MiCA Stablecoin Regulation: ART & EMT Compliance Requirements for Crypto Businesses

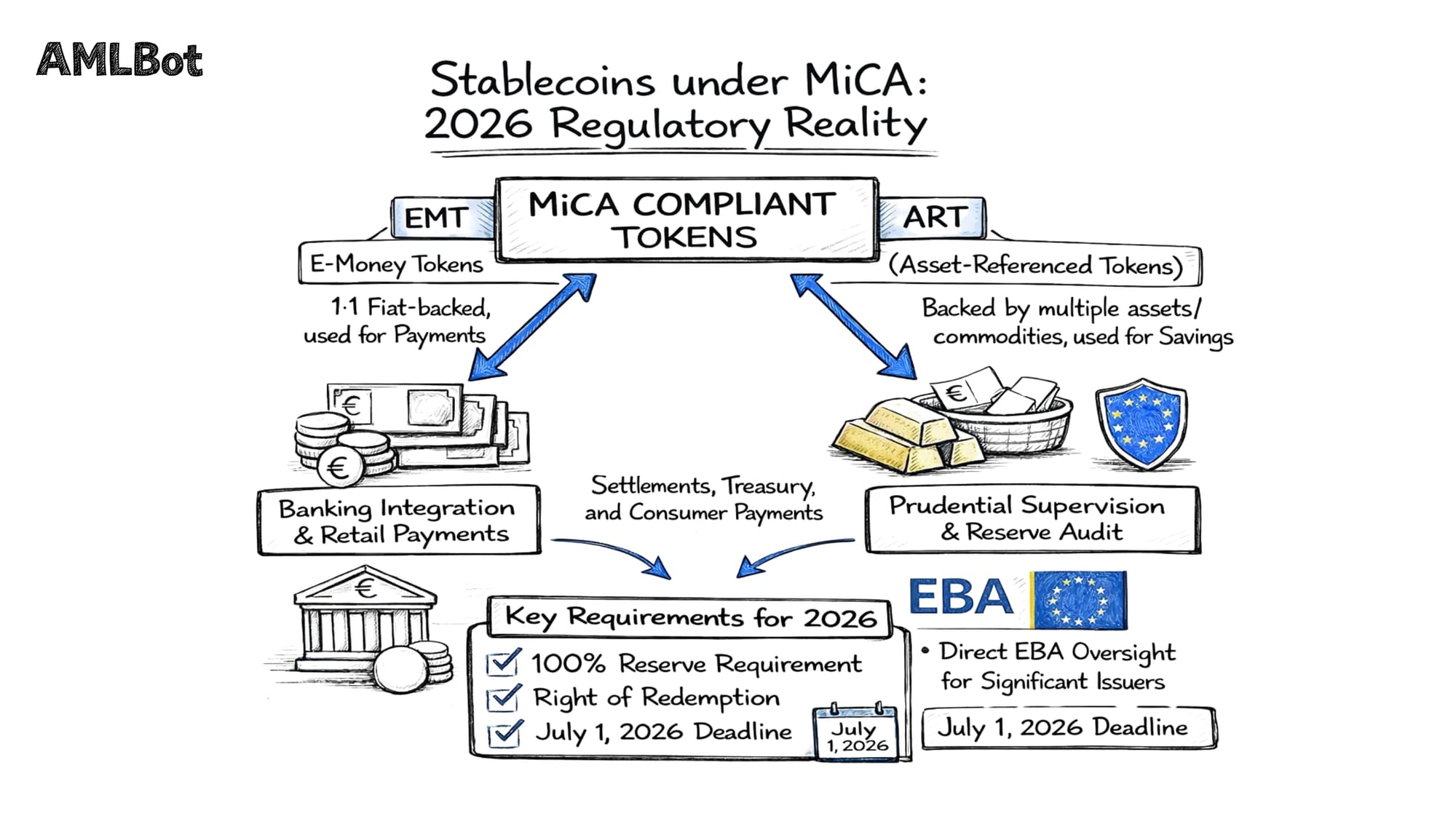

Stablecoins under MiCA are regulated as a separate, higher-risk category of crypto-assets because of their potential scale in payments and settlement. This article focuses solely on MiCA stablecoin regulation and the specific compliance rules that apply to MiCA stablecoins classified as Asset-Referenced Tokens (ART) and E-Money Tokens (EMT). It is written for stablecoin issuers under MiCA and for crypto businesses that rely on USDT/USDC (exchanges, PSPs, fintechs, DeFi interfaces) and need to understand issuer duties, stablecoin reserve requirements, redemption rules, and expectations for stablecoin transaction monitoring. It does not explain MiCA in general.

MiCA treats stablecoins as a distinct category of crypto-assets due to their potential to be used at scale as a means of payment and a store of value. Unlike volatile crypto-assets, stablecoins are designed to maintain price stability and can therefore function as de facto substitutes for fiat money in payments, settlements, and treasury operations. EU legislators explicitly identified this characteristic as a source of increased risk, particularly when stablecoins are widely adopted by retail users or integrated into payment systems.

Recital-level reasoning in MiCA reflects concerns that large stablecoin issuances could affect financial stability, monetary transmission, and consumer protection if left outside a prudential framework. The early application of MiCA’s stablecoin provisions underscores that stablecoins were treated as a regulatory priority.

Source: Regulation (EU) 2023/1114. This article explicitly states that Title III (Asset-Referenced Tokens — ARTs) and Title IV (E-Money Tokens — EMTs) apply from June 30, 2024. In contrast, the remaining provisions of MiCA (covering Crypto-Asset Service Providers (CASPs) and other asset types) only became applicable on December 30, 2024. Refer to Article 149, Paragraph 2, Point (a).

Note: None of this information should be considered as legal, tax, or investment advice. While we’ve done our best to ensure this information is accurate at the time of publication, laws and practices may change, so please double-check it.

Why Regulators Consider Stablecoins a Systemic Risk

From a regulatory perspective, stablecoins present systemic risk when three factors converge: large issuance volumes, high transaction velocity, and integration into payment and settlement use cases. A widely accepted stablecoin used for everyday transactions can, in practice, compete with sovereign currency without the equivalent safeguards. MiCA responds to this risk by: (a) requiring full reserve backing; (b) imposing strict redemption rights; (c) introducing transaction and volume thresholds for non-Euro stablecoins used in the EU.

In particular, MiCA empowers supervisors to intervene if a non-euro stablecoin exceeds defined transaction volume limits within the EU, reflecting concerns over currency substitution and monetary sovereignty. Algorithmic stablecoins that rely on stabilization mechanisms rather than real reserves are excluded from

Where MiCA Draws the Line Between Crypto-Assets and E-Money

MiCA establishes a clear legal boundary between ordinary crypto-assets and stablecoins by aligning certain stablecoins with existing EU e-money concepts. Where a stablecoin references a single official currency, it is classified as an E-Money Token (EMT). MiCA defines EMTs as tokens that “purport to maintain a stable value by referencing the value of one official currency,” meaning they operate as regulated e-money on DLT in practice. EMTs are considered “funds” under EU law and may only be issued by licensed credit institutions or electronic money institutions.

By contrast, stablecoins that reference multiple assets or non-currency benchmarks are classified as Asset-Referenced Tokens (ART). MiCA defines an ART as a token that “purports to maintain a stable value by referencing another value or right or a combination thereof.” These tokens are not considered e-money or legal tender, but they are nevertheless subject to a dedicated MiCA regime that reflects their potential scale and complexity. ARTs remain regulated exclusively under MiCA, with bespoke requirements on reserves, governance, and disclosure.

Through this classification, MiCA establishes a two-tier stablecoin framework that bridges crypto regulation and traditional financial law, ensuring that stablecoins that function as money are regulated accordingly, while other stable value tokens remain subject to enhanced crypto-specific oversight.

ART vs. EMT Under MiCA – What’s the Difference?

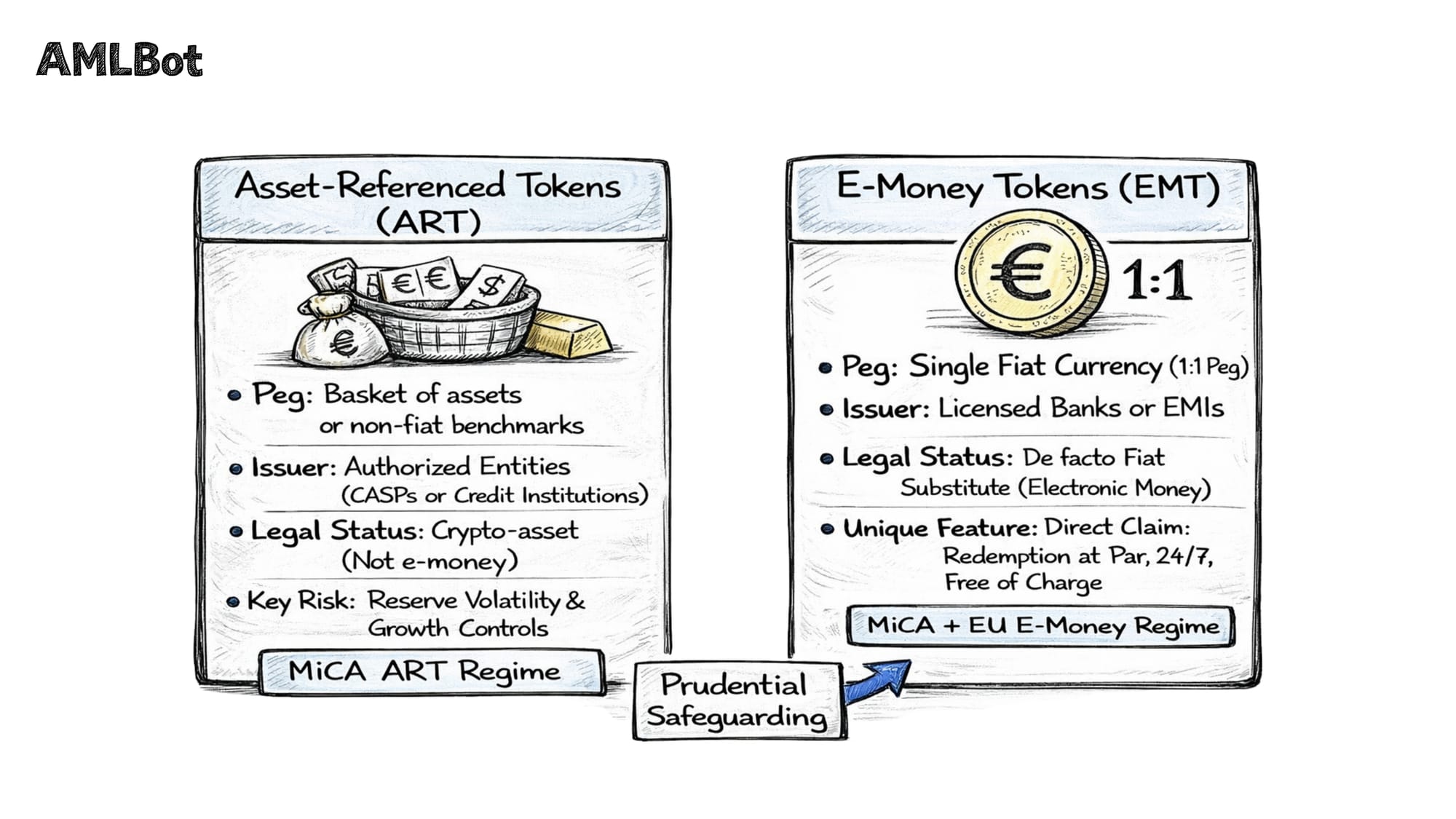

MiCA establishes two legally distinct categories of stablecoins: Asset-Referenced Tokens (ART) and E-Money Tokens (EMT). While both are designed to maintain a stable value, they differ in what they reference, how redemption works, and which regulatory regime applies. This distinction is critical, as MiCA imposes different issuer obligations based on classification.

Asset-Referenced Tokens (ART)

An Asset-Referenced Token (ART) is a crypto-asset designed to maintain a stable value by referencing one or more assets, a combination of assets, or a non-fiat benchmark. The reference may include official currencies, but the token is not pegged to a single fiat currency. Stability is therefore achieved through exposure to a composite reference rather than a one-to-one currency peg.

Typical ART structures include stablecoins referencing a basket of fiat currencies, combinations of fiat currencies and commodities, or non-currency assets such as gold. Because ARTs do not reference a single official currency, they do not qualify as electronic money under EU law and are regulated exclusively under MiCA.

From a regulatory perspective, ARTs pose specific risks related to reserve valuation, asset liquidity, and potential currency substitution if adoption scales. MiCA addresses these risks by imposing strict requirements on ART issuers, including full reserve backing, independent custody of reserve assets, enhanced disclosure obligations, periodic reserve audits, and growth controls for large issuances. Algorithmic stabilization mechanisms that rely on supply adjustments rather than real reserves are excluded from the definition and cannot be marketed as stablecoins under MiCA.

E-Money Tokens (EMT)

An E-Money Token (EMT) is a crypto-asset that maintains a stable value by referencing one single official currency. Under MiCA, EMTs are legally classified as electronic money and treated as e-money issued using distributed ledger technology. As a result, EMTs are considered “funds” under EU law and fall within the scope of existing EU e-money regulation, in addition to MiCA-specific provisions.

Only licensed credit institutions or electronic money institutions (EMIs) are permitted to issue E-Money Tokens (EMTs) in the EU, a central requirement for MiCA-compliant stablecoins. Offering EMTs to the public without the required issuer authorization is prohibited under MiCA, ensuring that EMT issuers are subject to established prudential, governance, and supervisory standards applicable to traditional e-money providers.

EMTs must be issued at par value upon receipt of equivalent fiat funds and must remain fully backed by reserves denominated in the same currency. Holders have a direct legal claim against the issuer and are entitled to redeem EMTs at any time and at face value, free of charge. Safeguarding rules applicable to electronic money apply, including segregation of client funds and strict limitations on how reserves may be invested.

Stablecoin Issuer Obligations Under MiCA

MiCA imposes issuer obligations on stablecoin issuers that go significantly beyond those applicable to other crypto-asset issuers. These obligations reflect the monetary function of stablecoins and are designed to ensure financial stability, consumer protection, and continuous supervisory oversight. The scope and intensity of these obligations apply to both Asset-Referenced Tokens (ART) and E-Money Tokens (EMT), with certain differences depending on token classification.

Stablecoin Reserve Requirements

A core pillar of MiCA stablecoin regulation is the requirement to maintain full, high-quality reserves, including the obligation to maintain full, high-quality reserve backing at all times. Stablecoin issuers must hold reserve assets equal to the full amount of tokens in circulation, ensuring redemption claims can always be met.

For EMTs, reserves must be denominated in the same fiat currency as the token and structured in accordance with EU e-money safeguarding rules. This includes holding a significant portion of reserves in deposits with credit institutions and limiting the remainder to low-risk, highly liquid financial instruments. Currency mismatch and speculative reserve investments are not permitted.

For ARTs, reserve requirements are more complex due to the composite nature of the reference assets. ART issuers must ensure legal and operational segregation of reserve assets from their own funds, use independent custodians, avoid concentration risk, and subject reserves to periodic independent audits. In all cases, reserves must remain unencumbered and insolvency-remote, serving exclusively to protect token holders.

Governance and Transparency Obligations

MiCA requires stablecoin issuers to maintain robust governance arrangements appropriate to the scale and risk profile of their activities. Issuers must implement clear organizational structures, effective internal controls, and risk management frameworks that identify, measure, and mitigate operational and financial risks.

Transparency is a central requirement. Issuers must publicly disclose detailed information about the stablecoin, including its stabilization mechanism, reserve composition, valuation methodology, and key risks. Disclosures must be accurate, up-to-date, and presented in a manner that is clear and not misleading. Any material change affecting the stablecoin or its backing must be promptly communicated.

Reporting to Regulators

Stablecoin issuers are subject to ongoing supervisory reporting obligations under MiCA. These obligations are designed to give regulators visibility into issuance volumes, reserve adequacy, transaction activity, and potential systemic risks. Issuers must periodically report data such as: the number of tokens in circulation, the value and composition of reserve assets, transaction volumes and velocity, the geographic distribution of users.

As issuance and usage grow, reporting frequency and data granularity increase. MiCA also requires issuers to monitor how their stablecoins are used in practice, including payment and settlement activity, and to cooperate with supervisory authorities where risks to financial stability or monetary policy are identified.

Redemption Rights

MiCA establishes enforceable redemption rights as a fundamental protection for stablecoin holders. EMT holders are entitled to redeem tokens at any time and at face value in the referenced fiat currency. ART holders must be able to redeem their tokens for the market value of the reference assets or an equivalent fiat amount, depending on the token structure.

Issuers may not impose redemption fees or create artificial barriers to redemption. Clear and documented redemption policies are required, including procedures for stressed market conditions. The ability to honor redemption claims on demand is a non-negotiable element of MiCA-compliant stablecoin issuance.

Operational Resilience

Stablecoin issuers must ensure a high level of operational resilience, reflecting the potential impact of stablecoin disruptions on users and markets. This includes resilient IT systems, cybersecurity safeguards, business continuity planning, and incident response procedures.

Issuers are expected to identify operational vulnerabilities that could impair issuance, redemption, or reserve management and to implement measures that ensure continuity of critical functions. Recovery and orderly wind-down planning form part of this resilience framework, ensuring that stablecoin operations can be stabilized or terminated without disorderly effects on token holders.

AML & Transaction Monitoring Risks for Stablecoins

Stablecoins present distinct stablecoin AML risks under MiCA due to their price stability, high liquidity, and operational role in payments and settlements. Unlike volatile crypto-assets, stablecoins can be moved at scale without exposure to market risk, making them particularly attractive for laundering, sanctions evasion, and rapid fund displacement. As a result, regulators treat stablecoin flows as functionally comparable to electronic money, requiring enhanced monitoring and risk controls.

Velocity and Layering Risks

One of the primary AML risks associated with stablecoins is transaction velocity. Stablecoins are frequently used to move value rapidly across multiple wallets, platforms, and jurisdictions within a short period. This enables classic layering techniques, where illicit funds are fragmented, redistributed, and recombined to obscure their origin.

Because stablecoins retain a stable value, criminals can execute high-frequency transfers without the volatility constraints associated with other crypto-assets. Patterns such as rapid in-and-out movements, peel chains, and repeated short-hop transfers are particularly common in stablecoin laundering scenarios. These behaviors significantly reduce the effectiveness of static or threshold-based monitoring and require real-time behavioral analysis.

Cross-Chain Stablecoin Flows

Stablecoins are often issued on multiple blockchains and are actively bridged across networks. Cross-chain transfers allow funds to move between ecosystems with different visibility and compliance maturity, complicating traceability and risk attribution.

From an AML perspective, cross-chain stablecoin activity introduces blind spots where illicit flows may temporarily disappear before re-emerging on another network or platform. Monitoring only a single blockchain is insufficient. MiCA’s risk-based approach implicitly assumes that firms dealing with stablecoins understand and monitor multi-chain transaction paths, including bridges, decentralized exchanges, and intermediary wallets.

Use of Stablecoins in Laundering Schemes

Stablecoins are routinely used as an intermediate asset in laundering schemes involving:

- Conversion from illicit fiat into crypto.

- Movement through centralized and decentralized venues.

- Re-entry into the financial system via exchanges or payment services.

Their widespread acceptance across trading venues and DeFi protocols makes them an efficient tool for placement, layering, and integration. Stablecoins are also frequently observed in schemes involving sanctions circumvention, ransomware payments, fraud proceeds, and illicit OTC settlements.

This functional role means that stablecoins often act as the primary value carrier in complex laundering typologies rather than as a passive settlement asset.

Why Regulators Expect Advanced KYT Controls

MiCA, together with the EU’s broader AML framework, makes clear that stablecoin-related activity must be subject to stablecoin transaction monitoring, comparable to traditional payment systems. Regulators expect issuers and crypto businesses to understand how stablecoins circulate, not merely who holds them.

In practice, this means: monitoring transaction velocity and behavioral anomalies, identifying exposure to high-risk services, mixers, and sanctioned entities, detecting cross-chain laundering patterns, correlating on-chain activity with off-chain user behavior.

Static rules or basic wallet screening are not sufficient to meet these expectations. MiCA’s emphasis on reporting, reserve integrity, and systemic risk implicitly requires advanced KYT capabilities to analyze stablecoin flows in real time and across ecosystems.

From Regulatory Expectation to Transaction Monitoring

For crypto businesses relying on stablecoins, compliance is no longer limited to onboarding controls. Stablecoin transaction monitoring is becoming the primary risk-control mechanism for stablecoin-related activity, and regulators increasingly expect advanced KYT to support this control. Firms must be able to identify suspicious stablecoin movements in real time, assess risk dynamically, and generate defensible audit trails for regulators.

As stablecoins increasingly resemble regulated payment instruments under MiCA, KYT is the operational backbone that allows businesses to meet AML obligations while continuing to support high-volume, cross-border stablecoin use cases.

Circle and USDC – What the Case Shows About MiCA Compliance

Circle's experience as the issuer of USDC provides a clear illustration of Circle's MiCA compliance and how MiCA applies in practice to widely used stablecoins. Rather than serving as a news event, the Circle case demonstrates the regulatory logic MiCA applies to non-EU stablecoin issuers whose tokens are widely used in the European market.

Why Circle Is Important

Circle is one of the largest global stablecoin issuers, with USDC extensively used by exchanges, payment providers, and DeFi protocols. Because USDC is a fiat-referenced stablecoin pegged to a single currency, it falls squarely within MiCA’s definition of an E-Money Token (EMT), making USDC MiCA compliance dependent on EMT-specific requirements. As such, its continued use in the EU depends entirely on whether the issuer can meet MiCA’s EMT-specific requirements.

Circle’s relevance lies in the fact that it did not attempt to rely on extraterritorial issuance or informal market access. Instead, it aligned its structure with MiCA’s assumption that stablecoins used in the EU must be issued and supervised within the EU regulatory perimeter.

What Steps Were Required for EU Compliance

To meet MiCA requirements, Circle established an EU-based issuing entity and obtained authorization as an electronic money institution in France. This step was legally necessary because EMTs may only be issued by licensed credit institutions or electronic money institutions under EU law.

Beyond authorization, compliance required Circle to:

- Issue USDC and EURC through the EU entity rather than from outside the Union.

- Publish MiCA-compliant crypto-asset white papers.

- Align reserve management with EU e-money safeguarding and MiCA reserve requirements.

- Implement EU-standard governance, reporting, and risk controls.

- Subject the issuance and circulation of stablecoins to ongoing EU supervisory oversight.

The key regulatory point is that MiCA compliance was achieved through structural alignment, not through disclosure alone. USDC did not become MiCA-compliant because of its size or reputation, but because the issuer brought issuance, reserves, and supervision under EU law.

What This Means for Other Non-EU Issuers

The Circle case illustrates a broader conclusion: stablecoin usage in the EU cannot be sustained without an EU-compliant issuance model. Non-EU issuers cannot rely on global circulation, secondary-market trading, or technical decentralization to circumvent MiCA requirements.

For widely used stablecoins issued outside the EU, including those pegged to non-euro currencies, MiCA effectively presents a binary outcome:

- Either establish an EU-compliant structure that satisfies EMT or ART requirements.

- Face increasing restrictions on distribution, listing, and use within the EU.

This logic applies regardless of market size. The absence of an EU-authorized issuer exposes crypto businesses using such stablecoins to regulatory risk, particularly for exchanges and payment-facing platforms. The case of Tether and USDT illustrates this uncertainty: without an EU-authorized issuer, continued use in the EU becomes legally fragile under MiCA.

Regulatory Conclusions

The Circle and USDC case confirms three core principles of MiCA stablecoin regulation:

- Issuance location matters – stablecoins used in the EU must be issued under EU supervision.

- Compliance is structural, not cosmetic – disclosure without authorization is insufficient.

- Market access follows regulatory alignment – MiCA-compliant stablecoins gain legal certainty, while non-compliant ones face exclusion pressure.

For crypto businesses relying on stablecoins, this case underscores the importance of issuer-level compliance when assessing operational and regulatory risk. MiCA does not prohibit global stablecoins, but it conditions their use in the EU on full alignment with EU financial regulation.

What Crypto Businesses Using Stablecoins Must Consider

MiCA’s stablecoin rules do not apply only to issuers. Any crypto business that lists, processes, holds, or facilitates transactions involving stablecoins in the EU must reassess its risk exposure under the new framework. This includes exchanges, custodians, payment service providers, fintech companies, and DeFi interfaces that serve EU users. While issuer-level obligations sit with the stablecoin issuer, AML, transaction monitoring, and user-facing compliance responsibilities remain firmly with the service provider.

Exchanges and Trading Platforms

Crypto exchanges operating in or targeting the EU must ensure that stablecoins offered to users do not create regulatory or AML exposure. Even where an exchange is not responsible for reserve management or issuance, it remains responsible for how stablecoins are offered, traded, and monitored on its platform. Regulators expect exchanges to assess whether a stablecoin is issued in line with MiCA requirements and to reflect that assessment in listing decisions, disclosures, and risk controls. Regardless of issuer compliance, exchanges retain full responsibility for stablecoin transaction monitoring, including detecting high-velocity movements, layering patterns, and exposure to sanctioned or illicit wallets.

Custodians and Wallet Providers

Custodial service providers holding stablecoins on behalf of clients must consider not only safekeeping, but also redeemability and continuity risk. Holding a stablecoin that later becomes restricted or delisted in the EU can expose custodians to operational and client-protection issues. Custodians are also expected to apply AML controls to stablecoin inflows and outflows, including KYT screening of external wallets and monitoring unusual transfer behavior. The fact that a stablecoin is widely used does not reduce the custodian’s obligation to assess its regulatory and risk profile.

Payment Service Providers and Fintech Companies

Fintechs using stablecoins for payments, settlements, or remittances must treat them as regulated payment instruments in practice, even if they are technically crypto-assets. Stablecoin-based payment flows are subject to the same AML expectations as traditional electronic money transfers. This includes customer due diligence, transaction monitoring, sanctions screening, and reporting of suspicious activity. Where stablecoins are used at scale or in consumer-facing contexts, regulators expect particularly strong controls around transaction velocity, repeat usage patterns, and conversion to and from fiat.

DeFi Interfaces and Access Providers

While fully decentralized protocols may fall outside MiCA’s direct issuer rules, interfaces, front ends, and intermediaries do not. Any business providing user access to stablecoin-based DeFi activity in the EU must consider whether it is facilitating crypto-asset services and whether stablecoins used through the interface create AML or regulatory exposure. In practice, DeFi interfaces that integrate widely used stablecoins are increasingly expected to favor assets that do not pose obvious MiCA compliance or supervisory risks.

Risks of Using Non-MiCA-Compliant Stablecoins (USDT Example)

A key operational risk for crypto businesses is reliance on stablecoins that are not issued under a MiCA-compliant structure, particularly where market practice shifts toward MiCA-compliant stablecoins. Using USDT as an example, even though it is globally liquid and widely accepted, the absence of an EU-authorized issuer creates legal, operational, and AML uncertainty. Businesses facilitating USDT transactions in the EU may face regulatory pressure, delisting requirements, or restrictions on fiat conversion if supervisory expectations tighten. From an AML perspective, non-MiCA-compliant stablecoins also lack the transparency, reporting, and supervisory alignment required under MiCA, increasing counterparty and reputational risk for platforms that continue to rely on them.

Responsibility Does Not End With the Issuer

MiCA makes clear that while reserve management and issuance obligations belong to the issuer, service providers remain responsible for how stablecoins are used within their systems. This includes AML compliance, transaction monitoring, sanctions enforcement, and cooperation with regulators. Exchanges, custodians, and payment providers cannot rely solely on issuer assurances. They must independently assess stablecoin risks and implement controls proportionate to stablecoin usage.

From Compliance Obligation to KYT Reality

In practice, this means crypto businesses must treat stablecoins as high-risk, high-velocity instruments from an AML perspective. Effective compliance requires continuous transaction monitoring, cross-chain visibility, behavioral analysis, and timely escalation of suspicious activity. Under MiCA, KYT is not optional for stablecoin flows. It is the primary mechanism through which businesses demonstrate control over stablecoin-related risk.

How This Fits Into the Broader MiCA Framework

MiCA’s stablecoin regime operates as a distinct compliance layer within the EU’s broader crypto regulatory framework. The rules for Asset-Referenced Tokens (ART) and E-Money Tokens (EMT) do not replace general MiCA obligations, nor do they exist in isolation. Instead, they sit atop the broader framework governing crypto-asset services and market conduct.

For crypto businesses, this means stablecoin and broader MiCA compliance must be addressed in parallel. Issuer-level obligations apply specifically to ARTs and EMTs, while service-level obligations continue to apply to exchanges, custodians, payment providers, and other intermediaries handling stablecoins. Understanding how these layers interact is essential for building a sustainable EU-facing operating model.

To place stablecoin obligations in context, businesses should review:

(а) The broader set of rules that apply across the EU crypto market is covered in our guide to General MiCA Requirements.

(b) The authorization and compliance framework for crypto-asset service providers is explained in our overview of MiCA CASP Licensing Requirements.

Taken together, these layers reflect MiCA’s core regulatory logic: stablecoins are not banned, but they are no longer peripheral. Any crypto business operating in the EU must consider both the stablecoin-specific rules and the wider MiCA framework when designing products, managing risk, and implementing compliance controls.

Conclusion

MiCA has placed stablecoins within a separate, heightened regulatory layer, reflecting their monetary function and systemic relevance. For issuers and crypto businesses alike, this introduces new risks and new responsibilities, particularly around reserves, transparency, and transaction monitoring. Stablecoin compliance under MiCA is not static. It requires continuous oversight, reporting, and adaptation as supervisory expectations evolve. Businesses that treat compliance as an ongoing operational discipline, rather than a one-off exercise, will be best positioned to operate sustainably in the EU’s regulated stablecoin market.

-AMLBot Team

Follow AMLBot:

🔗 Website

🔗 Telegram

🔗 Support Team

🔗 LinkedIn

What Types of Stablecoins Are Regulated Under MiCA?

MiCA regulates stablecoins classified as Asset-Referenced Tokens (ART) and E-Money Tokens (EMT). Each category is subject to different compliance, reserve, and governance requirements depending on how the stablecoin is structured and what assets back its value.

What Is the Difference Between ART and EMT Under MiCA?

ARTs reference multiple assets or non-fiat benchmarks, while EMTs are pegged to a single official fiat currency. EMTs are closely aligned with EU e-money regulation and typically face stricter prudential and supervisory requirements than ARTs.

Do Stablecoin Issuers Need Authorization Under MiCA?

Yes. Stablecoin issuers must be authorized in the EU and comply with MiCA-specific obligations related to governance, reserves, transparency, and risk management. The authorization path depends on whether the token qualifies as an ART or an EMT.

Can Non-EU Stablecoin Issuers Operate in the EU Under MiCA?

Non-EU issuers can operate in the EU only if they establish a compliant structure that meets MiCA requirements. In practice, this typically involves establishing an EU-based entity and fully aligning issuance, reserves, and supervision with MiCA.

Are Popular Stablecoins Like USDC and USDT Affected by MiCA?

Yes. MiCA directly affects how widely used stablecoins can be issued, distributed, and used in the EU. Issuers must demonstrate compliance with MiCA rules covering reserves, governance, and transparency for their stablecoins to be lawfully supported in the EU market.

What Reserve Requirements Does MiCA Impose on Stablecoin Issuers?

MiCA requires stablecoin issuers to maintain adequate, high-quality reserves and to ensure token holders' redemption rights. Reserve composition, safeguarding, and reporting obligations vary between ART and EMT tokens, but full backing is a core requirement.

What AML and Transaction Monitoring Risks Are Associated With Stablecoins?

Stablecoins pose higher AML risks due to their liquidity, speed, and cross-chain use. Regulators expect advanced transaction monitoring and KYT controls to identify rapid fund movements, layering patterns, and exposure to illicit activity.

Do Crypto Exchanges and Platforms Have Obligations When Listing Stablecoins?

Yes. Even when they are not the issuer, crypto service providers remain responsible for AML compliance, transaction monitoring, and ensuring that listed stablecoins align with applicable MiCA requirements.

How Does MiCA Change the Use of Stablecoins in DeFi and Payments?

MiCA introduces stricter oversight of stablecoin use in payment and settlement systems. While fully decentralized protocols may fall outside the direct scope, intermediaries, interfaces, and access providers may still carry compliance and AML obligations.

How Does MiCA Stablecoin Regulation Fit Into the Broader EU Crypto Framework?

Stablecoin regulation under MiCA forms a dedicated compliance layer within the EU crypto framework. Businesses must consider both issuer-level obligations for stablecoins and broader MiCA requirements when operating in the EU.