The Crypto Investor's Guide: Assessing AML Compliance in Crypto Projects

Anti-money laundering (AML) compliance should be a top concern if you're a crypto investor. However, many crypto users know very little — if anything — about what an AML governance regulation is and what it means in the industry.

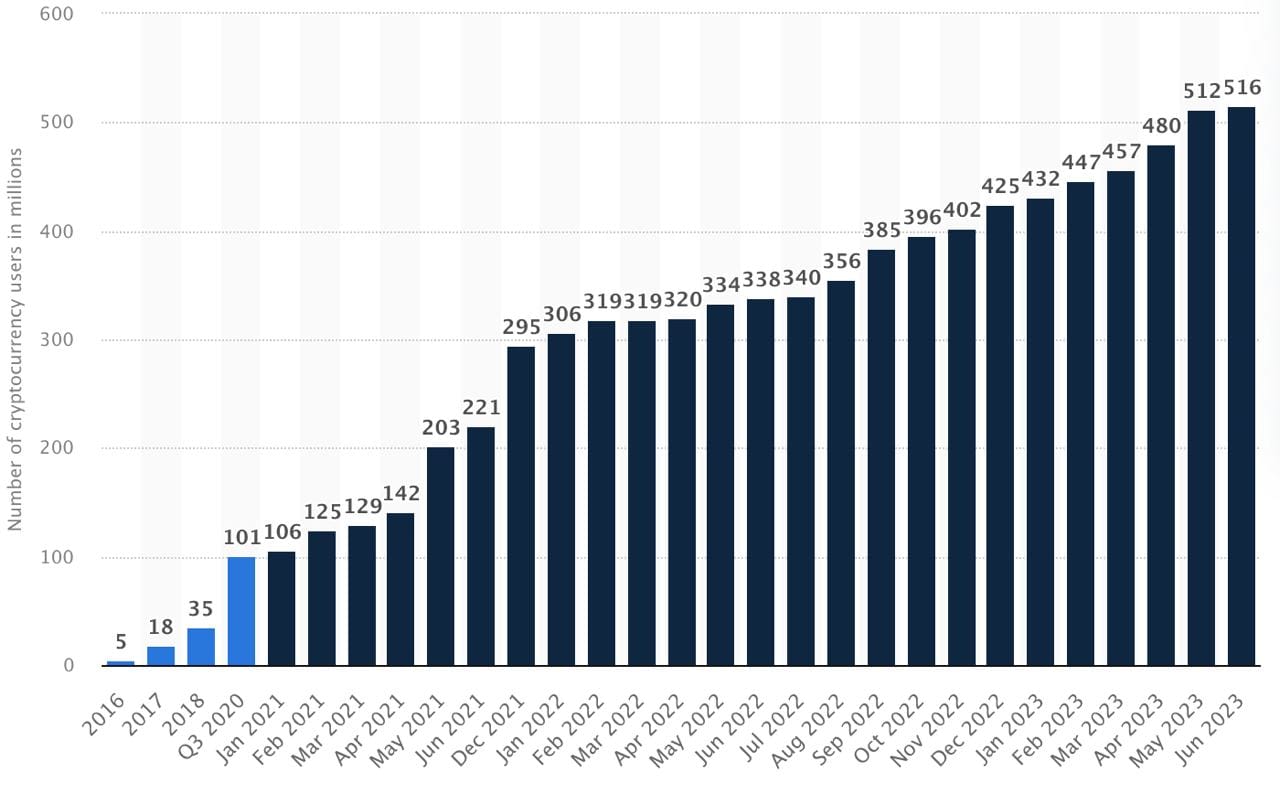

Experts project that the number of crypto investors will reach nearly one billion in 2024.

With so many people buying, selling, and trading cryptocurrencies, understanding the connection between crypto projects and criminal activity has never been more critical. Keep reading to learn why anti-money laundering compliance is essential and what an investor should look for in crypto projects.

An Introduction to the Concept of AML Compliance

An anti-money laundering regulation is meant to help prevent criminals from committing money laundering, where they disguise illicit funds as legitimate income. These types of regulations are nothing new. For example, the Bank Secrecy Act established comprehensive rules for American financial institutions in the 1970s.

In recent years, the birth of blockchain and crypto projects has created a new kind of AML regulation. Because criminals can use exchanges and other cryptocurrency platforms to funnel money through multiple addresses and conceal their origins, regulatory governance has been working overtime to put crypto investor protections into place.

Groups like the Financial Action Task Force (FATF) have developed standards for crypto companies. Doing so reduces risk, legitimizes cryptocurrency in the eyes of the public, and creates a more stable investor market.

What is AML Compliance?

When a cryptocurrency company complies with anti-money laundering rules, it carefully follows each regulation for its jurisdiction. These are a few examples of places with strict laws based on the FATF's framework:

- The United States: Cryptocurrency regulations and enforcement are split across several agencies, including the Financial Crimes Enforcement Network, the Securities and Exchange Commission, and the Commodity Futures Trading Commission.

- The European Union: The EU's Markets in Crypto-Assets (MiCA) legislation includes requirements for cryptocurrencies and stablecoins.

- The United Arab Emirates: The Virtual Assets Regulatory Authority outlines AML requirements for cryptocurrency businesses.

These regulations generally apply to crypto projects on peer-to-peer platforms and, in some cases, decentralized finance platforms and custodial wallet crypto exchanges. Companies that follow these and other regulations protect every investor, strengthen crypto projects, and are better prepared to identify and report criminal activity.

Stages of AML Compliance for Crypto Businesses

Although there is no standardized anti-money laundering regulation for blockchain services and crypto projects, many regulatory agencies' governance applies FATF guidelines. The most essential components include:

Verifying customer identities: Businesses use Know Your Customer (KYC) checks to confirm investor identities when registering for an account. You are requested to provide documentation, such as a passport or government ID, and your personal details for this assessment.

Conducting ongoing monitoring: Cryptocurrency companies have to monitor their activity after onboarding a new investor. They look for irregular transactions and concerning patterns of behavior.

Reporting suspicious activities: When businesses flag a potential issue that can't be satisfied or the investor fails to cooperate, the next step is to report it to the authorities or relevant regulatory bodies. This allows law enforcement to analyze the case further and determine whether any criminal activity has taken place.

All of these stages work in combination to achieve compliance. For example, if an exchange conducts thorough KYC checks but fails to monitor ongoing activity, they're most likely violating at least one AML regulation. Regulatory annual audits are design to identify weaknesses, which need to be rectified, this can attract fines and monitoring to ensure the measures are increased.

Requirements for AML Compliance in Crypto Projects

Cryptocurrency projects first emerged as an alternative to traditional financial institutions. They placed users in full control of their funds and opened doors to new opportunities. However, they also drew the attention of bad actors who wanted to take advantage of this technological revolution to further their interests.

Crypto projects have a legal obligation to help prevent that from happening. Depending on where they're located, many cryptocurrency businesses have to register or apply for a license from the appropriate governance to achieve regulatory compliance.

In addition, to open an account, they are required to collect customer information for blockchain users through Customer Due Diligence (CDD) checks and quickly notify legal authorities about any concerning activity on their platform. Many anti-money laundering regulations also require crypto companies to appoint a Chief Compliance Officer. This person oversees the AML compliance program and files suspicious activity reports.

Challenges in AML Compliance for Crypto Businesses

Complying with every AML regulation is a continuous challenge, especially when companies aren't sure what's required of them. Because regulatory governance is just beginning to understand the blockchain, crypto businesses face unique challenges in achieving regulations.

Addressing Anonymity and Pseudonymity

On the blockchain, cryptocurrency transactions aren't linked directly to a person's identity. Instead, they're connected to wallet addresses, which users can create anonymously. This can make it difficult to trace the origin and destination of transactions. It can also complicate the process of identifying individuals who are participating in suspicious activities.

Overcoming Differences in Cross-Border Regulatory Governance

Another obstacle cryptocurrency projects have to overcome is navigating the various regulations in places around the world. Governance in different countries, provinces, and states has taken its own approach to anti-money laundering. Businesses that serve blockchain users in multiple locations, as so many cryptocurrency companies do, might assume that they're in full compliance when they're actually violating AML requirements.

Technological Solutions for AML Compliance

The good news for cryptocurrency businesses is that technology makes compiling with AML governance easier. Blockchain analytics tools help to manage risks and monitor addresses and transaction data. This helps them identify criminal activity and avoid violating governance regulations and responsibilities.

Businesses can also partner with AML compliance platforms and services like AMLBot. Using automation makes compliance more streamlined and affordable. For example, AMLBot can help crypto businesses develop their AML procedures and training, implement KYC processes to verify user information, and track the source and destinations of crypto transactions.

Benefits of AML Compliance for Crypto Businesses

At its most basic level, anti-money laundering compliance comes down to protection for every business and investor. If money laundering and terrorist financing run rampant, governance will have to crack down even harder, potentially limiting the future of blockchain technology and pushing it underground.

Businesses that violate AML rules also put themselves at a high risk of facing expensive legal consequences. In 2023, global authorities levied $5.8 billion in fines against cryptocurrency and fintech firms for non-compliance.

Lastly, AML compliance is good for business because it makes a company seem more credible and trustworthy. If an investor gets the impression that a company doesn't value compliance and safety, they might take their funds elsewhere.

Case Studies: Successful AML Compliance Implementations

In the current crypto landscape, you don't have to look far to find businesses with failed anti-money laundering compliance. According to one report, more than half of all virtual asset service providers (VASPs) around the world have weak KYC processes. Fortunately, some standout companies have established strong policies safeguarding their customers and the market.

Case Study 1: Gate.io

One of the most popular cryptocurrency exchanges, Gate.io, has a thorough and effective AML program. They have a stellar due diligence process and require every customer to go through KYC before they can start trading. They also have advanced risk assessment procedures, assigning customers different permissions based on their profile.

Crypto businesses with lackluster AML procedures could learn much from Gate.io's approach. They conduct ongoing reviews and monitoring of all customer transactions, paying extra attention to high-risk clients, countries, and regions.

Case Study 2: LetsExchange

Another example of successful AML compliance is LetsExchange. Their AML and KYC procedures involve exhaustive identification and verification steps. Customers have to provide documents from a reliable source, and the company conducts additional identity checks as necessary after a user is actively trading.

The strength of the LetsExchange policies is also due, in part, to their reliance on partnerships. They use monitoring services to analyse transactional patterns. Beyond that, they conduct daily checks of customers against local and global watch lists, including the Office of Foreign Assets Control's sanctions list.

Steps for Crypto Businesses to Achieve AML Compliance

protections

- Conducting risk assessment: A risk assessment involves examining types and volumes of transactions and creating risk profiles. Businesses also analyse individual transaction details and geographical risk.

- Developing AML policies and procedures: Reliable crypto companies document their AML strategies, including how they screen customers, evaluate risk levels, and monitor transactions. These general policies should be readily available on a business's website so customers can learn about the process and protections.

- Training employees on AML compliance measures: The employees at a crypto company should receive extensive training in AML, including learning about risk assessment and how to identify a suspicious transaction or investor. Businesses should update their training regularly to reflect when a regulation or standard changes.

Crypto projects without risk assessment, monitoring, policies, and training pose a threat to the company and you as an investor.

Getting Help With Anti-Money Laundering Regulations

From an investor's perspective, your only job when it comes to AML is to carefully evaluate the crypto projects that come your way before making a move. Crypto companies, on the other hand, carry a much bigger burden. They have to meet legal requirements or face the consequences, which could be devastating to their finances, reputation, and long-term viability.

The success of crypto projects depends on robust AML measures and risk assessment, and crypto users should use caution with each transaction. Fortunately, AMLBot can help with both of those goals. Reach out to learn more about AMLBot's one-stop compliance solution for crypto businesses.