Crypto Customer Due Diligence (CDD) Guide: Best Practices

Customer Due Diligence (CDD) is a core pillar of AML and KYC programs for any financial firm, and this extends equally into the crypto realm. For crypto businesses, CDD serves as the first line of defense to identify who their customers are and assess the risks they pose. However, crypto Customer Due Diligence can be more challenging than CDD in traditional finance. The pseudonymous nature of cryptocurrency transactions and the global market make it harder to verify identities and trace funds.

This guide focuses exclusively on CDD in crypto businesses – explaining how CDD is applied in the virtual asset environment and highlighting crypto-specific due diligence practices – rather than rehashing general CDD theory. Unlike a generic compliance overview, this guide zeroes in on cryptocurrency Customer Due Diligence. It assumes you already know the basics of CDD from traditional AML/KYC guides. Here we delve into what makes crypto CDD unique: from risk-based approaches tailored to crypto, to handling high-risk customers and Enhanced Due Diligence (EDD) in virtual asset services. The aim is to outline crypto CDD best practices and regulatory expectations so that virtual asset service providers (VASPs) can strengthen their compliance without duplicating fundamental KYC/AML concepts.

What Is Customer Due Diligence (CDD) in Crypto?

Customer Due Diligence (CDD) in the crypto context refers to the process of identifying and verifying customers, assessing their risk profile, and monitoring their activity in order to meet AML and KYC obligations.

In practice, it involves verifying who your customer is and collecting information to confirm they are legitimate, not a fraudster or sanctioned individual. For example, a crypto exchange will identify a new user by gathering personal data and verify those details against reliable sources. The business then evaluates the customer’s risk level – considering factors like location, trading patterns, and source of funds – and applies appropriate measures based on that risk. In a crypto business, CDD must account for the industry’s pseudonymity and technology: ensuring that the person behind a crypto wallet is properly identified and that their blockchain transactions don’t indicate illicit behavior. Importantly, CDD in crypto businesses is not a one-time checkbox at onboarding but an ongoing process of risk management throughout the customer relationship.

Why Customer Due Diligence Is Critical for Crypto Businesses

Key AML Risks in Crypto Environments

Crypto companies face distinctive AML risks that make rigorous CDD especially critical.

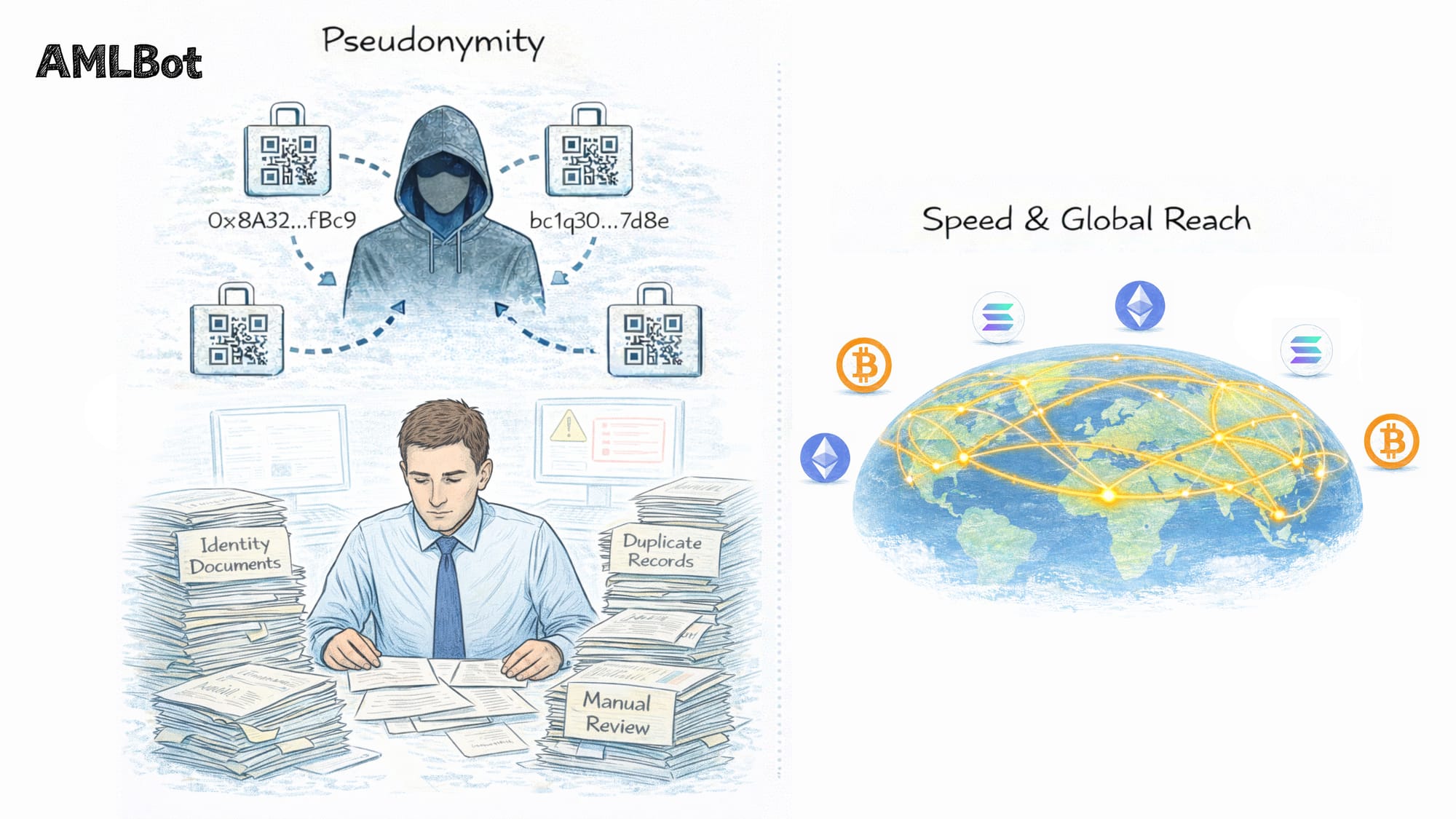

(a) One major challenge is Pseudonymity. Cryptocurrency addresses are not directly tied to real-world identities, which makes it difficult to identify customers and track their activities. A user might transact under a pseudonym or use multiple wallets, obscuring who the beneficial owner of funds truly is.

(b) Another risk factor is the High Speed and Global Reach of Crypto Transactions. Digital assets can be transferred across borders in minutes, bypassing the conventional banking system. This means funds can move through jurisdictions faster than traditional controls can detect, and bad actors can rapidly “layer” transactions to hide their trail. Indeed, high-velocity transactions that bypass conventional monitoring thresholds and cross-border flows creating multi-jurisdictional obligations are cited as key crypto compliance risks.

Crypto Customer Due Diligence is therefore crucial to mitigate these risks, providing a structured way to pierce through anonymity, flag high-risk behavior, and maintain oversight even as transactions span the globe.

Regulatory Expectations for Crypto Companies

Regulators worldwide now expect crypto businesses to perform CDD with the same rigor as traditional financial institutions. Under global standards (such as the FATF’s Guidance), VASPs are required to implement risk-based Customer Due Diligence just like banks. This means crypto exchanges, wallet providers, and other VASPs must identify and verify customers and beneficial owners, understand the purpose of the business relationship, and monitor for suspicious activity.

For example, in many jurisdictions crypto companies are treated as “financial institutions” or money service businesses under AML laws, making CDD a legal obligation. Regulators expect crypto firms to have internal policies and controls to vet customers at onboarding and to detect unusual behavior afterward. Recent regulatory frameworks explicitly include CDD requirements for crypto: as noted in our guide on crypto KYC Regulatory Requirements, the FATF’s Recommendation 15 was updated to extend full AML/CFT measures to the crypto sector. In practice, a compliant crypto company needs a CDD Program that can withstand scrutiny – failure to carry out proper Due Diligence can lead to regulatory penalties, reputational damage, or even loss of operating licenses.

Core Components of Crypto Customer Due Diligence

Customer Identification and Verification

The foundation of any CDD crypto program is Customer Identification + Verification.

Crypto businesses must collect sufficient information to reliably identify each customer, much like banks do. This typically involves gathering the person’s full name, date of birth, address, and government-issued ID number, and then verifying those details through official documents or databases. For individual users, onboarding processes will request an identity document (e.g. passport or driver’s license) and often a selfie or video for facial match.

For institutional clients, the business will collect corporate registration documents and identify the individuals who own or control the entity (beneficial owners). Modern exchanges often employ digital solutions and Automated KYC Verification workflows to streamline this step. Regardless of method, crypto Customer Due Diligence requires that the customer’s identity is verified to a high degree of confidence before they are allowed to transact. Customer identification and verification in crypto must also account for remote and global users – since services are online, firms rely on innovative methods like biometric ID checks or database lookups to validate customers from various countries.

The goal is to ensure “you know who you’re dealing with” even if the customer never sets foot in a branch, creating a trustworthy starting point for all further due diligence.

Beneficial Ownership in Crypto Context

Identifying beneficial ownership is a crucial part of customer due diligence, especially for business or institutional clients. Beneficial owners are the individuals who ultimately own or control an account, even if another legal entity is listed as the customer. In the crypto context, pinning down beneficial ownership can be tricky. Customers may interact with a VASP through corporate structures, trusts, or simply by controlling multiple wallets behind the scenes. Crypto businesses nonetheless have an obligation to identify and verify the beneficial owners of their clients, similar to banks. For example, if a corporation registers an account on an exchange, the exchange must determine which persons own or control that corporation (usually anyone with >25% ownership or significant control). The challenge is that crypto’s pseudonymity and use of layered wallet schemes can obscure who is actually pulling the strings. Regulators flag “anonymity in ownership that obscures beneficial owners” as a key risk in crypto oversight. Best practice is to collect ownership information during onboarding (through corporate documents, self-disclosure, and database checks) and to remain vigilant for signs that someone other than the named account holder is the true controller. By uncovering the beneficial owner, a crypto firm can properly assess risk – e.g. if the owner is a politically exposed person or comes from a high-risk country – and apply enhanced measures if needed. In short, understanding who ultimately benefits from or controls a crypto account is essential to effective CDD for crypto businesses.

Risk Assessment and Customer Profiling

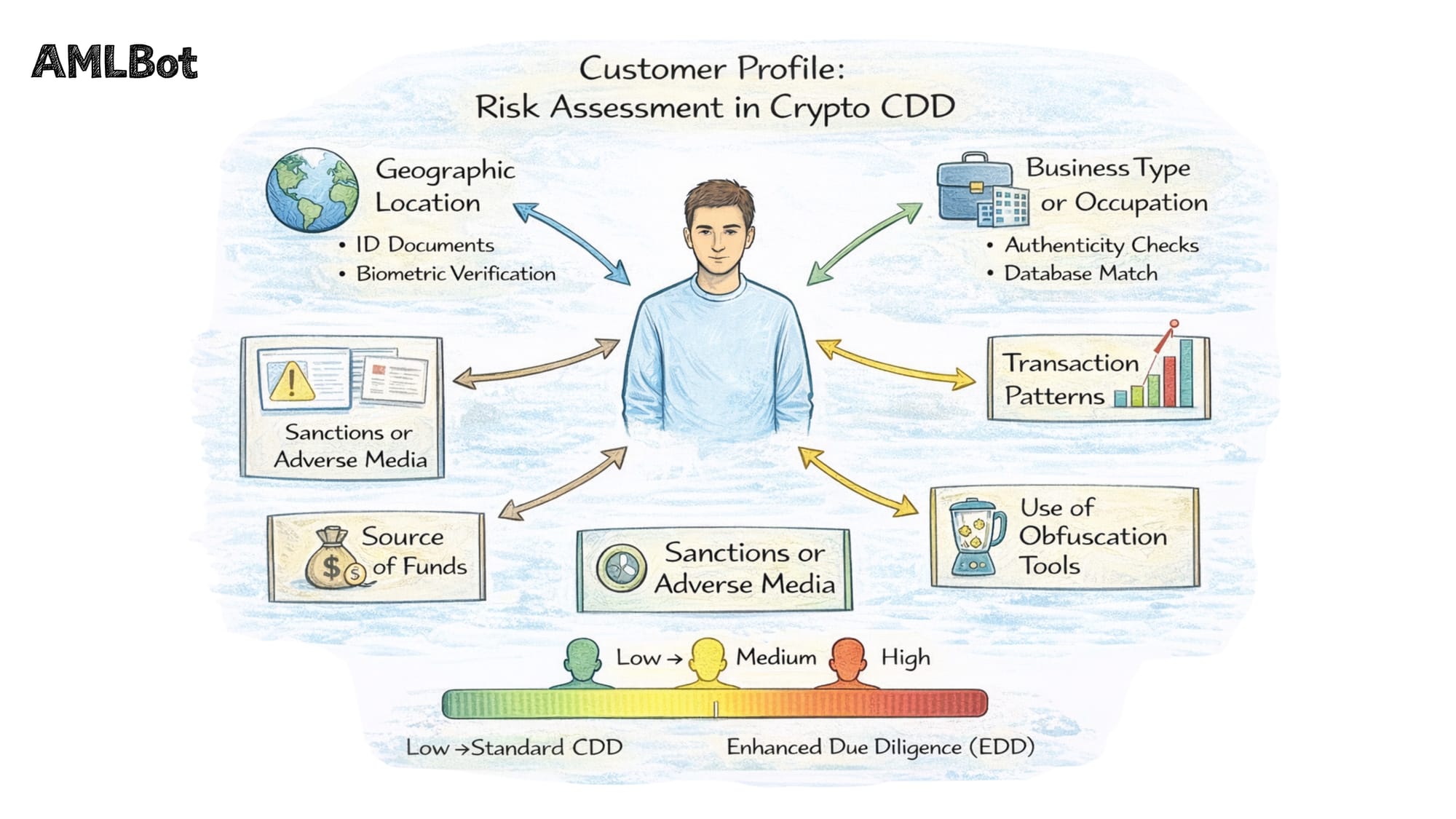

A hallmark of risk-based Customer Due Diligence is that not all customers are treated the same – the depth of checks and scrutiny should correspond to the customer’s risk profile. Crypto companies need to perform a risk assessment for each customer after initial identification. This involves evaluating various risk factors, such as the customer’s geographic location, occupation or business type, transaction patterns, sources of funds, and any adverse information or sanctions exposure.

For instance, a client from a jurisdiction with weak AML regulations or a client engaging in unusually large crypto transfers would be rated as higher risk. According to compliance best practices, cryptocurrency businesses assess these factors to determine each customer’s risk rating. The output is a customer profile – low-risk, medium-risk, or high-risk – which then dictates the level of due diligence applied. Profiling is especially important in crypto due to the prevalence of cross-border transactions and novel typologies (like use of mixers or DeFi platforms). A risk-based approach allows VASPs to allocate more resources and stricter controls to high-risk customers, while simplifying requirements for low-risk ones. The risk assessment should be documented and periodically updated, as a customer’s risk profile can change over time (for example, if their transaction volume spikes or if new negative news emerges). By integrating risk profiling into crypto CDD, companies can spot the users who warrant closer attention and ensure compliance measures are proportionate to the risk each customer poses.

Best Practices for CDD in Crypto Compliance

Applying a Risk-Based Approach

Regulators encourage and expect a risk-based approach to CDD, and this is especially true in the crypto sector where customer risks vary widely. Applying a risk-based approach means that a crypto business adjusts its level of verification and monitoring based on the customer’s risk level. In practice, this involves performing an initial risk categorization (as described above) and then tailoring Due Diligence measures accordingly.

(a) Low-Risk Customers. For example, a retail client buying small amounts of crypto from a low-risk country – might undergo standard ID verification and basic checks.

(b) High-Risk Customers, like those with large trading volumes or connections to high-risk jurisdictions, should face more rigorous scrutiny. A key crypto CDD best practice is to formalize what triggers enhanced checks: e.g., if a customer hits certain volume thresholds, exhibits suspicious transaction behavior, or matches to negative databases, the compliance team escalates their due diligence. By calibrating CDD to risk, crypto companies ensure they are not under- or over-stepping: they meet regulatory requirements without bogging down the onboarding of straightforward, low-risk users. Importantly, a risk-based approach should be dynamic. Crypto businesses should periodically re-assess customer risk (through ongoing monitoring) and be ready to elevate a customer’s risk level if new red flags appear. This proportional approach is both efficient and compliant, embodying the principle that risk-based customer due diligence directs resources where they are needed most.

Enhanced Due Diligence (EDD) for High-Risk Crypto Customers

When a customer is deemed high-risk, crypto businesses should apply Enhanced Due Diligence (EDD) measures. EDD is essentially an extra layer of investigation and verification for those customers who pose greater risk. Common scenarios that warrant EDD in crypto include: customers with very large transaction volumes, those from high-risk jurisdictions, those with complex corporate structures or opaque ownership, and those flagged as politically exposed persons (PEPs) or having adverse media hits. Under EDD, the VASP will seek additional information to ensure it fully understands the customer’s profile and source of funds. This can involve requiring more identity documents, gathering information on the customer’s source of wealth, checking the background of beneficial owners, and performing more intense screening against sanctions or crime databases. Ongoing transactions might be monitored in real-time or more frequently for EDD customers. In practice, for high-risk customers, crypto businesses are required to conduct enhanced due diligence, which may include extra verification steps, continuous monitoring, and increased scrutiny of transactions. For example, if an exchange has a client transferring cryptocurrency from addresses linked to mixers or darknet markets, it would invoke EDD procedures such as deep blockchain analysis (if available) and possibly request proof of funds’ origin. The goal of EDD is to “get comfortable” with a risky customer or else decide to refuse or exit the relationship. Incorporating EDD protocols is a crypto CDD requirement under many regulations, ensuring that higher-risk cases are not treated with a one-size-fits-all approach, but rather with the heightened vigilance they demand.

Ongoing Review and Monitoring

Customer Due Diligence doesn’t end after onboarding – ongoing monitoring is a best practice (and legal requirement) to keep customer information up-to-date and to catch emerging risks. Crypto businesses should have processes to continuously monitor customer transactions and activities for anomalies or suspicious patterns. This could involve automated transaction monitoring systems that flag unusual behavior (e.g., a sudden spike in volume, use of high-risk counterparty wallets, or frequent cross-exchange transfers). Additionally, firms need to perform periodic reviews of their customers’ KYC information. For example, if a user’s ID document on file expires or if there are significant changes (new address, new associated wallets), the business should update and re-verify the information. Ongoing CDD also means re-assessing risk levels: a customer might start as low risk but later engage in activity that bumps them to high risk, triggering EDD or other controls. Risk-Based Customer Due Diligence programs typically define review cycles (e.g., high-risk accounts reviewed every 6 or 12 months, low-risk perhaps every 24 months).

The importance of ongoing monitoring is underscored by regulations like FinCEN’s CDD Rule, which explicitly includes conducting ongoing monitoring to identify and report suspicious transactions and to maintain up-to-date customer information.

Ongoing CDD helps ensure that today’s trusted customer doesn’t become tomorrow’s liability. It allows crypto companies to spot red flags (such as a previously innocuous account starting to receive funds from a sanctioned address) and take action promptly. In summary, continuous review and monitoring are what make CDD an active, life-cycle process rather than a one-time check, thereby strengthening a crypto business’s overall compliance stance.

How Crypto CDD Differs From Traditional Financial CDD

While the fundamental principles of due diligence are similar, crypto CDD differs from traditional financial CDD in several notable ways.

First, the data and tools involved can be very different. Traditional banks rely on extensive government databases, credit reports, and face-to-face verification; by contrast, crypto platforms often must leverage blockchain analytics and specialized software to link customers to on-chain activity. The decentralized and pseudonymous nature of crypto means compliance teams are often dealing with wallet addresses and transaction hashes, which have no direct equivalent in banking.

As one industry commentary notes, the tools and standards in the cryptocurrency environment for identification are still evolving; it is a much different operating space than traditional banking and finance.

Another difference is the risk landscape: crypto transactions are irreversible and global, so a lapse in CDD can quickly result in illicit funds moving across borders, whereas banks might have more time to flag and freeze suspicious wires. CDD requirements in AML and KYC for crypto also tend to emphasize certain things more – for example, verifying a customer’s source of crypto funds (to ensure they didn’t come from a darknet market) might be more heavily emphasized at a crypto exchange than it would be at a local retail bank. On the other hand, crypto firms have to fit into existing regulatory frameworks that were built for traditional finance. In many cases, regulators simply require crypto companies to adhere to the same CDD requirements (customer identification, beneficial owner identification, risk profiling, ongoing monitoring) that banks do. The difference is in execution: performing those steps in a crypto context requires additional technical measures and awareness of crypto-specific red flags. In summary, customer due diligence crypto vs traditional differs mainly in the methods of verification and risk detection, owing to the unique characteristics of digital assets – yet both share the same goal of preventing illicit financial activity by knowing your customer thoroughly.

Common CDD Challenges for Crypto Businesses

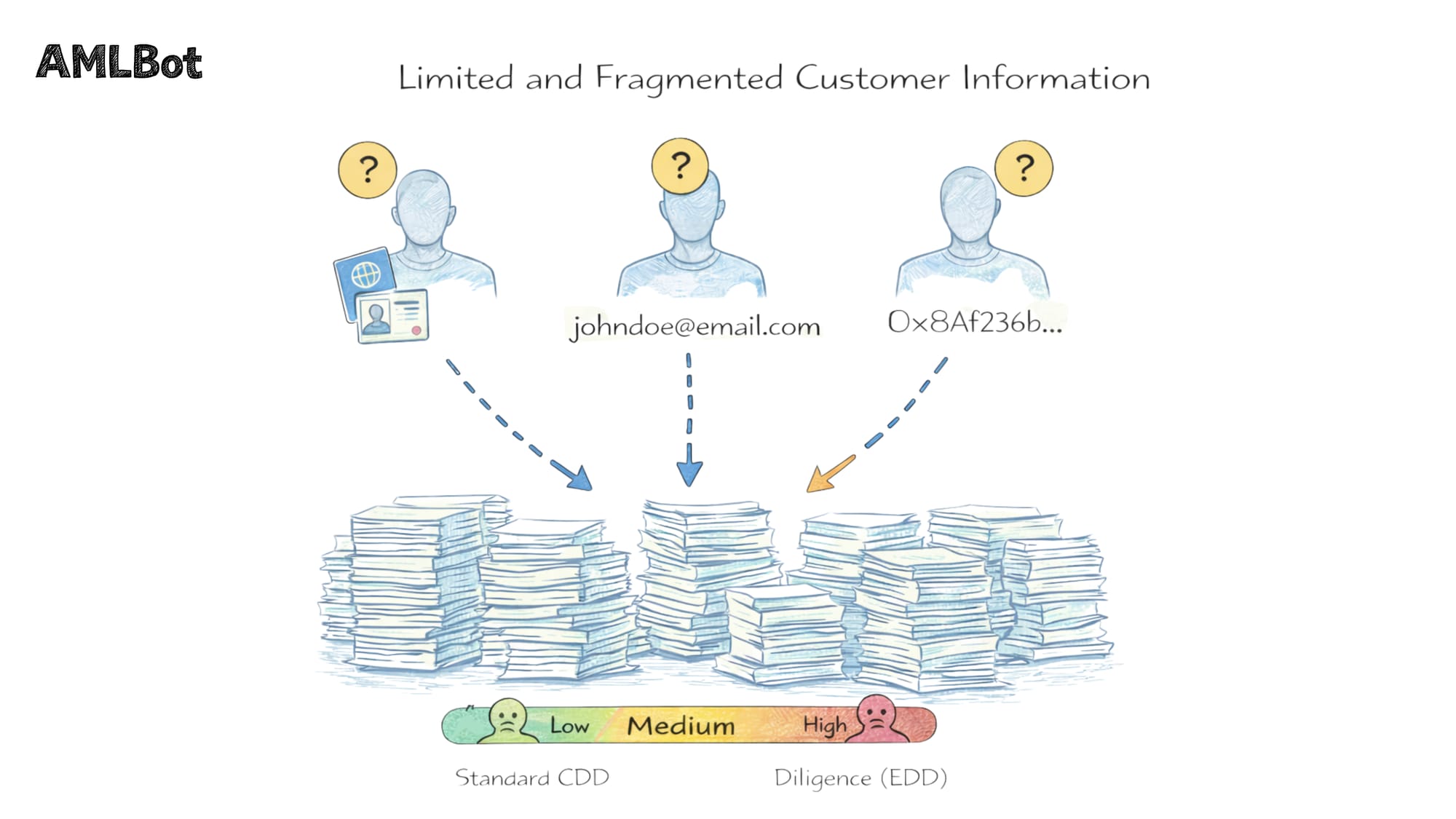

Limited and Fragmented Customer Information

Crypto businesses often contend with having limited or fragmented information about their customers, which complicates due diligence. Because many cryptocurrency services are delivered online with minimal face-to-face interaction, the amount of verifiable data at onboarding can be sparse. Users may only provide basic identification documents, and linking those to their on-chain activity is not straightforward. Moreover, customers can use multiple accounts or wallets, creating data silos. Pseudonymity in crypto allows users to present false or alternative identities, making it harder for companies to associate accounts with the real person and their risk factors. For example, a single bad actor might create several accounts under slight name variations or use “straw man” sign-ups, resulting in fragmented customer profiles that evade detection if the CDD process isn’t robust. This challenge means crypto compliance teams must often pull information from multiple sources to get a full picture of a customer. They might need to combine KYC data with blockchain analysis, open-source intelligence, and transaction patterns to truly understand who they are dealing with. In short, the Customer Due Diligence Requirements for crypto firms include developing methods to consolidate and cross-check information, in order to overcome the inherent anonymity that the crypto ecosystem offers malicious actors.

Cross-Border Compliance Complexity

By their nature, cryptocurrencies enable seamless cross-border transactions, which introduces significant compliance complexity. A crypto exchange or platform can easily have a global user base, meaning it falls under the purview of many different national regulations at once. Each jurisdiction may have its own CDD rules – differing ID requirements, varying thresholds for due diligence, data privacy laws, etc. The lack of a single global regulatory framework for crypto leads to contradictions and gaps that savvy criminals could exploit.

As one analysis notes, cross-border transactions make the problem more complicated because different jurisdictions may have contradicting laws.

For a crypto business, this means navigating a patchwork of AML/KYC standards: a practice acceptable in one country might be insufficient in another. Additionally, sharing customer data internationally (for example, as required by the FATF Travel Rule for cross-border transfers) raises operational challenges. Compliance teams must ensure they meet the strictest applicable standard to avoid regulatory trouble – a difficult task when laws are uneven. High-risk customers might route activity through countries with weaker oversight, further complicating risk assessment. As a best practice, crypto firms often implement a unified global CDD program that meets or exceeds the toughest regulations, and then apply local tweaks as needed. The operational burden of multi-jurisdiction compliance is high, but unavoidable. Thus, understanding and keeping up with international AML trends is now part of crypto CDD best practices, ensuring that cross-border operations don’t become the weak link in due diligence.

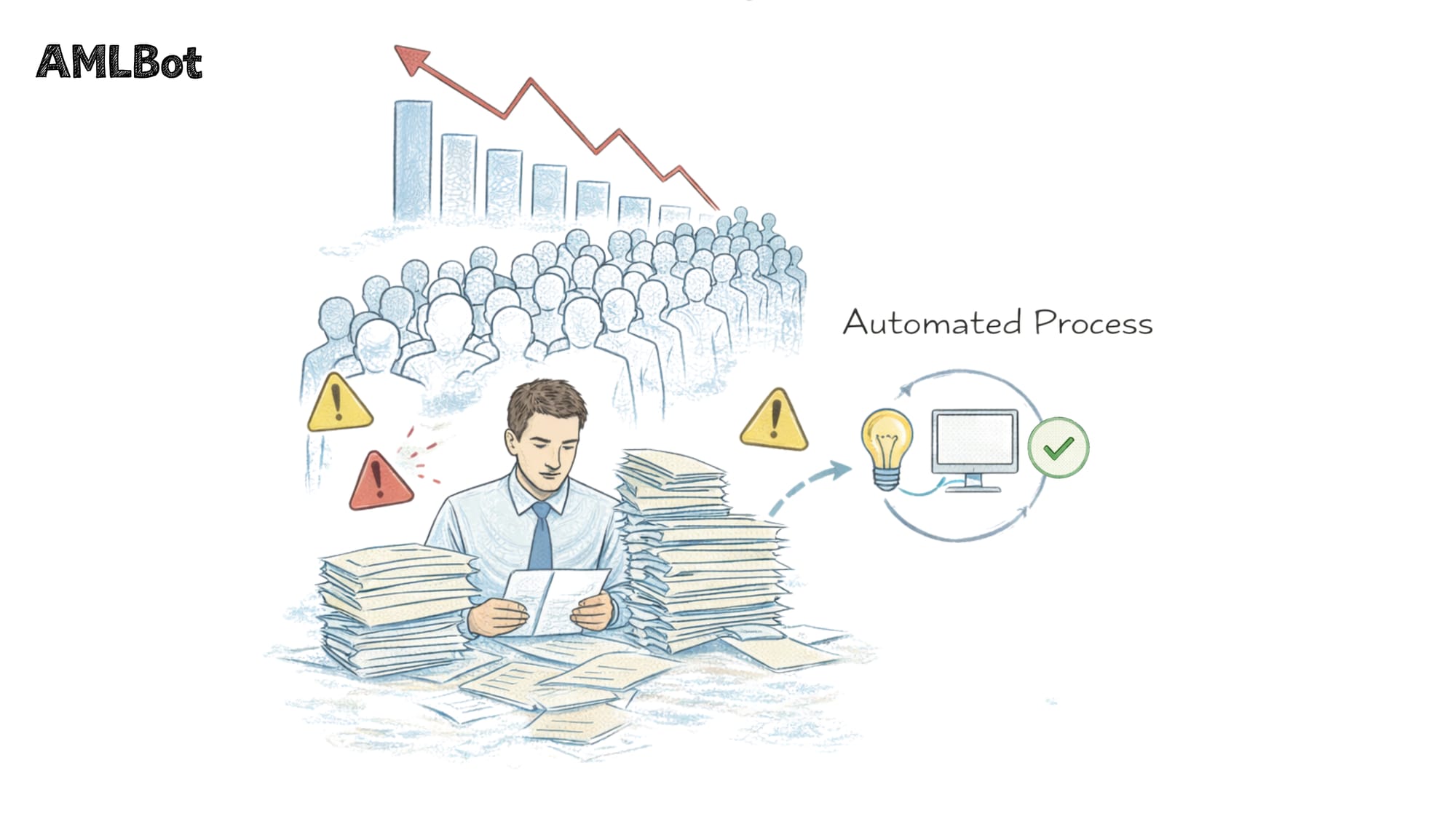

Scaling CDD Without Losing Control

Another challenge for crypto companies is how to scale up their CDD processes as the business and user base grows, without sacrificing compliance quality. Successful crypto platforms can onboard thousands of new users in a short time, especially during market booms. Handling this volume with a manual, review-every-document approach can overwhelm compliance teams and lead to backlogs or mistakes. On the other hand, automating everything without oversight can result in false positives or missed red flags. Common pain points include integrating CDD into a fast user signup flow (maintaining a good user experience while still collecting all required info) and monitoring high volumes of transactions in real-time. As transaction and customer counts increase, weak or outdated KYC and EDD procedures may start to fail, and monitoring tools might struggle to track layered or high-volume flows across jurisdictions. For example, if a crypto exchange expands into dozens of countries and sees exponential trade volume growth, its initial compliance setup might not catch complex patterns like a user spreading illicit funds over hundreds of micro-transactions. To address scaling challenges, crypto businesses often invest in advanced RegTech solutions (for identity verification and transaction monitoring powered by AI) and continually train their compliance staff. The key is to build CDD processes that are robust and automated where possible, but still allow human judgment for complex cases. Establishing clear procedures, exception handling, and periodic audits of the CDD program can help ensure that as the crypto business scales, its compliance does not lose control but rather grows in tandem to effectively manage the larger risk surface.

Regulatory Standards Affecting Crypto Customer Due Diligence

FATF Guidance on Virtual Assets

At the international level, the Financial Action Task Force (FATF) sets the tone for crypto CDD standards.

The FATF’s Recommendations are not laws themselves, but member countries translate them into their own regulations. In 2019, FATF updated Recommendation 15 to explicitly extend AML/CFT requirements to virtual assets and VASPs. This was a pivotal move that essentially told the world: regulate crypto like you regulate banks. The FATF Guidance emphasizes a risk-based approach for virtual asset activities and mandates that VASPs perform CDD, keep records, and report suspicious transactions just as other financial institutions do. One of the most notable FATF measures is the “Travel Rule,” which requires VASPs to obtain and transmit identifying information about the sender and receiver in crypto transactions above certain thresholds. As of 2025, 99 jurisdictions have passed or are in process of passing Travel Rule legislation, reflecting a broad adoption of this FATF standard.

In terms of Customer Due Diligence, FATF guidance means that a crypto exchange in, say, Europe or Asia should be performing identification, verification, beneficial owner checks, and ongoing monitoring in line with the same principles a bank would. Regulators in different countries use FATF’s framework as a baseline, so understanding FATF’s expectations is key for any crypto business operating internationally. In summary, FATF Guidance on Virtual Assets has set crypto CDD requirements on the global stage – obliging VASPs to implement due diligence measures to prevent illicit finance and calling for “stronger global action” where gaps remain.

Regional Regulatory Approaches

Beyond the global FATF Standards, different regions have developed their own specific CDD regulations for crypto businesses.

In the European Union, regulators have integrated crypto into the existing AML regime through updates to the Anti-Money Laundering Directives (5AMLD, 6AMLD) and new laws. These require that VASPs perform full customer due diligence for account opening, including verifying customer identities and identifying beneficial owners, plus ongoing monitoring and suspicious activity reporting. The EU’s Markets in Crypto-Assets Regulation (MiCA) and a new EU AML Authority are further harmonizing rules across member states, ensuring that every European crypto company implements standard CDD measures.

In the United States, the approach is to apply Bank Secrecy Act rules to crypto intermediaries. The U.S. Financial Crimes Enforcement Network (FinCEN) classifies many crypto exchanges as Money Services Businesses, which means they must follow the Customer Identification Program (CIP) and FinCEN’s CDD Rule just like banks do. This rule includes the four pillars of CDD:

(1) identify and verify the customer, (2) identify and verify beneficial owners of legal entity customers, (3) understand the nature and purpose of the account (to develop a risk profile), and (4) conduct ongoing monitoring and updating of customer information.

Other jurisdictions vary – for instance, Singapore mandates strict CDD and even requires verifying ownership of self-hosted wallets for large transfers, while Hong Kong and Japan have licensing regimes that enforce KYC, risk management, and EDD for high-risk customers.

The specifics may differ, but the common thread is that Customer Due Diligence requirements for crypto businesses are now part of law in most major markets. Crypto companies must stay abreast of the regulatory expectations in each region they operate, ensuring their CDD program meets all applicable standards – whether that’s checking EU lists of high-risk third countries or complying with US sanctions screening and reporting obligations.

Conclusion

Building an Effective CDD Framework for Crypto Businesses

Effective Crypto Customer Due Diligence is a vital framework that protects both the business and the broader crypto ecosystem. By building a comprehensive CDD program, crypto companies can deter illicit actors, maintain trust with banking partners and users, and avoid costly compliance sanctions. An effective framework starts with clear CDD policies that encompass crypto-specific risks: it should outline how the firm verifies customer identities worldwide, how it identifies beneficial ownership in complex structures, and how it applies a risk-based approach to allocate effort where it’s needed most. Crypto businesses should integrate technology with expert oversight to address challenges like pseudonymity and high transaction volumes. This might include automated ID verification, blockchain monitoring tools (for ongoing tracking of transactions), and regular training for the compliance team on emerging typologies. High-risk customers should be well-defined in the policy, with protocols for enhanced due diligence and approval by senior compliance officers before onboarding or during the relationship. Regular audits and updates to the CDD framework are also important, as the crypto industry and its regulations evolve quickly. In closing, crypto businesses that invest in a strong CDD framework – aligned with AML and KYC requirements yet tailored to crypto’s unique environment – will be well-positioned to grow sustainably. They will meet their obligations to prevent Money Laundering and Terrorist Financing while also safeguarding their operations from fraud and reputational risks. In the long run, robust CDD practices contribute to making the crypto industry more secure and reputable, bridging the gap between the new world of digital assets and the established expectations of financial compliance.

-AMLBot Team

Follow AMLBot:

🔗 Website

🔗 Telegram

🔗 Support Team

🔗 LinkedIn

FAQ

What Is Customer Due Diligence (CDD) in Crypto Businesses?

Customer Due Diligence in crypto businesses refers to the process of identifying customers, verifying their identity, assessing their risk profile, and continuously monitoring their transactions to comply with AML and KYC obligations in the virtual asset space. In practice, CDD means a crypto company collects and verifies personal information (like IDs and proof of address) and keeps an eye on customer activity to ensure no involvement in illicit finance.

Why Is Customer Due Diligence Especially Important for Crypto Companies?

CDD is especially important for crypto companies due to the pseudonymous and borderless nature of cryptocurrencies. Crypto exchanges and platforms face higher exposure to money laundering and fraud because users can transact anonymously and move funds globally in seconds. Thorough customer due diligence helps crypto firms identify who their customers really are and detect high-risk behavior, which is critical for preventing misuse of their platforms and for meeting regulatory expectations.

How Does Crypto Customer Due Diligence Differ From Traditional Financial CDD?

Crypto CDD differs in execution and focus. Crypto platforms deal with decentralized, pseudonymous transactions, so they often rely on different tools (like blockchain analysis and stricter online verification) compared to traditional banks. The risk indicators also differ; for instance, crypto firms pay more attention to things like the origin of a customer’s crypto funds or their use of mixers. Traditional banks operate in a more controlled data environment, whereas customer due diligence crypto programs must adapt to an evolving, tech-driven landscape. Essentially, the due diligence principles are identical (know your customer, assess risk, monitor activity), but the crypto industry requires additional measures to pierce through anonymity and handle rapid, global transactions.

What Are the Key Components of Customer Due Diligence in Crypto?

The key components of CDD in the crypto sector include: customer identification and verification (collecting and confirming personal details and official IDs), beneficial ownership checks (finding out who ultimately owns or controls an account, especially for corporate clients), risk assessment and profiling (rating each customer’s risk level based on factors like geography and behavior), and ongoing monitoring of transactions and account activity. Together, these steps ensure a crypto business knows its customers and can spot red flags over time.

What Is a Risk-Based Approach to Customer Due Diligence in Crypto?

A risk-based approach means adjusting the depth and rigor of CDD measures according to the risk level of each customer. In crypto, this translates to doing the minimum required checks for low-risk customers and progressively more intense scrutiny for higher-risk ones. For example, a user transacting small amounts in a low-risk country might go through basic verification, whereas a user dealing in large volumes or coming from a high-risk jurisdiction would face enhanced due diligence (additional identity checks, source of funds inquiries, etc.). This approach ensures that compliance resources are focused where the risk of money laundering or terrorist financing is highest.

When Is Enhanced Due Diligence (EDD) Required for Crypto Customers?

Enhanced Due Diligence is required when a customer is classified as high-risk. In crypto businesses, triggers for EDD include factors like significant transaction volume, connections to high-risk or sanctioned countries, involvement of complex corporate structures, or if the customer is a politically exposed person. When such red flags are present, the crypto company will perform extra checks — for instance, requesting detailed source of funds documentation, verifying additional identity or business information, and monitoring the customer’s transactions more closely on an ongoing basis. EDD provides a deeper understanding of the customer to ensure that higher risk is mitigated appropriately.

What Role Does Beneficial Ownership Play in Crypto Customer Due Diligence?

Beneficial ownership identification is a crucial element of CDD that helps crypto companies look past shell companies or account aliases to see who is ultimately in control. In practice, this means if a business or organization opens an account on a crypto exchange, the exchange must find out which individuals are the true owners or controllers of that entity (e.g. major shareholders or executives). Knowing the beneficial owners is important because those individuals must be screened and risk-assessed just like direct customers. In the crypto world, where complex layers of wallets and entities can hide who profits from transactions, pinning down beneficial ownership ensures that a VASP is not unknowingly doing business with criminals or sanctioned parties. It adds transparency and accountability, aligning crypto CDD with global AML standards.

What Are Common Challenges in Implementing Customer Due Diligence for Crypto Businesses?

Common challenges include limited customer information (since crypto users can be more anonymous and may only provide minimal data), cross-border regulatory inconsistencies (a crypto firm often must comply with multiple jurisdictions’ rules, which can conflict or change frequently), and scalability issues as the business grows (processing large volumes of new users and transactions without missing red flags). Additionally, keeping up with new typologies of crypto misuse (like DeFi, mixers, NFT wash trading) means CDD policies must continuously evolve. Balancing a smooth user experience with rigorous checks is also a challenge – crypto companies strive to automate and streamline CDD to avoid driving customers away, but cannot compromise on compliance. Overall, the fast-moving and global nature of crypto amplifies the usual AML/KYC challenges.

Do Customer Due Diligence Requirements for Crypto Businesses Differ by Jurisdiction?

Yes, specific customer due diligence requirements for crypto businesses can vary by jurisdiction, although core principles are similar. Most jurisdictions now require crypto companies to follow basic CDD steps (KYC verification, record-keeping, reporting suspicious activity), but there are differences in thresholds and scope. For example, the EU might mandate CDD for any crypto-fiat exchange above a certain euro amount and enforce the Travel Rule for transfers, while the US requires compliance with FinCEN’s CDD Rule including beneficial owner identification for legal entities. Some countries require verification of even small transactions, others allow simplified due diligence for lower-risk scenarios. It’s important for crypto businesses to understand the local regulations wherever they operate and adjust their compliance program to meet each set of requirements. Many leading VASPs choose to apply a comprehensive global standard (often aligned with FATF guidance) that meets the strictest rules, thereby satisfying all jurisdictions by default.

How Does Ongoing Monitoring Support Effective Customer Due Diligence in Crypto?

Ongoing monitoring is what keeps CDD effective after the initial onboarding. By continuously watching customer transactions and behavior, crypto businesses can detect inconsistencies or suspicious activities that emerge over time. This might include alerts for unusual transaction patterns (e.g. sudden large transfers or use of high-risk services like mixers), periodic sanctions screening updates, or re-verifying identity information when it changes or after a certain period. Ongoing review ensures customer risk profiles remain accurate, allowing the firm to escalate diligence measures if a customer who was once low-risk begins engaging in higher-risk behavior. In essence, ongoing monitoring ties together all CDD elements. It uses the data collected and the risk criteria established to guard against criminals “slipping through” after passing initial checks. For crypto companies, where customers can quickly move funds in and out, having a robust monitoring system is indispensable to catch red flags in real time and fulfill obligations like filing Suspicious Activity Reports.