Guide to AML Compliance for Peer-to-Peer (P2P) Cryptocurrency Platforms

Cryptocurrency regulations can be difficult to decipher, and AML compliance for peer-to-peer (P2P) exchanges is especially tricky. Regulatory agencies across the globe have implemented different standards for P2P platforms, and you might be tempted to ignore them and hope for the best.

Unfortunately, giving in to that temptation could be catastrophic. Failed compliance exposes customers to potential scams and leaves your organization open to criticism. To keep that from happening, we've put together this guide that covers everything a P2P platform needs to know to follow regulatory compliance requirements.

The Basics of Peer-to-Peer Cryptocurrency Platforms

Peer-to-peer transactions aren't exclusive to cryptocurrency, but they do look a little different when you're dealing with digital funds. Before you can even begin to think about compliance, you'll first need to have a solid understanding of how P2P platforms work.

What Is a P2P Platform?

P2P platforms allow users to trade cryptocurrencies directly with other users without relying on an intermediary. These online marketplaces are appealing because they allow for more payment and withdrawal options and make it possible for traders to set their own terms.

Although different companies tailor their approach to P2P transactions, the general setup usually looks something like this:

- Sellers list their crypto for sale at a price that they're willing to accept.

- Buyers use search parameters, such as price ranges or currency types, to find a trade that interests them.

- The buyer and seller connect through the platform and agree to the terms of the trade, often using smart contracts.

- Some platforms use escrow systems to store crypto tokens until the seller confirms that they've received payment.

Throughout the trading process, the platform serves only as a place for people to connect. It doesn't control the specifics or prices of the transactions, leaving those decisions up to the buyers and sellers.

What Are the Risks of P2P Cryptocurrency Transactions?

Any type of P2P transaction could become a problem. When you place your trust in another individual, there's a chance that they'll deceive or manipulate you.

In the case of peer-to-peer crypto platforms, bad actors might create fake profiles or give false information to trick users into completing transactions. Buyers might also be up to no good. They sometimes report trades as fraud and request refunds from their payment providers, even if everything is above board.

The lack of regulation in some jurisdictions has made it easier for criminals to get away with these types of behaviors. P2P platforms often have limited customer support options, making it difficult to work through transaction disputes.

With that said, P2P platforms are far from a free-for-all. Government agencies around the world have taken steps to make these types of transactions more secure.

Understanding Anti-Money Laundering (AML) in Cryptocurrency

When you work in finance, you quickly get accustomed to regulations, and cryptocurrencies are no exception. If you operate a P2P platform, AML requirements should be at the top of your priority list.

What Are AML Regulations?

Anti-money laundering (AML) regulations are requirements that financial institutions have to follow. They help reduce the likelihood of money laundering and other illegal activity. This protects consumers, investors, businesses, and the economy as a whole.

How Do AML Regulations Apply to Cryptocurrency?

In the early days of cryptocurrency, regulators kept their distance, allowing platforms to operate freely without interference. However, government agencies eventually started navigating this uncharted territory and looking for ways to better protect members of the crypto community. And it’s national risks from money laundering, which can affect a country's financial stability.

In 2014, the Financial Action Task Force (FATF) established a set of AML regulations specifically for cryptocurrency, also known as virtual assets. Over the next several years, regulators such as the Financial Crimes Enforcement Network (FinCEN) embraced the FATF's recommendations and implemented them in their jurisdictions.

Despite this progress, the application of AML regulations remains an uneven work in progress. Certain countries are only beginning to consider putting measures into place, while others have built strict protections for all types of crypto organizations, including peer-to-peer exchanges.

Key Challenges in AML Compliance for P2P Cryptocurrency Platforms

AML regulations for centralised crypto companies have become more standardized, but progress has been slower for peer-to-peer exchanges. They have to overcome serious obstacles to keep up with and meet new and changing requirements.

The biggest hurdle is the number of variations between different jurisdictions. What applies in one country may be entirely different from another. This makes it difficult for P2P exchanges to ensure that their compliance is consistent.

P2P platforms also have to find a balance between user privacy and AML compliance. The relatively anonymous nature of blockchain technology is one of the most attractive aspects of cryptocurrencies. While platforms want to prove to traders that they respect them, they also have to play their part in the AML effort.

Best Practices for AML Compliance in P2P Cryptocurrency Platforms

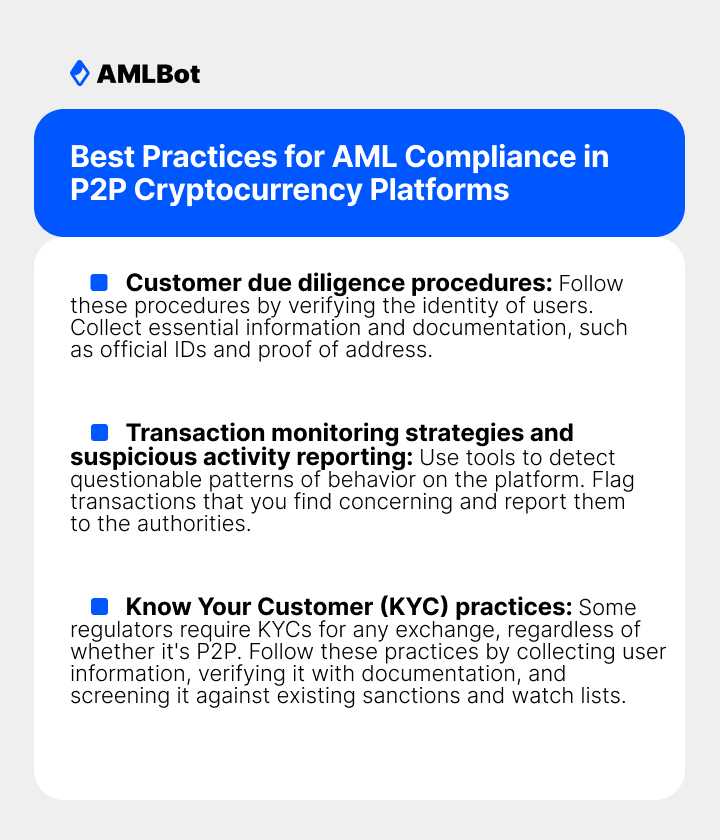

Your AML policies depend on the specific regulatory requirements of your jurisdiction. However, these best practices are a good place to begin:

- Customer due diligence procedures: Follow these procedures by verifying the identity of users. Collect essential information and documentation, such as official IDs and proof of address.

- Transaction monitoring strategies and suspicious activity reporting: Use tools to detect questionable patterns of behavior on the platform. Flag transactions that you find concerning and report them to the authorities.

- Know Your Customer (KYC) practices: Some regulators require KYCs for any exchange, regardless of whether it's P2P. Follow these practices by collecting user information, verifying it with documentation, and screening it against existing sanctions and watch lists.

Certain jurisdictions have more nuanced AML requirements, so it's always important to carefully review the regulations that apply to your business operations.

Collaboration and Partnerships in AML Compliance

P2P platforms sometimes see regulators as the enemy because their requirements can make it harder to do business. That was certainly the case for Paxful, which suspended its operations in April 2023 and put some of the blame on regulators.

When peer-to-peer platforms and regulatory bodies can move past their frustration and animosity, it's better for everyone. Their collaboration creates a safer, more productive environment for crypto traders.

Leaders of P2P platforms should also remember that they don't have to figure everything out on their own. Building partnerships for AML solutions makes it easier to achieve lasting compliance. For example, AMLBot offers automated KYC checks to make platforms more secure and efficient.

Implementing AML Compliance Programs for P2P Cryptocurrency Platforms

Once you understand what AML compliance should look like, the next step is to put it into action. That begins with comprehensive policies and procedures.

Many regulators require companies to explain their transaction monitoring strategies and KYC processes. It's also essential to building transparency and stability within your organization. If you're unsure where to start, AMLBot can help you prepare paperwork that aligns with regulatory standards.

In addition to documenting your policies, you'll also need to provide training and education. Your platform users and staff need to know what AML compliance is and what to look for when analyzing transactions. AMLBot provides expert AML training to crypto platforms of all kinds.

Case Studies: Successful AML Compliance Implementation in P2P Platforms

Looking at what other cryptocurrency companies have done well — or completely wrong, as the case may be — can help clarify your strategy. These examples represent the best and the worst of P2P AML compliance.

Case Study 1: OKX's AML Compliance Journey

If you want to see a company that has adopted an AML culture and has implemented controls in the right way, look no further than OKX. The company offers a detailed explanation of their AML policies on their website.

Within their documentation, OKX describes their customer identification program, customer due diligence procedures, transaction monitoring, and activity reporting. The company regularly updates the document to reflect changes to regulations.

OKX has also put its commitment to AML compliance into practice. In November 2023, the platform announced that it had worked alongside the United States Department of Justice and cryptocurrency company Tether to investigate suspicious activity and freeze more than $220 million in digital funds.

Case Study 2: Lessons Learned from AML Failures in P2P Platforms

On the other side of this coin are exchanges that failed their AML compliance test more than once. For example, FinCEN issued a $35,000 penalty against Eric Powers for violating the Bank Secrecy Act's requirements. He failed to register as a money services business, had no written compliance procedures, and failed to report suspicious transactions.

On a much larger scale is BitMex, a P2P exchange that agreed to pay $100 million to settle charges brought by FinCEN and the Commodity Future Trading Commission (CFTC). BitMex failed to comply with AML requirements, including reporting suspicious activity and implementing a customer identification program.

Both these examples prove why ongoing compliance is so important and what can happen if you fail to achieve it. Take note of what a violation could mean for your company and keep it in mind as you establish your AML program.

Making P2P AML Compliance Possible

Whether your company is dabbling in P2P transactions for the first time or you've built your entire business around them, you need to take AML compliance seriously. KYC checks, customer due diligence, and transaction monitoring help to create a safer space for crypto users to conduct their direct transactions.

There's a lot to lose if you don't maintain compliance. Request a demo to see how AMLBot's solutions can protect your business from compliance violations and safeguard your users against fraud.