration of advanced AI technology at every step (document analysis, face matching, risk scoring) is making KYC processes more automated, accurate, and intelligent than ever before.

Global Coverage and Cross-Border Compliance

Another central trend is the expansion of KYC providers' global coverage. As fintech and crypto companies serve international user bases, KYC services must verify identities from virtually anywhere in the world. Top-tier providers in 2025 boast truly global document libraries. For instance, support for identity documents from over 190+ countries and more than 8,800+ document types. This broad coverage is critical for companies that want to onboard customers across regions such as Europe, Asia, Africa, and the Americas without running separate verification processes for each region. Providers achieve this by continuously adding new document templates and often partnering with local data sources or registries to confirm ID information. Along with documents, language and script support has expanded to improve verification accuracy for non-Latin documents.

In tandem with broad document coverage, KYC providers are focusing on cross-border compliance capabilities. This means helping businesses navigate the patchwork of regional KYC/AML regulations.

In 2025, there’s a push toward more harmonized global standards. For example, coordination among regulators through FATF recommendations and the EU’s AML directives. Nonetheless, each country can have its own specific requirements. Providers differentiate themselves by how well they adapt to local regulatory requirements: offering compliance modules tailored to different jurisdictions, maintaining up-to-date lists of acceptable ID types for each country, and ensuring data handling complies with local privacy laws (such as GDPR in Europe).

It's also vital to share cross-border data and include watchlist coverage. Leading KYC services screen customers against international sanctions, terrorism financing, and politically exposed persons lists, which require aggregating data from many sources worldwide. As regulators share information across borders and enforce Travel Rule in crypto, KYC providers in 2025 must operate with a global mindset.

In short, the trend is towards KYC solutions that are truly global in reach yet locally aware, enabling companies to expand globally while staying compliant with both home and host country rules.

API-First Approach and Integration with AML Tools

As compliance technology matures, integration and interoperability have become key priorities. Many KYC service providers are adopting an API-first approach, offering APIs and software development kits (SDKs) that enable businesses to integrate KYC checks directly into their apps and platforms.

Instead of using a standalone portal, companies can seamlessly embed identity verification into their onboarding flow via RESTful API calls or mobile SDKs. This trend reflects a shift to “compliance as a service,” where KYC checks run in the background of a platform’s user experience. For example, some providers offer a unified API that provides access to a suite of compliance checks – identity verification, document authentication, selfie biometrics, sanctions screening, etc. – via a single integration.

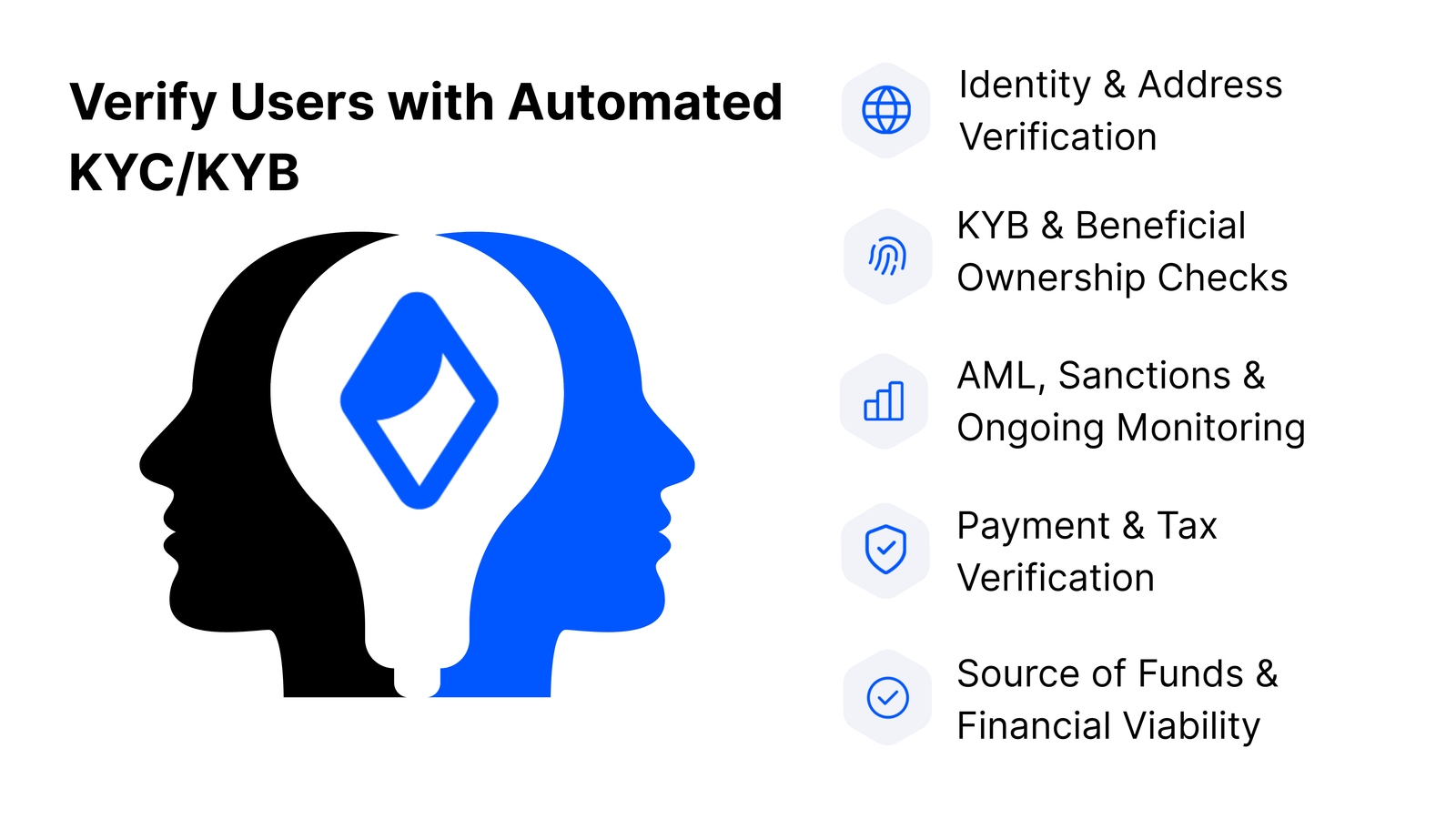

Alongside KYC itself, providers are increasingly offering integrated AML toolkits. Instead of just verifying identity and leaving the rest of compliance to the client, many KYC vendors now bundle additional services such as AML name screening, transaction monitoring, ongoing customer risk monitoring, and Know Your Business (KYB) checks for corporate clients. For instance, a KYC service might include built-in screening against sanctions and PEP lists, adverse media checks, and even fraud-detection signals, all accessible through a single API or dashboard.

Some have expanded into cryptocurrency compliance, linking identity verification with blockchain analysis (KYT, “Know Your Transaction”) to flag risky crypto wallet addresses or suspicious crypto transactions. The integration with broader compliance platforms is a notable trend. It’s not just KYC in isolation, but KYC as part of an end-to-end compliance solution. This is illustrated by the emergence of one-stop-shop compliance providers that combine identity verification, KYB, AML screening, and transaction risk monitoring on a single platform.

A prime example of this integrated solution is AMLBot. The platform allows businesses to stay compliant across all AML stages, offering Automated KYC/KYB Verification alongside Real-Time Transaction Monitoring (KYT) and specialized tools like the Tracer for Crypto Investigations.

In short, the API-first, integration-focused trend means KYC services work smoothly with other technologies. Developers get flexibility, and compliance officers get a more unified view of risk. As one guide noted, a single integration can now give access to multiple data sources and verification services under the hood, reflecting how KYC providers are evolving into integrated compliance partners rather than single-purpose tools.

Common Challenges for KYC Service Providers and Their Clients

The KYC process itself remains challenging for all parties involved, both the providers building these solutions and the companies implementing them. In 2025, as KYC systems become more advanced, they also face higher expectations and complex hurdles. Here we discuss some of the common challenges that persist in the realm of KYC verification and compliance:

Balancing Accuracy and User Experience

One challenge is finding the right balance between stringent security checks and a smooth user experience. On the one hand, businesses want KYC to be remarkably accurate. This often means adding more verification steps, such as additional document uploads, more detailed forms, or multi-factor biometric checks. On the other hand, every extra step or bit of friction in the onboarding process can drive customers away. Providers and their clients must constantly calibrate this balance. If KYC screening is too intrusive or time-consuming, users will simply abandon the signup. That represents lost business that no company wants to see.

KYC service providers tackle this challenge by making verification as seamless as possible – for example, using automated data capture, providing in-app guidance to help users take a good photo, and reducing the number of touchpoints. Some have introduced features such as document-free verification, where known, trusted digital identities or database checks can replace the need to upload traditional documents for certain low-risk customers. Providers also enable risk-based KYC workflows, in which a lower-risk customer might go through fewer steps than a high-risk customer.

Still, clients need to configure these systems wisely: an overly strict approach will create user frustration, whereas a very lenient approach could miss red flags. The key is maximizing accuracy and security without making honest customers jump through unnecessary hoops.

Managing False Positives and Compliance Costs

Another challenge in KYC/AML processes is dealing with false positives. Cases where a screening system flags a customer as potentially risky or a document as suspicious when, in fact, everything is legitimate. False positives are common in name screening and in automated document checks. These false alarms create extra work. Compliance teams must manually review and clear cases, and legitimate customers may be asked for additional proof or face delays. Nearly half of the crypto companies surveyed identified false positives or negatives in the verification process as a significant issue impacting their onboarding flow. For KYC providers and their clients, the goal is to minimize false positives, enabling compliance efforts to focus on true risks.

False positives tie directly into the broader issue of compliance costs. Every unnecessary review or repeated customer outreach adds to the cost of KYC compliance. Big financial institutions already spend enormous sums on KYC/AML operations.

In 2020, this figure was estimated at roughly $72.9 million per institution, on average, according to Thomson Reuters research. Today, this financial burden is even greater: compliance costs increased for 99% of North American financial institutions in 2024, with the total cost of financial crime compliance reaching $61 billion in the US and Canada, according to LexisNexis data.

Smaller fintechs or crypto startups also face cost pressures to maintain compliance teams and tools.If a KYC system generates too many alerts that turn out to be nothing, that’s wasted time and money. One promising development is the use of AI and Machine Learning (as noted earlier) to reduce false positives by learning what normal behavior looks like and flagging only truly anomalous activity.

Additionally, outsourcing parts of the process to KYC service providers can sometimes reduce costs via economies of scale. The provider can spread the cost of maintaining top-notch verification infrastructure across many clients. However, businesses must weigh vendor costs as well, ensuring that using a third-party service is cost-effective compared to building in-house.

In 2025, we also see regulators expecting institutions to manage costs while still improving compliance, and they often encourage the adoption of technology as a solution. The challenge will remain to keep compliance efficient: filter out bad actors and risks without drowning in “noise” from false alerts, and do it in a cost-conscious way.

Adapting to Changing Requirements

The regulatory landscape for KYC and AML is anything but static. Regulations are continually changing, posing a challenge for both KYC providers and the businesses that use them: systems need to be updated, often on short notice, to remain compliant with new rules.

In 2025, for example, multiple jurisdictions implemented fresh KYC-related laws. The EU’s Sixth Anti-Money Laundering Directive (6AMLD) came into effect with stricter provisions on customer due diligence and liability for compliance failures. Many countries introduced or enhanced crypto-specific KYC regulations, such as the Markets in Crypto-assets (MiCA) regulation in the EU, which mandates that crypto asset service providers implement KYC and Due Diligence for users. Providers and companies must also respond to periodic updates of FATF (Financial Action Task Force) Guidance, which can expand the scope of who needs to be verified or how data should be shared.

A notable example is the FATF’s “Travel Rule” for cryptocurrency transactions, which requires virtual asset service providers (VASPs) to exchange identifying information for senders and receivers of crypto transactions above certain thresholds.

Regulators worldwide are pushing for it, meaning many exchanges and platforms had to scramble in 2025 to integrate Travel Rule solutions or risk regulatory action. Similarly, sudden geopolitical events can lead to expanded sanctions lists. KYC and screening systems have to immediately adapt to such changes, adding new names to watchlists and adjusting risk rules.

All this requires agility from KYC service providers. Providers need to update their software and databases quickly when laws change. They also must push these updates to clients or make them configurable in the platform. From the client side, businesses should consider how responsive a KYC provider is to regulatory changes. Do they have compliance experts on staff tracking new laws? Do they release timely updates? The ability to adapt is almost as important as current features, because a solution that is excellent today but slow to update could leave a company non-compliant tomorrow.

Evaluating a KYC Service Provider: What Really Matters

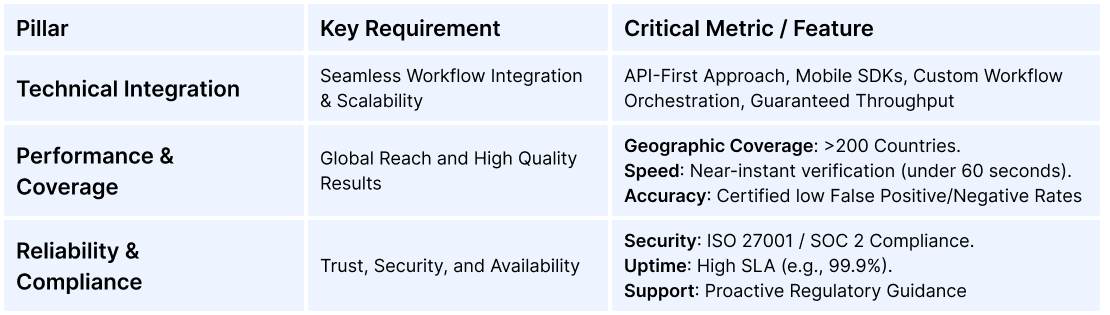

Choosing a KYC provider means selecting a partner that aligns with your compliance, technical, and business needs. The evaluation process is based on 3 main things: 1. Technical Capabilities2. Performance & Coverage 3. Compliance Reliability

Integration and Technical Capabilities

Put an API-first solution at the top of your list. This should offer comprehensive RESTful APIs and mobile SDKs (iOS/Android) for easy integration. The provider must demonstrate scalability, ensuring their system can handle increasing verification volumes without performance degradation. Look for flexibility in workflow orchestration, allowing you to customize verification steps (e.g., risk tiers) and integrate results smoothly using tools like webhooks.

Coverage, Accuracy, and Speed

This Pillar Defines The Quality Of The Verification Process:

- Coverage. Must be broad, encompassing both geographic regions (ideally >200+ countries) and document types. If there are gaps, it will be much harder to get users from all over the world up and running.

- Accuracy. A key quality indicator. Evaluate success rates, false acceptance/rejection rates, and look for external certifications (e.g., ISO, iBeta) that validate the precision of their AI/ML algorithms. High levels of accuracy are key to minimising both compliance risk and the wrongful rejection of legitimate users.

- Speed. Users demand near-instant verification (ideally under 60 seconds). Low latency, high system uptime, and reliable manual review processes are non-negotiable for customer retention.

Compliance, Reliability, and Support

Trust is paramount. Ensure the provider maintains stringent security standards and certifications (GDPR, ISO 27001, SOC 2) to protect sensitive PII and biometric data.

Crucially, evaluate their support model. Look for 24/7 availability, dedicated account management, and clear Service Level Agreements (SLAs) for uptime and response times. A top provider acts as a proactive compliance partner, alerting you to regulatory changes and assisting with optimization.

Explore how an Automated KYC Solution by AMLBot can streamline user verification and reduce compliance workload.

The Future Outlook for KYC Service Providers

In the future, KYC compliance is likely to continue maturing. KYC service providers in the future will need to innovate continuously in response to both technological change and the shifting tactics of financial criminals.

Two broad trends seem poised to shape the future of KYC: a move towards more unified compliance platforms and the increasing use of data intelligence and predictive tools to stay ahead of risk.

From Fragmented Tools to Unified Compliance Platforms

Today, many organizations use a patchwork of different tools for various compliance tasks. One system for customer KYC, another for transaction monitoring (KYT), another for sanctions screening, and so on. We’re already seeing a strong trend to integrate these into unified platforms, and this is likely to accelerate.

In the near future, KYC service providers may evolve or partner to deliver all-in-one compliance suites. This means that instead of juggling separate solutions, a compliance team could log in to a single platform that handles end-to-end onboarding and monitoring.

From the providers’ perspective, we’re seeing KYC companies broaden their scope by developing new capabilities in-house or by merging with/partnering with other regtech firms. For example, some traditionally “KYC-only” providers now offer add-on modules for ongoing transaction screening or case management. The end goal appears to be a unified compliance framework that can be marketed as a single solution.

Data Intelligence and Predictive Compliance

The future direction for KYC and AML is a shift from reactive compliance to proactive, data-driven risk management. Thanks to advancements in Artificial Intelligence (AI), providers are constantly implementing learning predictive analytics models. These models analyze behavioral patterns, device data, and historical fraud data to assign the customer a real-time risk score. This allows for the detection of anomalies and potential issues BEFORE they escalate into financial crime. Essentially, KYC is transforming from a static, one-time tool into an always-on guardian that adapts as the customer relationship evolves, thereby securing the financial system.

Conclusion: Building a Trustworthy Compliance Framework

KYC service providers in 2025 are not just vendors but key partners in building a trustworthy compliance framework for businesses in fintech, crypto, and traditional finance.

As we’ve explored, these providers bring together cutting-edge technology, from AI-driven identity verification to global data coverage, to help companies meet regulatory requirements without crippling their user experience. However, along with these opportunities come challenges that businesses must navigate, such as maintaining user-friendly onboarding, minimizing false positives, and keeping up with ever-changing regulations.

Choosing the right KYC provider is thus a strategic decision. It’s about finding a solution that fits the company’s risk profile, scales with its growth, and adapts to the regulatory environment.

In conclusion, as the financial landscape evolve with new technologies and regulations, businesses that invest in strong KYC capabilities will be better positioned to thrive. They will be able to onboard customers quickly from anywhere, proactively manage risk, and expand into new markets while staying compliant. KYC providers will continue to play a crucial role in this ecosystem, bridging the gap between regulatory obligations and operational execution.

FAQ

What Does A KYC Service Provider Do?

A KYC service provider verifies customer identities on behalf of businesses to ensure they comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) rules. The provider offers a digital service that collects and checks customers’ ID documents, confirms their identity, and screens them against relevant databases. By using a KYC provider, a company can outsource the complex process of identity verification and customer due diligence, making sure that every new customer is legitimate and not involved in fraud or financial crime.

How Do KYC Service Providers Help Crypto And Fintech Companies?

KYC providers are valuable to crypto exchanges, fintech apps, and other online financial services because they automate user verification and reduce onboarding friction. This automation means crypto and fintech companies can onboard customers globally with minimal delay while still performing all necessary compliance checks. At the same time, KYC providers help these companies meet regulatory requirements across multiple jurisdictions.

What Are The Main Types Of KYC Service Providers?

There are generally three main categories of KYC service providers, distinguished by their approach and offerings:

- Manual KYC Vendors. These are providers that rely on human staff to perform verifications. Essentially, a business outsources its KYC to a service that employs teams of trained analysts who manually review documents and information.

- Automated KYC Platforms. These providers use software and AI to verify identities. They offer tools such as document verification via OCR, automated database checks, and biometric identity verification. Everything happens digitally, often in real-time. Automated KYC platforms are known for speed and scalability. They can handle large volumes of verifications quickly and are commonly integrated via API into apps and websites.

- Integrated Compliance Suites. These are comprehensive platforms that combine KYC with other compliance functions. Providers in this category offer an all-in-one solution for a company’s compliance needs.

How To Choose The Right KYC Service Provider?

First, look at coverage: does the provider support the countries and ID document types your business requires? If you have an international user base, you’ll need a service with broad document and language coverage. Second, consider verification speed and accuracy. A good provider should be able to verify most customers quickly with a high success rate and low error rates. Check that the provider offers an API and technical tools that make it easy to plug into your website or app, and that it can integrate with your existing workflows or CRM. You’ll also want to assess the provider’s security and data protection standards. Ensure they comply with regulations such as GDPR and, ideally, hold certifications such as ISO 27001 or SOC 2, indicating strong data security practices. Pricing is important too. Look for transparent pricing without hidden fees, and make sure it fits your expected volume. Finally, consider the provider’s track record and adaptability. Do they have good customer support, and will they update their service quickly if regulations change or if you need new features?

In short, choose a KYC service provider that covers your target markets, performs reliably, integrates well technically, safeguards data, and offers responsive support with clear pricing.

What Are The Latest Trends Among KYC Service Providers In 2025?

Key trends in 2025 include an emphasis on AI-driven identity verification and automation in the KYC process. Providers are using advanced AI for tasks such as document recognition and facial biometric matching, thereby improving speed and accuracy. Related to that, liveness detection has become standard, ensuring that the person verifying is physically present and real. Another trend is an API-first approach and better integration, meaning KYC services are delivered as seamless components that fintechs and banks can easily embed in their apps. We’re also seeing the convergence of KYC with other compliance tools: many providers now offer unified platforms that combine KYC with KYT and AML screening in one system. Additionally, global coverage and localization are a trend. Providers are expanding support for more countries, regional ID documents, and local regulatory requirements, since companies need to onboard users globally. Lastly, user experience enhancements such as document-free verification and risk-based verification orchestration are on the rise, all aimed at making KYC both robust and frictionless. In summary, 2025’s KYC provider trends center on leveraging technology (AI, Biometrics, Data Analytics) to accelerate and improve compliance, while offering more integrated and comprehensive solutions to clients.

How Does An Automated KYC Solution Differ From Manual Verification?

An Automated KYC Solution uses technology, like AI, Machine Learning, and OCR, to perform identity checks instantly. Whereas manual verification relies on human staff to review documents and make decisions.

Are KYC Service Providers Required By Law?

No, using a third-party KYC service provider is not required by law. But KYC itself is required by various regulations for many businesses. Laws and regulations mandate that banks, crypto exchanges, and other regulated companies perform KYC checks to verify customer identity and prevent money laundering. However, these rules don’t dictate how a business must do KYC. Companies can choose to handle KYC in-house or to outsource it to a service provider. The regulators’ concern is that KYC is done properly, not who does it. That said, many businesses opt to use certified KYC service providers because it helps them meet the compliance standards more easily.

How Do KYC Providers Ensure Data Security?

KYC service providers handle highly sensitive personal data, so top providers prioritize robust security measures to protect it. First, they typically use encryption extensively. Data is encrypted during transmission and at rest in databases, so that even if intercepted or accessed, it’s not readable without the keys. Many providers anonymize or redact data where possible to limit exposure. Compliance with data protection laws, such as the GDPR, is mandatory. Providers will have clear policies on data retention and will let clients specify where data is stored. Leading KYC providers often undergo independent security audits and certifications. For example, achieving ISO 27001 Certification indicates they have a robust information security management system in place, and some may have SOC 2 Type II reports attesting to their security controls. They also implement access controls so that only authorized personnel can access sensitive data and often provide features such as audit logs that show who accessed what. Many providers have regional servers or cloud instances to ensure data residency. Additionally, they invest in secure infrastructure. Firewalls, intrusion detection systems, DDoS protection, and run regular penetration tests to find and fix vulnerabilities.